Cost of Equity Formula

The shareholder or investor defines the cost of equity as the minimum rate of return required when putting equity into the firm.

Here’s the Cost of Equity Formula –

Where

- ke = Cost of Equity

- Rf = Risk-free rate

- β = Beta of stock/company

- E (Rm) – Rf = Equity Risk premium

Examples of Cost of Equity Formula

Let’s take an example to find out the Cost of Equity for a company: –

Cost of Equity Formula – Example #1

Let’s take an example of a stock X whose Risk-free rate is 10%, Beta is 1.2, and Equity Risk premium is 5%.

The calculation for The cost of Equity is as below:

- Cost of Equity (ke) = Rf + β (E(Rm) – Rf)

- Cost of Equity = 10% + 1.2 *5%

- Cost of Equity = 10% + 6%

- Cost of Equity = 16%

Cost of Equity Formula – Example #2

Let’s take the example of an Indian company, Reliance.

Risk-free rate Rf = 10 years Treasury Government Bond yield = 7.48%

To calculate beta β, one can regress the stock’s return over previous years with the market return. For assumption purposes, we take already calculated Beta from financial sources, and it is assumed currently at 1.18

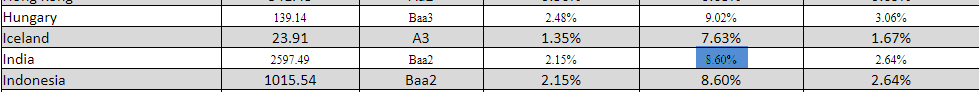

Equity Risk Premium (E(Rm) – Rf) can be assumed from Damodaran’s website, which is an NYU professor, and he calculated market risk premium for all countries.

As one can see Equity Risk Premium for India is 8.6%.

- Cost of Equity (ke) = Rf + β (E(Rm) – Rf)

- Cost of Equity = 7.48% + 1.18 (8.6%)

- Cost of Equity = 7.48% + 10.148%

- Cost of Equity = 17.63%

Cost of Equity Formula – Example #3

Let’s take an example of Exxon Mobil listed on the New York Stock Exchange.

Risk-free rate Rf = 10 year Treasury Government Bond yield = 2.67%

Financial sources have already calculated the Beta for the stock, which is currently assumed to be 0.63. The beta calculation involves regressing the stock’s return over previous years with the market return.

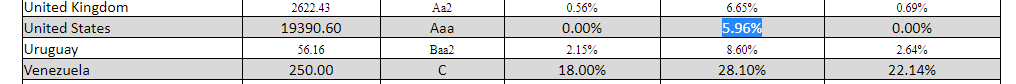

Equity Risk Premium (E(Rm) – Rf) can be assumed from Damodaran’s website, which is an NYU professor, and he calculated market risk premium for all countries.

As one can see Equity Risk Premium for the United States is 5.96%.

- Cost of Equity (ke) = Rf + β (E(Rm) – Rf)

- Cost of Equity = 2.67% + 0.63 (5.96%)

- Cost of Equity = 2.67% + 3.7548

- Cost of Equity = 6.42%

Explanation of Cost of Equity Formula

The cost of equity can be defined as the minimum rate of return required by the shareholder or investor when equity is being put into the firm. This particular return is associated with the risk premium over a 10-year government bond yield, as this bond is generally deemed to be a risk-free investment. The cost of equity can be measured either by the dividend discount model or the more followed Capital Asset Pricing Model (CAPM).

The Capital Asset Pricing Model uses Risk-Free Rate, Beta, and Equity Risk Premium to measure the cost of equity for any firm or business.

Risk-Free Rate – The investor expects a return from a risk-free investment. Analysts generally use 10-year government bond yields as a proxy for the risk-free rate. They assume that the 10-year government bond yield, due to the security provided by the federal government, has no default risk, no volatility, and a zero beta.

Beta – The overall market’s return varies with the degree to which a company’s equity returns. Beta, a function of both business and financial risks, measures this relationship. To calculate beta, we regress the stock’s returns with the market returns over a specific period, such as 5 or 10 years. Beta values generally fall either below 1 or above 1. A higher beta indicates that the company’s stock price experiences significant volatility, resulting in an increased cost of equity.

Equity Risk Premium – Investors expect additional compensation for putting their money in risky assets, defining it as the equity risk premium. They demand this additional compensation because markets exhibit more volatility than safer bonds. Investors widely utilize the equity risk premium released by NYU Stern professor Damodaran, which market sources can estimate.

Significance and Use of Cost of Equity Formula

Investors widely use the Capital Asset Pricing Model to calculate the cost of equity. This is the expected return required by investors for putting their money into risky assets. This calculation of the Cost of Equity is then used to calculate the Weighted Average Cost of Capital, which is used as a discounting factor in financial modeling for various purposes.

The cost of equity is typically cheaper than the cost of debt because equity investments carry higher risk and potential returns than debt investments, secured by assets. Debt holders have a higher preference over equity holders if the company is liquidated. The cost of equity is also important in determining the debt a company wants to take. Any company has an optimum capital structure; hence, calculating the cost of equity helps determine the amount of debt required to achieve optimum capital structuring.

The cost of equity varies across industries and among companies within those industries. For instance, utility companies experience a very low cost of equity due to their low beta, which means market fluctuations do not significantly influence them. Steel companies experience a very high cost of equity due to the heavy impact of market movements on them, making them considered risky investment options.

Cost of Equity Calculator

You can use the following Cost of Equity Calculator

| Rf | |

| β | |

| E(Rm - Rf) | |

| Cost of Equity Formula = | |

| Cost of Equity Formula = | Rf + (β x E(Rm - Rf)) |

| = | 0 + (0 x 0) = 0 |

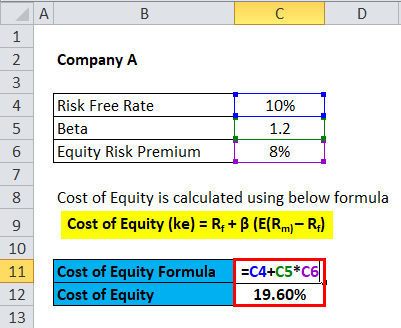

Cost of Equity Formula in Excel (With Excel Template)

Here, we will do the Cost of Equity formula example in Excel. It is very easy and simple. You need to provide the three inputs i.e, Risk-free rate, Beta of stock, and Equity Risk premium

You can easily calculate the Cost of Equity using the Formula in the template provided.

Conclusion

Investors require a rate of return to put their money in a firm or business, known as the cost of equity. The Capital Asset Pricing Model estimates the cost of equity by using variables such as the Risk-Free Rate, Beta, and Equity Risk Premium. External and internal factors can cause the cost of equity to vary among industries and companies within the same industry.

Recommended Articles

This has been a guide to a Cost of Equity formula. Here, we discuss its uses along with practical examples. We also provide a Cost of Equity Calculator with a downloadable Excel template. You may also look at the following articles to learn more –