Updated July 25, 2023

Cost of Goods Manufactured Formula (Table of Contents)

What is the Cost of Goods Manufactured Formula?

The term “cost of goods manufactured” refers to the total cost incurred in converting the work in process inventory into finished goods that are ready to sell during a specific period.

In other words, it is the cost of manufacturing the products, which includes movement of work in process inventory, labor cost, cost of raw material and other manufacturing overhead that can be directly assigned to the production process. The formula for the cost of goods manufactured can be derived by adding beginning work in process inventory and total manufacturing cost minus ending work in process inventory. Mathematically, it is represented as,

Again, the total manufacturing cost is the aggregate of direct labor cost, direct material cost and factory overhead.

Examples of Cost of Goods Manufactured Formula (With Excel Template)

Let’s take an example to understand the calculation of Cost of Goods Manufactured in a better manner.

Cost of Goods Manufactured Formula – Example #1

Let us take the example of a company named SDF Ltd. The company is a shoe manufacturing entity in the city of Chicago, IL. The accounts department of the company has provided the following information related to cost of production,

- $1.50 million paid to direct labor

- $2.50 million incurred on leather and stitching thread

- $0.80 million expensed towards factory overhead

- Work in process inventory at the start of the year was $4.50 million

- Work in process inventory at the end of the year was $4.00 million

Calculate the cost of goods manufactured by SDF Ltd. based on the above information.

Solution:

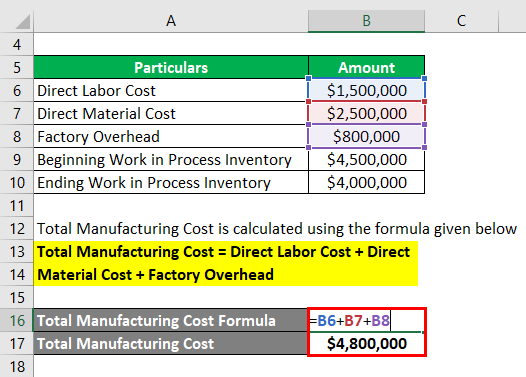

Total Manufacturing Cost is calculated using the formula given below

Total Manufacturing Cost = Direct Labor Cost + Direct Material Cost + Factory Overhead

- Total Manufacturing Cost = $1.50 million + $2.50 million + $0.80 million

- Total Manufacturing Cost = $4.80 million

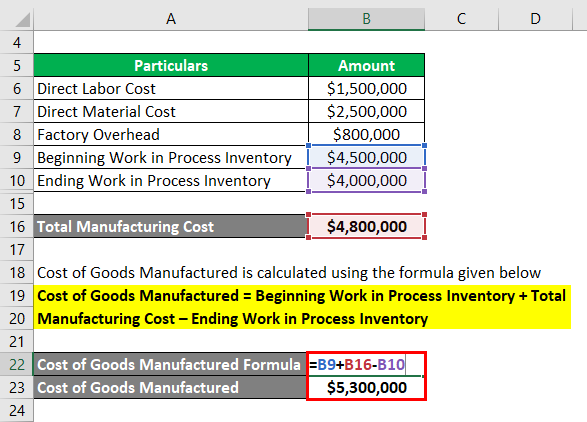

Cost of Goods Manufactured is calculated using the formula given below

Cost of Goods Manufactured = Beginning Work in Process Inventory + Total Manufacturing Cost – Ending Work in Process Inventory

- Cost of Goods Manufactured= $4.50 million + $4.80 million – $4.00 million

- Cost of Goods Manufactured= $5.30 million

Therefore, the cost of goods manufactured by SDF Ltd. during the period was $5.30 million.

Cost of Goods Manufactured Formula – Example #2

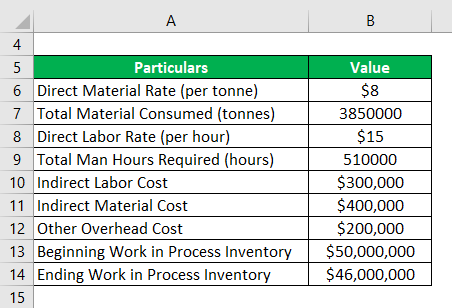

Let us take the example of David Jenner who is the chairman of ZXC Inc., a company in the business of manufacturing precision metal components for aerospace OEMs. As per the latest financial report for the year 2018, the company generated revenue of $70 million during the year. Further, the company incurred the following expenses,

So, Calculate the cost of goods manufactured incurred by the company during the year on the basis of the given information.

Solution:

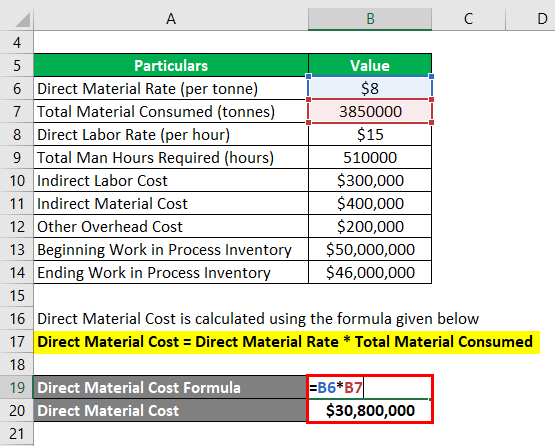

Direct Material Cost is calculated using the formula given below

Direct Material Cost = Direct Material Rate * Total Material Consumed

- Direct Material Cost = $8 per tonne * 3.85 million tonnes

- Direct Material Cost = $30.80 million

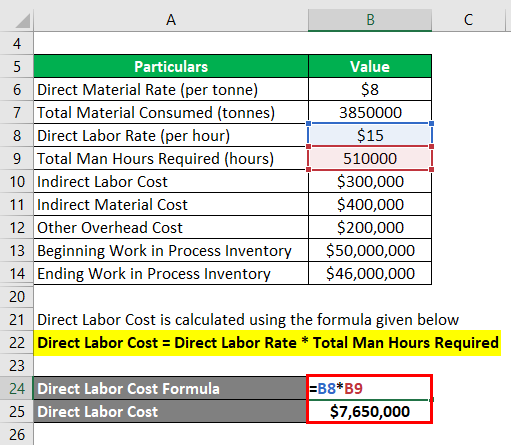

Direct Labor Cost is calculated using the formula given below

Direct Labor Cost = Direct Labor Rate * Total Man Hours Required

- Direct Labor Cost = $15 per hour * 510,000 hours

- Direct Labor Cost = $7.65 million

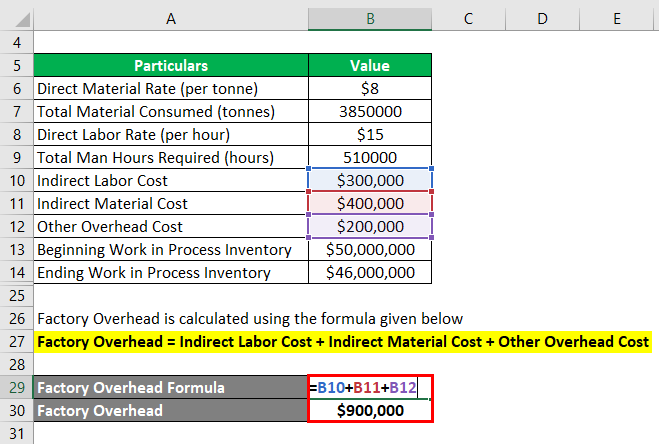

Factory Overhead is calculated using the formula given below

Factory Overhead = Indirect Labor Cost + Indirect Material Cost + Other Overhead Cost

- Factory Overhead = $0.3 million + $0.4 million + $0.2 million

- Factory Overhead = $0.90 million

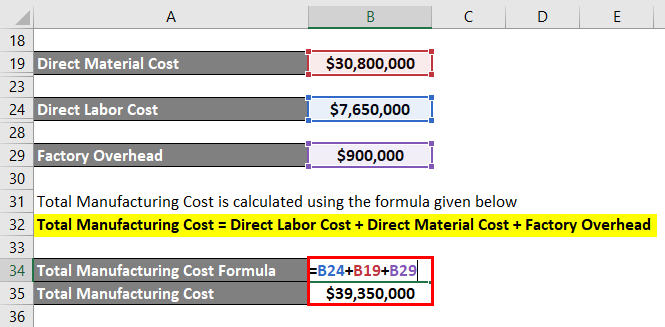

Total Manufacturing Cost is calculated using the formula given below

Total Manufacturing Cost = Direct Labor Cost + Direct Material Cost + Factory Overhead

- Total Manufacturing Cost = $7.65 million + $30.80 million + $0.90 million

- Total Manufacturing Cost = $39.35

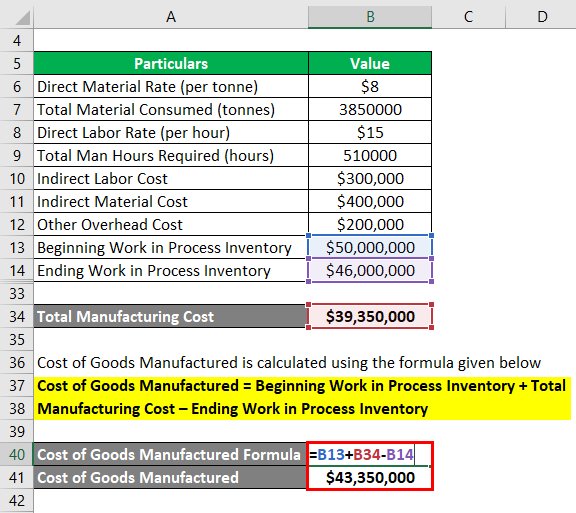

Cost of Goods Manufactured is calculated using the formula given below

Cost of Goods Manufactured = Beginning Work in Process Inventory + Total Manufacturing Cost – Ending Work in Process Inventory

- Cost of Goods Manufactured = $50.00 million +$39.35 million – $46.00 million

- Cost of Goods Manufactured = $43.35 million

Therefore, the cost of goods manufactured incurred by ZXC Inc. during the year 2018 was $43.35 million.

Explanation

The formula for the cost of goods manufactured can be derived by using the following steps:

Step 1: Firstly, determine the beginning and ending work in process inventory of the period. It is the intermediate or half processed product between the raw material stage and the finished product stage.

Step 2: Next, determine the direct labor cost of production, which takes in the manpower cost that can be directly assigned to the process of production.

Step 3: Next, determine the direct material cost, which is the cost of raw material used in the production of the ready to the sale end product.

Step 4: Next, determine the factory overhead cost, which includes all the manufacturing overhead costs that are necessary for production but still can’t be directly assigned to the final product.

Step 5: Next, total manufacturing cost can be derived by adding direct labor cost (step 2), direct material cost (step 3) and factory overhead (step 4).

Total Manufacturing Cost = Direct Labor Cost + Direct Material Cost + Factory Overhead

Step 6: Finally, the formula for the cost of goods manufactured can be derived by adding beginning work in process inventory (step 1) and total manufacturing cost (step 5) minus ending work in process inventory (step 1) as shown below.

Cost of Goods Manufactured = Beginning Work in Process Inventory + Total Manufacturing Cost – Ending Work in Process Inventory

Relevance and Use of Cost of Goods Manufactured Formula

It is important to understand the concept of cost of goods manufactured as it captures the true cost of products manufactured during a specific period of time. It is also known as the cost of goods completed and it is part of the cost of goods sold. Investors and analysts can use this metric to assess the production cost of the past in order to forecast that of the future.

Cost of Goods Manufactured Formula Calculator

You can use the following Cost of Goods Manufactured Formula Calculator

| Beginning Work in Process Inventory | |

| Total Manufacturing Cost | |

| Ending Work in Process Inventory | |

| Cost of Goods Manufactured | |

| Cost of Goods Manufactured= | Beginning Work in Process Inventory + Total Manufacturing Cost - Ending Work in Process Inventory | |

| 0 + 0 - 0 = | 0 |

Recommended Articles

This is a guide to the Cost of Goods Manufactured Formula. Here we discuss how to calculate the Cost of Goods Manufactured along with practical examples. We also provide a Cost of Goods Manufactured calculator with a downloadable Excel template. You may also look at the following articles to learn more –