Updated November 23, 2023

What is the Cost of Goods Sold Formula?

The cost of goods sold formula is a financial figure that gives an overview of the total goods or services sold by a company, including the direct costs and excluding the indirect costs.

COGS includes materials, labor, and overhead expenses directly related to producing the goods or services and excludes indirect expenses such as marketing, selling, and administrative expenses.

Any increases in the COGS indicate that the company has to bear high raw material costs or increased labor costs, which might affect its bottom line.

Let’s analyze an example to understand how the cost of goods formula works. Assume Austin & Co. had a $4,000 inventory at the beginning of FY22. The company spent $8,000 on raw materials or products to boost productivity. The ending Inventory at the end of FY22 is $5,000. So the COGS for the company would be $4,000 (starting inventory) + $8,000 (purchases) – $5,000 (ending inventory) = $7,000.

Cost of Goods Sold Formula

The cost of goods formula is,

Where,

- Beginning Inventory is the inventory value at the start of an accounting period.

- Purchases are the total cost incurred from manufacturing to transporting goods and services.

- Ending Inventory is the inventory value at the end of an accounting period that gets carried over to the upcoming period.

Explanation

The cost of goods sold (COGS) formula is essential for creating an accurate income statement. This figure represents the direct costs of producing the goods or services that your company sells.

The COGS formula can calculate your business’s gross profit, which is the difference between revenue and COGS.

It can also help you price your products or services more effectively. If your COGS is too high, you may need to review your production process and make changes to reduce costs. If your COGS is too low, it may indicate you are not charging enough for your products or services.

So, for a company such as Ferrari, the direct costs in the COGS are the costs associated with manufacturing a Ferrari car and its labor costs. However, the costs of sending the car to a specific dealership or the sales workforce cost of selling a car will be excluded from the COGS. Also, the costs associated with unsold Ferrari cars will not be included in the company’s COGS.

What is the Extended COGS Formula?

The formula below is often termed the Extended COGS formula for an extended and detailed calculation.

- Beginning Inventory is the opening amount of a stock period.

- Freight In is the cost of transporting raw materials to the manufacturing site.

- Purchases are the total costs incurred when purchasing goods such as raw materials.

- Ending Inventory is the total amount of Inventory at the end of a stock period.

- Purchase returns are the items returned to the supplier. Allowances, on the other hand, are complementary discounts received during a product’s purchase chain.

- Purchase discounts are discounts received in the supply chain that are not counted as costs because they help increase profit.

How to Calculate the Cost of Goods Sold Formula? Excel Examples

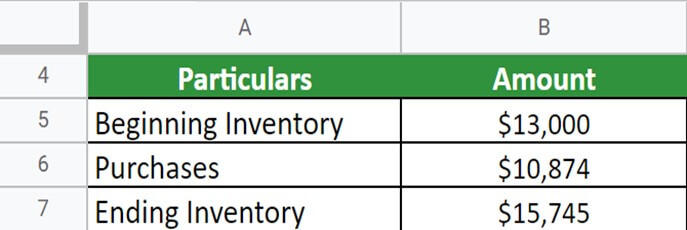

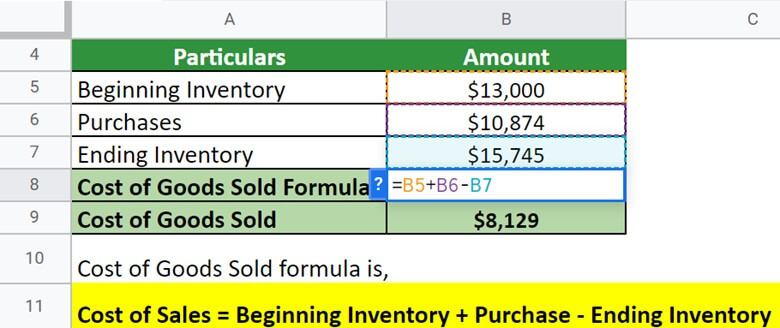

Example #1

Mr. Alex owns a leather factory in Dallas and is well-known for producing leather bags, shoes, and coats. We have to calculate his company’s COGS with the information below appearing in the company’s income statement for FY22.

Given,

Solution:

Using the formula, let us calculate the COGS for the company based on the data provided:

Thus, the cost of goods sold for the leather company of Mr. Alex for FY22 is $8,129. This will help Mr. Alex know and analyze the upcoming strategies that will be profitable to grow the company.

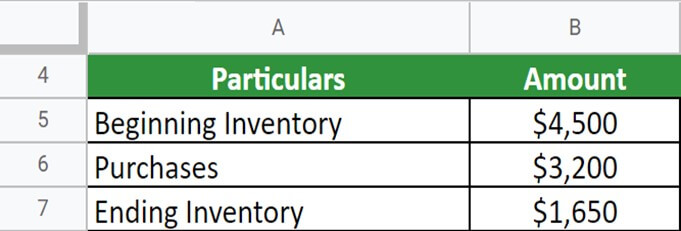

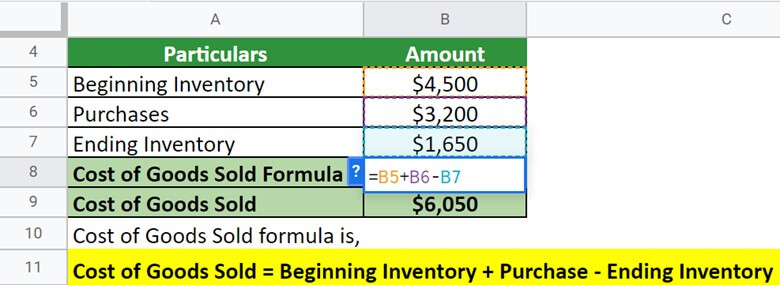

Example #2

Burger & Bites wants to find their COGS for February 2023. They had $4,500 of leftover Inventory from January. (It will be the beginning of Inventory as it is the start of a new accounting period).

The leftover Inventory included buns, soft drinks, vegetable and chicken patty, and seasonings (ingredients required to make the burgers). In February, they had to restock and buy food inventory worth $3,200 and ended the month with food inventory worth $1650.

Given,

Solution:

Implementing the formula, let’s find the COGS for computing the given data:

Thus, the cost of goods sold for Burger & Bites for February is $6,050. This will help Burger & Bites know and analyze the upcoming strategies that will be profitable to grow the restaurant.

Example #3

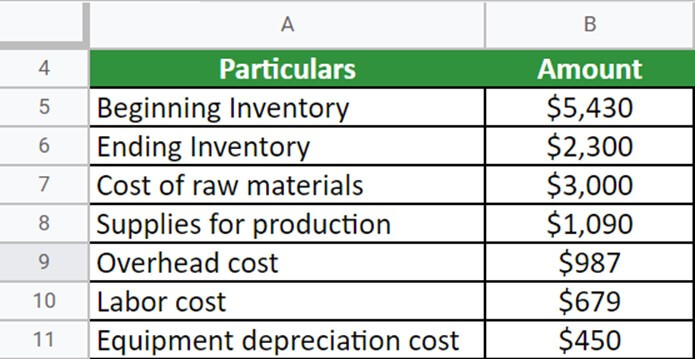

Goods Pvt. Ltd. is a retail business with the following mentioned in its income statement:

- Beginning Inventory = $5,430

- Cost of raw materials = $3,000

- Supplies for production = $1,090

- Overhead cost = $987

- Labor cost = $679

- Equipment depreciation cost = $450

- Ending Inventory = $2,300

Calculate the COGS of Goods Pvt. Ltd.

Given,

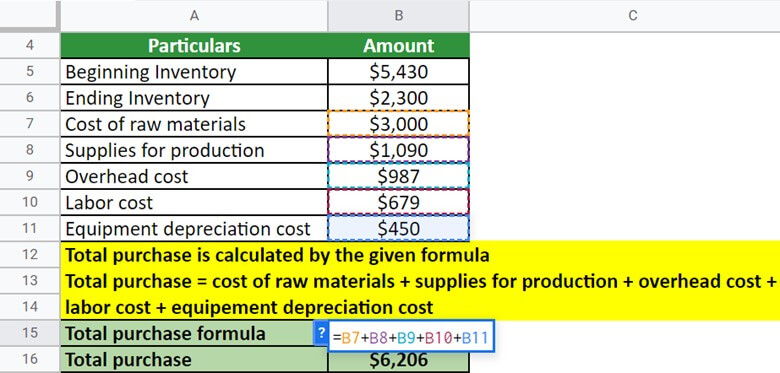

Solution:

First, we must calculate the total purchase, which can be done as follows:

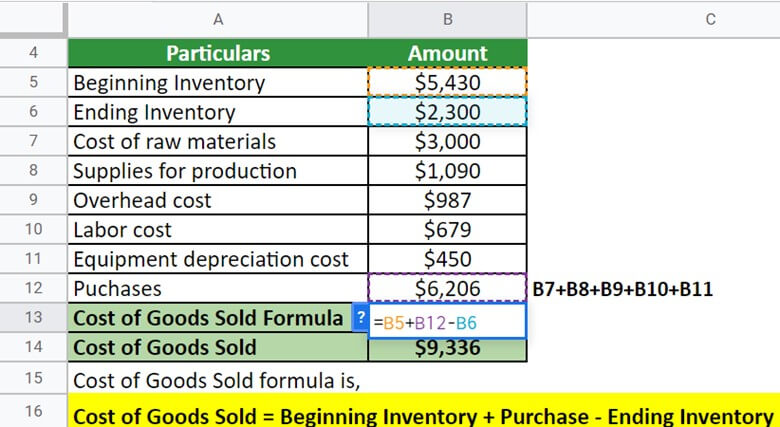

So the company’s total purchase is $6,206. Now, using the formula, let us calculate the company’s COGS:

Thus, the cost of goods sold for Goods Pvt. Ltd. is $9,336. This will help Goods Pvt. Ltd. to find ways to increase its profitability in the retail business.

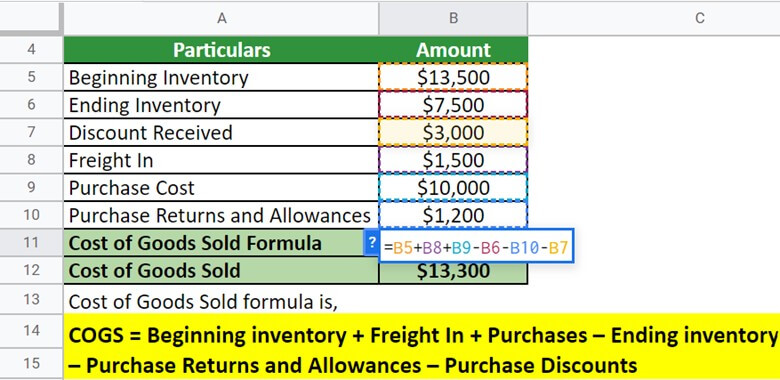

Example #4

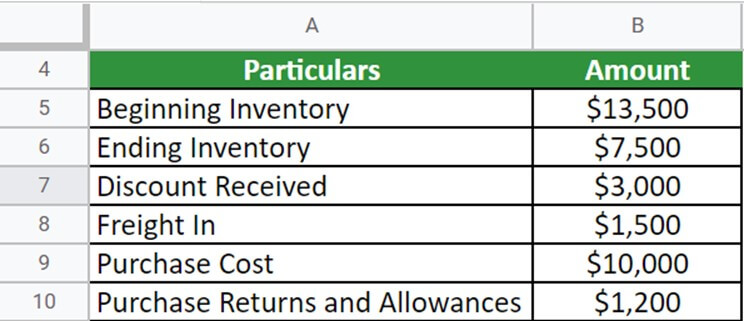

Toffees & More is a toffee manufacturing company with the cost of manufacturing one toffee at $3.00. Below is the other related information:

- Beginning inventory = 4,500 toffee

- Ending inventory = 2,500 toffee

- Discount received = $3,000

- Freight in = $1,500

- Purchase Returns and Allowances = $1,200

- Purchase cost = $10,000

Calculate the COGS for the company.

Given,

Let’s first find the cost of the beginning and ending Inventory, respectively:

Cost of beginning inventory = 4,500*3 = $13,500

Cost of ending inventory = 2,500*3 = $7,500

Thus, the cost of beginning and ending Inventory is $13,500 and 7,500, respectively.

Solution:

Implementing the formula, let’s find out the COGS for the company:

Thus, the COGS for Toffees & More is $13,300.

Real-World Examples for Cost of Goods Sold Formula

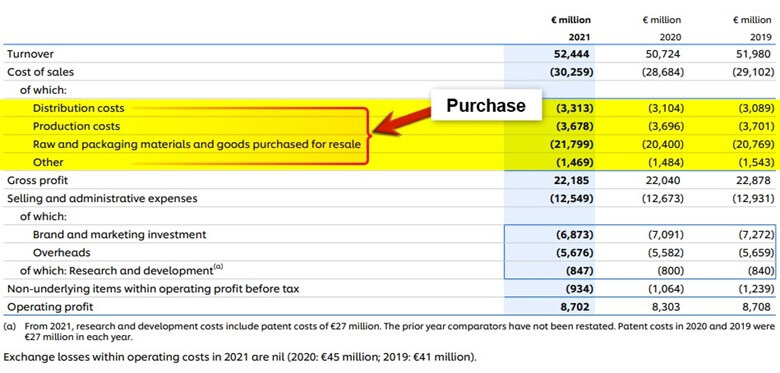

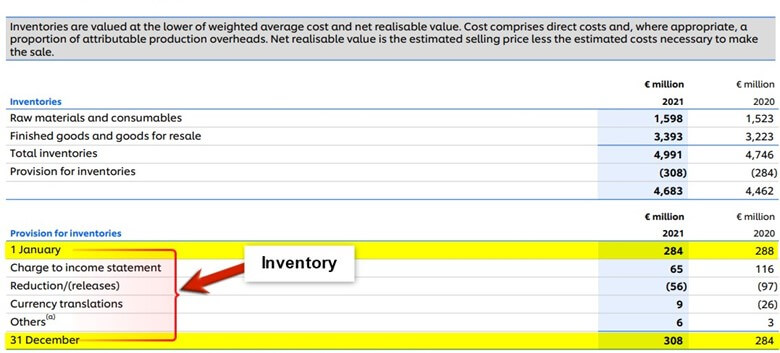

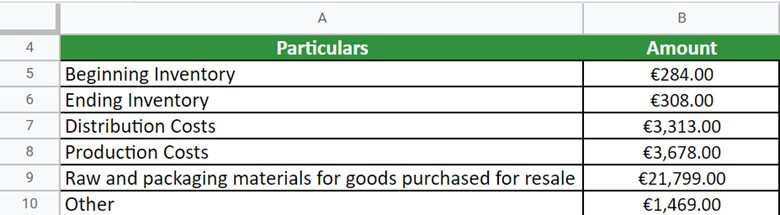

#1 Unilever

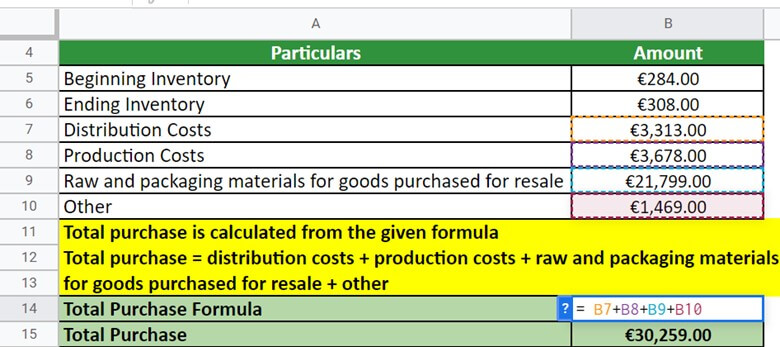

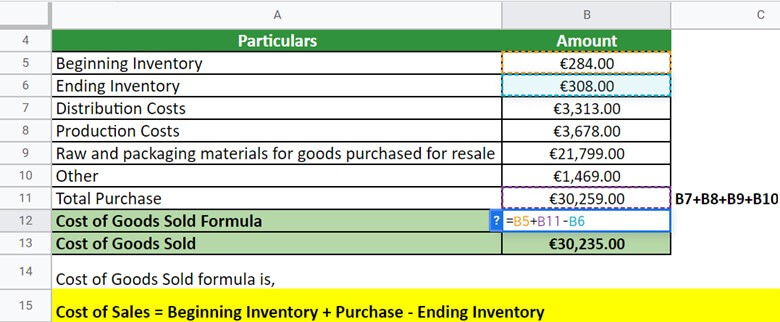

Take the example of Unilever to calculate the COGS for a real-world company.

(Image Source: Unilever’s Annual Report 2021)

As per the latest annual report, Unilever reported the following:

- Beginning inventory = €284

- Ending inventory = €308

- Distribution costs = €3,313

- Production costs = €3,678

- Raw and packaging materials and goods purchased for resale = €21,799

- Other = €1,469

Calculate the COGS for Unilever for FY21.

Given,

Solution:

Before moving ahead, first, we need to find the total purchase for the company by the below method:

So, the company’s total purchase is €30,259. Now, using the formula, let us calculate the company’s COGS:

Thus, the COGS for Unilever is €30,235. This will help Unilever to find ways to increase its profitability in the retail business.

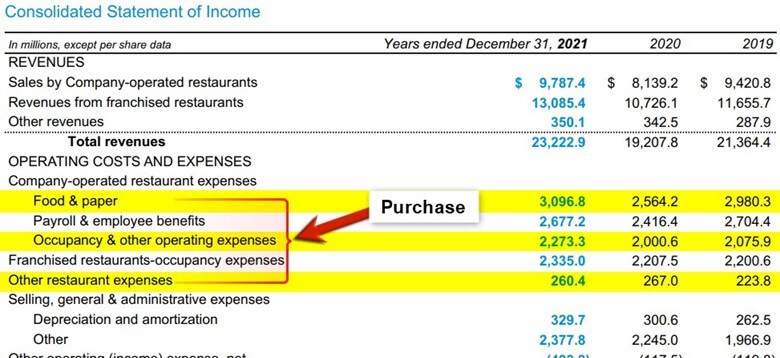

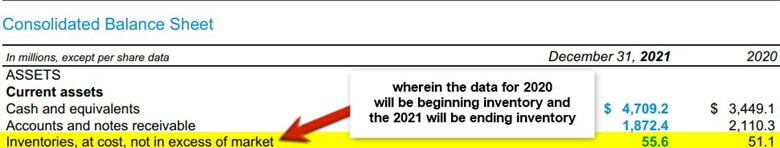

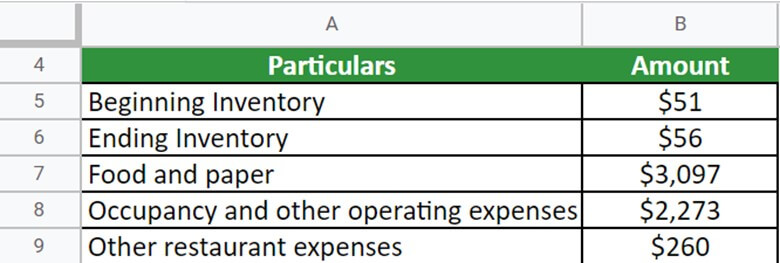

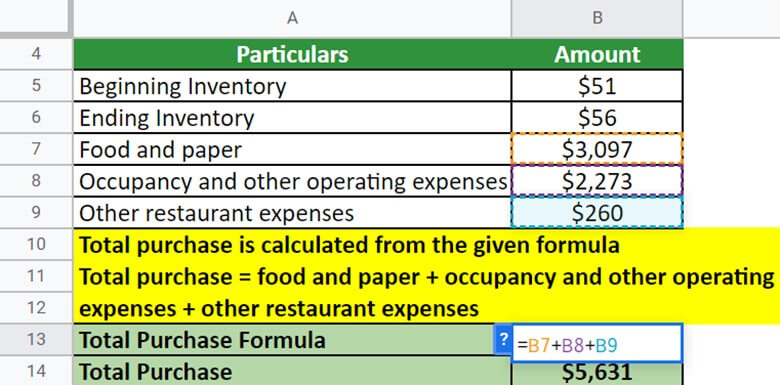

#2 McDonald’s

Let us take the example of McDonald’s to calculate the COGS for a real-world company.

(Image Source: McDonald’s Annual Report 2021)

As per the latest annual report, McDonald’s reported the following:

- Beginning inventory = $51.1

- Ending inventory = $55.6

- Food and paper = $3,096.8

- Occupancy and other operating expenses = $2,273.3

- Other restaurant expenses = $260.4

Calculate the COGS for McDonald’s for FY21.

Given,

Solution:

First, we have to calculate the total purchase, which can be calculated in the given way:

So, the total purchase or purchase for the company is $5,631. Now, implementing the formula, let’s find out the COGS of the company:

Thus, the COGS for McDonald’s is $5,627. This will help McDonald’s to increase its profitability in the retail business.

Cost of Goods Sold Calculator

You can use the following Cost of Goods Sold Calculator:

| Beginning Inventory | |

| Purchases | |

| Ending Inventory | |

| Cost of Sales Sold = | |

| Cost of Sales Sold = | Beginning Inventory + Purchases - Ending Inventory |

| = | 0 + 0 - 0 = 0 |

What is the Budgeted Cost of Goods Sold Formula?

- The budgeted COGS formula estimates the cost of goods sold within a specific timeframe.

- This data is combined with other financial data to create a budget for a business or individual.

- The budgeted COGS formula considers the costs of acquiring, storing, and selling Inventory.

- Materials, labor, overhead, and shipping can all be included in these costs. A budget for a single product or company can be created using the budgeted COGS formula.

Methodologies in Cost of Goods Sold Formula

There are various methods for calculating beginning and ending Inventory, which can affect a company’s COGS. Companies typically use three methods: First-in, first-out (FIFO), Average Cost, and Last-in, first-out (LIFO).

#1 First-in, First-Out Method or FIFO

- The FIFO method assumes that the earliest Inventory manufactured or purchased is sold first.

- Therefore, in an inflationary environment with rising prices, any company selling its least expensive products first will have a higher net income. Thus, using this method, the net income can increase with time.

#2 Last-in, First-Out Method or LIFO

- The LIFO method assumes that the most recent Inventory manufactured or purchased is sold first.

- As a result, any company’s net income will decrease during a period of rising prices because the most expensive products will be sold first, resulting in a higher cost of goods sold. Thus, using this method, the net income may decrease with time.

#3 Average Cost Method

- The method averages the costs of all items in stock to calculate the value of sold goods without considering their purchase date.

- The smoothing effect minimizes the impact of high-cost acquisitions or purchases on COGS by averaging the product’s cost over time.

- This method is ideal because it eliminates discrepancies caused by an inflationary or deflationary environment.

Why is Inventory Used in the Cost of Goods Sold Formula?

- A company’s Inventory consists of raw materials, finished goods, and work in progress.

- Typically, there are two inventories, i.e., the beginning and ending Inventory. Beginning Inventory represents the Inventory remaining from the previous year while ending Inventory denotes the Inventory that a company has in stock at the conclusion of the fiscal year.

- The COGS formula includes Inventory because it measures the cost of the goods sold during an accounting period.

- To determine the COGS, you take the cost of the Inventory at the beginning of the period, add the cost of purchases made during the period, and then subtract the cost of the Inventory at the end of the period.

- Inventory is essential in the COGS formula because it allows businesses to track and manage inventory costs.

Use of COGS in Various Industries

#1 Service Industry

- The COGS includes the cost of any materials used in providing the service.

- For example, if you own a catering business, COGS would include the cost of the food and supplies used to prepare and serve the food.

#2 Manufacturing Industry

- COGS includes the cost of raw materials and the cost of labor used to produce the finished product.

#3 Merchandising Company

- The COGS for a merchandising company is the sum total of all the products, such as shopping products, specialty goods, etc., it sells in an accounting period.

- Deducting the COGS from the resultant sales to determine the gross profit is essential for any merchandising company.

- If a company utilizes the perpetual inventory system, it will calculate the COGS after each sale made by the company.

#4 Retail Business

- For any retail business, COGS is an expense category that helps develop a better yet effective cost strategy.

- Retail businesses that sell their Inventory can calculate COGS.

- Since both direct and indirect costs are considered in the calculation; thus, it can also give insight into a company’s financial situation.

#5 Restaurant Business

- For any restaurant business, COGS refers to the incurred expenses in the making and delivering foods and beverages.

- COGS calculation helps restaurants stay within budget and keep costs in control. This allows restaurant owners to save money on food inventory by analyzing patterns and trends.

Cost of Sales vs Cost of Goods Sold Formula

|

Cost of Sales |

Cost of Goods Sold |

| The cost of Sales is found after the working edge or operation margin in an income statement. | A company lists COGS after its sales revenue in an income statement. |

| Sales costs include all the costs associated with selling the goods or services. | It only includes the costs associated with producing or acquiring the goods or services. |

| The cost of sales will be higher than that of goods sold due to the additional costs involved. | It will be lower than the cost of sales in the income statement. |

Final Thoughts

Understanding COGS is essential to comprehend a company’s cost analysis. These metrics reflect the operational expenses involved in producing a good or service. When the cost of sales of a good or service is higher than COGS, it means that your input cost is more than your direct cost. The result will impact revenue generation and profitability, as the company will spend more on producing than generating revenue from sales.

Frequently Asked Questions (FAQs)

Q1. How to calculate the cost of goods sold formula?

Answer: To calculate the cost of goods sold, you should add the purchases made during the accounting period to the beginning inventory and then deduct the resulting sum from the ending Inventory. The formula is,

Cost of Goods Sold = Beginning Inventory + Purchases – Ending Inventory.

Q2. Is the cost of goods sold an expense?

Answer: Yes, the cost of goods sold (COGS) is an expense. Companies consider COGS (Cost of Goods Sold) as representative of the direct costs involved in producing the goods they sell. These costs include materials, labor, and overhead expenses.

Q3. Does the cost of goods sold go on the income statement?

Answer: Yes, the cost of goods sold (COGS) appears on the income statement right after the sales revenue. COGS includes the direct costs associated with producing the goods or services sold during a period.

Q4. Is the cost of goods sold an asset or liability?

Answer: It’s important to note that the COGS is neither an asset nor a liability. COGS is an expense that a company incurs during an accounting period due to the goods and services sold.

Q5. Are the cost of goods sold tax deductible?

Answer: The IRS or Internal Revenue Service permits the inclusion of COGS in tax returns, which can lower a company’s taxable income. The same guidelines apply to both traditional and online retailers.

Q6. What is COGS’s impact on the company’s profit?

Answer: COGS, or the cost of goods sold, is a significant expense for most businesses and directly impacts profit. The higher the COGS, the lower the profit. There are a few ways to lower COGS, but it’s essential to understand how COGS affects profit before making any changes.

Recommended Articles

This is a guide to the cost of goods sold formula. Here we discuss its uses along with practical examples. We also provide you with the calculator with a downloadable Excel template. You may also look at the following articles to learn more –