Updated July 27, 2023

Cost of Sales Formula (Table of Contents)

What is the Cost of Sales Formula?

The term “cost of sales” refers to the total cost incurred to manufacture the product or service, which includes the cost of raw material, labor cost and other costs of manufacturing. It is also known as the Cost of goods sold and it is used to calculate the gross profit of a company.

The formula for the cost of sales can be derived by adding beginning inventory, raw material purchase, cost of direct labor and overhead manufacturing cost minus ending inventory. Mathematically, Formula for Cost of Sales is represented as,

Examples of Cost of Sales Formula (With Excel Template)

Let’s take an example to understand the calculation of Cost of Sales in a better manner.

Cost of Sales Formula – Example #1

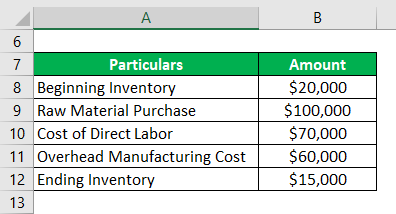

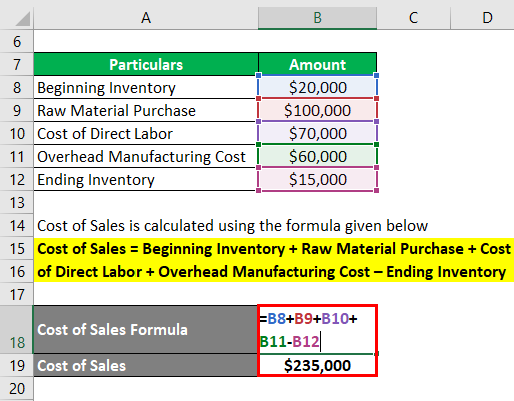

Let us take the example of a company that had an inventory of $20,000 in stock at the beginning of the year. During the year, the company spent another $100,000 in the purchase of raw material and various other inventory items and then ended the year with an inventory of $15,000. During the year, the total labor cost and manufacturing overhead that can be attributed to the production stood at $70,000 and $60,000 respectively. Calculate the cost of sales for the company based on the given information.

Solution:

Cost of Sales is calculated using the formula given below

Cost of Sales = Beginning Inventory + Raw Material Purchase + Cost of Direct Labor + Overhead Manufacturing Cost – Ending Inventory

- Cost of Sales = $20,000 + $100,000 + $70,000 + $60,000 – $15,000

- Cost of Sales= $235,000

Therefore, the company incurred cost of sales of $235,000 during the year.

Cost of Sales Formula – Example #2

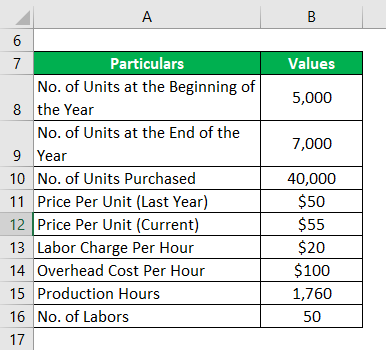

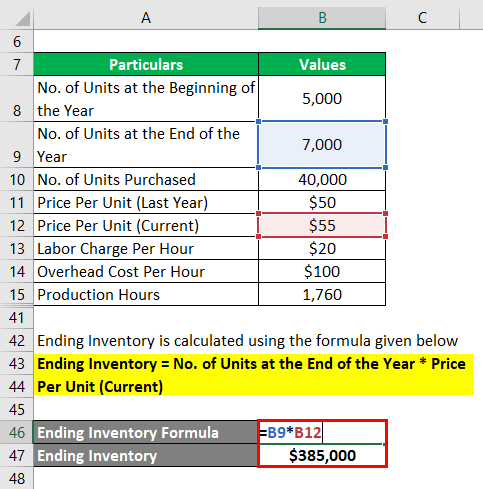

Let us take the example of another company to understand the concept of cost of sales in further detail. At the beginning of the year, the company had an inventory of 5,000 units that are worth $50 each. However, during the year the price of the raw material surged to $55 per unit and the company purchased 40,000 and ended the year with an inventory of 7,000 units. The company maintains inventory based on the FIFO method. During the year, the labor cost was $20 per hour while the manufacturing overhead was $100 per hour. The total manufacturing time attributed to production during the year was 1,760 hours and total manpower was 50. Calculate the cost of sales for the company based on the given information.

Solution:

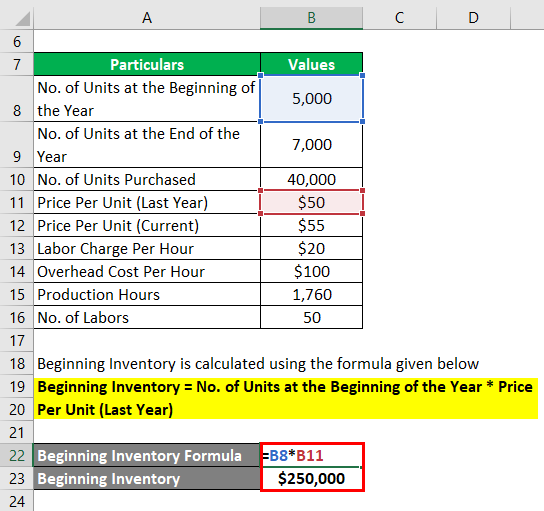

Beginning Inventory is calculated using the formula given below

Beginning Inventory = No. of Units at the Beginning of the Year * Price Per Unit (Last Year)

- Beginning Inventory = 5,000 * $50

- Beginning Inventory = $250,000

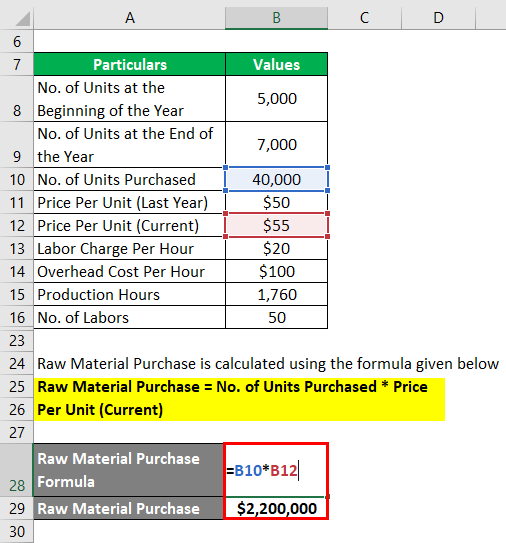

Raw Material Purchase is calculated using the formula given below

Raw Material Purchase = No. of Units Purchased * Price Per Unit (Current)

- Raw Material Purchase = 40,000 * $55

- Raw Material Purchase = $2,200,000

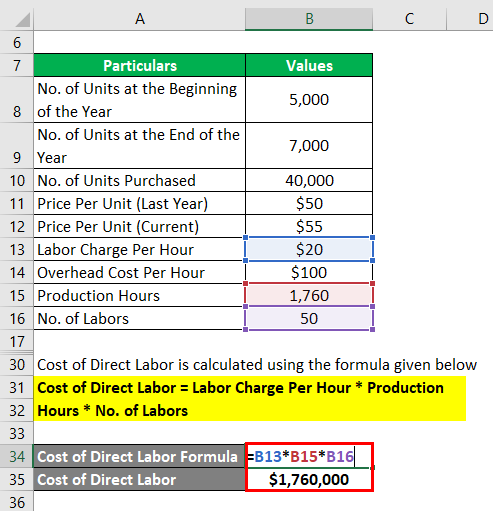

Cost of Direct Labor is calculated using the formula given below

Cost of Direct Labor = Labor Charge Per Hour * Production Hours * No. of Labors

- Cost of Direct Labor = $20 * 1,760 * 50

- Cost of Direct Labor = $1,760,000

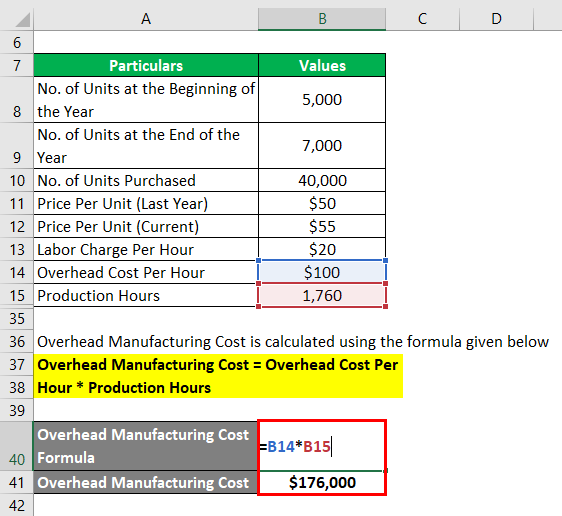

Overhead Manufacturing Cost is calculated using the formula given below

Overhead Manufacturing Cost = Overhead Cost Per Hour * Production Hours

- Overhead Manufacturing Cost = $100 * 1,760

- Overhead Manufacturing Cost = $176,000

Ending Inventory is calculated using the formula given below

Ending Inventory = No. of Units at the End of the Year * Price Per Unit (Current)

- Ending Inventory = 7,000 *$55

- Ending Inventory = $385,000

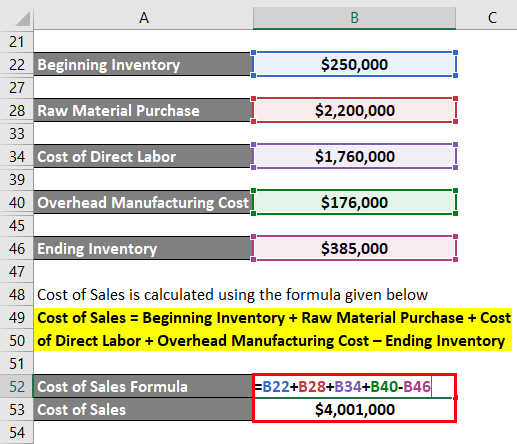

Cost of Sales is calculated using the formula given below

Cost of Sales = Beginning Inventory + Raw Material Purchase + Cost of Direct Labor + Overhead Manufacturing Cost – Ending Inventory

- Cost of Sales = $250,000 + $2,200,000 + $1,760,000 + $176,000 – $385,000

- Cost of Sales = $4,001,000

Therefore, the company incurred the cost of sales of $4,001,000 during the year.

Explanation

The formula for the cost of sales can be derived by using the following simple steps:

Step 1: Firstly, determine the beginning inventory of the company, which is the value of the inventory at the start of the period.

Step 2: Next, determine the value of the raw material purchased during the year.

Step 3: Next, determine the cost of labor which is directly attributable to the production.

Step 4: Next, determine all other costs of manufacturing over and above raw material cost and labor cost and directly attributable to the production process.

Step 5: Next, determine the ending inventory which is the value of the inventory at the end of the period.

Step 6: Finally, the formula for cost of sales can be derived by adding beginning inventory (step 1), raw material purchase (step 2), cost of direct labor (step 3) and overhead manufacturing cost (step 4) minus ending inventory (step 5) as shown below.

Relevance and Use of Cost of Sales Formula

It is important to understand the concept of cost of sales as is it an indispensable component of the financial statements. When the cost of sales is deducted from the revenue it gives the gross profit which is a measure of the effectiveness of a company in managing its operating cost. Further, investors and analysts use the cost of sales to forecast the company’s future earnings. The cost of sales is inversely proportional to gross profit, i.e. any increase in the cost of sales results in a reduction in gross profit and vice versa. As such, companies put great emphasis on managing the cost of sales to maintain their profitability.

Cost of Sales Formula Calculator

You can use the following Cost of Sales Formula Calculator

| Beginning Inventory | |

| Raw Material Purchase | |

| Cost of Direct Labour | |

| Overhead Manufacturing Cost | |

| Ending Inventory | |

| Cost of Sales | |

| Cost of Sales = | Beginning Inventory + Raw Material Purchase + Cost of Direct Labour + (Overhead Manufacturing Cost - Ending Inventory) | |

| 0 + 0 + 0 + (0 - 0) = | 0 |

Recommended Articles

This is a guide to the Cost of Sales Formula. Here we discuss how to calculate the Cost of Sales along with practical examples. We also provide a Cost of Sales calculator with a downloadable excel template. You may also look at the following articles to learn more –