Updated July 29, 2023

Difference Between Cost of Sales vs Cost of Goods Sold

Cost analysis of any company is a vital aspect and an important analysis to be done when making investment decisions for a company and extracting important information from the same. Cost of Sales vs Cost of goods sold is two important aspects of any business which need to be analyzed in detail when you are deciding to invest in any company for the long-term or the short-term. In this article, we will try and understand the basic differences and the key aspect of both methods.

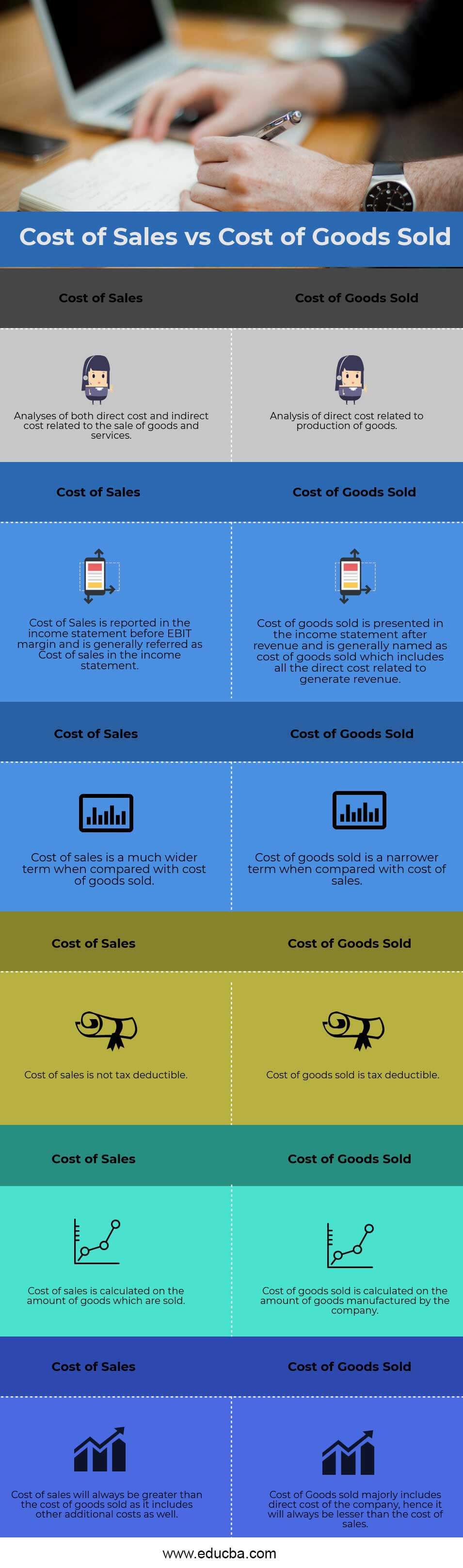

Head to Head Comparison Between Cost of Sales vs Cost of Goods Sold (Infographics)

Below is the top 6 difference between Cost of Sales vs Cost of Goods Sold

Key Differences Between Cost of Sales vs Cost of Goods Sold

Let us discuss some of the major differences between Cost of Sales vs Cost of Goods Sold:

- The key difference between the cost of sales vs the cost of goods sold is that the cost of goods sold refers to the analysis of direct cost related to the production of goods and no indirect cost is involved in the cost of goods sold. The cost of goods sold reflects the changes in the inventory and the movement of current assets and how well is inventory is converting itself into cash.

- Another major difference between the cost of goods sold and the cost of sales is the amount which is incurred by the company to sell the goods in a particular accounting period is the cost of sales. Whereas, on the other hand, Cost of goods sold does not necessary means that all the products produced are sold by the company especially if the company is experiencing seasonal sale or has a business which fluctuates with time

- The cost of goods sold is normally found in the companies involved in the manufacturing of goods and services or trading of goods and services. On the other hand, the Cost of Goods sold is a more generic term in general and is used in accounting also. It refers to either the sales of goods or services.

- Cost of sales is not always consistent across companies within or outside the industry as each company has its own cost of sales and there is no standardization anywhere in the accounting principles that only certain costs can be used to calculate the term cost of sales. On the other hand, the Cost of goods sold is more or less has the same items in the notes to accounts section of the cost of goods sold which is directly related to the production of goods, the nomenclature is changed, but the nature of the cost is more or less the same.

Cost of Sales vs Cost of Goods Sold Comparison Table

Let’s look at the top 6 Comparisons:

|

Cost of Sales |

Cost of Goods Sold |

| Analyses of both direct cost and indirect cost related to the sale of goods and services | Analysis of direct cost related to the production of goods |

| Cost of Sales is reported in the income statement before the EBIT margin and is generally referred to as Cost of sales in the income statement. | The cost of goods sold is presented in the income statement after revenue. It is generally named as the cost of goods sold which includes all the direct costs related to generating revenue. |

| Cost of sales is a much wider term when compared with the cost of goods sold. | Cost of goods sold is a narrower term when compared with the cost of sales. |

| Cost of sales is not tax-deductible | The cost of goods sold is tax-deductible |

| The cost of sales is calculated on the number of goods which are sold. | The cost of goods sold is calculated on the number of goods manufactured by the company. |

| The cost of sales will always be greater than the cost of goods sold as it includes other additional costs as well. | The cost of Goods sold majorly includes the direct cost of the company; hence it will always be lesser than the cost of sales. |

Conclusion

Every business should critically analyze these two major cost concepts and should run a detailed cost analysis on each line item of cost. Analysis of the direct cost of goods manufactured helps the company to forecast its inventory as the company can produce more for the future when the raw material of the goods manufactured is at a low, hence improving its margins. Equity research analysts should also do a cross-sectional analysis of the company before giving it a buy or sell recommendation.

Recommended Articles

This has been a guide to the top difference between Cost of Sales vs Cost of Goods Sold. Here we also discuss the key differences with infographics and comparison table. You may also have a look at the following articles to learn more.