What is a Cost-Plus Contract?

Cost-Plus Contract is a way of pricing a project or service where the customer pays the contractor for their actual costs plus a guaranteed profit margin. For instance, if a construction company builds an office building under a cost-plus contract, they would bill the client for all costs and receive payment for those costs plus an agreed-upon profit margin.

Contractors use this type of contract when the total cost of a project is uncertain or difficult to estimate in advance. However, it can lead to potential conflicts of interest as the contractor may have the incentive to increase costs to increase their profit margin.

Key Highlights

- In a cost-plus contract, the contractor receives payment for the costs incurred along with a predetermined fee or percentage.

- Key components of contracts such as direct, indirect, and overhead costs, fees, profits, and incentives.

- Construction companies frequently utilize additional cost contracts when money is tight, or there is a good chance that actual costs will be lower than projected.

- Various kinds of contracts such as, cost-plus are Cost-plus-percentage-of-cost (CPPC), Cost-plus-fixed-fee (CPFF), and Cost-plus-incentive-fee (CPIF).

Components

The main components are:

1. Direct costs: In this case, the expenses, which are directly related to the project include labor, materials, and equipment.

2. Indirect costs: These are the expenses that are not directly related to the project but are still necessary for the completion of the project. For example, rent, utilities, and administrative costs.

3. Overhead: This refers to the ongoing costs of running the business, like salaries, insurance, and taxes.

4. Profit: This is the amount of money that the contractor wants to take on the project. Additionally, Economists usually express it as a percentage of the total cost.

5. Fee: This is the amount that the contractor charges for their services. Moreover, it is usually a fixed amount or a percentage of the total cost.

6. Incentives: In some cases, the contract may include incentives for the contractor to complete the project ahead of schedule or under budget. Moreover, It can be in the form of bonuses or other rewards.

How Does a Cost-Plus Contract Work? (With Example)

Such a Contract follows these steps:

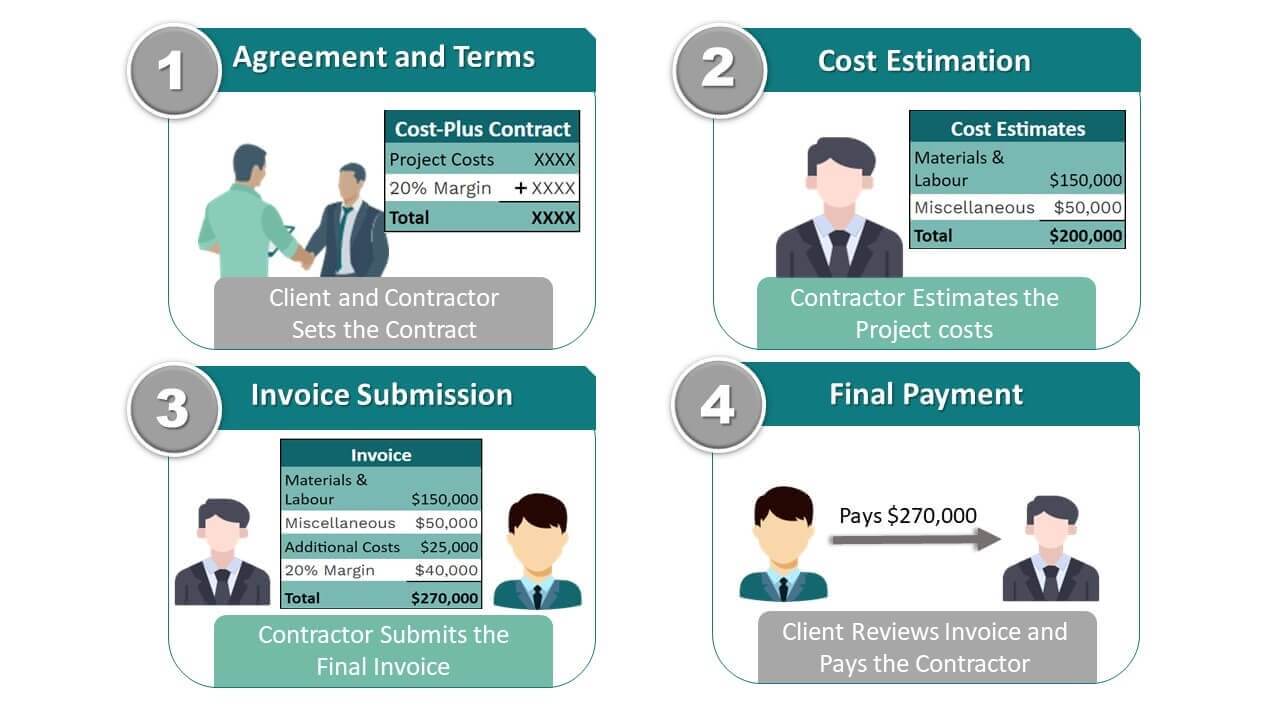

Step #1 Agreement and Contract Terms

The contractor and the client agree to enter into a contract for a project or service, and they outline the terms of the agreement in a written contract.

For example, the client and the construction company agreed to build a house under a contract specifying the reimbursement of the company’s actual costs plus a profit margin of 20%.

Step #2 Cost Estimation

The contractor estimates the project’s cost, including labor, materials, and other expenses.

For example, the construction company estimates the cost of building the house to be $200,000, including $150,000 for materials and labor and an additional $50,000 in miscellaneous expenses.

Step #3 Project Execution

The contractor carries out the project and incurs actual costs during the process, which may include additional expenses that the contractor did not anticipate during the cost estimation stage.

Example: the construction company encounters issues during the construction process that require additional labor and materials, resulting in actual costs of $225,000.

Step #4 Invoice Submission

The contractor submits an invoice to the client that reflects the actual costs incurred during the project plus the agreed-upon profit margin.

For example, the construction company submits an invoice to the client for $270,000, reflecting the actual costs of $225,000 plus a 20% profit margin of $45,000.

Step #5 Payment

The client reviews the invoice and pays the contractor for the costs and profit margin. Businesses use automatic contract obligation tracking software to track due payments and other contract obligations. This helps speed up payment cycles and streamline contractual processes.

For example, the client reviews the invoice and pays the construction company $270,000, which includes the actual costs of $225,000 and the 20% profit margin of $45,000.

Types

Here are a few different contracts under cost-plus that you may want to consider:

1. Cost-plus-percentage-of-cost (CPPC) contracts: The contractor gets paid for their actual costs plus a percentage of the costs as profit. Individuals use this contract when the project is big and complex, and it’s hard to estimate the costs accurately.

2. Cost-plus-fixed-fee (CPFF) contracts: The contractor gets paid for the principal cost plus some profit. Individuals use this contract when the client wants a project completed but don’t know all the details yet.

3. Cost-plus-incentive-fee (CPIF) contracts: The contractor gets a bonus if they finish the project within budget or on schedule. Both parties agree upon the compensation before the project starts, a percentage of the savings.

Examples

#1 Construction Contracts

In this case, the customer reimburses the builder for the project’s actual costs plus a fixed fee. The fee can be a percentage of the total cost or a set amount.

#2 Government Contracts

Many governments use these contracts, where the customer reimburses the contractor for their actual costs plus a fee. However, these contracts often have strict requirements for documentation and reporting.

#3 Consulting Contracts

Consultants often work on a cost-plus basis, paying for their time and expenses plus a fee. This type of contract is common in industries such as IT, engineering, and management consulting.

#4 Research and Development Contracts

Contractors often use these contracts in research and development projects, however, the costs can be challenging to estimate. Additionally, the customer reimburses the contractor for their actual expenses plus a fee for their expertise and services.

#5 Manufacturing Contracts

In this case, the customer reimburses the manufacturer for producing the goods plus a fee. This type of contract is common in industries such as aerospace and defense, where the costs can be high, and the production process is complex.

#6 Technological Contracts

The American space agency NASA has invited interested contractors to build Geostationary Extended Operations Sounder Instrument. They will provide a cost contract that will reimburse the contractor for all the expenses he will incur in addition to his share of the profit.

Advantages and Disadvantages

|

Advantages |

Disadvantages |

| Cost certainty:

It gives businesses total cost certainty, making budgeting and forecasting more accessible and accurate. |

Unpredictable and High Costs:

They can lead to higher costs than initially anticipated, causing budget blowouts for the customer. |

| Flexibility:

These contracts allow for adjustments to the scope of a project without incurring additional costs. |

Lack of Incentive:

They do not incentivize the contractor to complete the project efficiently and quickly, resulting in longer project durations and higher costs. |

| Transparency:

They ensure all costs are transparent and accounted for. |

Poor Quality Control:

There is no quality guarantee, leading to unsatisfactory results and a lack of accountability for the contractor. |

| Collaboration:

These contracts encourage collaboration and build trust between all parties involved. |

Potential Fraud:

They can lead to potential fraud, as the contractor may inflate costs and overcharge customers. |

| Predictability:

These contracts accurately predict all costs associated with a project or venture. |

Limited Negotiation:

They limit negotiation and can lead to an unfair agreement and an unhappy customer. |

Frequently Asked Questions (FAQs)

Q1. What are the types of contracts?

Answer: There are 3 types of contracts:

1. Fixed-price contracts: In this, both parties agree upon the price of the product/service before the start of the project and remain the same throughout the project.

For example, a construction company may agree to build a house for a fixed price of $500,000.

2. Cost-reimbursable contracts: This type of contract involves the buyer reimbursing the seller for all the costs incurred during the project, plus a predetermined fee or profit.

For example, a research project where the buyer pays the seller for all the expenses involved in the research and development process.

3. Time and materials contracts: In this case, the buyer pays for the materials used and the time spent on the project at a predetermined rate.

For example, a marketing agency may charge a client for hours worked and the cost of materials used to create a marketing campaign.

Q2. What is the difference between a cost-plus and a fixed-price contract?

Answer:

Fixed price example: The buyer pays a specific amount, regardless of the seller’s spending. Hiring a graphic designer to design a logo for $500, regardless of how many revisions or hours it takes.

Cost-plus example: The buyer pays for the actual cost of production plus a profit margin for the seller. Hiring a construction company to build a house and agreeing to pay for the actual cost of $300,000 plus 10% profit, making the total cost $330,000.

Q3. What is the risk of a cost-plus contract?

Answer: The risk of a cost-plus contract is that the party paying for it may end up paying more than expected. It can occur if the party performing the work incurs unexpected costs or inflates their prices to increase their profit margin.

Recommended Articles

This is an EDUCBA guide to Cost-Plus Contract. To learn more, please read the recommended articles: