Updated July 11, 2023

What is Coupon Bond?

The term “coupon bond” (CB) refers to the type of bond which includes coupons that are paid periodically (mostly semi-annual or annual) from the time of issuance until the maturity of the bond.

These bonds come with a par value and a coupon rate, which is the bond’s yield at the time of issuance. Bonds with higher coupon rates provide investors a higher investment yield. A CB is also known as a bearer bond.

Explanation of Coupon Bond

A CB is basically a debt obligation with attached coupons, which represent the periodic interest payments. The CB can be transferred from one investor to another prior to its maturity and the issuer of the bonds neither maintains any records of the investors nor the investors’ name are printed on the bond certificates. The holders of bonds receive the coupons on a pro-rata basis based on the tenure of holding the bonds. On the other hand, the issuer is obligated to pay the coupons timely during the period from the time of issuance of the bonds until its maturity.

How Does Coupon Bond Work?

Investors who are interested in putting money in CB should know the following to start:

- To buy a newly issued bond, the investors need to process it through a brokerage account. The broker then gets the money from the investors and in exchange, deposits the bond into their account. The bond’s purchase price is the par value at the time of issuance.

- In the case of secondary bonds, which are those bonds that were initially purchased by one investor and are now currently held by another investor, the purchase price of the bond may be quite different from the par value. The reason is that secondary purchases are done on the basis of market value and not the par value of the bond.

- In case the bond is redeemed prior to its maturity, if there is a provision,then the coupon rates may be valued differently from its initial yield-to-maturity.

Formula

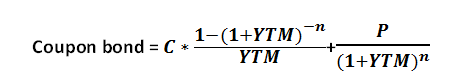

The formula for CB is derived based on the sum of the present value of all the future cash inflows either in the form of coupons or principal at maturity. The yield to maturity is used to discount the future cash flows to present value. Mathematically, the coupon bond formula is represented as,

- where, C = Coupon payment

- P= Par value

- YTM = Yield to maturity

- n = Number of periods until maturity

Examples

Following examples are given below:

Example #1

Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%.

- Given,Par value, P = $1,000

- Coupon, C = 5% * $1,000 = $50

- Number of years until maturity, n = 10

- Yield to maturity, YTM = 4%

Solution:

Now, the price of the CB can be calculated by using the above formula as,

- Coupon Bond = $50* [(1-(1+4%))^(-10))/(4%)] + [$1,000/(1+4%)^10] Coupon Bond = $1,081.11

Therefore, the price of the CB raised by ASD Inc. will be 1,081.11.

Example #2

Let us take the example of another bond issuance by ZXC Inc., and these bonds pay coupons semi-annually. The par value of the bond is $1,000, coupon rate of 6%, and a number of years until maturity in 6 years. Determine the price of the CB if the yield to maturity is 7%.

Solution:

- Given,Par value, P = $1,000

- Yield to maturity, YTM = 7%

- Since the coupon is paid semi-annually,

- Coupon, C = $1,000 * 8% / 2 = $40

- Number of periods until maturity, n = 6 * 2 = 12

Now, the price of the CB can be calculated by using the above formula as,

CB = C * [ (1-(1 + YTM))^(-n))/ YTM ]+ [P/(1 + YTM)^n]

Coupon bond = $40* [(1-(1+7%/2))^(-12)) / (7%/2) ] + [$1,000/(1+7%/2)^12]

Coupon Bond = $951.68

Therefore, the price of the CB raised by ZXC Inc. will be $951.68.

Coupon Bond Price

The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Please understand that a bond is sold at its par value at the time of issuance, and later the value changes on the basis of the coupon rate offered by the bond and the prevalent yield to maturity. There are three main categories of bond price – at par, discount, and premium.

- If the coupon rate and yield to maturity are equal, then the market value of the bond is the same as its par value, and the bond is known to be sold at par.

- If the coupon rate is less than the yield to maturity, then market value of the bond is less than the par value and the bond is known to be sold at a discount.

- If the coupon rate is higher than the yield to maturity, then market value of the bond is also higher than the par value and the bond is known to be sold at a premium.

Who Pays Coupon on A Bond?

The coupon payment represents the return generated by the bond and it is paid by the issuer of the bond. Mostly bonds are issued for a specified purpose, and the cash flow from that specific operation is then used by the issuer to service the coupon payments of the bond.

Conclusion

So, it can be seen that CB can be used by investors who are interested in long-term investment with stable cash flow generation. The price of a CB is determined on the basis of its coupon rate and the market return from investment with a similar risk profile (yield to maturity).

Recommended Articles

This is a guide to Coupon Bond. Here we also discuss the introduction and how does it work? along with examples. You may also have a look at the following articles to learn more –