Updated July 29, 2023

Difference Between Coupon Rate vs Interest Rate

Various debt instruments come with various kinds of coupon rate or interest rate which makes them less risky debt instruments in general which provides timely payment of the principal and the interest. However, for many financial analyst coupon rates and interest rates are used interchangeably and less difference is understood between them. In this article, we will try and understand the key differences between coupon rates vs interest rates in general and their different kinds of payment structures

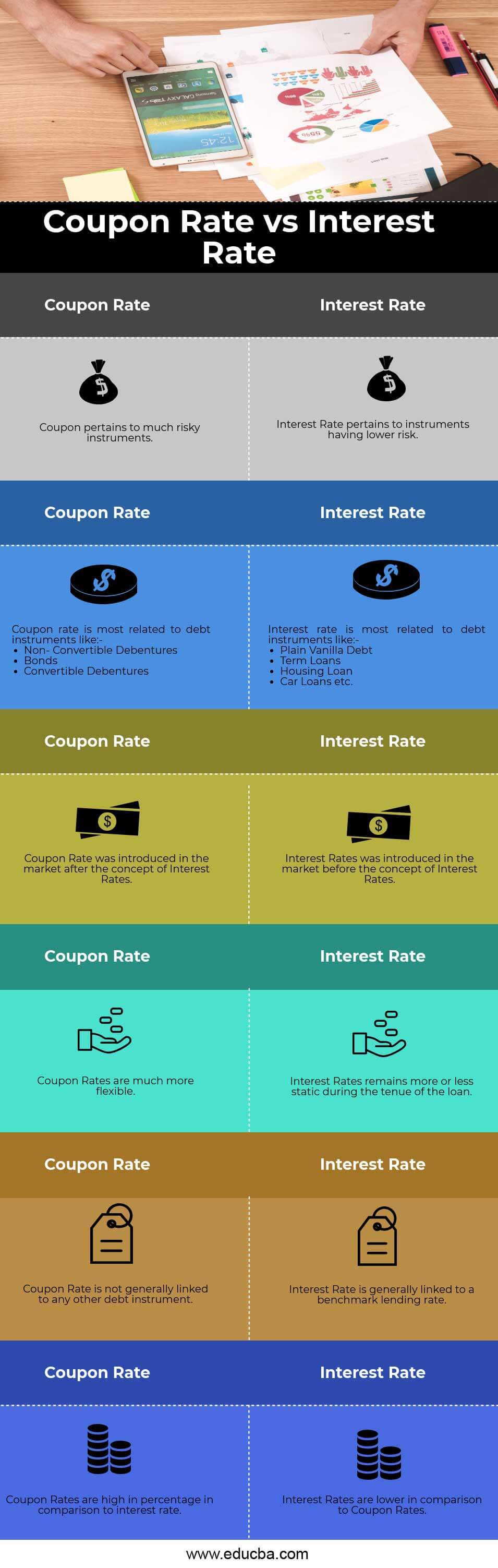

Head to Head Comparison Between Coupon Rate vs Interest Rate(Infographics)

Below is the top 6 difference between Coupon Rate vs Interest Rate

Key Differences Between Coupon Rate vs Interest Rate

Let us discuss some of the major differences between Coupon Rate vs Interest Rate :

- The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. On the other hand, the Coupon rate is generally associated with debt instruments like non-convertible debentures and any kind of new debt instrument which are in today’s world prevailing in the market that is now being sold

- Under interest rate can be fixed, floating, or pegged to a benchmark lending rate like LIBOR, MIBOR, or Marginal Lending Rate on which the financial institution and banks these days lend to the general public. The nature of the interest rate is commonly decided at the initiation of the term sheet and remains fixed in most of the debt instruments or can be changed during the tenure of the loan. On the other hand, coupon rates which are fixed in the case of Bonds and Debentures and in the case of NCD’s which are now commonly lent by various fund houses and institutions are often related to the leverage ratio i.e. Gross Debt/EBITDA.

- The interest rate in most of the cases are consistent and are due on a monthly or a quarterly basis on a term loan or any other loan availed from the financial institutions and the banks. They are consistent on the payment terms and generally do not change throughout the tenure of the loan which makes it less complex when compared with coupon rates debt instruments. On the other hand, the Coupon rate is very flexible in nature and generally, most of the lenders and fund houses provide an option of bullet payment or balloon payment towards the end of the loan which is inclusive of the coupon rate and the principal involved in the loan tenure

- Interest rates vary from various product to product and also the credit profile of the company and various other aspects such as how the company is generating cash flow and also future projections. On the other hand, a Coupon rate is introduced where the risk profile of the borrower is high and the borrower needs re-finance or needs to go off from immediate cash outflow of its debt obligations which makes the company let go of the heavy principal payment which is due in the coming quarter or year

Coupon Rate vs Interest Rate Comparison Table

Let’s look at the topmost Comparison between Coupon Rate vs Interest Rate

|

Coupon Rate |

Interest Rate |

| The coupon Rate pertains to many risky instruments | Interest Rate pertains to instruments having a lower risk |

The coupon rate is most related to debt instruments like:-

|

The interest rate is most related to debt instruments like:-

|

| Coupon Rate was introduced in the market after the concept of Interest Rates | Interest Rates was introduced in the market before the concept of Interest Rates |

| Coupon Rates are much more flexible | Interest Rates remains more or less static during the tenure of the loan |

| The coupon Rate is not generally linked to any other debt instrument | Interest Rate is generally linked to a benchmark lending rate |

| Coupon Rates are high in percentage in comparison to interest rate | Interest Rates are lower in comparison to Coupon Rates |

Conclusion

The concept of lending revolves around the principle of interest and is frequently used all over the world although from different nomenclature but the basis and the concept of most of the debt instruments remains the same. The interest rate which is earned by the lender is also known as the Return on Investment for the bank or the financial institution. An individual today has a variety of choices among different debt instruments.

Recommended Articles

This has been a guide to the top difference between Coupon Rate vs Interest Rate. Here we also discuss the Coupon Rate vs Interest Rate key differences with infographics and comparison table. You may also have a look at the following articles to learn more-