Difference Between Coupon vs Yield

A coupon payment on the bond is the annual interest amount paid to the bondholder by the bond issuer at the bond’s issue date until its maturity. Coupons are generally measured in terms of coupon rate, calculated by dividing it by the face value. Coupons are paid in two fashions semi-annually and annually in percentage. We also refer to coupons like the “coupon rate”, ”coupon percent rate,” and “nominal yield”. Yield to Maturity is the total return an investor will earn by purchasing a bond and holding it until its maturity date. Yield to maturity is a long-term bond yield and expresses in terms of an annual rate. In other words, it is the internal rate of return in which the investor holds the bonds until maturity and makes all payments as scheduled, simultaneously reinvesting into it at the same rate.

Example for Coupon

If a bond’s face value of $1000 pays $70 a year at 7%, interest payment may be either semiannually or annually. Later, the bond’s face value drops to $900; its current yield rises to 7.8% ($70 / $900).

Usually, the coupon rate does not change, it is a function of the annual payments and the face value, and both are constant.

Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with their face value.

The bond’s price is calculated by considering several other factors, including:

- Bond’s face value

- The maturity date.

- The coupon rate and frequency of it are payments.

- Issuer’s creditworthiness.

- The yield on comparable investment options.

Yield

Yield to Maturity is also known as a booking yield or redemption yield. The yield to maturity of a bond depends upon the market’s current price of the bond. However, the yield-to-maturity formula proves to be a more effective yield of the bond based on compounding against the simple yield calculated with the help of the dividend yield formula.

- C = Coupon / Interest Payment

- F = Face Value

- P = Price

- n = years to maturity.

The formula is used to calculate the approximate yield to maturity. However, determining the actual yield to maturity requires employing a trial and error method by putting rates into the present value of a bond formula until P matches the actual price of the bond.

The yield to maturity is calculated by the present value formula discussed below.

For evaluating yield to maturity present value of the bond is already present, and calculating YTM is working backward from the present value of a bond formula and trying to determine “r”.

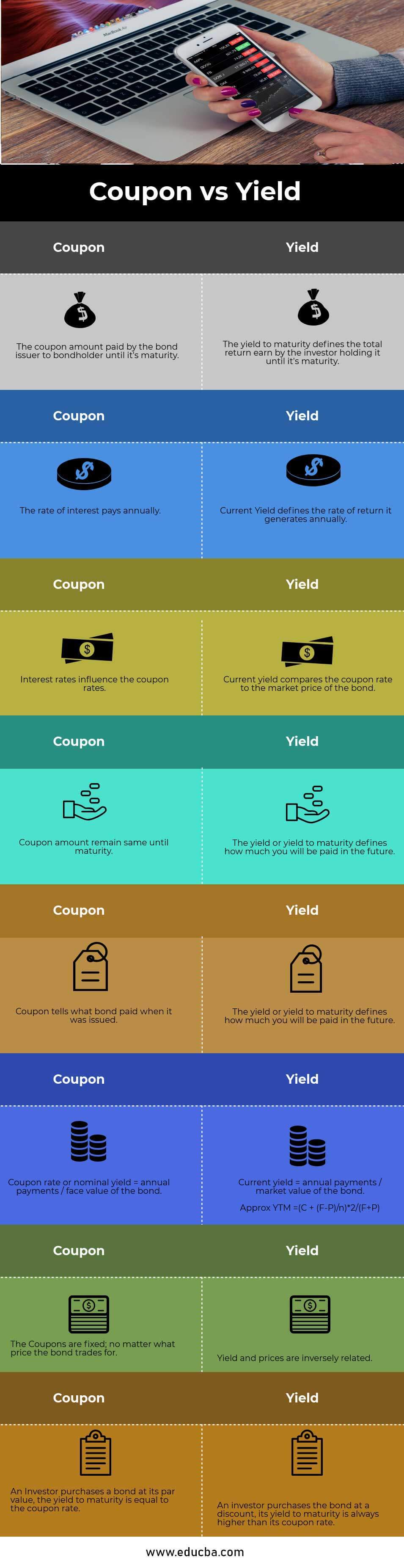

Head To Head Comparison Between Coupon vs Yield (Infographics)

Below is the top 8 difference between Coupon vs Yield

Key Differences Between Coupons vs Yield

Both Coupons (like you can find on Bountii and Retailescraper) and Yield are popular choices in the market. Let us discuss some of the major Difference Between Coupons vs Yield:

- The coupon rate of a bond is the interest paid on the principal amount of the bond(at par). While yield to maturity defines that it’s an investment that is held till the maturity date and the rate of return it will generate at maturity.

- The coupon amount is the amount that is paid out semi-annually or annually till the maturity date on the face value of the bond. At the same time, the current yield generates the return annually, depending on the market price fluctuation.

- Coupon rates are more likely influenced by the interest rates fixed by the government body on the basis country’s economy. While calculating the current yield, the coupon rate compares to the bond’s current market price.

- During the bond’s tenure, the bond price remains the same till maturity due to the continuous fluctuation of the market price; it is better to buy a bond at the discount rate, which offers handsome returns on the maturity at face value.

- The coupon amount decides what amount will be paid by the bond annually or semiannually as per government norms till maturity. At the same time, yield defines the returns after reinvestment of the coupon amount at maturity.

Coupon vs Yield Comparison Table

Below are the 8 topmost comparisons between Coupon vs Yield

| Sr.No. | Coupon | Yield |

| 1 | The coupon amount the bond issuer pays to the bondholder until its maturity. | The yield to maturity defines the total return earned by the investor holding it until its maturity. |

| 2 | The rate of interest pays annually. | The current Yield defines the rate of return it generates annually. |

| 3 | Interest rates influence the coupon rates | The current yield compares the coupon rate to the bond’s market price. |

| 4 | The coupon amount remains the same until maturity. | Market price keeps fluctuating, so buying a bond at a discount representing a larger share of the purchase price is better. |

| 5 | Coupon tells what bond was paid when it was issued. | The yield or yield to maturity defines how much you will be paid in the future |

| 6 | Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond |

|

| 7 | The Coupons are fixed, no matter what price the bond trades for. | Yield and prices are inversely related. |

| 8 | An investor purchases a bond at its par value; the yield to maturity equals the coupon rate. | An investor purchases the bond at a discount; its yield to maturity is always higher than its coupon rate. |

Conclusion

This coupon vs yield article aims to clarify the ambiguity between the yield and the coupon when someone has limited or no experience with the endless list of financial industry terms. These two terms, coupon vs yield, are most commonly encountered while managing or operating in bonds. Moreover, combined usage gives better returns and translates into the concept higher coupon rate means a higher yield. Apart from the usage of bonds, both terms are quite different.

Recommended Articles

This has been a guide to the top difference between Coupon vs Yield. Here we also discuss the Coupon vs Yield key differences with infographics, and a comparison table. You may also have a look at the following articles to learn more.