FRM (Financial Risk Manager) Training

Financial Risk Manager (FRM) is a professional designation awarded by the Global Association of Risk Professionals (GARP) to the candidates who successfully complete this certification program. It is a globally recognized standard for those who manage risk.

With the rapid changes in the finance industry worldwide there is a need for professionals who manage risk, money, and investment to obtain globally standardized up-to-date knowledge and FRM aims to fill that gap.

FRM Certification Requirements

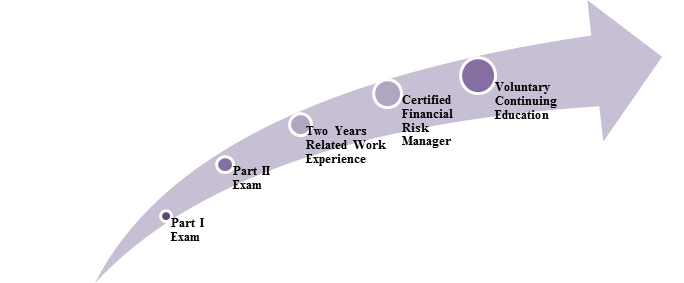

There are no educational or professional requirements to appear for the FRM Exam. It is practice-oriented examination offered in two parts; questions are designed to relate theory to practical, real-world, problems. However, to become a Certified Financial Risk Manager, candidates must comply with the following outline of the program:

In order to become a Certified Financial Risk Manager after passing the FRM Exam Part I & II, candidates must demonstrate a minimum of two years of risk-related full-time professional experience positions including portfolio management, risk consulting, and other fields.

FRM Part I Exam

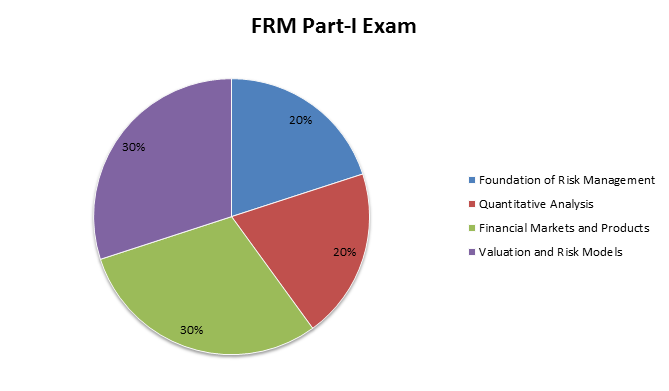

Clearing the FRM Exam Part I is the first step for an individual to become a Certified Financial Risk Manager. The candidates are expected to know about the risk management concepts and theories as they would apply to a risk manager’s daily work. The Part I exam focuses on the essential tools and concepts required to assess financial risk. This exam is available in the month of May and November each year. There are 100 multiple choice questions to be attempted within the duration of 4 Hours. The below diagram depicts the subjects that the candidates are supposed to prepare for in level I exam with their respective weight age.

FRM Part II Exam

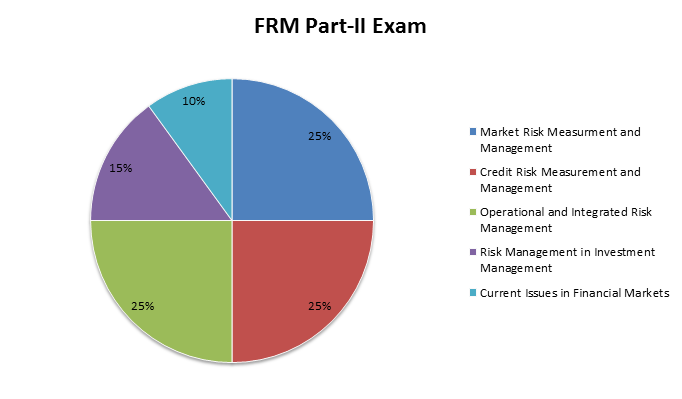

The Financial Risk Manager Exam Part II is the second of two exams that a candidate has to clear to become a certified FRM. The FRM Exam Part II focuses on the practical application of risk management tools covered in Part I to specific areas of risk management such as credit risk, market risk, and operational risk. This exam is available in the month of May and November each year. There are 80 multiple choice questions to be attempted within the duration of 4 Hours. The below diagram depicts the subjects that the candidates are supposed to prepare for in level II exam with their respective weight age.

FRM Career Opportunities

The FRM certification differentiates you from your peers, provides a competitive advantage to colleagues, clients, and prospective employers. It gives the opportunity for individuals to accelerate their careers irrespective of their educational background. It aids the candidates with specialized knowledge and skills in financial risk management. It provides you with a network to connect with the world’s prominent financial risk management professionals. It provides with varied career options in Risk Management, Trading, Structuring, Modeling, etc. FRM holders can have positions such as Chief Risk Officer, Senior Risk Analyst, Head of Operational Risk, and Director, Investment Risk Management, to name a few. It is a great value addition to skills, credentials, and resume

Provide financial advice and service to clients. Identify the key skills of a successful wealth manager. Provide effective financial services to clients.

Industries Employing Certified FRM’s

Candidates for the FRM designation work in any number of industries, including:

- Banks

- Investment banks

- Asset management firms

- Corporations (including non-financial corporations)

- Consulting firms

- Hedge funds

- Insurance firms

- Credit agencies

- Government/regulatory agencies

- Risk and technology vendors

Frequently Asked Questions (FAQ)

- How much time is there to prepare for the FRM Exam?

This will vary with individual’s prior experience, concept familiarity, and academics background, Therefore, it is difficult to give out a specific number of hours to prepare for this exam. However a survey in May 2012 FRM Exam Part I test takers indicates that, on average, individuals devoted about 240 hours to Exam preparation though it varied from less than 100 to more than 400 hours.

- What are my career opportunities after becoming a Certified FRM?

There are various career prospects available as it is one of the most widely accepted designations in risk management industry. It provides a competitive edge as against other peers. It is a valued designation by employers around the world. FRM holders can have positions such as Chief Risk Officer, Senior Risk Analyst, Head of Operational Risk, and Director, Investment Risk Management, to name a few. It is a great value addition to skills, credentials, and resume

- How much work experience is required before applying for the FRM Exam?

To become a Certified FRM, individuals must have professional experience of two years in risk-related full-time professional experience positions including portfolio management, risk consulting, and other fields. However, there are no educational or professional prerequisites to apply for the Financial Risk Manager Exam.

- When can one appear for the exam?

Part I & Part II exams are available on 3rd Saturday of May & November each year.

- Are there any exemptions offered by GARP for either part of the exam?

Though there are many other reputed professional designations in the financial services industry, GARP does not accept other designations in partial fulfillment of their requirements. To maintain the integrity of the FRM certification and to fulfill their obligations to the risk management community, therefore, GARP cannot rely on the assessments performed by other designation-granting organizations. Thus, there are no exemptions that are offered to students for either part of the exam.

- If candidates appear for Part I and II in one day and do not pass Part I, Part II are not marked. Why so?

The Financial Risk Manager Exam tests cumulative knowledge, concepts tested in Part I is needed for Part II. Thus to grade Part II, a candidate must first clear Part I. Hence, if a candidate has appeared for both Parts I and Part II on the same day, will not be graded for Part II unless a candidate has passed Part I. Also the candidate will have to re-take Part I until they pass.

- Is use of calculator allowed during the exam?

Yes, it is allowed to use specified financial calculators (TexasI BA II Plus or professional and HP 12C)

- What is the mode of examination for both Part I and Part II exam?

Both the exams would be manual via paper and pencil.