Early Bird Offer

Equity Research Bootcamp Live Classes

Our Equity Research Bootcamp provides access to over 36 hours of live online Bootcamps that include advanced Financial Modeling, Investment Banking, Valuations, M&A, and Leverage Buyout topics. In addition, you also get access to our 55+ hours’ worth of comprehensive self-study package that includes video training courses. This Bootcamp will help you learn how to analyze a company by projecting its financials and performing valuation.

Includes:

- 25,023 ratings

Key Features

- Live Online Classes (36+ Hours)

-

Self-Paced Training (55+ Hours)

- Basic Microsoft Excel Training

- Microsoft Excel - Advanced

- Accounting:01 - Income Statement

- Accounting:02 - Balance Sheet

- Accounting:03 - Cash Flows Analysis

- Corporate Valuation - Beginner to Pro in Microsoft Excel

- Financial Modeling of Siemens AG

Course Fees

Live Online Classes PREFERRED

Everything in self-paced, plus

Overview

Our Equity Research Bootcamp covers more than 36 hours of interactive, wide-ranging, and instructor-led training with real-life case studies, thus imparting working knowledge of important Equity Research concepts.

Live Online Classes Curriculum Download Curriculum

-

Module 01 – Ratio Analysis - Fundamental Analysis Bootcamp

How to analyze a company?

- Common size statements

- Balance sheet

- Income statement

- Internal liquidity analysis

- Current ratio / quick ratio / cash ratio

- Inventory turnover

- Receivable turnover

- Payables turnover

- Operating profitability analysis

- Gross profit margins

- Operating margins

- Return on total capital

- DuPont analysis - Return on equity

- Extended DuPont analysis

- Risk analysis

- Operating leverage

- Financial leverage

- Debt to equity ratio

- Interest coverage ratio

- Growth analysis

- Sustainable growth rate

- Hands-on Exercise: Colgate Case Study

- Common size statements

-

Module 02 – Financial Modeling - Fundamental Analysis Bootcamp

Introduction to Modeling

- Introduction to financial modeling

- Why financial models are used?

- What skills are needed for financial modeling?

- General structure and model design

- Historical data

- Sources of information

- Presentation of historical data

- Analysis of historical data

- Building the model

- Core statements

Projecting Schedules

- Revenues

- Costs

- Fixed asset, capital expenditure, and depreciation schedule

- Capital lease schedule

- Amortization schedule

- Working capital and change in working capital schedule

- Completion of income statement logic

- Shareholders’ equity schedule

- Shares outstanding schedule

- Individual schedules of inventory, deferred revenue, receivables, and other working capital categories

- Other long-term items schedule

- Debt and debt repayment schedule

- Interest schedule

- Income tax schedule

- Schedules of investments and dividends received

- Details of minority and non-consolidated subsidiaries

Drivers

- Income statement drivers

- Revenues

- Costs

- Operating expenses

- Other income statement items

- Income taxes

- Equity income

- Minority interest

- Balance sheet drivers - assets

- Working capital

- Cash and cash equivalents

- Accounts receivables

- Inventories

- Fixed assets (PPE, depreciation and net fixed assets)

- Non-consolidated subsidiaries

- Balance sheet drivers – liabilities

- Short term debt

- Accounts payable

- Deferred taxes, accrued liabilities, and other current Liabilities

- Minority interest

- Equity

Balancing Act

- Balancing the balance sheet

- Calculating cash flow from operations

- Calculating cash flow from investing activities

- Calculating cash from financing activities

- Calculating net cash flows

Hands-on Exercise: Colgate Case Study

-

Module 03 – Business Valuation - Business Valuation Bootcamp

Valuation Overview

- Valuation overview

- Why valuation?

- Importance of valuation

- Valuation approach

- Key valuation tools

- Valuation summary table

- Key valuation questions

- Valuation – subjectivity versus objectivity

- Introduction to discounted cash flow

- Discounted cash flow

- Overview of discounted cash flow

- Steps in a Discounted cash flow (DCF)

Discounted Cash Flows

- Free cash flow

- Valuing a firm using free cash flow to firm (FCFF)

- Valuing a Firm using free cash flow to equity (FCFE)

- Suitability of FCFF and FCFE

- Discounted cash flow projections

- Sales

- Operating expenses

- Depreciation

- Capital expenditure

- Income tax

- Working capital

- Deferred tax

- Projections – some questions?

Terminal Value

- Terminal value overview

- Exit value method

- Exit multiple exercise

- Perpetuity growth method

- Perpetuity growth exercise

- Terminal value spot check

- Terminal value concerns

Discount Rate

- Discount rate overview

- Discount rate – cost of debt

- Yield to maturity method

- Credit rating method

- Synthetic rating method

- Company report method (spot check!)

- Risks

- Unsystematic risk

- Systematic risk

Capital Asset Pricing Model

- Introduction to capital asset pricing model (CAPM)

- Risk-free rate

- Beta

- Calculation of regression beta

- Calculation of bottom-up beta – levered and unlevered beta

- Beta concern

- Preferred beta methodology

- Market risk premium

- Historical risk premium method

- Forecast risk premium method

- Market risk premium: size premium

DCF Synthesis

- DCF – present value

- Discounting

- Mid-year discounting

- Valuation

- DCF – adjustments

- Sensitivity analysis

- FCF and terminal value using growth rate and WACC as inputs

- Enterprise value using growth rate and WACC as inputs

- Price/share using growth and WACC as inputs

- Effect on EPS by changing the value drivers

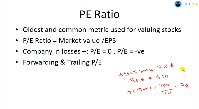

Valuation Multiple

- What is a multiple?

- Why multiples vary

- Advantages and disadvantages of Multiples

- Identifying comparables

- Operational parameters

- Financial parameters

- Equity value

- Enterprise value

- Advantages of equity value and enterprise value

- Introduction to equity value multiples

- Introduction to enterprise value multiples

Equity and Enterprise Multiple

- Calculation of valuation multiples

- Enterprise value multiples

- EV/Sales

- EV/EBITDA

- EV/EBIT

- EV/FCF

- EV/Capacity

- Equity value multiples

- P/E

- P/CF

- P/BV

- PEG

- Dividend Yield

- Let’s put it together!

Other Valuation Approaches

- Asset-based valuation

- Sum of parts

- Mergers and acquisitions comparables

- Replacement cost method

- Qualitative factors in valuation - management quality

- Valuation overview

-

Module 04 – Mergers & Acquisitions - Mergers & Acquisitions Bootcamp

- Overview of Mergers & Acquisition

- Purchase Price Calculations & Sources

- Purchase Price Calculations

- Sources & Uses of Funds

- Financial Statements

- Purchase Price Allocation

- Proforma Opening Balance Sheet Format

- Proforma P&L Forecast

- Proforma NI & EPS

- Proforma Balance Sheet Actuals & Forecast

- Working Capital Calculations

- Proforma Statement Completion

- Preparation of Proforma Cash Flow Statement

- Debt Repayment Schedule

- Accretion & Dilution Calculations

- Synergies and Assumptions

- Synergy Assumptions

- Synergy Calculations

- Sensitivity Analysis

- Summary

-

Module 05 – Leveraged Buyout - Leveraged Buyout Bootcamp

- Overview of Leverage Buyout

- Transaction Assumptions

- Transaction Assumptions

- Debt Assumptions

- Sources & Uses of Funds

- Projecting Schedules

- Revenue Built-up

- Cost Sheet

- Working Capital Management

- Depreciation & Amortization

- Linking to Financial Statements

- Linking to Income Statement

- Linking to Balance Sheet

- Linking to cash Flow Statement

- Shareholder’s Equity & Debt Schedule Calculations

- Shareholder’s Equity Schedule

- Debt Schedule

- Completing the Missing Links

- IRR & Sensitivity Analysis

IN : +91-8800880140

Self-Paced Training

Our Self-paced Equity Research is an Ultimate bundle of 15+ courses with 55+ hours of video tutorials and Lifetime Access.

This isn’t all, you also get verifiable certificates (unique certification number and your unique URL) when you complete these trainings.

Self-Paced Training Curriculum Download Curriculum

In this section, each module of the Equity Research course is explained briefly:

-

BASIC MICROSOFT EXCEL TRAINING

This is the first module of the course. Before if you ever learn to analyze or understand investments, you need to make your basics clear. That’s why you will learn how to feed data into excel, how to apply various functions, how to avoid common errors, and also how to make excel your ally. You would need to invest around 4 hours for this module.

-

MICROSOFT EXCEL - ADVANCED

This module will teach you the advanced excel. In the first module, you would learn the basics. In this module, you will use the fundamentals to go to the next level. From data functions, what-if analysis to the array, pivot tables, names & dynamic range, form controls, advanced charts - you will learn. You need to invest around 6 hours.

-

Accounting:01 - Income Statement

Next module is on the income statement. The income statement is one of four most important financial statements you need to analyze. You will learn how to create an income statement and also how to look at an income statement. You will learn the difference between a fiscal year and a calendar year. You will also learn how to calculate profit margins, you will know about revenue recognition, nonrecurring items, depreciation expense, and finally a case study on Colgate.

-

Accounting:02 - Balance Sheet

This Equity research course is dedicated to the balance sheet analysis. A balance sheet is one of significant four financial statements for any company. You will learn about current assets, current liabilities, long-term assets, long-term liabilities, financial reporting standards, and shareholders’ equity. This entire module will take around 3.5 hours.

-

Accounting:03 - Cash Flows Analysis

This is the next module on cash flow analysis. Here you will learn how to look at a cash flow statement and how to make sense of it. You will learn to find out net cash flow from operating activities, investing activities, and finance activities. You will also learn the direct method and the indirect method of calculating cash flow from operations. You will also get to understand the entire module via examples and case studies. This module will take around 1 hour.

-

Corporate Valuation - Beginner to Pro in Microsoft Excel

In this Equity research course, first, you will learn a brief overview of corporate valuation. Then, sequentially, you will learn the dividend discount model (DDM), discounted cash flow (DCF), you will also learn how to calculate enterprise value (EV) and relative valuation. To complete the module, you need to invest around 3 hours.

-

Financial Modeling of Siemens AG

Since this is a comprehensive training, at last, you will learn how to create a financial model for a real company. That’s why in this module, you will learn about the framework & prerequisites of the valuation, how to define the need, how to project income statement, how to look at the working capital schedule, how to create a cash flow statement, ratio analysis, scenario analysis, and finally DCF valuation.

Self Study Course Bundle Details

| Course | No. of Hours | |

|---|---|---|

| Equity Research Overview | 1m | |

| Microsoft Excel - Beginners | 6h 44m | |

| Microsoft Excel - Advanced | 9h 21m | |

| Advanced Excel Practicals: Essentials for the Real World | 3h 25m | |

| Accounting - The Foundation | 43m | |

| Accounting:01 - Income Statement | 1h 57m | |

| Accounting:02 - Balance Sheet | 3h 19m | |

| Accounting:03 - Cash Flows Analysis | 1h 2m | |

| Accounting:04 - Financial Analysis Techniques | 2h 23m | |

| Accounting:05 - Income Taxes | 1h 03m | |

| Corporate Valuation - DCF and Relative Valuation | 3h 01m | |

| DCF - Discounted Cash Flow for Beginners | 5h | |

| Comparable Comps - Comparable Company Analysis | 3h 41m | |

| Comprehensive Relative Valuation Training | 4h 51m | |

| Equity Research Report Writing | 1h 34m | |

| Financial Modeling of Apple Inc | 8h 24m | |

| Financial Modeling - Big Books | 8h 53m | |

| Financial Modeling - Siemens AG | 8h 33m | |

| Financial Modeling - Twitter | 5h 07m | |

| Financial Modeling - Indian Telecommunication Sector | 3h 48m | |

| Financial Modeling - Automobile Sector | 4h 8m | |

| Comcast and Time Warner Merger Modeling Training | 3h 29m | |

| Financial Modeling - Banking Sector | 7h 54m |

Self Study Projects

- 6+ Industry Projects

- Hands-on Instructor-led Case Studies

- Perform financial analysis on Live company data

- Build a financial & Valuation Model from scratch

- Forecast Target Price of Shares

- Showcase Projects in your CV/Linkedin

Equity Research Course - Certificate of Completion

Industry Growth Trend

The Financial Services Application Market is expected to grow from $66.92 billion in 2014 to $103.66 billion to 2019, at a Compound Annual Growth Rate (CAGR) of 9.1% during the forecast period 2014-2019.[Source - MarketsandMarkets]

Average Salary

[Source - Indeed]

What tangible skills will I learn from this course?

In this Equity Research analyst certification, you will get to learn many, many skills. Here’s a list of tangible skills you would learn from this Equity research course –

- MS Excel: Even if as an ER analyst, it’s given that you should know MS Excel, we haven’t left anything to chance. So, we will begin the course with the basics and the advanced level excel.

- Valuation: This is one of the most important skills you would learn in this Equity research course. You will learn the dividend discount model (DDM), discounted cash flow (DCF), and also how to calculate enterprise value (EV) and relative valuation. Along with that, you will also learn how to apply this knowledge in real life.

- Research report writing: This is again not being taught in every ER course. So, in this Equity research course, you will also learn how you should approach ER report writing. And with practice, I would be able to write incredible ER reports.

Pre-requisites

- Willingness for a career in equity research: The only prerequisite to this course is your interest in equity research. If you’re a finance student but you don’t have any interest in equity research, you will not get the best value out of this course.

- Basic knowledge of finance: This Equity research course consists of a lot of advanced concepts. Without the basic knowledge of finance, it wouldn’t be possible for you to grasp the entire course under hours.

Target Audience

- We want to say that this course is for everybody if anyone is interested. But it’s more applicable to –

- Students of finance: This is an ideal course for those students that want to build a career in equity research. But make sure you love data, analysis, research, investments, and writing.

- Professionals of finance: If you’re a juncture at your career and want to shift from one to another, equity research may be the career you should look for. If you love research and analysis, you would love this course. This Equity research course will guide you step by step on how to become an equity research analyst.

FAQ’s- General Questions

Why should I do this Equity research training course?

You shouldn’t if you want to pursue something else. But if you want to build a career in equity research, this course is the most significant one you would ever do.

How much time do I need to invest after doing the course?

This Equity research course is something that you can take on again and again and again. And perfection depends on how much you work on yourself and the materials you receive.

I’m not a finance professional, should I do this Equity research course?

No. First, I have a basic knowledge of finance. You can opt for a basic finance course and then go ahead and do this course.

Sample Preview

Career Benefits

- Comprehensive equity research module: We are certain that you wouldn’t get any better course than this on equity research. If you want to master equity research and aim to be an equity research analyst, this is a must-do course for you.

- You will be way ahead than your peers: We don’t believe in competition either, but what if you do this course and they don’t? The obvious side-effect is that you would be way ahead than your peers – and you would rather feel amazing being the center of the crowd.

- With the right application, you will become an equity research analyst: This Equity research course works if you will work. And with the right use of the material, you will achieve your dream of becoming an equity research analyst. And you will also master several skills (financial analysis, financial modeling, valuation, MS Excel, ER report writing) in a go.

Course Testimonials

Satisfied with course

The course was up to the mark, Only relevant was taught in the course, as said in the introduction. Minto’s Pyramid approach was a nice and useful method, which would be handy in making all projects/Reports.

The readability statistics were also interesting and completely new. Great work by the content creator.

Linked

Prateek Chawla

Great overview of Report Writing

This was a great overview to get the gist of what report writing entails. The instructor’s humorous inflection as you got deeper into the course made it an enjoyable review. The instructor was clear and concise going through each example presented within each segment which was extremely appreciated. Using real-life examples made grasping the information very helpful. Will take instructors’ advice for other courses offered that utilizes what was reviewed.

Romona Robinson

Equity Research Report Writing Training

Incredibly informative and easy to follow. Excellent overview of critical components with complete and thorough instruction. All topics addressed clearly and concisely. Case studies helped to tie all aspects of the instruction together. A complicated topic presented in an easy to understand and follow package. I also appreciated the added instruction of using Microsoft Word tools to aid in assessing writing quality.

Brandon Hall

Good course

Good course. I liked the examples. The Instructor is best, He communicates information exceptionally clearly and efficiently, adds humor, and uses relevant examples to make connections between course material and the real world. I have nothing bad that I can think of to say about his style of and proficiency at teaching. I would recommend this course to those looking to take this course

Linked

José Agostinho Pedro

Excellent! Financial Modelling Course

The course layout was structured in a clear, thoughtful manner. The course instructor gave practical examples to illustrate basic accounting concepts (which was a good reminder). Some real-world advice was provided by the instructor, at the beginning (understanding the users of the financial model) and at the end (interview questions, common mistakes). That was a good heads up of what to expect in the real world.

Linked

Cheng Zhongyi