EDUCBA Advantages

EDUCBA Universal Bundle is a comprehensive package that includes all prominent and essential courses in one place to help learners excel and succeed in diverse fields of Finance, Data Science, Design, IT and Software Development, Excel, Project Management, Marketing, HR, Personal Development and many more. Invest in your professional goals with EDUCBA Universal Bundle and get unlimited access to the entire EDUCBA website and its all-inclusive resources.

Learn anything

Choose any topic, and advance your skills

Save money

Take multiple courses from diverse fields at no additional cost

Flexible learning

Learn at your own pace, move between multiple courses, or switch to a different course

Unlimited certificates

Earn a certificate for every learning program that you complete at no additional cost

What you’ll get

Lifetime Unlimited Access to 300+ world-class Finance courses, hands-on projects, job-ready certificate programs and learning paths, tests and quizzes

All current and future access to courses and learning paths

1500+ hours of upskilling content

Unlimited certificates

200+ downloadable excel templates

Latest trends in real world covered

New content added every month

100% online & self-paced curation

Lifetime of support at your convenience

Lifetime access to the complete resource bundle

Convenient and cost-effective way to gain knowledge in multiple domains

What Will You Learn?

This bundle helps you master

Accounting, Bitcoin, Capital Budgeting, Corporate Valuation

Equity Research, Excel, Financial Modeling

Fixed Income, Forex Trading, Hedge Funds

Investment Banking, IPO Valuation, Pitchbook

Mutual Funds, Options Trading

Project Finance Modeling, Private Equity Modeling

Venture Capital Modeling, Financial Analytics

Credit Risk and Rating, Crypto

Stock Trading, Structured Finance

IFRS, US GAAP

Merger & Acquisition, LBO Modeling

And many more skills.

Curriculum

Goal: In this module, you will learn how to prepare financial models from scratch in Excel.

Learning Objective:

After completing this module, you should be able to:

- Perform industry and ratio analysis in Excel

- Prepare a 3-statement financial model

- Learn financial statement forecasting for 5-10 years, discounted cash flow analysis, comprehensive relative valuation, and more.

- Prepare financial models of global companies – Starbucks, Twitter, IBM, etc.

- Prepare financial models of the banking sector, petrochemical sector, real estate sector, metals sector, Islamic banking modeling, consumer goods, and many others.

Core Topics:

- Financial Modeling – Starbucks

- Financial Modeling – Twitter

- Financial Modeling – IBM

- Financial Modeling – Bank of America

- Financial Modeling – Petrochemical Sector

- Financial Modeling – Real Estate Sector

- Financial Modeling – FMCG Sector

- Financial Modeling – Automobile Sector

- Financial Modeling – Banking Sector and many more

Goal: In this module, you will learn about the equity research domain within the investment banking sector, as well as how to create reports and financial models for equity research.

Learning Objective:

After completing this module, you should be able to:

- Gain hands-on training in basic and advanced Excel (latest version – 2019),/li>

- Gain insights into Accounting of Income Statment, Balance Sheet, and Cash Flows,/li>

- Learn about corporate valuation, financial modeling, discounted cash flow valuation, relative valuation, and equity research report writing,/li>

- Learn to prepare equity research models in Excel,/li>

Core Topics:

- Basic Excel (latest version – 2019)

- Advanced Excel (latest version – 2019)

- Accounting

- Corporate Valuation

- Discounted Cash Flow Analysis

- Comparable Company Analysis

- Relative Valuation

- Equity Research Report Writing

- Financial Modeling – Siemens AG

- Merger Modeling – Warner Brothers & Comcast

- Financial Modeling – Automobile Sector

- Financial Modeling – Telecom Sector

- Financial Modeling – Banking Sector

Goal: In this module, you will learn how to identify and evaluate what makes an Excellent private equity deal, perform valuation, understand term sheets, etc.

Learning Objective:

After completing this module, you should be able to:

- Gain hands-on training in basic and advanced Excel

- Gain insights into Private Equity deals

- Understand what makes a good investment

- Learn about corporate valuation, financial modeling, discounted cash flow, relative valuation training, and equity research report writing

- Learn to prepare equity research models in Excel

Core Topics:

- Basic Excel (latest version – 2019)

- Advanced Excel (latest version – 2019)

- Accounting

- DCF Analysis

- Financial Modeling

- Private Equity Fundamentals

- Private Equity Modeling

- Private Equity & Venture Capital

- LBO Modeling – Siemens AG

- Advanced Venture Capital Modeling

Goal: In this module, you will learn how to analyze a company using several valuation methods.

It covers discounted cash flow (DCF) analysis, relative valuation, comparable company analysis, etc.

Learning Objective:

After completing this module, you should be able to:

- Find out the intrinsic value of a security using the DCF valuation method

- Find the value of all expected future free cash flows

- Understand how the XNPV function is used in Excel to calculate the NPV of the forecasted cash flows and the terminal value

- Learn about the relative valuation approach - EV/EBITDA, PE ratio, EPS, etc

- Learn to build financial models in Excel

Core Topics:

- Corporate Valuation - Beginner to Pro

- DCF Valuation using Microsoft Excel

- Comparable Company Valuation

- Relative Valuation – Siemens

- Financial Modeling using Excel – Big Books Case Study

- Financial Modeling – Twitter

- Financial Modeling – Real Estate

- Financial Modeling – Automobile Sector

- Financial Modeling – Telecom Sector

- Financial Modeling – Banking Sector

- Financial Modeling – Biotech Company

- Financial Modeling – Media Sector and much more.

Goal: In this module, you will learn to perform accretion/dilution analysis that impacts the acquirer's earnings per share (EPS) during an M&A deal.

Learning Objective:

After completing this module, you should be able to:

- Determine the Offer Value Per Share

- Determine the Purchase Consideration

- Estimate New Share Issuances and Transaction Fee

- Calculate Goodwill and Synergies

- Build Pro Forma Balance Sheet

- Estimate the Accretive/Dilutive Impact

Core Topics:

- Merger Modeling – Albemarle Corp and Axiall Chemicals

- Merger Modeling – Hannifin & Clarcor

- Merger Modeling – Comcast & Time Warner

- Reverse Merger Modeling & Valuation

- Spin-offs (De-Merger Modeling)

Goal: In this module, you will learn about venture capital, financial modeling, and advanced venture capital modeling.

Learning Objective:

After completing this module, you should be able to:

- Understand company valuation and money valuation

- Gain thorough insights into return analysis and total equity valuation

- Learn to calculate the internal rate of return in a VC deal

- Understand what is the deal process

- Learn to build a Venture Capital Model in Excel.

Core Topics:

- Basic Venture Capital Modeling

- Advanced Venture Capital Modeling

Goal: In this module, you will learn to create an LBO model in Excel and understand the ins and outs of an LBO transaction and its related concepts.

Learning Objective:

After completing this module, you should be able to:

- Understand LBO features and benefits

- Gain thorough insights into sources of funds in an LBO deal

- Learn about debt structure and scenario analysis

- Understand what is the deal process

- Learn to build an LBO Model in Excel

Core Topics:

- Basics of LBO

- LBO Modeling – Siemens

- Advanced LBO Modeling

Goal: In this module, you will get a solid understanding of key subjects of the CFA level 1 examination.

Learning Objective:

After completing this module, you should be able to:

- Acquire an understanding of Corporate Finance, Economics, Ethics, Portfolio Management, etc.

- Gain an understanding of fundamental concepts, including market structure and business cycles

Core Topics:

- Economics

- Financial Reporting & Analysis

- Alternative Investments

- Portfolio Management

- Derivatives

- Fixed Income

Goal: In this module, you will understand the US GAAP Standards as well as their applications using practical examples in Excel.

Learning Objective:

After completing this module, you should be able to:

- Acquire an understanding of Corporate Finance, Economics, Ethics, Portfolio Management, etc.

- Gain an understanding of fundamental concepts, including market structure and business cycles

Core Topics:

- ASC 105

- ASC 205 & 210

- ASC 215 & 205

- ASC 260 & 305

- ASC 470 & 505

- ASC 605 & 606

- ASC 705, 740, 810, and many more

Goal: In this module, you will understand the IFRS Standards as well as their applications using practical examples in Excel.

Learning Objective:

After completing this module, you should be able to:

- Learn about the first-time adoption of international financial reporting standards

- Learn about share-based payments, business combinations, insurance contracts, operating segments, and many such IFRS standards.

Core Topics:

- IFRS 1 – First Time Adoption

- IFRS 2 – Share-based Payments

- IFRS 3 – Business Combinations

- IFRS 4 – Insurance Contracts

- IFRS 5 –Non-current Assets held for Sale and many more

Goal: In this module, you will understand the analysis of projects along with their feasibility analysis.

Learning Objective:

After completing this module, you should be able to:

- Comprehend project financing features

- Understand financial instruments, risk analysis, and risk mitigation

- Learn how to perform a feasibility study

- Learn how to calculate project costs

- Prepare a project finance model in excel and its report.

Core Topics:

- Basic & Advanced Excel 2019

- Accounting: Income Statement, Balance Sheet & Cash Flows

- Project Finance Modeling in Excel

Goal: The course will walk you through essential hedge fund strategies to help you deal with the real world

Learning Objective:

After completing this module, you should be able to:

- Learn about various aspects of hedge funds

- Understand accounting and taxation of hedge funds

- Understand risk management in hedge funds

Core Topics:

- Strategies in hedge funds

- Performance Analysis

- Concepts of Leverage

- Hedge Fund Accounting and Taxation

- Risk Management

- Fund Accounting

Goal: The goal is to walk you through important Excel functions (basic & advanced levels) that will allow you to implement them in real life.

Learning Objective:

After completing this module, you should be able to:

- Learn about the various functions of Excel

- Understand the application of VBA and macros

- Create Excel dashboards from scratch (Sales & HR dashboard)

Core Topics:

- Basic Excel (latest version – 2019)

- Advanced Excel (latest version – 2019)

- Excel Shortcuts for real-world

- Pivot Table

- Power Pivot

- Microsoft Excel Reports

- Graphs & charts

- Financial functions

- Statistical tools

- VBA & Macros

- Excel Dashboards

Goal: In this module, you will understand cost accounting and its applications.

Learning Objective:

After completing this module, you should be able to:

- Understand how it is relevant in the organizational scenario

- Understanding of various types of costing

- Learn about the cost volume profit analysis

- Understand how cost accounting helps in decision-making

Core Topics:

- Cost accounting overview

- Costing types

- Cost allocation and analysis

- Marginal costing

- Process Costing

Goal: In this module, you will understand what Cryptocurrencies are and how to trade them.

Learning Objective:

After completing this module, you should be able to:

- Use cryptocurrencies for business opportunities

- How to participate in ICO

- How to invest and trade in Ethereum, Bitcoin, Ripple, and more.

Core Topics:

- Cryptocurrency overview

- Technology and trading for cryptocurrency

- Initial Coin Offering (ICO)

- Bitcoin

- Ethereum

- Ripple

- Litecoin

- Dash

- Live Trading using the Binance Platform

Goal: In this module, you will understand VBA & Macros and their applications.

Learning Objective:

After completing this module, you should be able to:

- Use VBA Macros

- Create an interface using VBA Macros

- Understand different types of bar code

- Learn about charting using VBA and user forms

Core Topics:

- Basic VBA & Macros

- Advanced VBA & Macros

- Interactive dashboard creation

- Financial modeling using VBA

- Automation using loop and much more.

Goal: This course aims to develop financial skills among professionals working in non-finance functions

Learning Objective:

After completing this module, you should be able to:

- Understand the fundamental concepts of finance

- Understand and interpret financial statements

- Analyze cash flow

- Perform ratio analysis

Core Topics:

- Accounting foundation

- Income statement

- Balance sheet

- Cash flow analysis

- Earning Per Share (EPS)

- Ratio Analysis

- Corporate Finance Training

Goal: In this module, you will understand how to build credit risk models in Excel

Learning Objective:

After completing this module, you should be able to:

- Understanding what is credit risk

- Perform UFCE and WC Credit Modeling

- Build credit risk models

Core Topics:

- Credit Risk Modeling

- Credit Analysis

- Altman Z-score

- Merton's Model

- UFCE Modeling

- Working capital analysis

DOWNLOADABLE EXCEL TEMPLATES (200+)

Starbucks Financial & Valuation Model

Twitter Financial & Valuation Model

IBM Financial & Valuation Model

Equity Research on Pharmaceutical Industry

IPO Model

Credit Analysis Model- Real Estate Sector

LBO Valuation Model of Siemens

DCF Model

Comparable Company Analysis Model

Islamic Banking Model

Projects (40+ Real-World Projects)

Financial Modeling - Twitter

In this Twitter financial modeling course, you will learn how to create, evaluate, and predict Twitter's financial statements (Balance Sheet, Cash Flows, and Income Statement). We will also look at valuation, including DCF and relative valuation, as well as sensitivity analysis.

Financial Modeling - Starbucks

This is a comprehensive financial modeling course on Starbucks. You will learn how to build a 3-statement financial model from scratch. You will also learn how to perform basic analysis and create a working capital schedule, revenue built-up, depreciation & amortization schedule, cost sheet, perform DCF valuation, and relative valuation.

Financial Modeling - Harley Davidson

In this Financial Modeling course, we will use the Harley-Davidson Case Study to learn how to build up a financial model from scratch, beginning with obtaining SEC filings and progressing through building the financial model in Excel. We will also examine the revenue build-up model, income statement, cash flow, and balance sheet.

Financial Modeling - Banking Sector

Banking financial modeling is quite distinctive from financial modeling in other sectors. In this section, we examine the drivers of each line item, such as Gross Loans, Allowances, Interest Rates, and so on. Finally, we will examine how banks are valued.

Financial Modeling - Real Estate Sector

This financial modeling course provides an in-depth understanding of how to value the real estate market. This course will walk you through the process of developing a dynamic financial model that incorporates a sensitivity analysis of development costs, sales prices, and other areas of development.

Financial Modeling - Automobile Sector

This course on the Financial modeling-automation sector deals with financial statement forecasts for future years; therefore, we will anticipate the company's future balance sheet, cash flows, and income statement.

Financial Modeling Telecom Sector

You will study the telecom sector, industry dynamics, and other topics in this financial modeling on the telecommunications sector course. You will learn how to construct a financial model by downloading annual data and manually entering the financials. We will examine industry revenue drivers to create the revenue sheet, depreciation schedule, cost sheet, working capital schedule, debt schedule, shareholder's equity schedule, and more. We will also examine how to evaluate the firm utilizing the DCF approach and comparable valuation techniques.

Skillsets You’ll Acquire

Investment Banking

- Build Financial Models, including Valuation models, IPO models, PE models, LBO Models, DCF Analysis, etc

- Develop M&A Models and show the accretion or dilution impact based on allocation scenarios for debt and equity

- Prepare pitchbooks that help Investment Bankers present their analysis to clients.

Financial Modeling

- Get hands-on experience in accounting, financial statement creation, and financial forecasting

- Create and understand Financial Modeling spreadsheets

- Create a link between a company's historical financial statements

- Predict how a firm will perform in the near future (revenue forecasting, cost forecasting, working capital forecasting, and much more)

Equity Research

- Understand Excel, VBA Macros, and Accounting functions that help in financial analysis

- Perform Fundamental Analysis, Financial Modeling, and Valuation of real companies

- Review Annual Reports to forecast revenue figures, expenses, depreciation, amortization, etc.

- Analyze data and prepare detailed equity research reports for clients to help them make investment decisions.

Project Finance

- Estimate the cost of the project, understand the means of finance, conduct feasibility analysis, mitigation, and risk analysis

- Understand the assumptions for project finance modeling, income statement & balance sheet, depreciation schedule, preparing project finance report, etc.

- Get comprehensive and broad knowledge of Advance Accounting and Fundamentals of Micro and Macro Economics

- Get acquainted with estimating the cost of projects, tools used for assessing the feasibility of projects, benefits of scenario analysis, the role of taxation, and various sources of project finance.

Mergers & Acquisitions

- Understand the fundamental principles in M&A

- Develop M&A models in Excel to calculate the accretion/dilution impact

- Build a Pro-forma Model

- Learn acquisitions strategies and understand how the acquisition could affect the future performance and shareholder’s value

- Build the M&A model from scratch to predict future financial performance before acquiring a company.

Private Equity

- Understand how Private Equity is structured, its strategies, and insights

- Get detailed insights into raising equity, debt, interest, and leverage buyouts

- Construct a Private Equity Income Statement, Cash Flow Statement, Balance Sheet, and finally, an integrated LBO model

- Explore the valuation techniques used in LBO modeling

LBO

- Build LBO Models from scratch in Excel

- Understand modeling best practices for building income statements and cash flow statements, as well as creating multiple scenarios for assumptions

- Calculate IRR, cash-on-returns, and sensitivity analysis and identify the value drivers of an LBO.

Accounting

- Identify and integrate the fundamental concepts underlying finance, accounting, and management

- Build financial statements and their components, and understand how business transactions flow into these statements

- Analyze financial information to make decisions, estimate costs, tax implications, and engagement procedure

- Key principles of US GAAP and IFRS.

Excel

- Understand basic to advanced Excel functions and formulas, including the user interface

- Use advanced functions to enhance the functionality while building Financial Models

- Understand data linking to create a more efficient workbook

- Create Data Tables and Pivot Tables using advanced Excel techniques.

Benefits

There are several benefits to taking these courses, including

Gaining knowledge in various fields

Our All-in-One bundles cover a wide range of topics, allowing you to gain understanding in multiple areas. It is beneficial for those professionals looking to change careers.

Improving career prospects

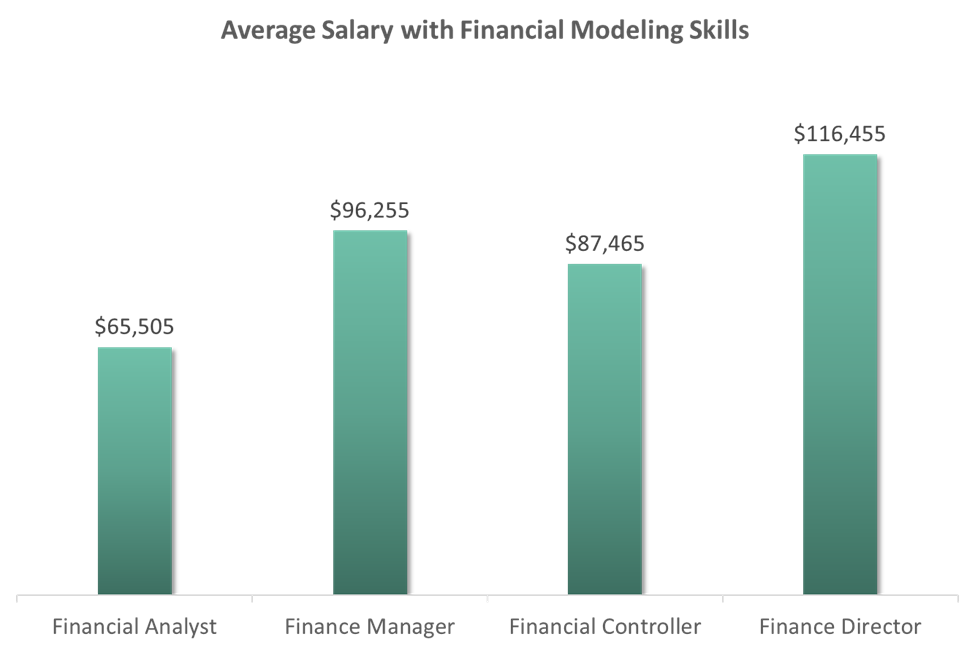

By gaining knowledge in multiple areas, you can make yourself more attractive to potential employers, leading to better job opportunities and higher salaries.

Saving time and money

Instead of enrolling in multiple programs, our All in One bundles offer a cost-effective solution by providing access to all the courses in one place.

Convenience

Access to all the courses in one place makes it easy to manage your learning and take classes at your own pace and on your own schedule.

Course Features

Here are some of the course features in the All in One bundles

1. Lifetime access The bundles offer lifetime access, which means you can access the course content anytime, even after completing the course.

2. Certification We offer completion certification, which you can add to your resume or LinkedIn profile to showcase your skills to potential employers.

3. Expert support With expert support, you can email your queries and receive help from industry experts or course instructors.

4. Mobile accessibility The courses are easily accessible on mobile devices, which allows you to learn on the go and at your own pace.

5. Interactive learning materials Interactive learning materials such as videos, quizzes, and assignments can help reinforce learned knowledge and improve understanding of the subject.

6. Progress tracking The bundles offering progress tracking allow learners to track their progress and ensure they meet their learning goals.

Career Opportunities

Finance is one of the specializations and occupations that many students seek. They must be aware of the career options available in finance, particularly in the present shifting business environment on a domestic and worldwide level. Here are the most desirable finance careers or roles.

1. Financial Modeling

- Jr. Financial Analyst

- Sr. Financial Analyst

- Associate

- Finance Manager

- Vice President

Hiring Companies: Bank of America, Amazon, GE, Walmart, Crisil, Deutsche Bank, Deloitte, JPMorgan, Nomura, Motilal Oswal, BlackRock, S&P Global

2. Investment banking

- Investment Banking Analyst

- Associate – Investment Banking

- Vice President

- Managing Director

Hiring Companies: Goldman Sachs, JPMorgan, Bank of America, HSBC, Kotak Mahindra Bank, Accenture, Genpact, BNP Paribas, Monster India, Wells Fargo, Barclays

3. Equity Research

- Equity Research Analyst

- Financial Analyst

- Research Analyst

- Finance Manager

Hiring Companies: JPMorgan, Goldman Sachs, CRISIL, Credit Suisse

4. Private Equity

- Private Equity Analyst

- Associate – Private Equity

- Vice President

- Managing Director

Hiring Companies: Motilal Oswal, Amazon, JPMorgan Chase, Accenture

5. Venture Capitaly

- Analyst

- General Partner/Partner/Managing Director

- Venture Partners/Operating Partners

- Associates

- Entrepreneurs-in-residence

Hiring Companies: Morgan Stanley, Goldman Sachs, Credit Suisse, Bain & Company

6. Capital Markets

- Credit Analyst

- Fund Manager

- Business Development Manager

- Broker

- Portfolio Manager

Hiring Companies: Accenture, JPMorgan Chase, Citi, IDFC

7. Risk Management

- Risk Analyst

- Associate

- Risk Manager

- Chief Risk Officer (CRO)

Hiring Companies: Credit Suisse, Deloitte, J.P.Morgan, American Express

8. Mergers and Acquisition

- M&A Analyst

- M&A Associate

- Vice President

- M&A Consultant

Hiring Companies: Deloitte, Boston Consulting Group, JPMorgan Chase, Morgan Stanley

Our alumni in top companies

Who can take this course

Students

If you are studying finance and are an aspiring investment banker or a financial analyst, it would be an invaluable resource for you.

Finance professionals

If you’re a working professional and want to grow in your career in Finance, this Financial Analyst course would add immense value to your financial acumen.

Entry-level Financial Analysts

This course is for you if you are an analyst who works with financial models and needs a refresher course in financial modeling and the investment banking domain.

Experienced Professionals

This course will teach you various techniques if you are an experienced professional who does not build models regularly.

Pre-Requisites

Willingness to dive into the world of finance: This Financial Analyst course is vast. And it covers everything you can think of under the finance domain. It won't be easier to tackle if you’re unwilling to put in the time, effort, and practice. But if you’re interested, you can do one course at a time, and within a solid block of time, you would be able to do the entire course.

A basic interest/knowledge in becoming a master of finance: This Financial Analyst course will make you a master of finance. A little knowledge would help you become interested and learn more about the beautiful world of finance.

Faq

Here are frequently asked questions (FAQ) that someone might have about the All-in-One bundles:

Why should I do this Financial Analyst Course?

For financial professionals and entrepreneurs, mastering financial analysis has become crucial. Unfortunately, students find it challenging to enter the industry because they lack the necessary skills (Excel, Accounting, Financial Modelling, Corporate Valuation, etc.), which are typically not covered in the college curriculum. However, our online course provides a holistic understanding of financial modeling, investment banking, equity research, and business valuation with hands-on practical projects. It will offer you an advantage over other candidates and make you job-ready before you begin your career.

Why should you join this course?

The All-in-One Financial Analyst Certification Bundle from eduCBA is not just equipped with the core fundamentals but also advanced concepts for developing Excel-based models. You will learn to create models of companies such as Starbucks, IBM, Twitter, JP Morgan, Siemens, Harley Davidson, and many more.

Moreover, the courses within this bundle are designed with an outcome-focused curriculum that will allow you to gain expertise in crucial topics within the investment banking domain. You will acquire the fundamental skills needed to perform company and IPO valuations, evaluate mergers and acquisitions, LBO projects, Private Equity proposals, and much more.

Additionally, you will also learn about Mutual Funds, Options, Hedge Funds, Stock market trading, CFA, FRM, CMA, and CMT examinations, Pitch Books, Venture Capital, and Cryptocurrencies, as well as how to prepare for investment banking interviews.

This is an ideal course for those who want to break into the investment banking field but only have a basic knowledge of finance.

Who is a Financial Analyst?

A financial analyst is a professional who works in investment banks, insurance firms, mutual fund houses, and other related firms. Their primary function is to conduct financial analysis for investments, IPOs, M&A deals, Private equity deals, etc. Financial analysts utilize their findings to assist investors/corporates in making business decisions (for example - buy, hold, or sell a security).

What is the average salary of a Financial Analyst?

The global financial market has recently grown and evolved dramatically. Financial Analyst job opportunities are expanding continuously. The average annual salary for a financial analyst is $72,744 (Source: Indeed.

Why should I learn a Financial Analyst course online? How is it better than offline training?

Our Financial Analyst course is entirely self-paced, emphasizing user convenience. We give you lifetime access and continue adding updated courses to the module at no additional cost. Learners can watch the video material whenever, wherever they want, and as often as they wish. We also offer a 24-hour technical support system.

I’m not from a finance background. Can I do this Financial Analyst Course?

You surely can, and you should if you’re interested. Start with the "Finance for non-finance Managers" module to begin with.

How would I make time for this comprehensive course?

The idea is to find a bite-size time for each course. You can decide to do one course, Let’s say, MS Excel, in a week and find an hour or two on the weekdays and a few hours at the weekend to complete the course.

What study material will be provided to us for this course?

The learning will take place through 1000+ hours of self-paced video tutorials. The learning portal allows you to access study materials such as video recordings, case studies, Excel-based financial models, quizzes, and mock tests. You will be given access to an online dashboard where you will be able to access these study materials.

What will my job title be once I complete this Financial Analyst course?

After completing this, you will be qualified for a variety of positions, including:

- Financial Analyst

- Investment Banker

- Equity Research Analyst

- Finance Manager

- Financial Risk Manager

What are the other related Finance Courses offered by eduCBA?

EDUCBA offers a variety of finance courses. Here are some of them:

- Investment Banking Course (123 Courses, 25+ Projects)

- Financial Modeling Course (6 Courses, 14 Projects)

- US GAAP Course (29 Courses with 2022 Updated)

- Business Valuation Training (16 Courses)

- Private Equity Training (17+ Courses with Case Studies)

- CFA level 1 Course with Mock Tests & Solutions (18 Courses, 3+ Mock Tests with Solutions)

- CFA level 2 Course with Mock Tests & Solutions (10 Courses, 1+ Mock Tests with Solutions)

What if I have queries while completing this Financial Analyst online course?

We are always willing to assist. If you have a query, please contact us at info@educba.com, and we will try our best to respond within 24 hours.

How soon after registering for this course would I get access to the Course Content?

After enrolling in the Financial Analyst course, you will immediately receive access, which is available to you for a lifetime. All you need to do is log in to the EDUCBA website using the provided credentials and access study materials like video content, solved case studies, financial models built in Excel, quizzes, and mock tests.

Is the course content available to students after the training is completed?

Yes, after you enroll in the course, you will have lifetime access to the course content using your dashboard.

Who are the instructors for this course?

All the instructors at EduCBA are industry practitioners with at least 10-12 years of relevant experience. They are subject matter experts trained by EduCBA to provide an Excellent learning experience.

Financial Analyst Course – Certificate of Completion

Sidney Bostian

Vladimir

Yasser Zafar

Malan Alexis KOUAME

Shaikh Yunus

Njabulo Vincent Hadebe

Beatrix Antoine

Samonas Michael

Special Offer