Difference Between CPA and CMA

In CPA vs. CMA, a CPA (Certified Public Accountant) is an accounting professional who ensures a company’s financial records are correct and handles tax calculations and filing. In contrast, a CMA (Certified Management Accountant) uses a company’s financial information to develop strategies and plans for its future growth.

Let us study much more about CPA and CMA in detail:

Accountancy or Finance can be termed the blood of any Business. Be it a small firm or an MNC employing millions of people, with its presence across the Globe, the business needs Accountants to maintain the day-to-day transactions related to money. From Revenue generation to all petty and Capital-intensive expenditures, the Accountant is liable for the accountability of every transaction. Thus, Finance requires Accountants with special training that could summarize the procedures and train new Accountants to maintain the books regularly. Therefore, a Commerce Graduate with decent knowledge of Accounts needs the extra expertise to maintain so that it is possible to know the correct interpretations of the Business flow and each & every nook and corner of the Business. Hence, It helps the Investors and the management board to know the exact situation of the Business and the essential actions to improvise certain courses.

Across the Globe, all the successful Business houses implemented several procedures to identify problems within a business and apply proper modules so that the Business should run properly and, in the longer term, improvise from its earlier mistakes. On the other hand, CPAs are the authorized persons who can conduct audits at the Federal and State levels and guide other Business units as Consultants regarding the legal and regulatory framework. They are the ones who could handle the income tax for individuals and other small and midsized firms.

CPAs can choose any financial segment, be it Management Accounting, Financial Analyst, Auditing, Taxation, Finance Controlling, etc. On the other hand, CMAs focus on the management of finance, finance control, and the adoption of different strategies within a business. To pass CPA, one has to pass the Uniform Certified Public Accountant Examination organized by AICPA. After completing the exam, degree holders must uphold specific moral standards and follow the legal guidelines provided by the governing agencies. The regulating body has the authority to revoke the degree in the event of any contract violations. CMAs, on the other hand, need to follow ethics. CPAs are well-informed about the business’s profitability, and any illegal steps taken for personal benefit can harm their professional ethics.

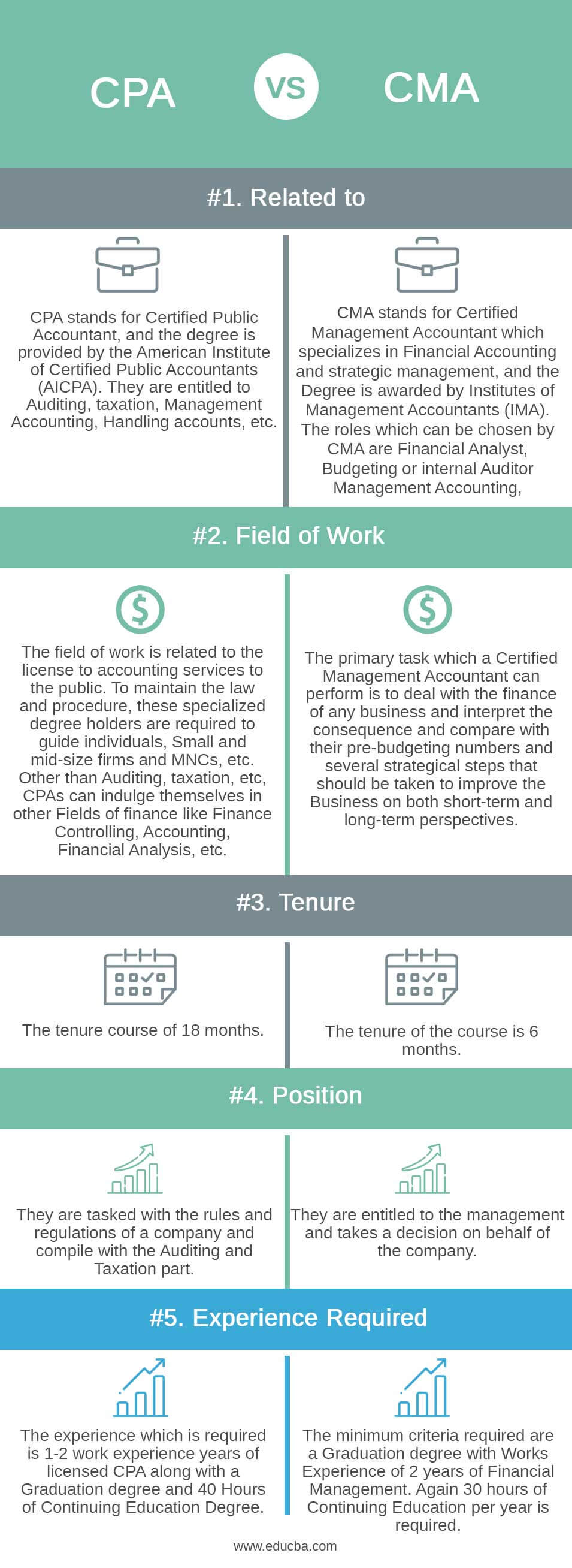

CPA vs CMA Infographics

Below is the top 5 difference between CPA and CMA

Key Differences

Both CPA vs CMA are popular choices in the market; let us discuss some of the major Differences:

- CPA stands for Certified Public Accountant, whereas CMA stands for Certified Management Accountant. A CPA is the auditor or the Regulator of a business, whereas a CMA takes charge of the Management of any company.

- CMA Course deals with subjects like Financial Accounting and Reporting, Audit & Attestation, and Business Environment.

- CMA Course includes a few subjects: Financial Planning, Performance and Control, and Financial Decision-Making.

- The timeframe for the course of CMA is six months, whereas CPA takes 18 months to complete.

- CMAs undergo a comparatively shorter training period as they are primarily involved in private bodies only. In contrast, CPAs undergo a more extensive training program since they are authorized to work with government and private entities.

Comparative Table

Below, we discuss the primary comparison between CPA and CMA.

| Basis of Comparison | CPA |

CMA |

| Related to | CPA is a Certified Public Accountant, and the American Institute of Certified Public Accountants (AICPA) provides the degree. They are entitled to Auditing, taxation, Management Accounting, Handling accounts, etc. | CMA stands for Certified Management Accountant, specializing in Financial Accounting and strategic management, and the Degree is awarded by Institutes of Management Accountants (IMA). The roles which CMA can choose are Financial Analyst, Budgeting or internal Auditor Management Accounting, |

| Field of Work | The field of work is related to the license to accounting services to the public. To maintain the law and procedure, these specialized degree holders must guide individuals, Small and mid-size firms, MNCs, etc. Other than Auditing, taxation, etc, CPAs can indulge in other Fields of finance like Finance Controlling, Accounting, Financial Analysis, etc. | A Certified Management Accountant can primarily perform the task of managing the finances of any business, interpreting the consequences, comparing them with their pre-budgeting numbers, and suggesting several strategic steps that should be taken to improve the business from both short-term and long-term perspectives. For those considering a pathway in strategic management under the CMA certification, choosing the right CMA prep course is pivotal. The right preparation equips candidates with a comprehensive understanding of financial management, comparable to the expectations set out by Chartered Public Accountants. When selecting your course, consider factors in alignment with your career goals and learning style. |

| Tenure | The tenure course of 18 months. | The tenure of the course is 6 months. |

| Position | They must comply with the rules and regulations of a company and handle the Auditing and Taxation part. | The management entrusts them with decision-making responsibilities on behalf of the company. |

| Experience required | The required experience is 1-2 work experience years of licensed CPA, a Graduation degree, and 40 Hours of Continuing Education Degree. | The minimum criteria required are a Graduation degree with work experience of 2 years of Financial Management. Again, 30 hours of Continuing Education per year is required. |

Conclusion

Advanced modules in the finance segment include both CPA and CMA. The courses have benefits of their own by which one can promote their position in the workplace. The packages offered by the companies after completing these courses are equal. But the difference between CPA and CMA is the active role one plays after passing the Course. On the other hand, the field of strategy and management is the primary focus of CMAs, while CPAs have the flexibility to handle both fields.

Recommended Articles

This has been a guide to the top differences between CPA vs CMA. We discuss the CPA vs CMA key differences with infographics and a comparison table. You may also have a look at the following articles –