Updated November 15, 2023

Difference Between CPI vs RPI

The CPI vs RPI debate has been going on forever, to know forecast or compare or to know what has happened with retail and consumer prices. The Consumer Price Index (CPI) is commonly heard and used globally. RPI, on the other, is more UK-specific and outdated for use. Let’s look at some better explanations for CPI vs RPI so that we know what effects when we put them to use.

Consumer Price Index (CPI)

- It forms a basis of inflation targets around the globe of various governments and central banks to control and monitor inflation.

- It is always less than RPI as RPI uses Arithmetic Mean

- The use of the formula here is Geometric Mean (GM).

- It has a more robust way of calculation and uses “Jevons,” which is more indicative of the economy; it accounts for the elastic use of items by consumers, which will shift to other alternatives or use the thing less as costs rise.

- The basket of food, clothes, petrol, and other broad items uses Rent for housing cost, year-to-year comparisons on how they have increased or decreased proportionately.

Retail Price Index (RPI)

-

The index measuring inflation, known as the Consumer Price Index (CPI), has been in use and reformed multiple times since its inception in 1914 during World War I. At first, it only measured food prices but has since expanded to include clothing and fuel prices among other items.

- The formula base it uses is Arithmetic Mean (AM).

- In practice, RPI is always greater than CPI, usually by 0.8 to 1 percent. RPI does provide more continuity which is important as to increase the pension and other incomes used it before and would now have excessive growth, which might affect the economy as projections and planning methods have used RPI reference when calculating income and inflation so they would align better by sticking with it.

- It uses a more primitive way of calculation, “Carli,” which doesn’t consider consumer behavior concerning price rise; that is, the consumer will continue to use the goods the same way, no matter what the price will be.

- RPI overstates inflation, and no developed economies use it or use it as a basis. It uses more of a perspective of the homeowner as it includes the council tax or insurance. Will another inflation index worldwide use the conventional “Rent” as it is more realistic and practical for most people?

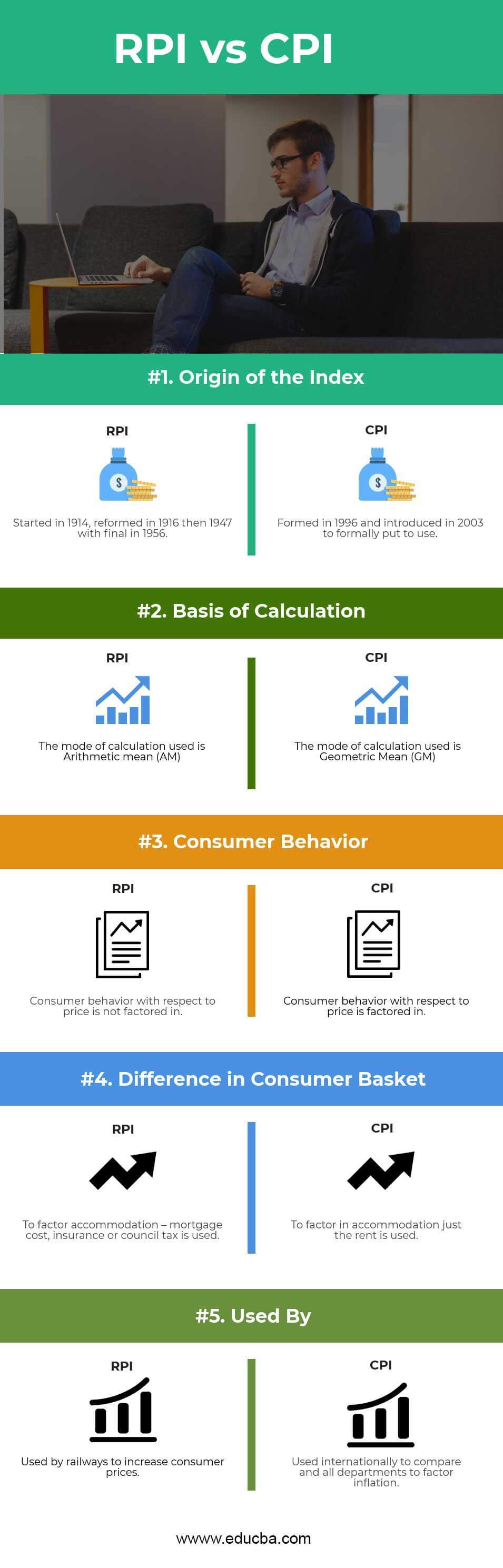

Head To Head Comparison Between CPI vs RPI (Infographics)

Below is the top 5 difference between CPI and RPI:

Key Differences Between CPI vs RPI

CPI vs RPI inflation indexes are among the most common and used by many big departments and industries, so they affect us differently. Let us take a look at some key differences between CPI and RPI:

- RPI has been put in use since 1916 when it was broadened to include items other than food like clothing, fuel, etc., then again in 1947 after that final reform in 1956 which is like the current version of what we see and use today. In contrast, the CPI was formally introduced to be used and measured in 2003 after 1996 when it was formed. So, while doing various studies on how economy/income/ lifestyle fared compared to inflation, RPI is better to use.

- There are various methods for calculating RPI vs. CPI. RPI uses a more basic calculation method: Arithmetic Mean (AM), while CPI uses Geometric Mean (GM).

- In almost all cases, RPI has always been higher than CPI.

- RPI uses “Carli,” which doesn’t consider consumer behavior and assumes they will use the products irrespective of the price rise. CPI uses more advanced “Jevons,” which considers consumer behavior, which uses the items less than they used to when the prices rise.

- Including “Rent” as the housing in CPI makes its basket of goods different than RPI, which uses mortgage interest rate costs, insurance or council tax, etc., while considering the housing cost in the inflation.

CPI vs RPI Comparison Table

Let’s have a look at the Comparison between CPI vs RPI:

| The Basis of Comparison | RPI | CPI |

| Origin of the index | It started in 1914, reformed in 1916, then in 1947, with the final in 1956 | Formed in 1996 and introduced in 2003 to formally put to use |

| Basis of calculation | The mode of calculation used is Arithmetic mean (AM) | The mode of calculation used is Geometric Mean (GM) |

| Consumer behavior | Consumer behavior concerning price is not factored | The mode of calculation used is Geometric Mean (GM) |

| A difference in the consumer basket |

The Consumer Price Index (CPI) does not consider consumer behavior towards prices. |

Consumer behavior concerning price is factored in |

| Used by | Used by railways to increase consumer prices | International comparisons and inflation factor into all departments using CPI. |

Conclusion

Now, to understand more practically, let’s touch on a few points to understand better. Railways use RPI to increase the cost of the service, which is an alarming increase. Choosing RPI over CPI for cost-of-service increases can negatively impact your budget since RPI always overstates inflation while CPI always understates it. This means using RPI instead of CPI will result in higher service costs, adversely affecting your budget.

If your payment is increased based on RPI, you will receive a higher pay raise than based on CPI. However, many inflation-related pay allowances utilize CPI, resulting in a lower pay increase than you would have received with RPI.

The question about who captures is right is wide open. Still, certainly, CPI does a far better job than RPI as it uses geometric mean instead of the arithmetic mean, which involves the consumer behavior to know the consumption concerning price, as in the real world, we tend to use items less when their prices increase. So, CPI is a better measure of inflation when used alone or for global comparison.

Recommended Articles

This has been a guide to the top difference between CPI vs RPI. We also discuss the CPI vs RPI key differences with infographics and comparison tables. You may also have a look at the following articles to learn more –