Updated August 10, 2023

Creative Accounting Meaning

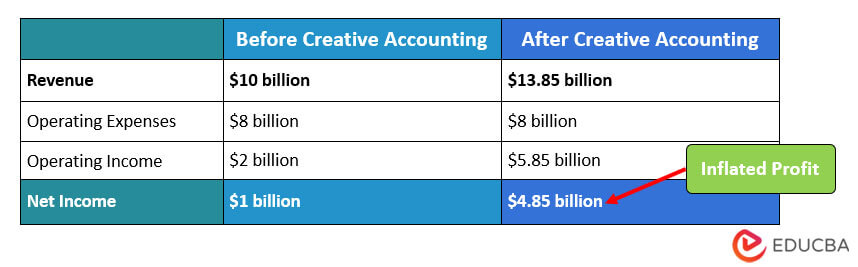

Creative accounting is when businesses make changes to their financial information to show improved performance without going against any accounting standards. For instance, a business may increase the useful life of one of the assets to decrease depreciation charges, boosting the company’s revenues.

Companies use it to increase profits, reduce taxes, or show a healthier financial position. The main objective is to deceive investors, regulators, or the public. Even though it is not illegal, it can be unethical if the company manipulates true values significantly.

Table of Contents

Examples

#1: Using Discontinued Operations to Cover Losses

Consider a hypothetical company named “TP Corp” with three divisions: X, Y, and Z. In 2022, Divisions X and Y generated profits of $250 and $150, respectively. Moreover, Division Z incurs a loss of $450.

Actual Situation:

The company would have an overall net loss of $50 in the actual scenario.

- Division X: $250 profit

- Division Y: $150 profit

- Division Z: $450 loss

- Overall Net Loss: $50 ($250 + $150 – $450)

Using Creative Accounting Method:

To manipulate the financial presentation, TP Corp labels the Z Division as “discontinued operations.” Now, the company can remove Division Z’s loss from its continuing business operations.

Outcome:

Using this accounting technique, the company can report a profit of $400, adding the profits from Divisions X and Y.

Consequences:

TP Corporation’s accounting technique distorts the financial picture by excluding the loss of Division Z. This can lead the shareholders and investors to think that the company is more profitable than it actually is.

Conclusion:

Shifting losses to discontinued operations is an example of how creative accounting can manipulate financial reporting. Investors and stakeholders should be attentive and examine all financial statements carefully to identify any such manipulations.

#2: Real Example- WorldCom’s Accounting Scandal

In the early 2000s, WorldCom, a prominent telecommunications company, used creative accounting to manipulate assets.

In 2001 and the first quarter of 2002, WorldCom inaccurately reported billions worth of operating expenses as investments and assets on its balance sheet. This increased its profits by $3.8 billion, generating a false appearance of higher profitability.

However, in 2002, an internal whistleblower exposed the irregularities within WorldCom’s financial practices, bringing the deceiving accounting scheme to light.

The aftermath was profound. WorldCom’s deceitful practices caused one of the biggest bankruptcies in US history. It triggered substantial losses for investors and stakeholders, showing the severe consequences of using dishonest accounting practices.

Implications & Effects

- Misleading Information: These techniques can create incorrect financial statements, misleading investors, creditors, and other stakeholders.

- Impact on Investor Decisions: Investors may make wrong investment choices by relying on manipulated financial statements.

- Inaccurate Capital Allocation: Company shareholders and investors may misallocate resources based on inaccurate information.

- Destructing Corporate Governance: This accounting can signal weak corporate governance practices, raising concerns about transparency, accountability, and ethical behavior within the company.

- Inefficient Decision-Making: Inaccurate financial information can lead to incorrect and ineffective decision-making by company management.

- Focusing on Short-Term Goals: Companies might use creative accounting to inflate short-term performance, diverting attention from long-term growth strategies.

- Legal Consequences: Investors who suffer losses due to manipulated financial information might take legal action against the company.

- Financial Instability: Over time, using such accounting practices to hide crucial information makes it difficult for the company to use corrective measures to make the business financially stable.

Advantages and Disadvantages

| Advantages | Disadvantages |

| It can enhance key financial ratios, making the company appear more favorable to investors. | It can mislead investors, analysts, and other stakeholders, damaging trust and reputation. |

| It may help companies access capital markets and secure favorable borrowing terms. | It can lead to legal repercussions and regulatory penalties. |

| It allows companies to maintain stock prices and meet financial targets or analyst expectations. | Over time, repeated use of this accounting can lead to losing credibility with investors and stakeholders. |

Frequently Asked Questions (FAQs)

Q1. Is creative accounting illegal?

Answer: Yes, creative accounting can be illegal if it involves deliberate manipulation or misrepresentation of financial information to deceive stakeholders, regulators, or investors.

Q2. How to prevent creative accounting?

Answer: Implement strict regulatory oversight, promote transparency, enhance internal controls, conduct thorough audits, and encourage ethical corporate culture to prevent creative accounting.

Q3. What are the reasons for creative accounting?

Answer: Creative accounting aims to manipulate financial data for purposes such as improving performance, reducing taxes, meeting expectations, and maintaining positive perceptions.

Recommended Article

We hope this EDUCBA information on creative accounting is beneficial to you. We have explained the types of accounting businesses use along with examples and the effects of using this accounting method. For further guidance on accounting-related topics, EDUCBA recommends these articles: