Updated July 17, 2023

What is Credit Insurance?

Credit insurance is a kind of insurance product that provides protection to the borrower’s businesses and the businessmen against the business risks that may impact the business finances and cause losses to the business due to non-repayment of outstanding debt obligations in certain uncontrollable events.

The insurance provides coverage to policyholders by paying off their debts or indemnifying for the losses in case of death, disability, and even the loss of employment.

Explanation

As financial protection is the top important thing for any business, many businessmen get their businesses insured which makes the insurance company obligated to pay the debts on their behalf in case certain unforeseen incidents such as death, disability, or loss of employment occur. The insurance coverage also includes indemnification against the losses due to the non-receipt of payments from the clients on account of the policyholder’s sale of goods or services.

The protection provided by the insurance company has multifold benefits for businesses since such insurance coverage helps businesses enhance their business performance by providing financial aid in certain cases. The benefits are not limited here; it is also useful for export houses as it provides insurance coverage on the losses that export houses might encounter during the export process of goods or services.

Purpose of Credit Insurance

It serves a number of purposes for businesses, and the main ones are below:

- Protection Against Financial Losses: It protects businesses from the financial losses which could happen in almost any business, irrespective of their scale of operation, due to several reasons which are usually beyond the control of businesses, such as death, disability, and so on.

- Protection Against Non-Collection from Clients: Businesses need to collect their receivables promptly. Credit insurance protects businesses by providing financial aid if businesses cannot recover amounts from their clients and the payments become non-recoverable.

- Providing aid in Repaying Debts: If, due to the occurrence of any unforeseen events such as death or disability, or unemployment, a businessman is not able to repay the existing debts, then credit insurance comes to the rescue and repays the debts.

How Does it Work?

At the commencement of the credit insurance policy, the insurance company has access to the creditworthiness and financial position of the policyholder and assigns the policyholder a credit limit up to which the insurance company shall provide indemnification against loss caused due to non-receipt of money from clients or non-payment of debt. The renewal of the limit gets done yearly. The policy mentions scenarios under which the indemnification shall be provided. When the policyholder encounters any scenario listed in the policy, a claim can be filed with the insurance company, which shall then process the claim subject to the credit limit. The policyholders have to pay the premiums of the insurance as agreed upon.

Example of Credit Insurance

Suppose Mr.X, a policyholder took trade credit insurance in the amount of $20,000, which secured the debts due to the creditor. Unfortunately, Mr. X found himself in a circumstance where he was short of $8,000 due to one of the conditions covered by the policy terms. Mr.X approached the insurance company for the same issue and asked for a claim of $8,000. The insurance company asked for proof of debt, and once the company verified the proof provided by the policyholder, they cross-checked it with the creditor through the original bills. When the insurance company got satisfied, it made the payment of $8,000 to the creditor on behalf of the policyholder.

Types of Credit Insurance

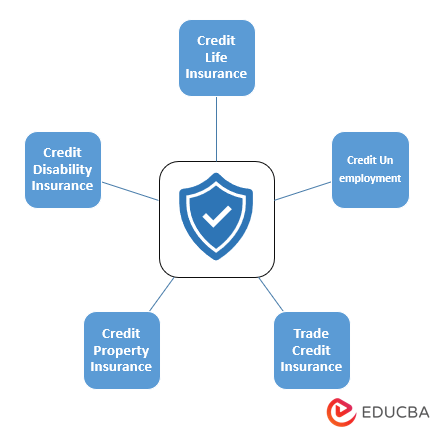

Following are the types as given below:

- Credit Disability Insurance: If the policyholder gets any disability covered by the policy’s terms and conditions, then the insurance company makes the payment to the creditors after proper verification.

- Credit Life Insurance: In case of the death of the policyholder, the insurance company makes the payment of all the outstanding debts of the deceased policyholder.

- Trade Credit Insurance protects the business from customers who cannot pay for any reason by indemnifying against such non-payments from clients.

- Credit Unemployment Insurance: If the policyholder remains unemployed for a specific period, the insurance company makes the payment after verifying the unemployment status.

- Credit Property Insurance: It protects the policyholder’s personal property from destruction or theft.

What Credit Insurance Covers?

The insurance company will cover two types of risks: commercial and political.

- Commercial Risks: These cover the risks of insolvency of the buyer or when the buyer cannot make the payment.

- Political Risks: It covers the risks of cancellation of license to import by the government, any unforeseen events like political and economic difficulties, revolution, civil war, riot, or when the government cannot pay.

Document Required for Credit Insurance Claim Process

The following documents are essential for the claim process:

- FIR report

- ID proofs

- Filled and signed claim form

- Account books and reports

- Policyholder’s Bank details

- Documents asked by the insurance company, if any.

Advantages

- Protection of Important Assets: The insurance company safeguards the account receivables or business sales, which can be converted into cash, thereby safeguarding the business’s most important assets.

- Increase in the Sale: Due to increased credibility, the market position of the policyholder becomes better, and more customers connect. This is because, due to credit insurance, the policyholder can offer better credit terms.

- Low Risk: The insurance company will take care of any unforeseen losses, reducing the risk.

- Strengthen the Relationship: Due to the help of credit insurance, the relationship between the customer and creditor and between the policyholder and insurance company strengthens.

Disadvantages

- Limited Coverage: The insurance company only provides coverage per the circumstances and events mentioned in the policy terms and conditions.

- Lots of Formalities: There are many formalities in granting the amount, and a lot of verification is done before providing the amount.

- Doesn’t Cover Every Amount: The insurance company will take responsibility for the types of amounts mentioned in the policy terms and conditions.

Conclusion

Credit insurance is much beneficial for the business and the creditors as it safeguards them from many types of risks, which helps the business to grow and increase its credibility. The insurance company provides many types of credit insurance to choose from. It has many advantages, yet it has some limitations because of the requirement of documents and the verification process.

Recommended Articles

This is a guide to Credit Insurance. Here we discuss the definition and what credit insurance covers. Along with advantages and disadvantages. You may also have a look at the following articles to learn more –