Introduction to Credit Research Books

Are you looking to learn how to navigate through the credit markets? Credit research books are the best source for understanding the credit market and learning about credit research. These books serve as comprehensive guides, offering insights into credit analysis’s fundamental principles and strategies. By reading these credit research books, you can gain valuable information on managing risks and using better financial practices in credit markets.

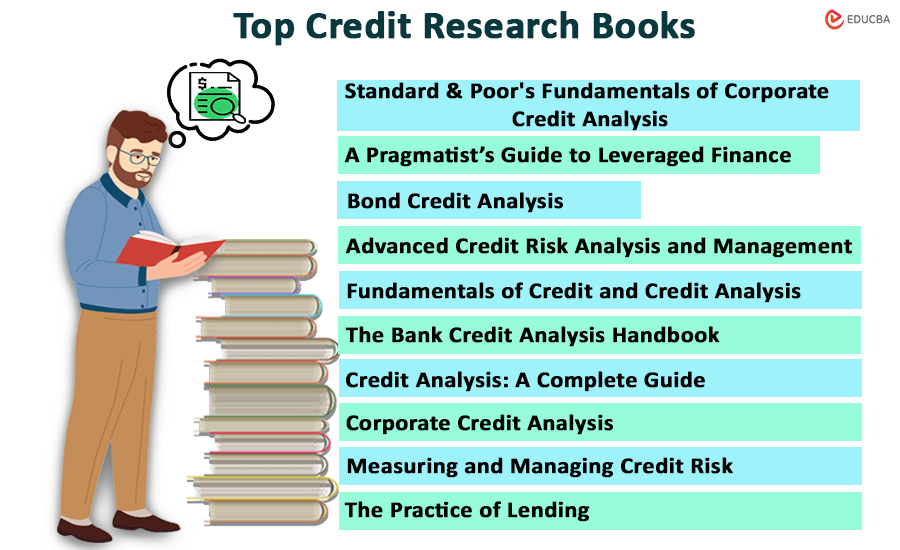

Whether you are a finance professional, investor, or student, these 10 credit research books provide a deep understanding of credit risk assessment, credit derivatives, and various financial instruments.

| # | Credit Research Books | Author | Original Publishing Year | Rating |

| 1 | Standard & Poor’s Fundamentals of Corporate Credit Analysis | Blaise Ganguin & John Bilardello | 2004 | Amazon: 4.5 Goodreads: 3.9 |

| 2 | A Pragmatist’s Guide to Leveraged Finance | Robert S. Krichef | 2012 | Amazon: 4.5 Goodreads: 4.2 |

| 3 | Advanced Credit Risk Analysis and Management | Ciby Joseph | 2013 | Amazon: 4.3 Goodreads: 4.3 |

| 4 | Fundamentals of Credit and Credit Analysis | Arnold Ziegel | 2014 | Amazon: 3.78 Goodreads: 3.9 |

| 5 | The Bank Credit Analysis Handbook | Jonathan Golin & Philippe Delhaise | 2001 | Amazon: 4.6 Goodreads: 4.9 |

| 6 | Credit Analysis | Roger H. Hole | 1983 | Amazon: 4 Goodreads: 5 |

| 7 | Measuring and Managing Credit Risk | Olivier Renault & Arnaud de Servigny | 2004 | Amazon: 4.5 Goodreads: 3.7 |

| 8 | Corporate Credit Analysis | Brian Coyle | 1992 | Amazon: 4.5 Goodreads: Nil |

| 9 | The Practice of Lending | Bijan M. D. Alagheband & Terence M. | 2020 | Amazon: 4 Goodreads: Nil |

| 10 | Bond Credit Analysis | Frank J.Fabozzi | 2001 | Amazon: Nil Goodreads: 3 |

Here is a detailed review of each of the credit research books. Read the extensively mentioned key points to understand which books are best for you.

Book #1: Standard & Poor’s Fundamentals of Corporate Credit Analysis

Author: Blaise Ganguin & John Bilardello

Buy the book here.

Review:

This book serves as a comprehensive framework for financial experts as well as newbies interested in knowing about Credit Research. Anyone with basic knowledge of financial concepts can read this book to understand credit research concepts. This guide equips readers with essential tools to analyze a company’s creditworthiness, make informed credit predictions, and assess recovery prospects in case of bankruptcy.

Key Points:

- The author thoroughly explains the concepts of Credit Risk in three parts: Corporate credit risk, the credit risk of debt instruments, and measuring credit risk for a better understanding.

- It delves into crucial topics such as industry and company-specific business risks, debt instruments, recovery prospects, credit risk scoring, etc.

- The included case studies provide practical guidance for readers, enabling them to apply the concepts learned in real-world scenarios.

Book #2: A Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Bonds and Bank Debt

Author: Robert S. Kricheff

Buy the book here.

Review:

The author, Robert Kricheff, has penned this book for those interested in widening their knowledge of credit research. It offers a practical approach and in-depth bond analysis and portfolio management knowledge. It is more suitable and beneficial for practitioners who already have some knowledge of credit analysis.

Key Points:

- The book covers all aspects of risk assessment, valuation, credit predictions, insolvency regimes, etc.

- Kricheff provides readers with real-world applications rather than delving into theoretical aspects of credit analysis.

- The book critically evaluates common practices in the finance industry, such as overemphasizing hard assets and the conventional wisdom about bond-rating agencies being backward-looking.

Book #3: Advanced Credit Risk Analysis and Management

Author: Ciby Joseph

Buy the book here.

Review:

The book covers macroeconomic and financial research for the study of credit risk, written by a credit specialist, Ciby Joseph, who has over 20 years of expertise in corporate finance. This book can be helpful to borrowers and lenders and includes case studies drawn from real-world instances. Anybody interested in corporate credit, as well as practitioners in credit risk, may find this guide helpful.

Key Points:

- The book covers a spectrum of credit risk topics, from credit risk grading to credit derivatives.

- The book draws connections between credit risk principles and the 2008/2009 credit crisis, emphasizing the importance of adhering to fundamental credit risk analysis.

- Through real-life case studies and practical exercises, Joseph offers valuable insights into credit risk management, exploring preventive measures against economic downturns.

- With a wealth of banking experience, the author delivers a practical, topical, and challenging resource for academics and practitioners alike.

Book #4: Fundamentals of Credit and Credit Analysis: Corporate Credit Analysis

Author: Arnold Ziegel

Buy the book here.

Review:

The book, written by Arnold Ziegel, is very helpful for beginners, particularly those with little or no background in the credit analysis industry. The book is for readers who want to learn the basics of credit research. In this insightful book, Arnold Ziegel leverages his extensive banking career to demystify credit analysis and risk management.

Key Points:

- The central theme revolves around the fundamental goal of credit – to retrieve the invested capital with an appropriate return based on risk.

- Drawing on real-world experiences, Ziegel emphasizes the primary goal of credit – ensuring the return of invested capital with commensurate risk-adjusted returns.

- Ziegel skillfully explores the tension between modern decision models and traditional credit analysis, illustrating key lessons from the 2008 financial crisis.

- The author advocates for a nuanced approach to credit decisions, moving beyond simplistic “yes or no” determinations.

Book #5: The Bank Credit Analysis Handbook: A Guide for Analysts, Bankers and Investors

Author: Jonathan Golin & Philippe Delhaise

Buy the book here.

Review:

This book is very helpful for practitioners who want to learn about Credit Analysis in-depth. It is an excellent handbook for financial experts like Bank professionals and Inventors. The book sheds light on the methodology behind credit ratings that rating agencies assign. The authors cover crucial aspects, from reviewing asset quality to exploring the restructuring of distressed banks.

Key Points:

- The book explains financial institutions’ banking concepts and credit ratings in a step-by-step analysis for easier understanding.

- According to today’s environment, the edition addresses increased oversight and transparency requirements, making it relevant for current banking practices.

- The inclusion of case studies from different regions provides readers with a comprehensive, global understanding of bank credit analysis.

- With charts, graphs, and spreadsheet illustrations, this handbook is an indispensable resource for equity and credit analysts.

Book #6: Credit Analysis: A Complete Guide

Author: Roger H. Hole

Buy the book here.

Review:

This book is best suited for you if you want to become a self-taught credit analysis specialist. However, it is an excellent book about credit research written two decades ago. While it may not delve into recent trends, the book excels in delivering fundamental concepts that have maintained their relevance over the years.

Key Points:

- The book’s clarity and accessible language make it an excellent tool for individuals aspiring to become self-taught credit analysis professionals.

- Its standout feature lies in the comprehensive explanation of concepts, providing a thorough understanding of credit analysis fundamentals.

- The book caters to the practical needs of analysts, offering quick and reliable insights for various credit scenarios.

Book #7: Measuring and Managing Credit Risk

Author: Olivier Renault & Arnaud de Servigny

Buy the book here.

Review:

This credit risk management book is an indispensable guide for both professionals and academics dealing with the intricacies of credit risk. By covering all aspects of credit risk management, the book addresses the complexities faced by banks, nonbank financial institutions, and corporations. The book covers current practices and discusses the latest literature on structured credit products, credit derivatives, etc., making it a relevant resource for contemporary credit risk management.

Key Points:

- The book delves into all facets of credit risk management, providing a holistic view of the challenges faced by financial institutions and corporations.

- The initial chapters introduce the microeconomic foundations of banking, emphasizing liquidity, risk intermediation, and information intermediation.

- The discussion on adverse selection and moral hazard adds depth to understanding credit dynamics.

- While emphasizing the importance of assessing credit risk, the authors explore various approaches, from traditional credit rating methods to cutting-edge quantitative models.

Book #8: Corporate Credit Analysis: Credit Risk Management

Author: Brian Coyle

Buy the book here.

Review:

This book by Brian Coyle is one of the best credit research books apt for professionals. Apart from credit analysts, this go-to resource for credit analyses also caters to risk managers, fund managers, investment advisors, and accountants. The author provides a detailed explanation of all the financial terminologies simply and comprehensively.

Key Points:

- Readers can learn to set corporate goals for creditworthiness and implement credit analysis systems.

- The book serves as a comprehensive guide, allowing readers to refer back to numerous case study analyses and sample credit analysis programs.

- With a focus on case study analysis, the book provides readers with practical insights into credit risk management.

- The book offers an international perspective, emphasizing credit risk management.

Book #9: The Practice of Lending: A Guide to Credit Analysis & Credit Risk

Author: Bijan M. D. Alagheband & Terence M

Buy the book here.

Review:

This comprehensive guide effectively combines theoretical foundations with practical insights, making it an indispensable resource for credit professionals. This book is an authoritative guide to credit risk assessment and rating, aligning with the Advanced Internal Risk-Based (AIRB) approach. The emphasis on practical applications makes it an invaluable resource for banking and investment professionals while also catering to students preparing for careers in lending. By balancing theory and practicality, the book stands out for its thorough coverage of credit risk assessment principles.

Key Points:

- It delves into crucial areas of credit risk analysis, including country analysis, industry analysis, financial analysis, business analysis, and management analysis.

- Including criteria-based and mathematical approaches, including regression analysis, caters to different learning preferences and practical applications in the field.

- It covers diverse industries, such as passenger airlines, commercial real estate, and commercial banking.

Book #10: Bond Credit Analysis: Framework and Case Studies

Author: Frank. J. Fabozzi

Buy the book here.

Review:

This book by Frank J. J. Fabozzi provides a list of case studies related to credit analysis. You can use this guide to review your fundamentals by practicing your knowledge of these case studies. Moreover, if you are a master in credit analysis and only want to refresh previously learned concepts, this book is highly recommended. However, it might not be very helpful for complete beginners.

Key Points:

- The study positions credit analysis as a crucial factor in evaluating investment value, emphasizing its role in providing deeper insights into potential profits.

- A professional framework provides a structured approach to understanding and managing successful corporate or municipal bond analysis.

- It presents important case studies from well-known commercial and public businesses.

- By delving into credit analysis methodologies, the book aims to empower investors with the tools and knowledge necessary for maximizing profits.

Recommended Books

We hope you found this EDUCBA guide on the top 10 credit research books helpful. Check the following recommendations for similar articles,