Definition of Credit Risk

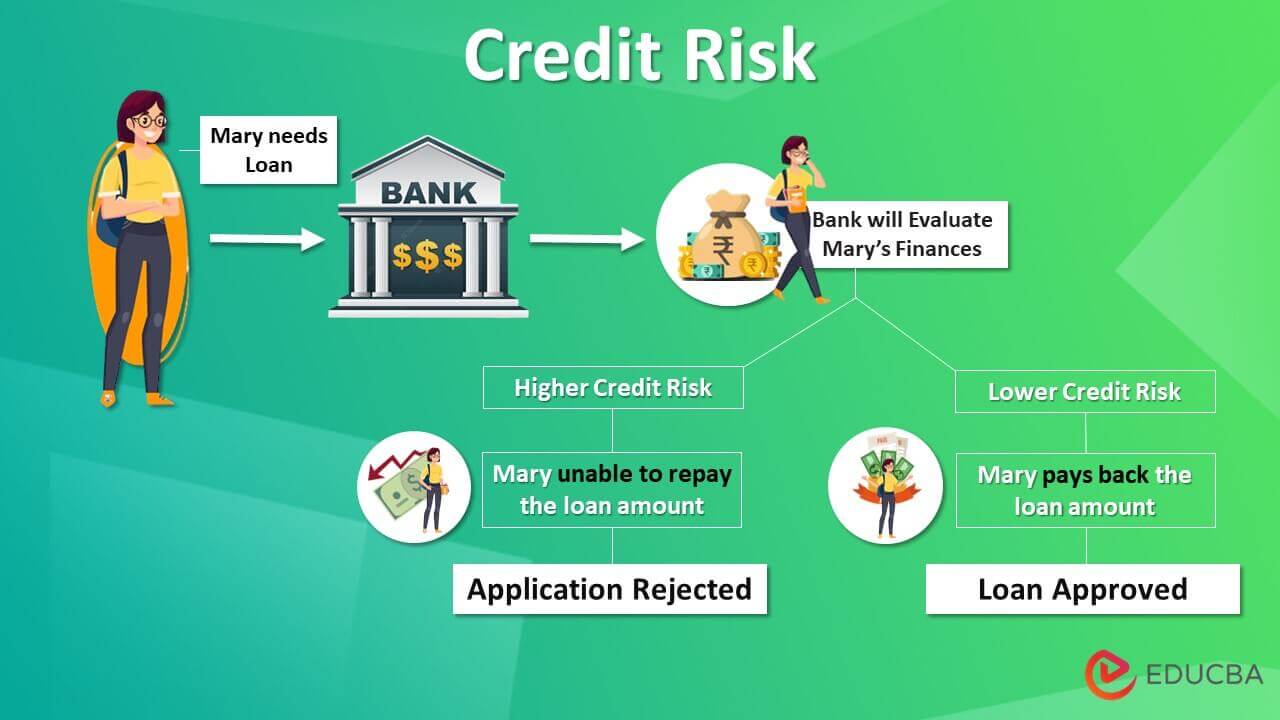

Credit risk infers the possibility of a loss emerging from a borrower’s downfall to pay back a loan or meet contractual commitments. Conventionally, it pertains to the risk arising from lenders’ inability to return the owed interest and principal, impacting the cash flows and increasing assemblage costs.

It’s inconceivable to predict who will default on agreements accurately. Still, a proper assessment and risk management can help you mitigate such credit risk to a remarkable extent by reducing the stringency of losses.

Explanation

When any lender extends loans such as mortgages, credit cards, or other similar loans, there is an avoidable risk that the borrower will not repay the loan amounts. Furthermore, if a company offers such credit to the customer, there’s the same risk that the customer will not pay back. It also incorporates other related risks, such as that the bond issuer may not make payment at the time of maturity and the risk occurring out of the incapacity of the insurance company to compensate for the claim. A higher level of credit risk in a profitable market will correlate with the elevated borrowing cost. Because of this, it is evaluated technically to mitigate such risk to a certain level.

How to Measure Credit Risk?

One of the modest ways to calculate credit risk loss is to compute expected loss which is calculated as the product of the Probability of default(PD), exposure at default(EAD), and loss given default(LGD) minus one.

Mathematically, it is depicted as follows-

- Where PD= Probability of default

- EAD= exposure at default

- LGD=Loss given default

Example of Credit Risk

Suppose that a bank, XYZ Bank Ltd, has given a loan of $250,000 to a real estate company. As per the bank credibility assessment, the company was rated “A” based on the industry cyclicality witnessed.

Let us formulate the expected loss for XYZ Ltd based on the details below:

|

Particulars |

Values |

| Exposure at Default (EAD) | $250,000 |

| Probability of Default (PD) | 1% |

| Loss Given Default (LGD) | 68% |

Solution:

Expected loss can be calculated by using the formula below:

Expected Loss = PD * EAD * (1 – LGD)

Given, PD= 1%, EAD = $250,000, LGD = 68%

PD = 0.10% * $250,000 * (1 – 68%)

Expected Loss = $800

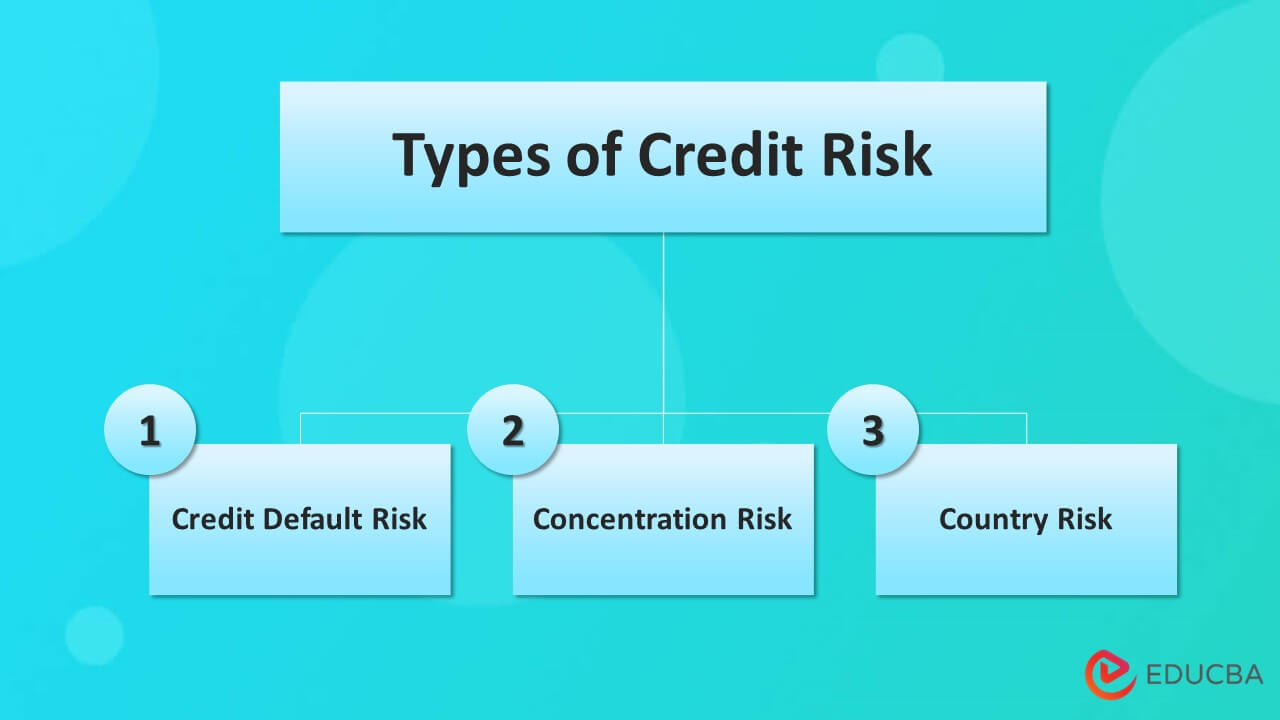

Types of Credit Risk

Credit risks are the reason why lending institutions undergo a lot of creditability assessments before providing credit. It can be considerably classified into three types.

- Credit Default Risk: It includes losses incurred by the lender when the borrower is incapacitated from returning such amount in entire or when the borrower has exceeded 90 days from the due date but hasn’t made any payment.

- Concentration Risk: Concentration risks emerge from substantial exposure to any individual or group because any unfavorable incident will likely impose significant losses. It is mainly concerned with any individual industry or company.

- Country Risk: Country risks are such risks that are inferred when a sovereign state halts the payment that needs to be made for foreign currency commitments overnight, which leads to default. Macroeconomic accomplishments primarily influence country risks. It is also termed sovereign risk.

Causes of Credit Risk

Credit risks are ingrained in the lending process. Along with the credit, the risk is accompanied. Such risks are more in the case of small borrowers with the most default probability. The leading cause of credit risk lies in the lender’s inappropriate assessment of such risk.

Most lenders prefer to give loans to specific borrowers only. This causes credit concentration, including lending to a single borrower, a group of related borrowers, a particular industry, or a sector.

Credit Risk Mitigation

Institutions providing loans must consider the following points to mitigate credit risks, including:

Risk-Based Pricing: Pricing should be based on the amount of risk undertaken. Lenders can charge a high-interest rate to those more likely to default. Such practice can mitigate loss from default to a much extent.

Covenants: Lenders can inscribe stipulates on the borrower in the form of an agreement called covenants. Such as,

- Periodically reporting the financial status of the borrower.

- Pre-payment in case of an unfavorable change in the borrower’s debt-equity ratio or interest coverage ratio.

- Diversification lenders face a high probability level in the case of small borrowers with an inevitable risk of default. Lenders can mitigate credit risks by diversifying the borrower funding pool.

Credit Insurance and Credit Alternative: Credit insurance is widely operated to mitigate credit risks. These contracts transmit the risk from the lender to the insurer in exchange for payment. The most general form of a credit derivative is a credit default swap.

Uses of Credit Risk

- Credit risk analysis is a type of scrutiny to acknowledge the borrower’s ability to pay back.

- Credit risks infer the ability of the individual to pay back what he owes; lenders usually perform various assessments to mitigate any loss that would arrive in the foreseeable future.

- Lenders can arrive at a less quantifiable loss probability by properly evaluating such credit risks to curb the chances of loss.

Advantages

- A good credit risk management scheme improves the capacity to foresee, which helps evaluate the potential risk in every transaction.

- The banks use the credit risks model to examine the degree of lending which can be financed to prospected or new borrowers.

- Credit risk management is an alternative to traditional techniques for pricing options.

Disadvantages

- Risk management can be a very expensive liaison.

- Although there are some quantitative techniques to evaluate credit risk, such decisions are inaccurate as assessing risk thoroughly is impossible.

- Generally, lenders apply one rigid model to all mitigation approaches, which is wrong.

Conclusion

Nowadays, technical innovations like AI Credit Repair have enhanced credit risk management, improving the ability to measure, identify, and regulate credit risks as part of the Basel III implementation.

Recommended Articles

This is a guide to Credit Risk. Here we also discuss the definition and How to Measure it with advantages and disadvantages. You may also have a look at the following articles to learn more –