Updated July 17, 2023

Introduction to Credit Risk Management

Credit risk management is a systematic process of identification, analysis, measurement, and decision making relating to various factors of credit risk to an individual or an entity, in respect of goods sold or services provided on a credit basis or grant of loan and such management also involves limiting the risk as well as eliminating risks.

Explanation

- Before we touch on the main topic of the article, we need to understand a few basic terms revolving around credit risk management.

- A business entity may sell its goods or provide its services either on a cash basis or on a credit basis to its customers. The realization of revenue has been issued only in the case of “credit sales”. The business entity is exposed to the risk “what if the customer does not pay the amount in full or what if the customer defaults in payment or what if it liquidates within the credit period”. Such questions give rise to the “credit quality” of the customer.

- Above was the case of a normal business entity. In the case of banking entities, they carry a huge risk of default in the case of low credit rating customers. Bankers cannot work on a cash basis for grant of loans. So, the problem is “credit risk” and the solution is “credit risk management”.

- Every problem can be tackled through preventive measures or compensatory measures. Credit risk management is a preventive measure for credit risks.

- For the growth of any normal entity or banking institution, credit is an important factor in multiplying the business. Such entities need to assess whether the customer is creditworthy of being trusted. Thus, credit risk management analyses various factors around the customer and provides a mechanism to identify, evaluate, mitigate, and eliminate credit risks.

- It also provides measures to manage the risk.

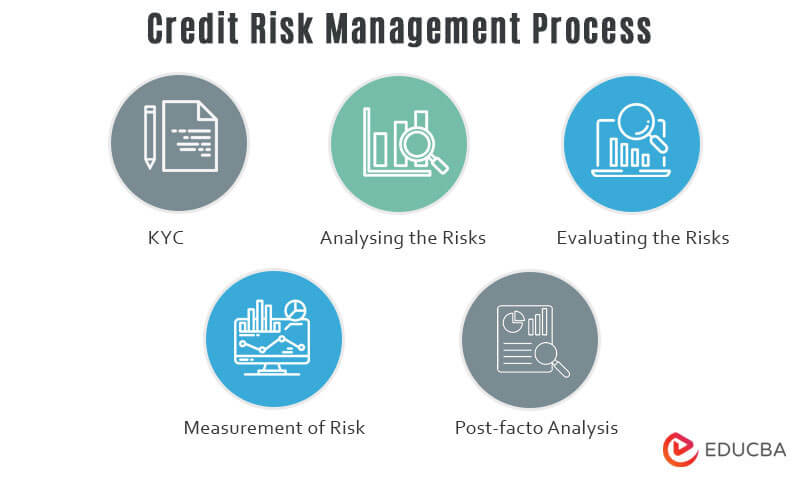

Credit Risk Management Process

The process of credit risk management is explained below:

Step 1: KYC

- KYC means Know Your Customer. This is the foremost procedure of getting every crux information about the customer. Such 6information can be gathered by asking the customer to fill out a form or provide documentation or obtain information from external sources.

- This is the master information document for the entity. Further information about the customer can be obtained from government websites or credit rating agencies or through the website of the corporate client.

Step 2: Analysing the Risks

- This is the second step in the process. After obtaining sufficient information about the customer, we need to analyze the data. The risks can be financial risks or non-financial risks.

- Financial risk analysis is called as “creditworthiness,” and it can be measured using data such as income sources, credit card expenses, bank statements, financial statements, reports from government websites, income tax returns, etc. A rating is assigned for each important factor.

- Non-financial factors such as the profession of the individual customer, the business sector of the entity, business age, market image, reviews from independent persons, etc., are taken into consideration.

- Other factors, such as the economic environment in which the business operates, the competitiveness of the management, level of competition faced by the business of the customer, are also considered.

Step 3: Evaluating the Risks

- Financial analysis is given more weightage than non-financial factors. One can assume 70% weight to financial factors and balance weight to non-financial factors.

- After all such analysis, the maximum credit to be provided and periodicity of credit is decided by the management. The management checks with the customer the manner of utilization and purpose for such credit to be provided.

Step 4: Measurement of Risk

- At this stage, management comes up with a credit rating for the prospective customer, and the final decision for the credit, as well as the periodicity of credit to be provided, is decided.

- In the case of banking institutions, the main consideration is the rate of interest to be charged to the customer. The interest rate is decided on the basis of the economic situation of the customer, the value of the security provided as collateral & the periodicity of the loan required.

- In the case of high creditworthiness customers with higher periodicity, the rate of interest charged is lower.

- In the case of entities other than banking institutions, the penal interest rate is decided in case the customer delays the payment.

Step 5: Post-Facto Analysis

- This involves keeping an eye on the credit utilized by the customer, the level of repayment of dues, and the timeliness of repayment.

- In the case of banking entities, such a job is done is by credit rating agencies who report the factors to the customers.

- In the case of other entities, the management conducts a periodic review and evaluation of the credit provided, and decisions are revisited for the credit terms.

Techniques of Credit Risk Management

- Credit analysis is the most rewarded mechanism in the globe for the management of credit risk. It basically involves collecting various sorts of information, evaluating & assessing the factors, and deciding on the credit profile. It also checks the ability of the customer to the repayment of the loan amount.

- Evaluating the market value of the collateral provided by the customer is another technique. Here, the entity asks for the independent valuation of the collateral security to be provided and its chances and quantification of deterioration in value over the period of the loan.

- Reassessing the credit profile on a periodic basis is done by various entities as a compensatory measurement to evaluate further risk.

- The entity needs to develop a credit analysis strategy and should automate the process therein to evaluate the credit risk for new customers.

- Many entities outsource such activities to an outside agency that evaluates various information regarding the prospective customer.

Challenges of Credit Risk Management

- The management may need to rework the credit rating evaluated earlier. Such a task is difficult due to the repetitive information available at the desk.

- There may be chances of data inefficiency. It means the management is unable to access the right source of information.

- Further, there may be an inconsistency between the same data from two sources. The management may get confused about the reliability of data.

- The credit analysis tools may not sufficient for unknown customers.

- Automatic, the process of risk analysis is difficult due to the subjectivity involved in every case.

- Overburdening data is another challenge, and it’s difficult to pick the relevant data.

Importance of Credit Risk Management

- Risk is something acceptable thing for a normal banking operation. Credit risk management plays the role of preventive measures to mitigate the probable risk or to reduce the chances of occurrence of the risk.

- This further helps bankers to protect the valued treasure from credit unworthy customers, who may defalcate the hard-owned money of depositors.

- Credit risk management is further important to decide on the collateral to be taken.

- It helps bankers to make cautious decisions.

Advantages

- It predicts the level of risk carried by a prospective customer.

- It forecasts the level of risk.

- It also quantifies the risk to a certain measurable level.

- It lowers the risk of default and saves the money of depositors.

- It helps bankers to reduce the chances of default for similar customer categories.

Disadvantages

- Everything cannot be quantified on figures, and such non-quantifiable factors may be material for the banks. Factors such as honesty, business ethics, discipline, timeliness, etc., cannot be qualified on grounds. The decision may turn out to be wrong in case such factors outweighs the financial factors.

- Even if the credit rating is high, there are uncertainties prevailing in any business, which may affect the repayment schedule of the customer to whom credit has been granted. In such cases, the business has to accept the loss.

- A certain amount of cost is involved in collecting and analyzing the information.

- Too much analysis may cause paralysis in the decision on creditworthiness.

Conclusion

Businesses nowadays prefer “lower level of business with quality customers than the higher scale of risky business”. At last, it depends on the risks to be taken by any entity. Risk and reward go hand in hand. Still, credit risk management does its job to a certain level which provides a minimum level of assurance.

Recommended Articles

This is a guide to Credit Risk Management. Here we discuss the introduction and techniques of credit risk management along with its advantages and disadvantages. You may also have a look at the following articles to learn more –