Updated July 17, 2023

Definition of Credit Spread

Credit Spread is the difference between the yields of two bonds with different credit potentials but the same maturity date. The strategy involves selling options as needed and purchasing another option with the same expiration period.

This strategy is very popular among fund managers and some potential investors willing to trade on option strategies. It is also said that this strategy can make a consistent return of 10% to 30% in each transaction.

Explanation

This strategy profits by selling or buying the option time decay. This can execute every 2 to 3 weeks but potentially make at least 10% to 30% profits. This is classified into Put Credit Spread and Call Credit Spread. The option traders willing to invest in a put credit spread strategy will always anticipate that the stock price will rise in the future. Similarly, in the case of a call credit spread strategy, the trader will enjoy the profit if the stock market will fall downward. In both these situations, the strategy can make profits because the time decay is always in its favor. Credit spreads are vertical spreads.

The formula :

The expiration date of both these bonds should be the same to calculate this spread.

How Does Credit Spread Work?

These options generally use when two underlying securities have different credit potential but similar maturity dates of expiration. First of all, the Put credit spread option is used. In this strategy, the options trader will receive the selling price in the credit of the trading account of the trader, and after that, the trader will buy some options at a cheaper price with those funds to make a net profit out of the option strategy. This is how the traders take the benefit of the credit spread.

Example of Credit Spread

An investor is planning to invest in options strategy by using the benefits of credit spread, and thus, he buys and sells two bonds, respectively, i.e., Bond A and Bond B. Bond A has a yield of 10%, and Bond B has a yield of 5%. Both these bonds have different credit stands in the market, but the maturity date of these bonds is the same, and thus it calculates, i.e. (10%-5%) equal to 5%.

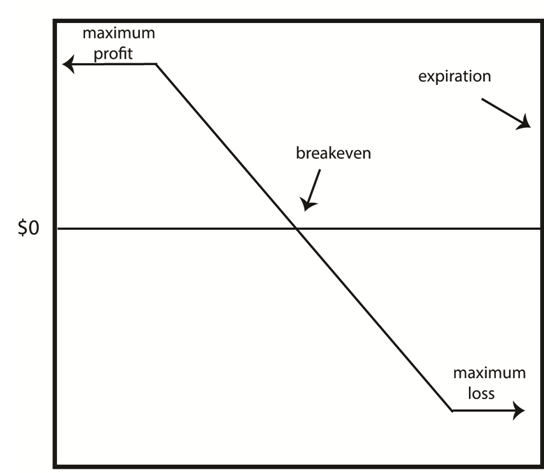

Credit Spread Chart

Source: https://www.optionsmoneymaker.com/wp-content/uploads/2018/02/bear-call-credit-spread.jpg

This diagram illustrates the concept of a credit spread, wherein an investor can achieve either maximum loss or maximum profit for an underlying asset at a specific strike price. The investor will also be aware of the breakeven point in this transaction so that they can make their decisions accordingly. it can help the investors predict the profit possibilities in this options strategy. This strategy is the vertical spread strategy.

Credit Spread Analysis

This is an options strategy used by investors willing to invest in the options. The investors can gain up to 30% in each transaction. It can understand by investing in underlying assets with the same expiration period but different credit capacities. The investor will gain from the spread of the returns from these bonds while the investors will buy or sell the underlying assets.

Credit Spread Risk

This risk arises from the difference in returns of the underlying asset at the expiration time. The market fluctuates every moment. Any stock price can go down or upward; in this scenario, the investors anticipating an arbitrage profit may not enjoy this position. Hence the risk is the market condition in this strategy. It can be very risky if the size of the security is big. Credit spreads are less risky than any stock trading in the market.

Why is Credit Spread Important?

It is important because it gives the investors an idea about the expected gain from the options swaps. Investors can get an indication of the bond’s yield by understanding the spreads of the underlying assets. This can give you an idea about how much a market can move by anticipating the spreads. This is also a key factor in analyzing the bond price in an economy. It can help the investor to anticipate the prices, and thus the investors prepare themselves for Call or Put credit spread. It involves buying and selling options contracts belonging to the same class but with different credit capabilities. Therefore it becomes important for investors to analyze the market condition and the key indicator, which is the credit spread.

Conclusion

This indicates the traders willing to invest their proceeds in this options strategy. However, this can help the investor opt for the right option, i.e., Call or Put credit spread. It involves buying and selling options as per the situation demands. This strategy is such that the investors can make out about much profit they can make in each transaction. This strategy also helps to manipulate the risk factors, if any, prevailing in the market. The price fluctuation or any other market movement will not drastically affect this strategy. However, investors willing to invest in this strategy should have deep knowledge about these strategies. These strategies are very helpful for those who clearly understand the concept. It is subjective because it varies from security to security. The expiration date of the underlying assets should be the same. This options strategy also helps overcome the uncertainty in the market.

Recommended Articles

This is a guide to Credit Spread. Here we also discuss the definition and how it works. Along with an example and importance. You may also have a look at the following articles to learn more –