Updated October 25, 2023

There have been innumerable mergers and acquisitions in the past. Many have been successful, and others have unfortunately been doomed. Recent trends show that despite economic uncertainties, cross-border mergers and acquisitions are gaining importance and are considered vital tools for growth.

Let’s consider this example from the past of the Daimler-Chrysler Merger, a cross-border M&A where Daimler-Benz was a German automotive company and Chrysler Corporation, an American automobile manufacturer. This German-American marriage occurred in 1998 and was a “merger of equals”.

Introduction

As the word suggests, cross border includes activities between two different countries. Hence, we could imply that cross-border mergers and acquisitions are basically those transactions wherein the target firm and the acquirer firm are from different home countries. This deal is such that the assets and processes of the firms in different countries form a new legitimate entity.

Cross-border mergers and acquisitions are of two types: Inward and Outward. Inward cross-border M&As involve an inward capital movement due to the sale of a domestic firm to a foreign investor; conversely, outward cross-border M&As involve outward capital movement due to the purchase of a foreign firm. Despite these differences, inward and outward M&A are closely linked as, on the whole, M&A transactions comprise sales and purchases.

You must wonder why firms go for cross-border mergers and acquisitions or what induces them to leave their home country. Well, various driving forces differ across sectors. A few factors which generally encourage firms for cross-border M&A include

- Globalization of financial markets

- Market pressures and falling demand due to international competition

- Seek new market opportunities since the technology is fast evolving

- Geographical diversification, which would result in exploring the assets in other countries

- Increase the company’s efficiency in producing goods and services.

- Fulfillment of the objective to grow profitably

- Increase the scale of production

- Technology share and innovation, which reduces costs

These factors have been supported by government policies such as regulatory reforms and privatization, leading to access to targets for potential acquisitions.

Recommended courses

Effects of Cross-Border Mergers and Acquisitions

Generally, it has been observed that cross-border mergers and acquisitions are a restructuring of industrial assets and production structures worldwide. It enables the global transfer of technology, capital, goods, and services and integrates universal networking. Cross-border M&A leads to economies of scale and scope, which helps gain efficiency. Apart from this, it also benefits the economy, such as increased productivity of the host country and increase in economic growth and development, particularly if the policies used by the government are favorable. Let’s look at those effects in detail.

- Capital Buildup

Cross-border mergers and acquisitions contribute to capital accumulation on a long-term basis. To expand its businesses, it undertakes investments in plants, buildings, and equipment and intangible assets such as technical know-how and skills rather than just the physical part of the capital.

- Employment creation

Sometimes, it is seen that the M&A that is undertaken to drive restructuring may lead to downsizing but would lead to employment gains in the long term. Downsizing is sometimes essential for the continued existence of operations. When businesses expand and become successful in the long run, it creates new employment opportunities.

- Technology handover

When companies across countries come together, it sustains the positive effects of the transfer of technology, sharing of best management skills and practices, and investment in intangible assets of the host country. This, in turn, leads to innovations and has an influence on the operations of the company.

This Merger between Daimler and Chrysler created a large automobile corporation which ranked third worldwide in terms of revenue and market capitalization and fifth in terms of the number of units they sold. The new corporation had 442,000 employees and a market capitalization approaching $100 billion all set to take advantage of synergy in in retail sales and distribution, purchasing, product design, and research and development. They were confident that the new corporation formed would exploit the huge growth opportunities in terms of the geographical coverage and product segments.

Cross Border Merger and Acquisitions – Issues and Challenges

Looking at the underlying dynamics, cross-border mergers and acquisitions are quite similar to domestic M&As. However, because the former is huge and international, they pose unique challenges regarding different economic, legal, and cultural structures. There could be huge differences in customers’ tastes and preferences, business practices, and culture, which could threaten companies to fulfill their strategic objectives. In this section, let’s discuss these issues and challenges briefly.

1. Political Concerns

A political scenario could play a key role in cross-border mergers and acquisitions, particularly for politically sensitive industries such as defense, security, etc.

Considering these aspects, it is also important to consider the concerns of the parties like the governmental agencies (federal, state, and local), employees, suppliers, and all other interests that should be addressed after the merger plan is known to the public. In certain cases, there could be a requirement for prior notice and discussion with the labor unions and other concerned parties. It is important to identify and evaluate present or probable political consequences to avoid any probability of political risk arising.

2. Cultural Challenges

This could pose a huge threat to the success of cross-border mergers and acquisitions. History has seen huge mergers that have failed because of the cultural issues they have had. When there are cross-border transactions, issues arise because of the geographic scope of the deal. Various factors such as differing cultural backgrounds, language necessities, and dissimilar business practices have led to failed mergers in spite of being in the age where we can instantly communicate. The research proposes that intercultural disagreement is one of the major pointers to failure in cross-border mergers and acquisitions. Hence, irrespective of what the objective behind the alliance is, businesses should be well aware of the intercultural endangerment and prospects that come hand in hand with the amalgamation process and prepare their workforce to manage these issues.

In order to deal with these challenges, businesses need to invest a good amount of time and effort to be well aware of the local culture to gel with the employees and other concerned parties. It is better to over-communicate; conforming to things tirelessly would be the key.

3. Legal Considerations

Companies wanting to merge cannot overlook the challenge of meeting the various legal and regulatory issues they will likely face. Various laws in relation to security, corporate, and competition law are bound to diverge from each other. Hence, before considering the deal, reviewing the employment regulations, antitrust statutes, and other contractual requirements is important. These laws are very much part of both while the deal is under process and also after the deal has been closed.

While undergoing the process of reviewing these concerns, it could indicate that the potential merger or acquisition would be totally incompatible. Hence, it is better not to go ahead with the deal.

4. Tax and Accounting Considerations

Tax matters are critical, particularly when it comes to structuring transactions. The proportion of debt and equity in the transaction involved would influence the tax outlay; hence, a clear understanding of the same becomes significant. Another factor in deciding whether to structure an asset or a stock purchase is the issue of transfer taxes. It is very important to alleviate the tax risks. Countries also follow different accounting policies, through the adoption of IFRS has reduced this to an extent; many countries have yet to implement it. If the parties in the merger are well aware of the financial and accounting terms of the deal, it will aid in minimizing the confusion.

5. Due Diligence

Due diligence forms a very important part of the M&A process. Apart from the legal, political, and regulatory issues we discussed above, infrastructure, currency, and other local risks also need a thorough appraisal. Due diligence can affect the terms and conditions under which the M&A transaction would take place, influence the deal structure, and affect the deal’s price. It helps reveal the danger area and gives a detailed view of the proposed transactions.

There are countless other issues, as every deal has flavors and differences. But identifying and tackling those challenges is very important to help close a deal.

Despite the Daimler-Chrysler merger showed a rosy picture it failed. Yes it is one of the most well-known of all international mergers then ended in fiasco. Let’s see what went wrong and which were the issues that caused its failure. Analysts have agreed on the fact that the cultural mismatch was one the main reasons for the downturn. Looking at the organization structure Daimler was a very well tiered organization with a clear chain of command and respect for authority. Chrysler, on the other cultural hand, favored a more team-oriented and unrestricted approach. There was lack of harmonization, opposing working styles and cultural values between American and German managers. Apart from this there was severe lack of trust among the employees. All these issues and the attempt of Daimler-Benz to run Chrysler USA operations in the same way its German operations, lead to its failure.

Trends in Cross Border Mergers and Acquisitions

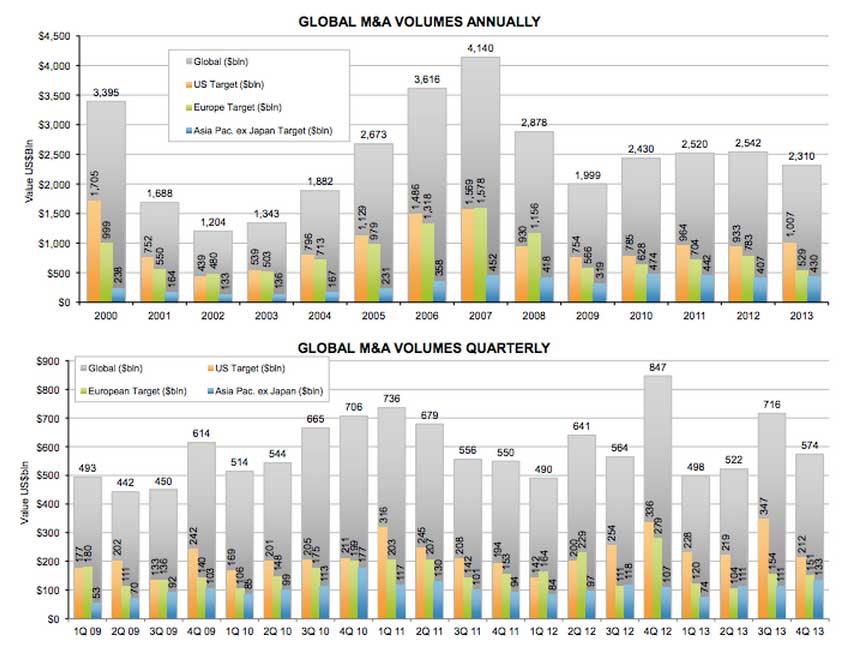

Despite the issue we have discussed above, the number of cross-border transactions has increased quite radically over the past few decades. Though there have been a few economic crises and the situation has not been so conducive, it has not disturbed the upward trend in cross-border M&A activity.

More and more companies want to go global as they offer great opportunities, which are comparatively cheaper options for companies to build themselves internally. The M&A sentiments worldwide show that the business acquisition emphasis is changing from domestic to cross-border transactions because of the various benefits it offers.

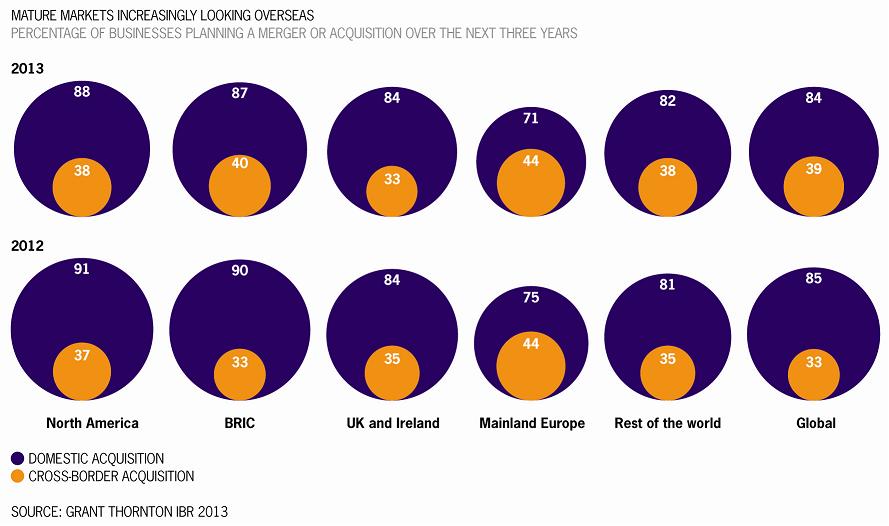

According to the International Business Report (IBR), two of five businesses preparing to grow through acquisitions over the next three years are contemplating cross-border opportunities. Last year, this equation was one in three; before the financial crisis, it was one in four. It’s no surprise with the things pacifying in the eurozone to see almost 44% of Europe and 38% of North America seek business opportunities abroad.

The BRIC countries are also looking at cross-border mergers and acquisitions to gain entry to new markets. In this, China is leading the way, getting involved in M&A transactions in a big way, and is ardent to show itself as a striking option for investors globally.

The other markets in Asia are following suit and are up for lucrative M&A activity in various emerging markets to grow.

Even though domestic acquisitions have been the prime focus for inorganic growth in companies, almost 84%, the yearning for cross-border mergers and acquisitions is becoming extremely protruding.

Summing It Up

On the whole cross, cross-border mergers and acquisitions can greatly benefit companies and increase their share price. Still, as we saw, there are a lot of factors that help to avoid any glitches. It is extremely vital for the business structures of both countries involved in M&A transactions to learn from cases like that of Daimler-Chrysler. The most critical factors that separate successful M&A transactions from those that fail are thorough and planned preparation and commitment of time and other resources. Considering all this, the prominence and importance of cross-border transactions clearly illustrate the business mindsets to access the global markets and grow.

Cross Border Merger and Acquisitions Infographics

Learn the juice of this article in just a single minute: Cross-Border Merger and Acquisitions Infographics.

Recommended Articles

Here are some articles that will help you to get more detail about the Cross-Border Merger, so just go through the link.