What is Crypto Remittance? – Introduction

Crypto Remittance is when one person from one country sends money to another person living across borders using cryptocurrencies.

Remittance, in general, plays a pivotal role in the global economy, connecting families and supporting livelihoods. However, the traditional remittance process has several challenges, such as high fees and slow transaction times. This is when crypto remittance comes into play, providing solutions to traditional remittance problems.

In 2009, Satoshi Nakamoto introduced Bitcoin to establish a decentralized system aiming to solve issues in traditional finance. Learning effective investing strategies is crucial to maximizing Bitcoin investments. For the same, Immediate Maximum can be a real game changer. In this article, we will see how Bitcoin addresses key limitations of the traditional remittance system.

Table of Contents

- Introduction

- Bitcoin as an Inclusive Solution

- Challenges and Concerns

- Real-World Examples

- Future Trends and Innovations

Crypto Remittances – Bitcoin as an Inclusive Solution

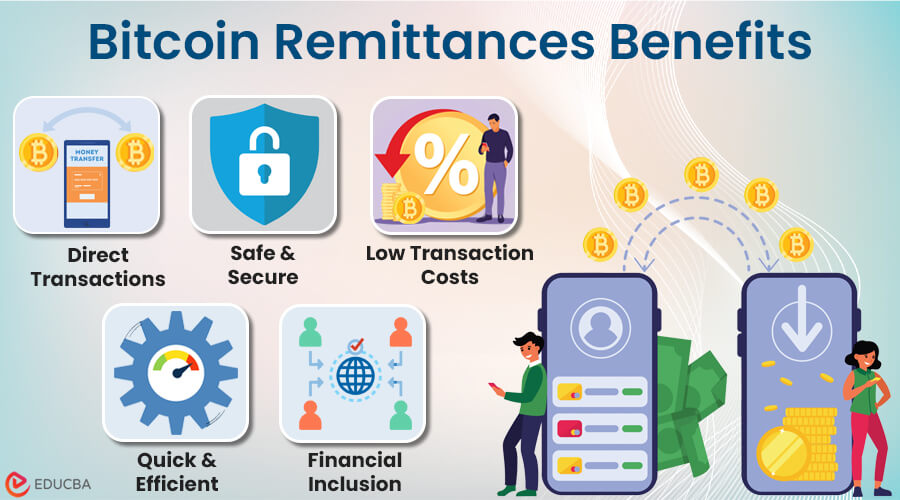

Bitcoin addresses key limitations of traditional remittance system and provides the following benefits:

➔ Direct Transactions

Traditional remittance processes involve multiple intermediaries like banks, leading to delays and increased costs. Bitcoin’s borderless nature eliminates the need for intermediaries, letting users send and get funds directly.

➔ Safe & Secure

Bitcoin transactions have three participants: a sender, a recipient, and miners. The sender sends money, the recipient receives, and miners validate and record the transaction. This decentralized network prevents any single point of failure, and using private and public keys ensures security.

➔ Low Transaction Costs

Compared to traditional remittance methods, Bitcoin transactions often come with lower fees. This cost reduction is particularly beneficial for individuals sending smaller amounts across borders, making Bitcoin an attractive remittance option.

➔ Quick and Efficient

Bitcoin transaction processing is relatively quick in comparison to traditional banking systems. The decentralized network and consensus mechanisms contribute to faster confirmation times, allowing recipients to access funds more promptly.

➔ Financial Inclusion

Bitcoin can help include more people in the financial system. Even people living in areas without banking services can use a smartphone and the Internet to make money transfers. It opens doors to the global economy, no matter where you are.

Challenges and Concerns

- Bitcoin’s decentralized nature does not fall under traditional regulations. It causes uncertainty and legal challenges for countries integrating cryptocurrencies into their financial systems.

- Bitcoin’s price is not always stable. This volatility is a concern for remittance users as the fluctuating value of Bitcoin can impact the final amount the recipient receives.

- While Bitcoin transactions are generally secure, crypto is not immune to fraud. Phishing attacks, hacking incidents, and other security threats pose risks that emphasize the importance of robust security measures.

Real-World Examples

Example #1: BitPesa

Many companies and platforms now use Bitcoin for remittance services. It lets users send money to Africa using cryptocurrencies. BitPesa converts the cryptocurrency to local currency, which is incredibly helpful for African immigrants or natives abroad. It offers lower fees and faster transactions for sending money to their families in Africa.

Example #2: El Salvador

In September 2021, Bitcoin became a legal tender in El Salvador. It allows for easier crypto remittance between El Salvador and other countries. People can now send Bitcoin, enabling cheaper and more accessible remittance options.

Future Trends and Innovations

➔ Evolving Technologies

Ongoing developments in blockchain technology and cryptocurrency may lead to innovations that improve Bitcoin remittances’ scalability, security, and efficiency.

➔ Potential Improvements

Researchers are actively working to address Bitcoin’s scalability issues, aiming to enhance transaction speed and reduce fees. These improvements could contribute to a more seamless and user-friendly crypto remittance experience.

➔ Regulatory Developments

As governments continue to explore and define cryptocurrency regulations, evolving regulatory frameworks will improve the landscape of crypto remittances. Clarity in regulations can foster greater adoption and integration into mainstream financial systems.

Final Thoughts

Bitcoin’s global reach has the potential to revolutionize crypto remittance by offering an efficient and inclusive alternative to traditional methods. While challenges such as regulatory uncertainties and price volatility exist, real-world applications and case studies demonstrate Bitcoin’s tangible benefits in cross-border transactions. As technology evolves and regulations mature, the future holds promising developments for Bitcoin’s role in reshaping the global remittance landscape.

Recommended Articles

We hope you found this article on crypto remittance informative. For similar cryptocurrency articles, refer to the following: