Updated December 4, 2023

What is the Currency Crisis?

A sudden and significant drop in the value of a country’s currency (dollar, rupee, yen, etc.) is called a currency crisis.

Although currency crises have occurred throughout history, the term “currency crisis” became popular during the 1990s when several economies across the world were failing.

This crisis starts when people start losing confidence in their country’s currency and start exchanging their currency for other ones. This loss of trust means that people believe that their currency’s coins or notes might lose their worth. This can happen for multiple reasons, like if a country’s government has a lot of debt and is struggling to pay it back or if there is increasing inflation.

Due to the sudden and rapid disposition of a country’s money, its value drops quickly compared to other currencies. As the currency value falls, imports become more expensive. This causes the prices of everyday items like food and clothes to rise. Businesses might also struggle because they have to pay more for materials from other countries. Such a crisis can make things pretty tough for a country’s economy and the people living there, causing unemployment and making it harder for the government to manage the country’s money.

Table of Contents

Key Highlights

- A currency crisis occurs when a country’s currency loses a significant amount of its value, typically over a short period.

- It leads to economic instability and unemployment.

- Some of the major causes are a high inflation rate, excessive government debt, trade deficit, speculations, and political unrest.

- A government can implement measures like float exchange rates, foreign reserve management, and trade balance management.

Examples

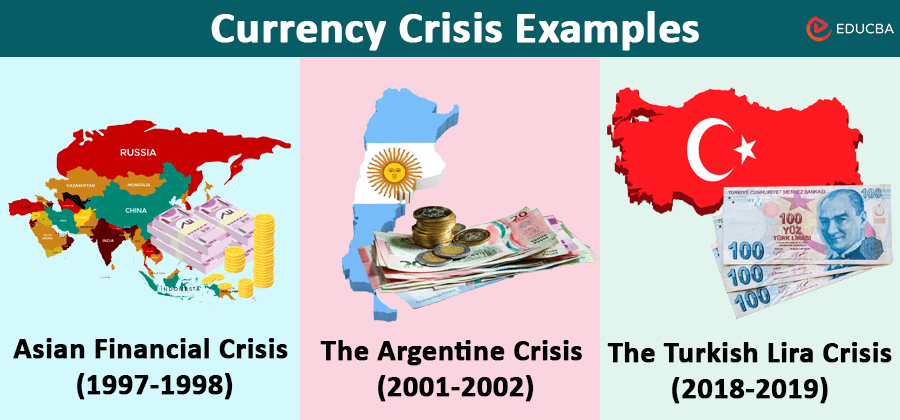

Example #1: Asian Financial Crisis (1997-1998)

The Asian financial crisis began in Thailand in mid-1997 when the Thai baht’s value dropped drastically due to high foreign debt. This crisis further spread to other East-Asian economies like South Korea, Indonesia, Malaysia, and the Philippines. Currencies in these countries lost their value rapidly against the US dollar, triggering economic turmoil. Some major issues included:

- Thailand: The Thai baht lost around 50% of its value against the US dollar in just a few months.

- South Korea: The Korean won depreciated by more than 50%, leading to a bailout from the International Monetary Fund (IMF).

- Indonesia: The Indonesian rupiah experienced a significant devaluation, leading to social and political unrest in the country.

Example #2: The Argentine Crisis (2001-2002)

In the early 2000s, Argentina was struggling with high levels of public debt and economic recession. Additionally, the Argentinian currency rate was pegged to the US dollar. Pegging a currency refers to tying its value to another currency, establishing a fixed exchange rate between the two.

This fixed exchange rate became unsustainable, causing the Argentinian currency peg to collapse in 2002. As a result, the value of the Argentine peso dropped to around 70%, causing widespread unemployment, poverty, and social unrest.

Example #3: The Turkish Lira Crisis (2018-2019)

Turkey faced a currency crisis in 2018 when the Turkish lira lost nearly 30% of its value against the US dollar within a short period. High inflation rates, reaching over 25% annually, added pressure on the economy.

These crises resulted in severe economic issues, currency devaluations, high inflation, increased unemployment, and social unrest, showcasing the devastating impacts of currency crises on countries and their populations.

Models

Indicators of a currency crisis can be presented in the following three stages:

1. First Generation

The gold rates start fluctuating at this stage due to stock market changes. This causes shifts in the Forex market. These shifts may worry the investors, but they stay after the government ensures fixed exchange rates.

2. Second Generation

This is the stage where exchange rates begin to fluctuate. Signs include inflation, economic slowdown, policy changes, and rising unemployment. To prevent a recession, the government may sell foreign reserves to stabilize rates.

3. Third Generation

At this stage, constant exchange rate fluctuations eventually lead to a burst. Balance of payment deficits and banking collapses happen due to heavy reliance on foreign investments. Government loans in foreign currencies increase due to home currency devaluation, forcing the country to devalue its currency, which starts a crisis.

Causes

A Currency Crisis occurs due to the following causes:

- High Inflation: When prices for goods and services rise rapidly, it decreases the value of money. As a result, people lose confidence in the currency’s purchasing power, leading to a currency crisis.

- Excessive Government Debt: If a country borrows too much money and struggles to pay it back, it can create doubts about the government’s ability to manage its finances. This, in turn, weakens the currency.

- Trade Imbalances: When a country imports more than it exports consistently, it leads to trade imbalances. This devalues the currency as there’s an increased reliance on foreign funds.

- Speculation and Investor Panic: When investors worry about a country’s economic situation, they might sell off their country’s currency. This can cause the currency’s value to drop rapidly, leading to a crisis.

- Political Instability or Unrest: Uncertainty or conflicts within a country’s political environment can reduce the people’s confidence in the government’s ability to manage the economy, resulting in a currency crisis.

Signs

A currency crisis doesn’t occur suddenly. There are always warning signs indicating that a currency’s value is depleting. Following are those signs:

- Rapid Devaluation: A sudden and significant decline in the value of the country’s currency against other currencies indicates a loss of confidence in the currency’s stability.

- Depleting Foreign Reserves: When a country’s foreign currency reserves drop quickly, it may struggle to support international transactions because its currency is losing value.

- Increased Borrowing Costs: Rising interest rates for government or corporate borrowing due to concerns about the country’s economic situation signals a lack of confidence from lenders.

- Growing Unemployment: A significant rise in unemployment rates reflects economic slowdowns and potential financial turmoil within the country.

- Instability in Financial Markets: Fluctuations and volatility in stock markets, bond markets, or banking sectors indicate uncertainty and investor anxiety about the country’s economic prospects.

Prevention

To prevent the currency crisis, countries can take the below-mentioned steps:

- Float exchange rate: It allows exchange rates to adjust gradually to reflect economic conditions instead of rigidly fixing them. This can reduce the risk of sudden devaluation. Thailand took this step to overcome the currency crisis in 1997.

- Sound Economic Policies: Governments should Implement correct fiscal and monetary policies to maintain a stable economy, control inflation, and manage government debt responsibly.

- Foreign Reserves Management: Another preventive measure is to build and maintain adequate foreign currency reserves. This helps support the national currency’s value and manage potential crises.

- Strong Institutions: Ensuring transparent and credible institutions, including central banks and regulatory bodies, leads to investor confidence and stability.

- Trade Balance Control: Countries should manage trade balances by promoting exports and reducing import dependency. This leads to balanced trade relations and the prevention of large deficits.

Final Thoughts

Not being in excessive debt doesn’t guarantee the prevention of a currency crisis. A country will have to take a lot of proactive measures to ensure the prevention of a currency crisis.

Frequently Asked Questions (FAQs)

Q1. What happens during a currency crisis?

Answer: During a currency crisis, the government might be forced to sell its foreign exchange reserves. They might also need to increase domestic interest rates to increase the currency value.

Q2. What will be valuable if an economy collapses?

Answer: During an economic collapse, precious metals like gold can be valuable. This is because these metals hold their worth even when money loses its value.

Q3. How do you survive the currency crisis?

Answer: To survive a currency crisis, the simplest thing to do is reduce expenses and purchase only essential items like food. People can also purchase valuable items like gold or other stable currencies for something equivalent to their currency’s worth. Budgeting carefully, finding ways to earn or trade for what’s needed, and seeking government support or community help is essential.

Recommended Articles

We hope this EDUCBA article about the currency crisis benefits you. If you need any further guidance on economics-related topics, check out these EDUCBA-recommended articles: