Currency Devaluation Definition

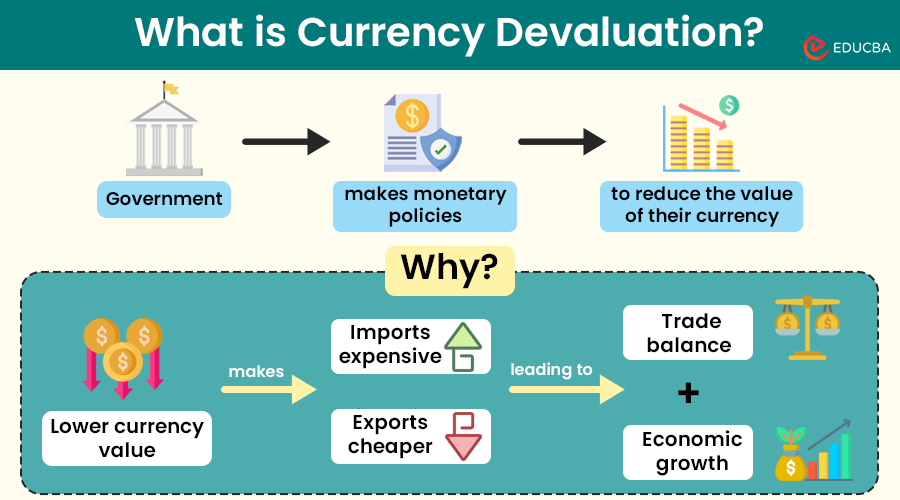

Currency devaluation is when a nation’s government introduces a policy to reduce the value of its currency compared to other currencies. They do this to make exports cheaper and imports more expensive, which, in turn, boosts trade balance and leads to economic growth.

For example, if China devalues Yuan against the US dollar (from 6.5 Yuan per dollar to 7 Yuan per dollar), Chinese products will become cheaper for American consumers, boosting Chinese exports. Meanwhile, American products will become more expensive for Chinese consumers, reducing American imports.

Table of Contents

- Definition

- How does it work?

- Policies that Help Devalue Currency

- Examples

- Causes

- Effects

- Advantages + Disadvantages

Key Highlights

- Currency devaluation refers to a decline in a country’s currency value relative to other currencies.

- The government and the central bank achieve this by employing monetary policies that weaken the currency compared to other countries.

- It boosts the economy by making a country’s exports cheaper and attractive to foreign consumers.

- The disadvantage of this phenomenon is that the imports of other countries become costly.

Currency Devaluation Explained

Here’s how currency devaluation takes place:

#1: Creating a Monetary Policy to Devalue Currency

Suppose China implements policies to decrease the Yuan’s value against the US

dollar. Initially, $1 was worth 6.5 Yuan. After the devaluation, $1 is worth 7 Yuan. It means the Yuan has become cheaper relative to the dollar.

#2: Products Become Cheaper for Foreign Nations

With the devalued Yuan, Chinese products become cheaper for American buyers.

So, if a piece of machinery was previously at 65,000 Yuan, costing $10,000 before devaluation ($1 = 6.5 Yuan). After the devaluation, the same machinery costs $9,285.71 ($1 = 7 Yuan).

Calculations are as follows.

Before the devaluation:

- Price in Yuan: 65,000

- Exchange rate before devaluation: 6.5 Yuan = 1 dollar

- Price in USD: 65,000 Yuan/6.5 Yuan = 10,000 dollars

After the devaluation:

- Price in Yuan: 65,000

- Exchange rate before devaluation: 7 Yuan = 1 dollar

- Price in USD: 65,000 Yuan/7 Yuan = 9,285.71 dollars

#3: Exports Increase

As a result of the lower prices, American companies find it more cost-effective to purchase machinery from China, leading to a rise in Chinese exports. For instance, if China exported 1,000 units of machinery per year before devaluation, it might now export 1,200 units.

#4. Import Costs Increase

Conversely, the cost of importing American machinery into China becomes more expensive.

If American machinery cost $10,000 before, it would cost a Chinese company 65,000 Yuan before devaluation:

Calculations for the pre-devaluation price in Yuan:

- Price in USD: 10,000

- Exchange rate before devaluation: 6.5 Yuan =1 dollar

- Price in Yuan: 10,000 dollars × 6.5 Yuan =65,000 Yuan

After the devaluation, it now costs 70,000 Yuan:

Calculations for the post-devaluation price in Yuan:

- Price in USD: 10,000

- Exchange rate after devaluation: 7 Yuan = 1 dollar

- Price in Yuan: 10,000 dollars × 7 Yuan =70,000 Yuan

#5: Inflation Occurs

The increased cost of importing American machinery and other goods leads to inflation in China.

#6: Demand Decreases

Higher prices for imported goods, including machinery, reduce consumer and business demand. Due to this, companies might delay purchasing new American machinery.

#7: Import Decreases

As a result, China’s imports from America typically reduce. For instance, if China used to import 500 units of American machinery per year, it might now only import 400 units.

#8: Trade Deficit Reduces

Finally, a decrease in imports and an increase in exports can help reduce China’s trade deficit with America. For example, if China had a trade deficit of $50 billion with America before devaluation, it might reduce to $45 billion after these changes.

Policies that Help Devalue Currency

1. Lowering Interest Rates

One way to devalue a currency is by lowering interest rates. When interest rates are lower, it becomes less attractive for investors to hold that currency, as they might receive a lower return on their investment. It leads to a decrease in demand for the currency and ultimately a devaluation.

2. Quantitative Easing

Quantitative easing (QE) involves a central bank purchasing assets such as government bonds, in order to increase the money supply in the economy. It decreases the value of the currency, as there is more of it in circulation.

3. Currency Intervention

In some cases, a government may directly intervene in the currency market to devalue its currency. It can involve buying foreign currencies or selling its own currency.

Currency Devaluation Examples

1. Basic Example

Suppose, on January 10th, 2020, an Indian car was sold for INR 20,00,000 in the USA. At that time, the exchange rate of the Rupee to the Dollar was INR 80 = $1. A week later, on January 17th, 2020, the Rupee devalued against the Dollar (INR 83 = $1).

Let’s break down the devaluation effects on the car:

| Exchange rate on 10th Jan 2020 | Value of Indian car in Dollars | Exchange rate on 17th Jan 2020 | Value of Indian car in Dollars now | Difference in Dollars |

| $1 = INR 80 |

$25,000 (20,00,000/80) |

$1 = INR 83 |

$24,096 (20,00,000/83) |

$25,000 – $24,096 = $904 |

American buyers could save up to $904 on the purchase of that Indian car as a result of currency devaluation.

2. Real-World Examples

#1. Argentina

In December 2023, Argentina’s government, led by President Javier Milei, devalued its peso currency by over 50%, setting the exchange rate at 800 pesos per dollar, down from 400 pesos per dollar. It is a part of an economic shock therapy to avoid catastrophe due to high inflation and financial instability and stabilize the economy. Economy Minister Luis Caputo has also announced deep cuts to public spending, including subsidies and freezing government contracts.

#2. Nigeria

After the first devaluation strategy in June 2023, the Nigerian government recently lowered the official exchange rate of its currency, the naira, to about 1,531 naira per US dollar from 900. It is the second devaluation in less than a year. It happened because Nigeria has been facing a shortage of dollars, which has made it hard for businesses to buy imports. The Central Bank of Nigeria made these changes to try to fix the problem and make the country’s economy more attractive to foreign investors.

Causes of Currency Devaluation

Here are a few reasons why nations choose to devalue their currency:

1. Intentional Reasons

#1. To balance the trade deficits:

When a country consistently imports more goods and services than it exports, it leads to a trade deficit. To finance this deficit, the countries devalue their currency to rebalance trade.

#2. To reduce the debt burden:

A government might want a weak currency to make paying off its debts easier. When a currency is weaker, the fixed debt payments in foreign currency terms become cheaper in the local currency. For example, if a government owes $1 million in interest each month and its currency loses half its value, it would only need half as much local money to make that payment—just $500,000 instead of $1 million.

#3. To increase exports:

Devaluation can boost exports by making a country’s goods cheaper for international buyers. When a currency devalues, its exchange rate decreases relative to other currencies. It means foreign customers can buy more of the country’s products for the same amount of their own currency.

2. Unintentional Reasons

#1: Due to economic events:

Economic downturns, high inflation rates, or stagnant growth can weaken a country’s currency. Devaluation may occur as a response to stimulate exports and economic activity.

#2: Due to global events:

Global economic events, geopolitical tensions, or changes in commodity prices (especially for countries dependent on exports like oil) can impact currency values and trigger devaluation.

#3. Due to spectators speculation:

Expectations and perceptions about a country’s economic prospects can influence currency value. Speculative trading can lead to currency devaluation if investors believe the currency is overvalued.

Effects of Currency Devaluation

Its effects depend on the level of the devaluation and the country’s economic situation.

- It can enhance the competitiveness of domestic industries against foreign imports, supporting local businesses.

- It reduces the purchasing power of domestic consumers as imported goods become costly, leading to higher living costs.

- It may attract foreign investment as assets become cheaper in local currency terms, but it also increases risks for foreign investors due to currency fluctuations.

- It often leads to higher inflation because imported goods become more expensive, affecting consumer prices domestically.

Advantages

- Devaluation makes exports more affordable for other nations to purchase, which helps boost exports.

- It encourages competition in the market by lowering product prices. Thus encouraging economic expansion.

- It can further lower a nation’s trade deficit by enhancing the competitiveness of its exports and by bringing down imports.

- By making exports cheaper, it increases demand for domestically produced goods and services.

Disadvantages

- Although exports increase at first, foreign investors can eventually lose faith in a constantly falling currency.

- Importing high-quality foreign goods becomes costly for local consumers.

- Due to the low prices of products in the economy, companies and businesses can face a lot of losses.

- If an individual has a loan or debt from a foreign country, then devaluation may lead to an increase in personal debt.

Recommended Articles

This is EDUCBA’s article on Currency Devaluation. Read the recommended blogs for similar content-based articles.