Updated October 27, 2023

Introduction to Currency Exchange Market

The currency exchange market is all about making the spread profitable. The space refers to the difference between the quote and the buy. With the advent of international forex, known as SWIFT, the development of the currency exchange market has become rapid.

The professional currency trader now has a set of tools at his disposal to exchange currency online at favorable rates. The online revolution has made this possible. Web-based technologies have made it possible to deal with multiple online forex brokers.

Even those with less capital can tap ample opportunities in the forex market. As a currency exchange trader, you must think big and make significant gains with small losses. The currency exchange market successfully is more challenging than it appears. This article will guide you if you are wondering where to go for tips.

The Basics Of Currency Exchange Market

Below are some basic steps to achieve Currency Exchange Market

1. Currency Exchange Market Know Yourself

You need to define risk tolerance carefully and understand the needs. Profiting from the currency exchange market means recognizing markers and their vagaries. To understand the market, you must also understand yourself and your motivations. Analyze financial goals while engaging in the currency exchange market. Try to find your economic priorities before looking for profits in the market. Everything from risk tolerance to capital allocations to the forex and currency exchange market is relatively easy. Analyzing financial goals is essential while engaging in the currency exchange market.

2. Currency Exchange Market – Make a Plan and Follow it!

Once you are clear about your currency exchange market motivation and priorities, you need to find the period for which you will work on your currency exchange market career. Be very clear about what your criteria for judging success and failure are. For some traders, it is simply making profits. Those with more specific goals want profits of a certain percentage. Trades could also be judged in terms of reward-risk ratio or failures. How much time can be spent on trading, and what is the goal? These are the right questions to ask if profit is your desired result.

3. Currency Exchange Market – Be Careful About the Broker in the Currency Exchange

The choice of the broker must be emphasized more. Only reliable brokers can create positive results. Expertise levels should be high, and currency exchange market goals should match. Find a broker who suits your currency exchange market style if profit is your motive.

4. Be Clear About Account Type and Leverage Ratio

Choosing the account type best suited to your needs, desires, and know-how is essential. The lower the leverage, the better the chances of success, as the risk is less.

5. Start Small, Become Big

To be a currency exchange market phenomenon, you must begin with small sizes and increase the account size through gains, not more deposits. Start with small sums and only invest further if you can generate significant returns. Pumping money without results is like burning cash in the currency exchange market.

6. Expand As You Grow

Rather than relying on outdated skills, update yourself. The currency exchange market is complicated, and mastering different kinds of financial activities is difficult, especially if you are a novice. Trade with the currency of your nation- reach out to the rupee, deal with the dollar, and push the pound. Deal with a currency pair that you understand. Another intelligent choice can be to rely on widely traded currency pairs. Whether you are a beginner or an advanced trader, the currency exchange market is about staying with the trends and bucking them simultaneously.

7. Understanding is Everything in the Currency Exchange Market

Only expect the market to reward you if you know what you are doing. Unless you can defend your point of view against critics, do not start the currency exchange market. Never rely on rumors. Always look for the facts. The currency exchange market wisely means understanding the benefits and drawbacks.

8. Don’t Hold on to Losses

Ignorance is dangerous in the markets. But then again, only a few people can assess where a currency pair is headed. So, adding to a losing position will only cut down on your gains. Role in red will place you in a dark spot, and chances of future success will also dimmer.

9. Control your Emotions

Markets are as much about control as they are about skill. Fear, anger, greed, panic, and euphoria should have no role to play in the calculations of a trader. Begin with small amounts and a calm mind; the lower the emotional intensity, the higher the gains. Currency exchange trading well means realizing long-term goals and short-term profits in an equation that translates into permanent returns.

10. Keep An Eye on the Trade

Rationally scrutinize your successes and failures and keep a daily account of your currency exchange trading activities. Mentors are all very well, but the currency exchange market is about discovering what works and what does not.

11. Automate Currency Exchange Market

Emotional control plays a vital role in a successful and profitable career. Automating is the best way to minimize the role of emotions. The choices and behavior become far more accessible to regulate due to this. Events in the market should evoke a studied reaction, not hurrying or worrying.

12. Forex Robots Do Not Work

Many unproven and untested products are supposed to generate massive profits for sellers yet are minor in the way of gains for excited or hopeful buyers. Innovation is outstanding, but blindly relying on technology can be costly in the currency exchange market.

13. Keep it Simple, and Get The Better of a Complicated Market

The currency exchange market is not molecular biology. You don’t have to be a mathematical guru, a financial genius, or even an economic whiz to acquire wealth through the currency exchange market. All you need to do is apply common currency exchange market principles using uncommon sense. Rather than overexplaining or rationalizing fear, finding out how to replicate your successes is more important.

14. Show Resilience if you Buck the Trend

Swimming against the tide is always easier for the expert. There should be enough patience and financial Resilience to go against the trend. If you lack these qualities, avoid the tide and follow the directions. Only seek to tap the momentum of market forces if you are filled with fear or uncertainty. Knowledge poses a great danger in the markets.

15. Forex is About Probabilities and Risk Analysis

Currency exchange trading is all about risk analysis and probabilities. Correctly assessing both will get you multiple returns, and positioning is only possible through risk allocations by chance and risk management principles.

16. Fight the Markets and Lose the Battle

Always recognize the source of your failures and successes. Don’t believe in magic bullets or miracle cures. Rely on solid facts and fundamentals before you shell out cash and Trade in the markets.

17. To Know Currency Exchange Trading, You Must Have Experience

While sharing your opinions with others is excellent, be sure they will not amount to much if you do not consider the basic principles of money management. Once profits are made, it is time to protect them. Money management is all about minimizing losses and maximizing gains. The trick to riding the currency exchange trading is to cut your losses short and let your profits soar. Always maintain a strong understanding of trades by studying fundamental and technical factors leading to price action. Some traders even benefit from an either/or approach. In currency exchange trading, there are no fixed rules, only sound principles based on which the flow of loss and profit can be balanced to minimize risk and maximize gains.

18. Giving up is Easy

But staying the course is a tricky proposition. You cannot become a trading genius overnight. You need to understand and develop your skills and talents; the learning process never stops. Rather than losing out on the Currency exchange Trade because of a few losses, rely on your successes to see you through. Money making on the currency exchange trading is easy. If you do your homework, expect to get first-grade results on all your trades.

19. Define Your Goals

It would help if you had a clear goal before your Trade. Are you looking for short-term profits or long-term gains? You will only get far if you know the destination if you go on a journey. Make sure your currency exchange trading methods are centered on some priorities which are essential to you. Currency exchange trading styles are many, but the risk can only be more or less. If you can handle an open position quickly, don’t put yourself in the situation. Become a position trader only if you expect to benefit from it.

20. Be Consistent

It would help if you chose a methodology to apply consistently. Successful currency exchange trading is all about making the right choice as to when to enter and exit trades. Use charts to plot the course of the Trade and always see the bigger picture. Just as the pieces of a jigsaw puzzle make no sense when seen alone, similarly, markets only translate into profits if you can see the complete scenario.

21. Make Allowances for Changes in Market Dynamics

Blending fundamental and technical analysis is straightforward. But it is the wrong choice if your system is in sync with market dynamics and solely reliant on either of the two forms of research. Choose a longer time frame for understanding market direction and the short-term impact of an exit or entry.

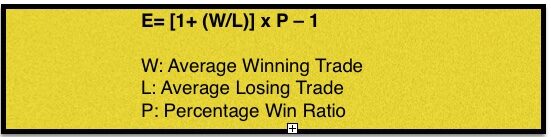

22. The Formula Behind Expectancy

The market is not the place for great expectations. You have to be clear about your system’s reliability if you want a steady stream of profits. Determining the extent to which winning trades were profitable against losses made by losing trades is also essential. Total your winning trades and divide them by the number of transactions made.

23. To Stop Negative Outcomes, Build Positive Feedback Loops

Listen to the currency exchange trading, not the trading pundits. Marketing gurus are experts in their field, but even they cannot understand your situation, with unique dynamics playing a key role. Form a positive feedback pattern if you want to build your profits and cut down on your losses.

Conclusion

In the ultimate analysis, markets will only work for you if you work hard for them. Making a trade is not simple, but understanding the markets is not difficult if you follow basic principles. Whether you rely on technical or fundamental analysis (or a combination of both), your method must be thoroughly well-versed. The currency exchange market is no place for amateurs. Instead, it is the perfect choice for those who believe in reliable moves and stable analysis. Again, too much of a good thing is wrong, which also holds for research. Overanalyzing the markets will lead to underperformance, for sure.

Recommended Articles

We hope that this EDUCBA information on the “Currency Exchange Market” was beneficial to you. You can view EDUCBA’s recommended articles for more information,