Updated July 6, 2023

What is Currency Pegging?

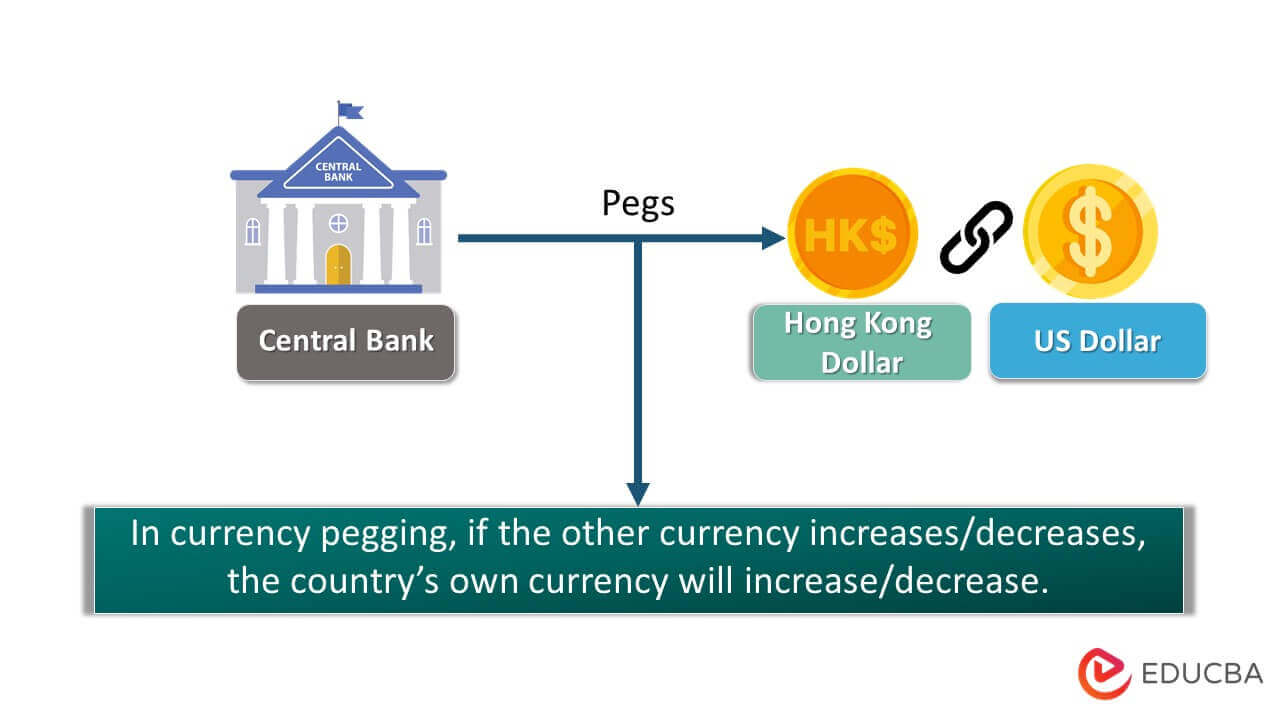

A currency Peg is when the central bank links their country’s currency (Hong Kong dollar) with another nation’s currency (US dollar) using a fixed exchange rate.

A currency peg is an international strategy that involves one country’s government or central bank fixing its exchange rate to that of another country’s currency. For example, since 1980, the Bahraini Dinar currency has been pegged to the US Dollar.

Currency pegging helps estimate rates for different currencies, allowing policy-making for various companies. It enables long-term investments in Foreign nations due to ease of exchange. It also facilitates trade and commerce.

Key Highlights

- A currency peg occurs when a country’s government maintains a constant exchange rate for its currency relative to another currency or a group of currencies.

- A stable currency exchange rate helps keep markets steady, encourages commerce, and stimulates economies.

- A currency peg that is too low has adverse effects on domestic living standards, foreign trade, and international tensions.

- A currency peg, set abnormally high, aggravates the overconsumption of imports, leading to inflation.

- As of 2022, 14 nations have fixed exchange rates with the dollar.

How Does Currency Peg Work?

If a country’s central bank wants to peg its currency, it can pick a fixed exchange rate relative to another currency or a basket of currencies. After that, it will make trades in the open forex market to protect the predetermined exchange rate or range of prices.

Several nations, most notably China, have maintained a fixed exchange rate in recent years. They have rigorous capital restrictions, and it is illegal to trade their currency at any rate other than the pegged rate. With strict government controls over money conversion transactions, nations like China have found this approach highly effective. However, it may be challenging to implement and can even lead to black market operations.

Currency Peg Examples

#1: Hong Kong

Since 1983, the Hong Kong government has pegged the Hong Kong Dollar currency to the US dollar. The idea was to gain the trust of the citizens and local companies. When the currency weakens, the Monetary Authority buys the Hong Kong Dollar that various banks keep as a reserve. As a result, there is less cash flow in the market, and liquidity falls. It then leads to a rise in interest rates and an increase in the currency’s value.

#2: United Arab Emirates

The UAE’s Dirham is pegged to the US dollar at 3.6725 dirhams to $1. UAE is a powerhouse in the gas and oil business, and the US values the price of gas and oil. The currency pegging has kept the oil trade between the two countries stable. Thus, helping UAE decrease the volatility of its earnings from the sector. With little to no uncertainty in exchange rates, UAE now also has the trust of investors.

#3: United States of America

The United States’ massive gold reserves gave it an edge when it linked its currency to gold. It also aided in the growth of their foreign commerce. To reduce uncertainty in international trade, the United States devised a comprehensive system in which powerful nations tied their native currencies to the dollar.

Monitoring Currency Peg

- The primary goal of a currency peg is to reduce the uncertainty associated with currency exchange, facilitating international commerce. Countries sometimes peg their currency to that of a more economically powerful or established nation so local businesses can access foreign markets more easily.

- There are several options, but the US dollar, the Euro, and gold have all been favorites for some time.

- Currency pegs help ensure predictability between trade partners and often stay in place for decades.

- The Hong Kong dollar, for instance, has been linked to the American dollar since the city’s inception in 1983. Only credible attempts to peg currencies to dampen volatility would benefit the economy.

- In the long run, all nations concerned will suffer from the imbalances caused by artificially high or low currency pegs.

Advantages and Disadvantages

|

Advantages |

Disadvantages |

| Pegged currencies may increase commerce and actual earnings when currency swings are stable in the foreseeable future. | A currency peg needs strong government support and a factual basis to succeed. Disorganization may hinder its ability to succeed. |

| With stable exchange rates, farmers can produce successfully, businesses can increase R&D, and retailers can purchase from efficient producers. | Policy making of a country is greatly affected due to currency peg. |

| Pegging enables long-term investments in foreign nations by protecting them against currency fluctuations. | Setting the exchange rate too low or too high may adversely affect the economy. |

| Individuals, companies, and governments may all gain more from specialization and trade while a currency peg protects them from uncertainties. | Setting a low currency exchange can reduce living standards and harm foreign companies. |

Frequently Asked Questions(FAQs)

Q1. What is Currency Pegging?

Answer. A currency peg is a policy where the Central Bank of a Nation ties its currency’s exchange rate against another Nation’s currency.

Q2. Is currency pegging good?

Answer. Yes, currency pegging is good. Tying a currency’s exchange rate to those currencies of powerful nations gives local business people better opportunities to import foreign goods and services. It also stabilizes the economy.

Q3. In what circumstances might a nation choose to peg its currency?

Answer. A nation usually resolves to currency pegging for various reasons. These reasons include fostering bilateral commerce, mitigating the dangers of entering new markets, and preserving economic stability.

Q4. Name the different countries that have their currencies fixed to the US dollar.

Answer: Bahrain, Belize, Cuba, Djibouti, Hong Kong Special Administrative Region of China, Jordan, Lebanon, Oman, Panama, Qatar, Saudi Arabia, United Arab Emirates, and Eritrea are among the 14 nations with currencies pegged to the US dollar.

Q5. State the number of currencies linked to the Euro.

Answer. Currently, eleven currencies, including the Croatian kuna and the Moroccan dirham, are “pegged” to the Euro (EUR).

Q6. Define soft peg.

Answer. During a soft peg, the government generally lets the market determine the exchange rate; however, the central bank may step in if the rate of currency seems to be moving too quickly in one way.

Recommended Articles

This is a guide about Currency Peg from EDUCBA. We recommend you view other articles as well.