Definition of Current Account vs Capital Account

Current account: The current account mainly represents the economy’s inflow and outflow of goods and services. It is further decomposed into four sub-accounts. A current account is one of the components of BOP that deals with the trade of ‘goods’ & ‘services’ of one country with another.

Capital account: Capital account represents the inflow and outflow of capital in the economy, made by public and private entities. It mainly depicts the foreign investment in domestic entities and domestic investment made in foreign entities.

Overview

Globalization of world economies has helped countries widen their trade, investments, and Risk. World economies have become interconnected, wherein the growth/decline of one country affects another. Central banks use a double-entry bookkeeping system called the balance of payments to monitor trade and investment performance. The balance of payments (BOP) typically summarizes the economic transactions of any country with the rest of the world for a particular period of time. BOP represents the exports and imports of a country with its trading partners, wherein a country whose exports exceed its imports is categorized as a ‘Balance of payment surplus’. On the other hand, a country that imports more than it exports is said to be in deficit. BOP gives an accurate picture of a country’s macroeconomic conditions and its long-term growth prospects.

The main components of the Current account are:

- Merchandise trade comprises all manufactured goods and commodities bought from or sold to other countries.

- Services consist of all the invisible services a country provides or receives from other countries. It mainly includes Tourism, Transportation, Engineering, Management consulting, Accounting, and legal services.

- Income receipts consist of all the income derived from the ownership of assets in foreign countries, such as Dividends and interest payments.

- Unilateral transfers represent the transfer of money, such as worker remittances from abroad to their home country.

The main components of the Capital account are:

- Foreign direct investment (FDI): The investment made by foreign entities in domestic businesses in joint ventures is known as foreign direct investment. Every country follows stringent processes to regulate the FDI, ensuring proper control and profitability for domestic entities.

- Foreign portfolio investment (FPI): FPI consists of investments in financial assets such as stocks, bonds, mutual funds, etc. In the context of the Indian economy, both FDI & FPI bring in foreign capital inflows into the country, resulting in strong demand for the Indian rupee.

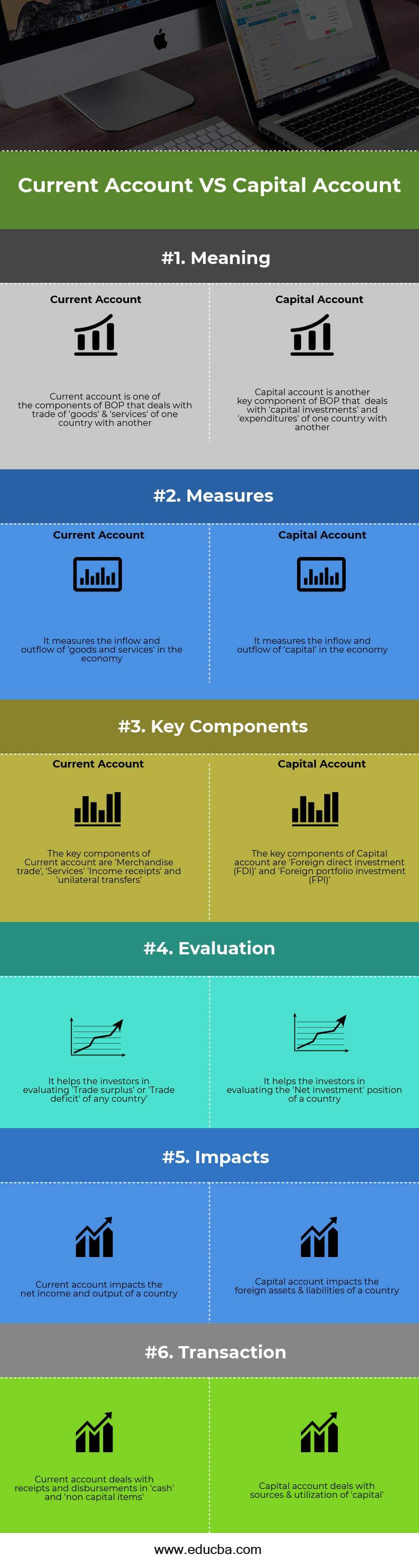

Head To Head Comparison Between Current Account vs Capital Account (Infographics)

Below is the top 6 difference between Current Account vs Capital Account

Key Differences Between Current Account vs Capital Account

Let us discuss some key differences :

- The current account consists of the flow of ‘goods & services’ in an economy, whereas the Capital account represents the flow of ‘capital’.

- It measures a country’s trade and evaluates the inflow and outflow of visible goods and invisible services in the economy. On the other hand, the current account measures capital investments made in the economy and helps evaluate sources and uses of capital.

- The key components of the current account are Merchandise trade, services, income receipts, and unilateral transfers. A Capital account consists of foreign direct investment, foreign portfolio investment, and loans and advances from one country to another country.

- The current account depicts the Net income position of the country, whereas the Capital account represents changes in ownership of assets of a country.

- A country with a positive current account balance is a net lender, and a negative current account balance indicates a net borrower. Similarly, if a country’s claims on the rest of the world are positive, it is a net creditor; if they are negative, it is a net debtor.

Current Account vs Capital Account Comparison Table

Let’s have a look at the Comparison between the Current Account vs Capital Account:

| Basis of Comparison |

Current Account |

Capital Account |

| Meaning | A current account is one of the components of BOP that deals with the trade of ‘goods’ & ‘services’ of one country with another. | The capital account is another key component of BOP that deals with ‘capital investments’ and ‘expenditures’ of one country with another. |

| Measures | It measures the inflow and outflow of ‘goods and services in the economy | It measures the inflow and outflow of ‘capital’ in the economy |

| Key components | The key components of the Current account are ‘Merchandise trade’, ‘Services’ ‘Income receipts’, and ‘unilateral transfers’ | The key components of the Capital account are ‘Foreign direct investment (FDI)’ and ‘Foreign portfolio investment (FPI)’ |

| Evaluation | It helps the investors in evaluating the ‘Trade surplus’ or ‘Trade deficit’ of any country’ | It helps the investors evaluate a country’s ‘Net investment’ position. |

| Impacts | The current account impacts the net income and output of a country | Capital account impacts the foreign assets & liabilities of a country |

| Transaction | The current account deals with receipts and disbursements in ‘cash’ and ‘non-capital items’ | Capital account deals with sources & utilization of ‘capital’ |

Conclusion

The difference between a current account and a capital account helps evaluate a country’s macroeconomic picture, its monetary & fiscal policies, and future growth potential. While the Current account measures the Inflow of goods and services in an economy, the Capital account gauges the inflow and outflow of capital in the economy.

Investors value these data points because they provide insight into a country’s international trade and investment activity. If the country’s Current account shows a trade surplus, it indicates that the country has exceeded its exports more than imports, strengthening its currency. Similarly, if the country’s capital account shows ‘Net creditor’, it represents that it owns more capital/assets than it owes to the rest of the world.

The investors perceive the economy to be in a poor state. If its capital account shows a ‘Trade deficit’, that indicates that the country’s imports are more than its exports. Similarly, the country is said to be a ‘Net borrower’ if it owes more capital/assets than it owns.

Recommended Articles

This is a guide to the Current Account vs the Capital Account. Here, we also discuss the Current Account vs Capital Account differences with infographics and a comparison table. You may also have a look at the following articles to learn more –