Updated July 31, 2023

Current Assets Formula (Table of Contents)

- Current Assets Formula

- Examples of Current Assets Formula (With Excel Template)

- Current Assets Formula Calculator

Current Assets Formula

The term current assets will represent all the firm’s assets that are expected to be easily sold, utilized, consumed, or exhausted through the company’s or standard business operations which can lead to their conversion into cash value within a single year.

Current assets in the face of the balance sheet shall include the following: cash, accounts receivable, cash equivalents, marketable securities, pre-paid liabilities, stock inventory, and other liquid assets.

The Formula for computing current assets will be as follows: (just a simple addition)

- Cash and cash equivalent

- Inventory

- Debtors and account receivables

- Prepaid assets

- Short term advances

- Other liquid assets

Examples of Current Assets Formula (With Excel Template)

Let’s take an example to understand the calculation of the Current Assets formula in a better manner.

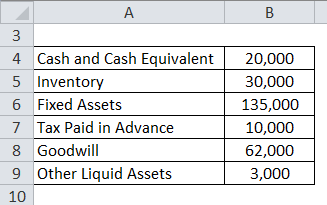

Example #1

Following is an extract from ABC Company Ltd, which it has filed with regulators. Let’s try to figure out the current asset value from it.

Solution:

The formula to calculate Current Assets is as below:

Current Assets = Cash + Cash Equivalents + Inventory + Account Receivables + Marketable Securities + Prepaid Expenses + Other Liquid Assets

- Current Assets = 20,000 + 30,000 + 10,000 + 3,000

- Current Assets = 63,000

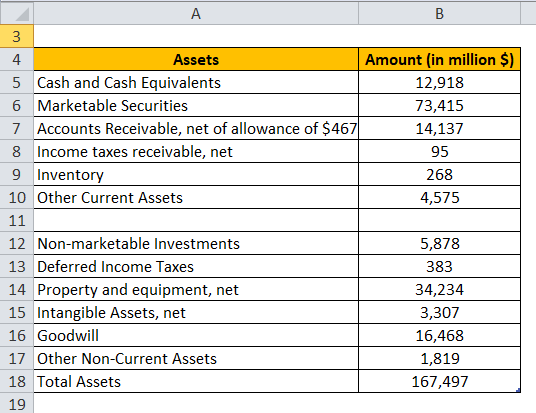

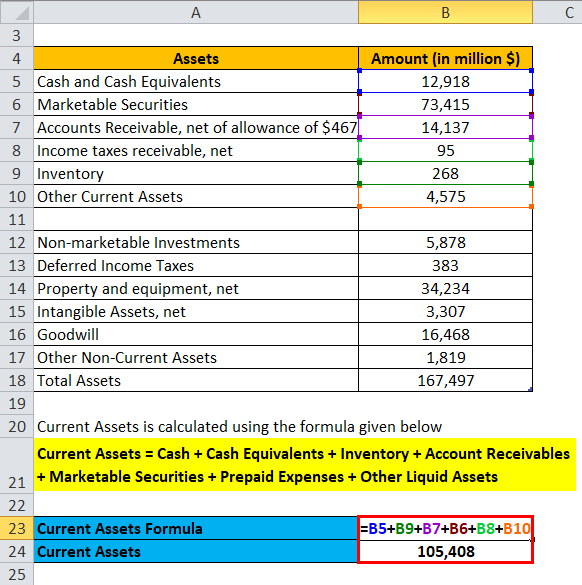

Example #2

Following is the extract of the assets total from Google’s annual report as of 2016. Let’s try to figure out the total of current assets.

Solution:

Excluding the long-term assets like Property and equipment, Intangible assets, Non-marketable investments, goodwill, deferred income taxes, and other non-current assets will yield us the current assets figure.

Current Assets = Cash + Cash Equivalents + Inventory + Account Receivables + Marketable Securities + Prepaid Expenses + Other Liquid Assets

- Current Assets = 12,918 + 268 + 14,137 + 73,415 + 95 + 4,575

- Current Assets = 1,05,408

Example #3

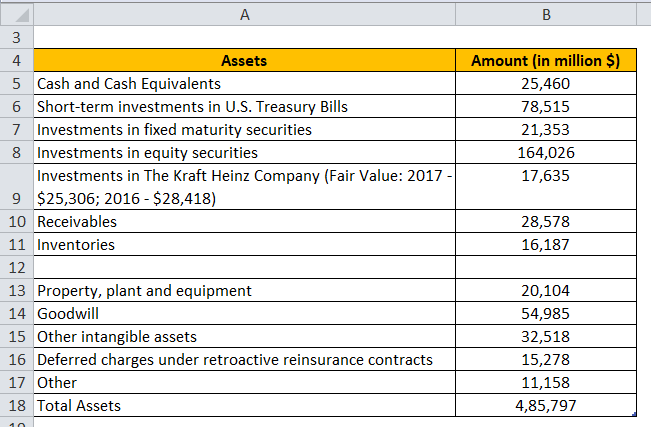

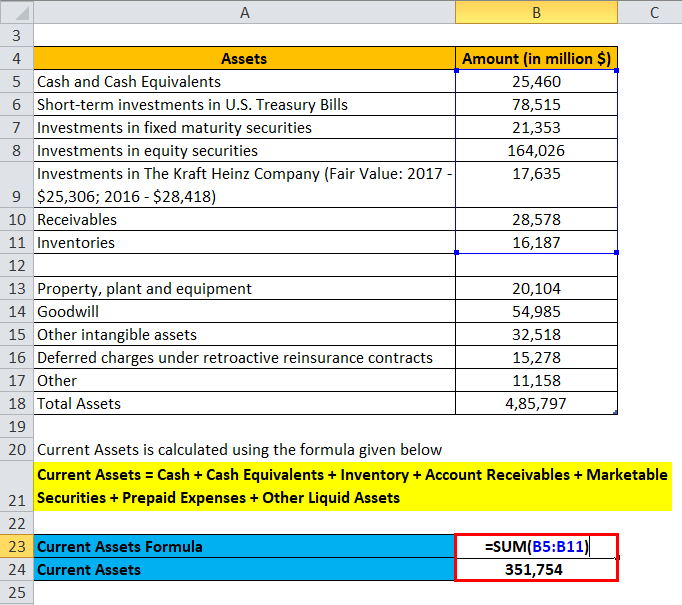

Coming to the second practical example, we have extracted asset data from Berkshire Hathaway Inc.’s annual report filing, which is under 10-K. Calculate its current assets.

Solution:

Again, we would include only assets with a life of 1 year and not more than that.

Hence we have excluded Property, plant and equipment, Goodwill, other intangible assets, Deferred charges, and others.

Current Assets = Cash + Cash Equivalents + Inventory + Account Receivables + Marketable Securities + Prepaid Expenses + Other Liquid Assets

- Current Assets = 25,460 + 78,515 + 21,353 + 1,64,026 + 17,635 + 28,578 + 16,187

- Current Assets = 3,51,754

Explanation of the Current Assets Formula

Current assets are all the firm or company assets expected to be conveniently consumed, sold, utilized, or exhausted through the standard company or business operations within the next year. Current assets shall include stock inventory, accounts receivable, cash, cash equivalents, pre-paid liabilities, marketable securities, and other liquid assets. These are the key assets that form the base of the current assets. There is no exhaustive list of current assets which can give, but 80% of the company’s current assets will compromise the above-mentioned things. One needs to judge if the company expects to realize value from the current assets within the year, then, it should be grouped under current assets.

Relevance and Uses

Current assets are important to the company or, say to the businesses because those current assets can be used to fund daily activities or the day-to-day business operations and are also helpful in paying for the company’s ongoing and recurring operating expenses.

As payments towards loans and bills frequently become due at regular intervals (say at the end of each month), the management or the company must be able to arrange for the necessary or, say, for the required cash in time to pay for its dues and obligations. The dollar value, which is represented by the current assets figure, will provide a general insight into the firm’s or the company’s cash and of liquidity position, and it shall allow the company or the management to remain prepared for the required or the necessary arrangements to continue its business operations without any hiccups.

Additionally, investors and creditors keep a close eye on the current assets of the firm or the company to assess the risk and the value involved in its operations. Many of them will use a variety of ratios, like liquidity ratios, which shall aid in determining a debtor’s ability to pay off its current debt obligations without raising any outside or external capital. Such commonly used ratios include the figure of current assets or their components as the main ingredient in their calculations.

Current Assets Formula Calculator

You can use the following Current Assets Calculator

| Cash | |

| Cash Equivalents | |

| Inventory | |

| Accounts Receivables | |

| Marketable Securities | |

| Prepaid Expenses | |

| Other Liquid Assets | |

| Current Assets Formula = | |

| Current Assets Formula = | Cash + Cash Equivalents + Inventory + Accounts Receivables + Marketable Securities + Prepaid Expenses + Other Liquid Assets | |

| 0 + 0 + 0 + 0 + 0 + 0 + 0 = | 0 |

Recommended Articles

This has been a guide to the Current Assets formula. Here we discuss How to Calculate Current Assets along with practical examples. We also provide the Current Assets Calculator with a downloadable Excel template. You may also look at the following articles to learn more –