Updated July 5, 2023

Understanding Current Assets vs Non-Current Assets

There are two types of assets that a business can own: Current Assets and Non-Current Assets. We differentiate Current Assets vs Non-Current Assets by their duration and liquidity. Current assets are those that can be readily converted into cash within a year, while we use non-current assets for long-term operations and are not easily convertible into cash.

Current assets are like the cash in your wallet – readily available for immediate use. Non-current assets, on the other hand, are more like a house or car – they provide long-term value but can’t be easily turned into cash on short notice. Just as you wouldn’t sell your house every time you needed to pay a bill, a company typically doesn’t rely solely on its non-current assets for day-to-day expenses. Instead, it carefully balances its current assets vs non-current assets to maintain both short-term liquidity and long-term growth potential.

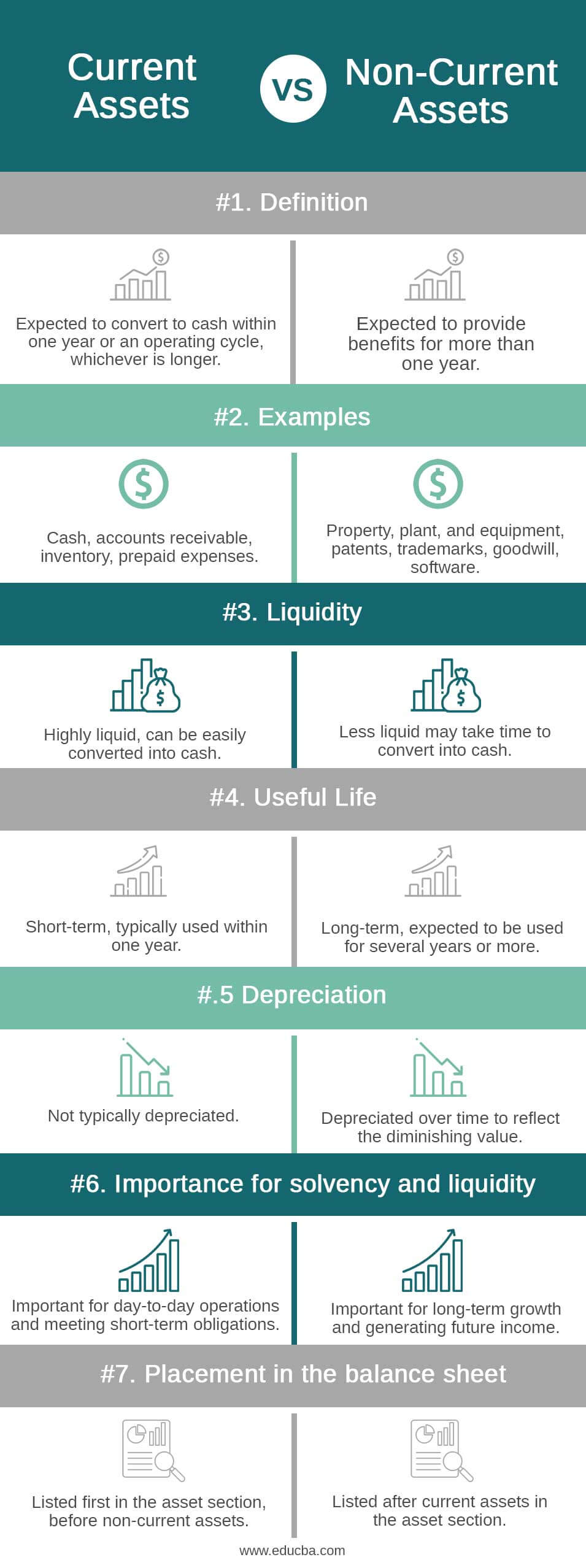

Head To Head Comparison Between Current Assets vs Non-Current Assets (Infographics)

What are Current Assets?

Current assets are resources that a company expects to convert into cash or use up within one year or an operating cycle. These assets are important because they represent the company’s ability to fund day-to-day operations and meet short-term obligations.

Examples:

- Cash is the most liquid current asset, which is the money that companies have readily available.

- Accounts receivable represents the amount of money customers owe to companies for goods or services that are delivered but not yet paid for.

- Inventory includes the goods companies have on hand that they plan to sell to customers.

- Prepaid expenses are the payments made in advance for goods or services received in the future, like rent or insurance premiums.

Importance for Day To Day Operations

Current assets can provide the company with the necessary liquidity to pay bills, purchase inventory, and fund other operating expenses. Having sufficient current assets also allows a company to take advantage of short-term investment opportunities or make quick decisions to adapt to changing market conditions.

Insufficient current assets can lead to difficulty meeting short-term obligations, forcing the company to borrow or raise capital, which can be expensive and harm financial health. Thus, maintaining a healthy balance of current assets is crucial for a company’s short-term financial stability and long-term growth.

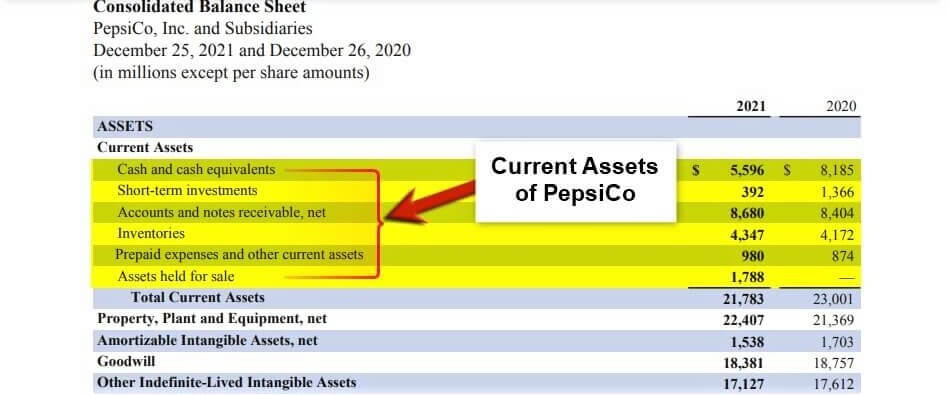

Placement on the Balance Sheet

Current assets are typically listed first on a balance sheet before non-current assets. This reflects their status as assets that can’t be converted into cash or used up within one operating cycle.

The image below depicts the balance sheet of Pepsico Inc. for FY 2021. The highlighted part in the image shows the current assets that the company holds.

(Source: Annual Report of Pepsico for FY 2021)

What are Non-Current Assets?

Non-current assets refer to tangible and intangible assets that can’t be converted into cash within the next year.

Tangible non-current assets are physical assets that a company owns and expects to use for more than one year. Tangible assets provide tangible benefits and are useful for producing goods or services.

Examples:

- Property, plant, and equipment (buildings and machinery)

- Land

- Vehicles

- Furniture

Intangible non-current assets are non-physical assets that a company owns and provide long-term benefits. Intangible assets are valuable because they provide benefits that are not physical, such as brand recognition or exclusivity.

Examples:

- Patents

- Trademarks

- Copyrights

- Goodwill

- Software

- Franchise agreement

- Licenses

Importance for day-to-day Operations

Property, plant, and equipment improve production processes, increase efficiency, and reduce costs, leading to higher profitability. Patents and trademarks provide a competitive advantage and protect a company’s market position.

Moreover, non-current assets enhance a company’s creditworthiness, representing its ability to generate future cash flows and repay debt. This makes it easier for a company to obtain financing from lenders and investors.

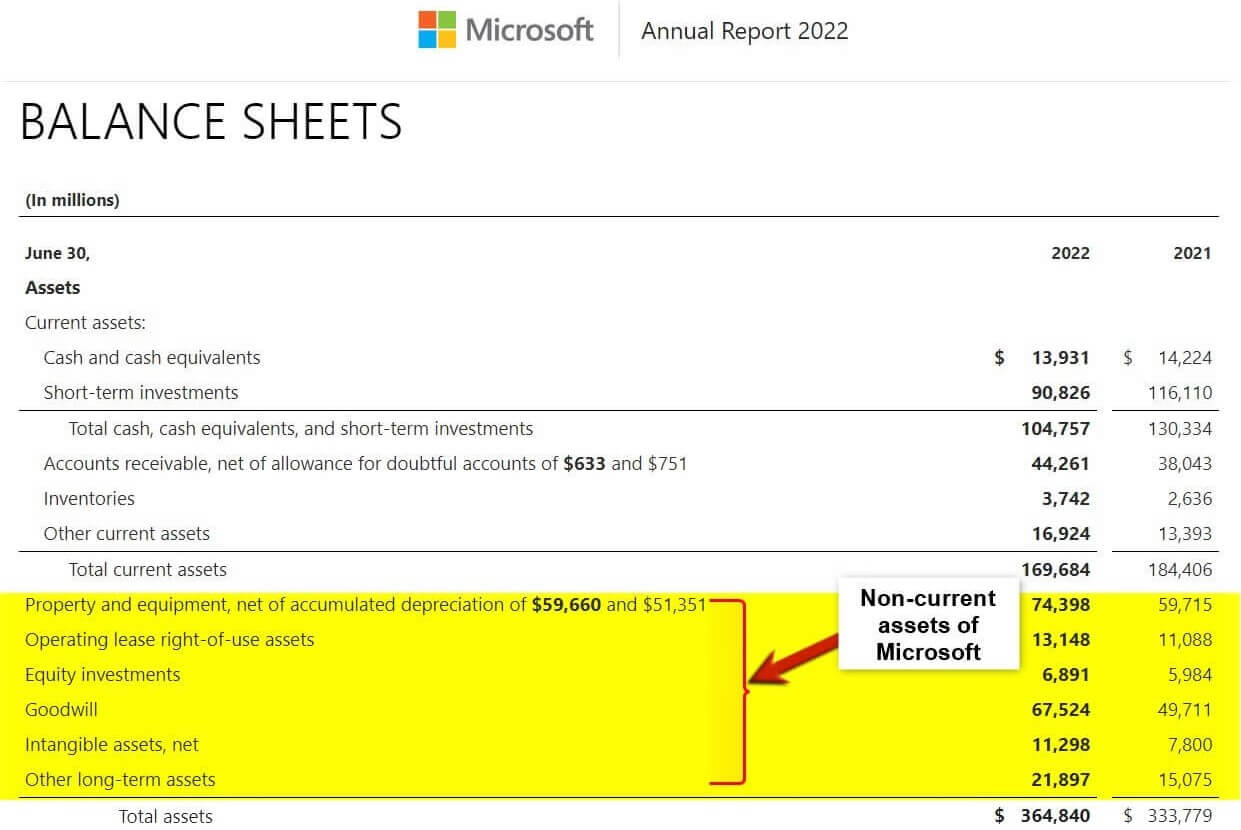

Placement on the Balance Sheet

Non-current assets are reported on the balance sheet immediately following current assets. We can also list the less liquid assets first, such as property, plant, and equipment, followed by intangible assets, like patents and trademarks, and long-term investments, including stocks and bonds.

We record these assets at their original cost, and any depreciation or impairment charges get deducted. Subtracting the total value of non-current assets from the total liabilities shows the company’s equity or net worth.

(Source: Annual Report of Microsoft for FY 2022)

Key Differences Between Current Assets vs Non-Current Assets

Although both types of assets contribute to a company’s overall value, they differ in several ways.

Depreciation

Current assets are not subject to depreciation, as they must be used or sold within a short period. Non-current assets, however, are subject to depreciation, which is the gradual decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors.

Cash flow

Change in current assets affects the cash flow from operating activities, while changes in non-current assets affect the investing activities of the business.

Valuation

We value current assets at their market value or the amount that will be paid if sold today on the open market. On the other hand, we value the non-current assets at their cost, less depreciation or amortization.

Importance for solvency and liquidity

Current assets are important for a company’s day-to-day operations and meeting short-term obligations, while non-current assets are essential for long-term growth and generating future income.

Sale

Selling a current asset is a trading activity that results in profit, whereas selling non-current assets leads to capital gains. This has implications for capital gain tax.

Liquidation

In case of liquidation of current assets, the cash balances will get increased.

On the other hand, any gain or loss on the sale of noncurrent assets will be reflected in the company’s profit and loss statement, thus affecting the company’s net income.

Impact of Asset Mix on the Company’s Financial Health and Performance

When a company has more current assets vs non-current assets, it may suggest that the company is not spending enough on its long-term growth and is too focused on short-term goals. This could cause the company’s growth to slow down and profits to decrease over time.

On the other hand, if a company has more non-current assets vs current assets, it could mean that it is mostly focused on long-term growth and may not have enough cash available to meet its short-term obligations. This could cause problems with cash flow, and the company may be unable to pay its bills, which could lead to bankruptcy if it cannot generate enough income to cover its short-term debts.

Factors to Consider When Analyzing a Company’s Asset Mix

Industry: The type of industry influences the asset mix. For instance, manufacturing firms will have more non-current assets due to costly equipment, while service-based firms will have more current assets.

Business Model: A company’s business model influences the asset mix. Companies with high inventory sales rely on current assets, while companies relying on long-term investments focus on non-current assets.

Growth Strategy: Companies with short-term growth goals will have more current assets, while long-term growth goals focus on non-current assets.

Liquidity Need: Companies with short-term obligations require more current assets, while those with fewer immediate liquidity needs can invest more in non-current assets.

Comparison Table

Below is the top 7 Comparison between Current Assets vs Non-Current Assets

|

|

Current Assets |

Non-Current Assets |

| Definition | Expected to convert to cash within one year or an operating cycle, whichever is longer | Expected to provide benefits for more than one year |

| Examples | Cash, accounts receivable, inventory, prepaid expenses | Property, plant, and equipment, patents, trademarks, goodwill, software |

| Liquidity | Highly liquid, it can be easily converted into cash | Less liquid, it may take time to convert into cash |

| Useful life | Short-term, typically used within one year | Long-term, expected to be used for several years or more |

| Depreciation | Not typically depreciated | Depreciated over time to reflect the diminishing value |

| Importance for solvency and liquidity | Important for day-to-day operations and meeting short-term obligations | Important for long-term growth and generating future income |

| Placement in the balance sheet | Listed first in the asset section, before non-current assets | Listed after current assets in the asset section |

Final Thoughts

To achieve long-term success and make more money, businesses need to balance their current and non-current assets. To do this, they must carefully review their assets and make the most of both short-term and long-term investments.

Frequently Asked Questions (FAQs)

Q1. Is accumulated depreciation a non-current asset?

Answer: Yes, accumulated depreciation is a non-current asset and we report it on the balance sheet under the heading of Property, Plant, and Equipment (PPE). It shows the amount of depreciation charged against an asset since it got acquired. Even though it’s not a physical asset, it’s still valuable because it indicates the decline in the value of a company’s long-term assets over time.

Q2. What are the ten current assets?

Answer: The ten current assets are:

- Cash and cash equivalents

- Marketable securities

- Accounts receivable

- Inventory

- Prepaid expenses

- Supplies

- Short-term investments

- Bank deposits

- Marketable securities held for trading

- Dividends receivable

Q3. Why is it important to distinguish between current and non-current assets?

Answer: Distinguishing between current and non-current assets is crucial for companies to report their financial position accurately, plan their investments, manage their risks, and achieve long-term growth. Current assets are more liquid, and non-current assets are longer-term investments, so companies must balance them to ensure they have enough liquidity to meet short-term obligations while still investing in long-term growth.

Q4. What is the purpose of non-current assets?

Answer: The purpose of non-current assets is to serve as long-term investments that can help businesses grow and generate revenue over a period of time, typically beyond one year. Therefore, non-current assets like property, plant, and equipment help businesses plan for the future, diversify their income streams, and remain competitive in their industries.

Q5. What are the five non-current assets?

Answer: The five non-current assets are Property, Plant and Equipment, Intangible Assets, Long-term Investments, Deferred Tax Assets, and Goodwill.

Recommended Articles

This is a guide to the top difference between Current Assets vs Non-Current Assets. Here we also discuss the Current Assets vs Non-Current Assets key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –