Updated July 24, 2023

Definition of Current Ratio

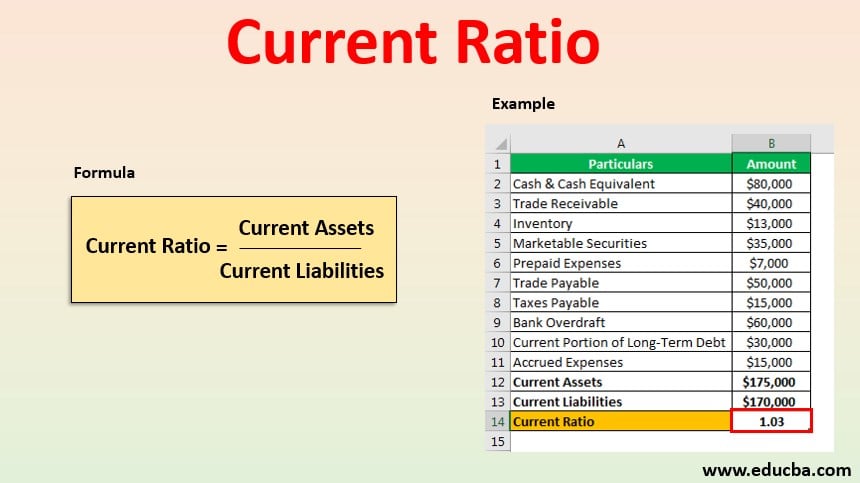

The term “current ratio” refers to the liquidity ratio that helps in determining whether or not a company has enough liquidity at its disposal to cover its short-term financial obligations. In other words, this ratio shows how efficiently a company has built its current assets by leveraging its current liabilities.

Formula

The formula is expressed as the current assets divided by the current liabilities of the subject company. Mathematically, it is represented as below,

Examples of Current Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

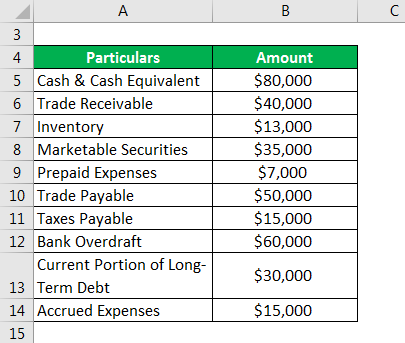

Let us take the example of a company to illustrate the calculation of the current ratio. As on 31st December 2019, the following financial information is available:

Solution:

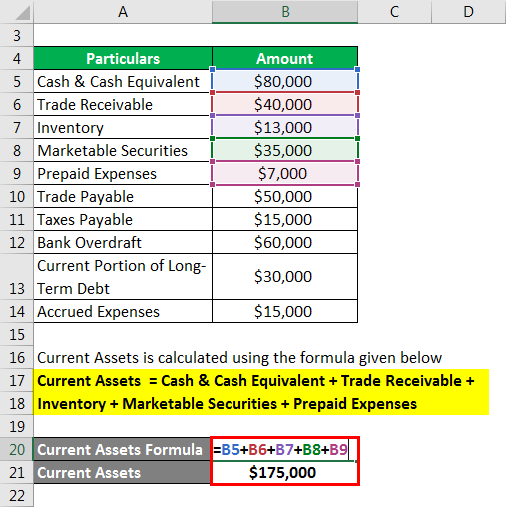

Current Assets is calculated using the formula given below

Current Assets = Cash & Cash Equivalent + Trade Receivable + Inventory + Marketable Securities + Prepaid Expenses

- Current Assets = $80,000 + $40,000 + $13,000 + $35,000 + $7,000

- Current Assets = $175,000

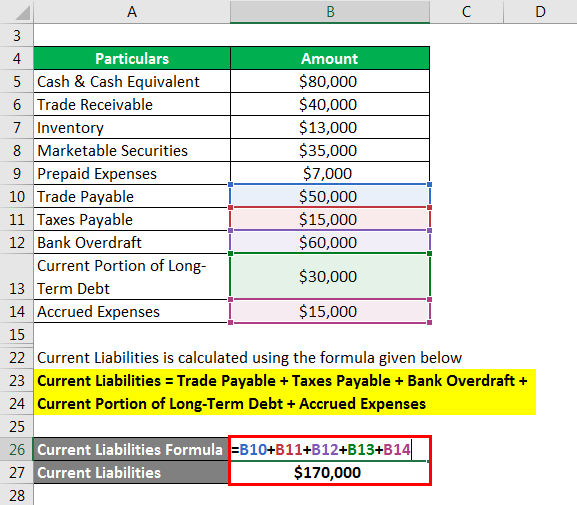

Current Liabilities is calculated using the formula given below

Current Liabilities = Trade Payable + Taxes Payable + Bank Overdraft + Current Portion of Long-Term Debt + Accrued Expenses

- Current Liabilities = $50,000 + $15,000 + $60,000 + $30,000 + $15,000

- Current Liabilities = $170,000

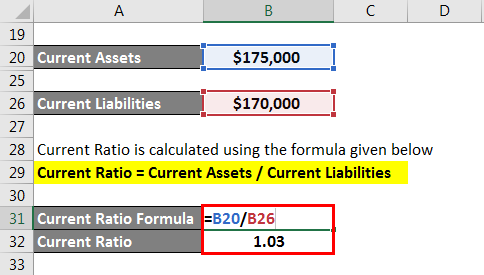

Current Ratio is calculated using the formula given below

Current Ratio = Current Assets / Current Liabilities

Current Ratio = $175,000 / $170,000

= 1.03x

Example #2

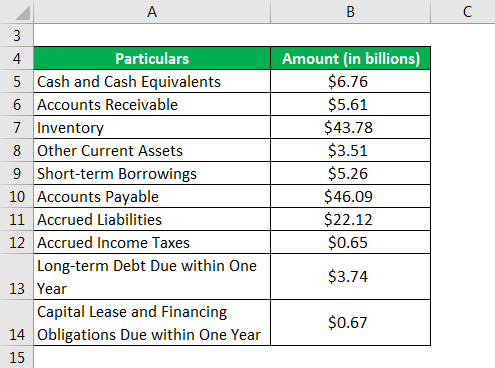

Let us take the example of Walmart Inc.’s to illustrate the calculation of the current ratio. According to the company’s annual report for the year 2018, the following balance sheet information is available:

Solution:

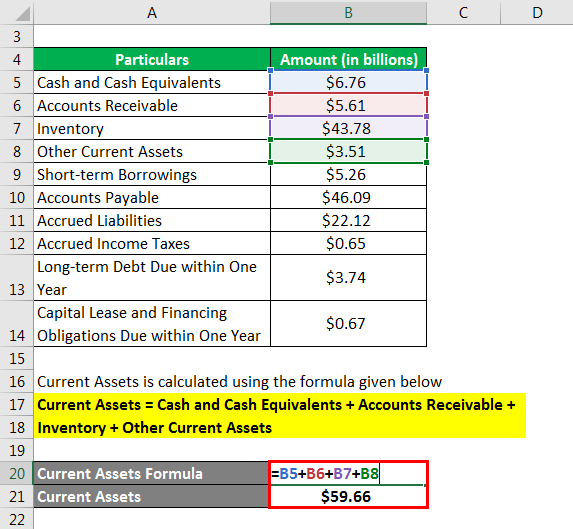

Current Assets is calculated using the formula given below

Current Assets = Cash and Cash Equivalents + Accounts Receivable + Inventory + Other Current Assets

- Current Assets = $6.76 billion + $5.61 billion + $43.78 billion + $3.51 billion

- Current Assets = $59.66 billion

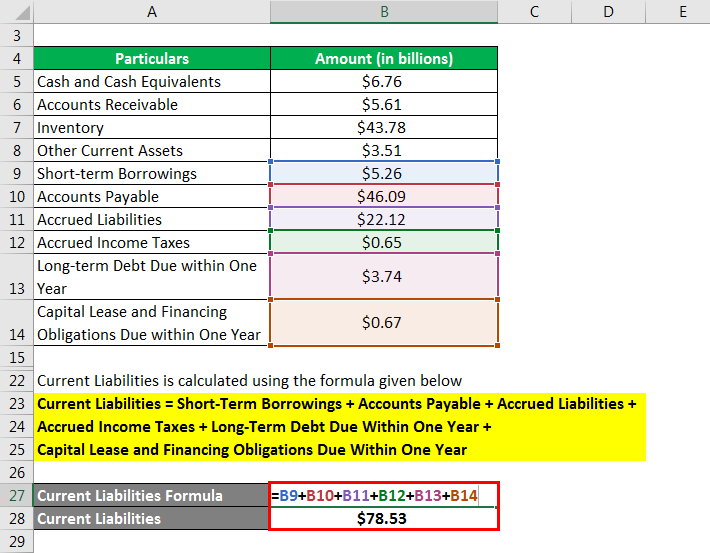

Current Liabilities is calculated using the formula given below

Current Liabilities = Short-Term Borrowings + Accounts Payable + Accrued Liabilities + Accrued Income Taxes + Long-Term Debt Due Within One Year + Capital Lease and Financing Obligations Due Within One Year

- Current Liabilities = $5.26 billion + $46.09 billion + $22.12 billion + $0.65 billion + $3.74 billion + 0.67 billion

- Current Liabilities = $78.53 billion

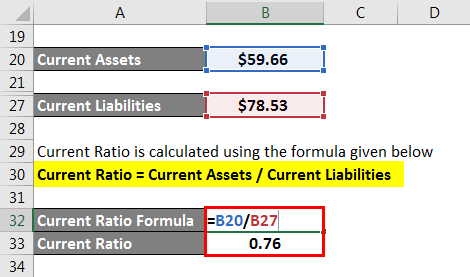

Current Ratio is calculated using the formula given below

Current Ratio = Current Assets / Current Liabilities

Current Ratio = $59.66 billion / $78.52 billion

= 0.76x

Explanation

It can be calculated by using the following points:

- This is an important indicator of a company’s liquidity position, and as such, both analysts and investors pay keen attention to this ratio.

- Although the thumb rule says that then it should be more than one, it is advisable to compare it with its peers to draw meaningful insights. If the current ratio value is in line with the industry average or is marginally lower, then it is considered acceptable.

- However, a very high current ratio vis-à-vis the industry average may not be seen as healthy as it basically indicates that the company is unable to use its assets efficiently. On the other hand, if the value is significantly lower than the industry average, it can indicate the potential risk of distress or default.

Components

The components of the same can be broadly categorized into the following:

1. Current Assets

The total value of the current assets of the subject company on any particular date includes all the assets that are expected to be liquidated within a period of one year. Examples of current assets include cash & cash equivalent, marketable securities, inventory, trade receivables, prepaid expenses, etc.

2. Current Liabilities

The total value of the company’s current liabilities on any particular date includes all the business obligations that are to be paid off within the next year. Examples of current liabilities include trade payables, short-term debt, current portion of long-term debt, taxes payable, accrued expenses, customer deposits, etc.

Difference Between Current Ratio and Quick Ratio

The major difference between the current ratio and quick ratio is that the latter considers more liquid for assets, and so it excludes assets that are more difficult to liquidate, such as inventory, prepaid expenses, etc. As such, a quick ratio is a more conservative liquidity measure as compared to the same.

Advantages and Disadvantages

The following are the major advantages and disadvantages of the same are as follows:

Advantages

- It is one of the easiest to understand liquidity ratios.

- It helps in understanding the working capital requirement and the operating cycle of a company.

Disadvantages

- Its calculation considers some of the not very liquid assets in nature, i.e. conversion to cash is not that easy.

- It doesn’t give meaningful insights if companies operating in different industries are compared.

Conclusion

So, it can be concluded that this is a very important liquidity ratio that is extensively used by both investors and analysts and to ascertain the liquidity position and working capital requirement of a company.

Recommended Articles

This is a guide to the Current Ratio. Here we discuss how to calculate the current ratio along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –