Updated August 10, 2023

What is Daily Compound Interest Formula?

Compounding is the effect where an investment earns interest not only on the principal component but also gives interest on interest.

So compounding is interest on interest. When we say that the investment will be compounded annually, we will earn interest on the annual interest along with the principal. Daily compounding is when our daily interest/return will get the compounding effect. The concept is such that it assumes that the interest earned every day is reinvested at the same rate and will bring an increase as time passes. That is why if we annualize the daily compound interest, it would always be higher than the simple interest rate.

The formula for daily compound interest:

Generally, the investment interest rate is quoted per annum basis. So the formula for an ending investment is:

Where n – Number of years of investment.

This formula applies if the investment is compounded annually, meaning we reinvest the money annually. For daily compounding, the interest rate will be divided by 365, and n will be multiplied by 365, assuming 365 days a year.

So

Examples of Daily Compound Interest Formula (With Excel Template)

Let’s take an example to understand the calculation of Daily Compound Interest in a better manner.

Example #1

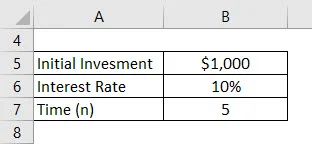

Let’s say you have $1000 to invest, and you can leave that amount for 5 years. The financial institution where you deposit the money offers you a 10% interest rate, which will be compounded daily. Calculate the Daily Compound Interest.

Solution:

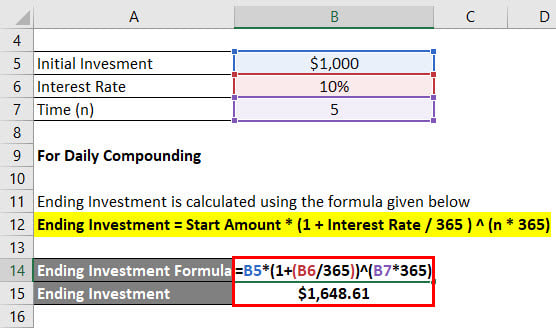

For Daily Compounding:

Ending investment is calculated using the formula given below:

Ending Investment = Start Amount * (1 + Interest Rate / 365 ) ^ (n * 365)

- Ending Investment = $1,000 * (1 + (10% / 365)) ^ (5 * 365)

- Ending Investment = $1,648.61

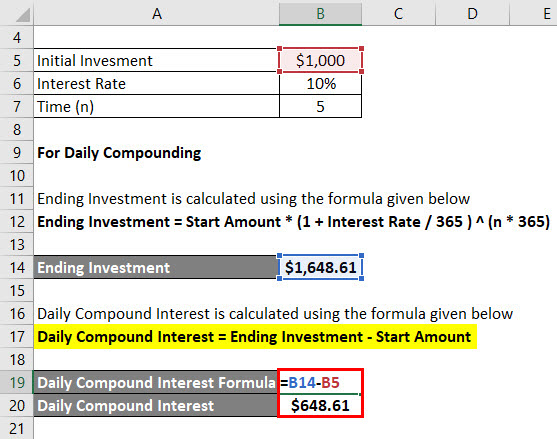

Daily Compound Interest is calculated using the formula given below

Daily Compound Interest = Ending Investment – Start Amount

- Daily Compound Interest =$1,648.61 – $1,000

- Daily Compound Interest = $648.61

The daily compound interest which you have earned is $648.60.

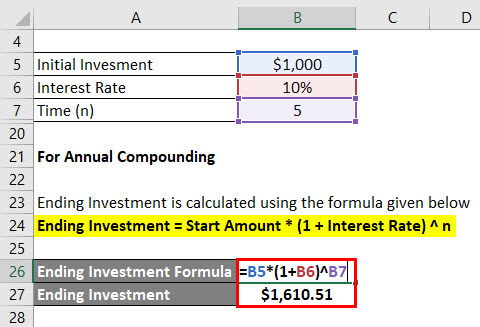

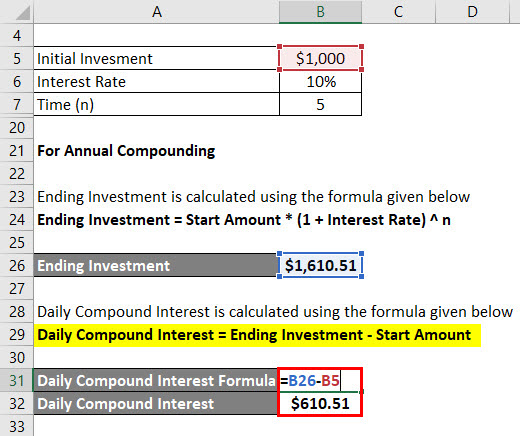

If the given rate is compounded annually, then

For Annual Compounding

Ending investment is calculated using the formula given below

Ending Investment = Start Amount * (1 + Interest Rate) ^ n

- Ending Investment = $1,000 * (1 + 10%) ^ 5

- Ending Investment = $1,610.51

Daily Compound Interest is calculated using the formula given below.

Daily Compound Interest = Ending Investment – Start Amount

- Daily Compound Interest =$1,610.51 – $1,000

- Daily Compound Interest = $610.51

So you can see that the interest earned is more in daily compounding than in annual compounding.

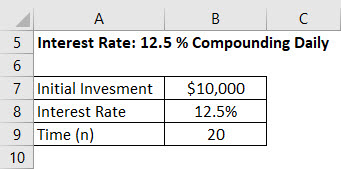

Example #2

Let’s say you have $10,000 from a lottery and want to invest that to earn more income. You do not need that funds for another 20 years. You approached two banks that gave you different rates:

- Bank 1: Interest Rate: 12.5% Compounding Daily

- Bank 2: Interest Rate: 12.5% compounding Annually

Solution:

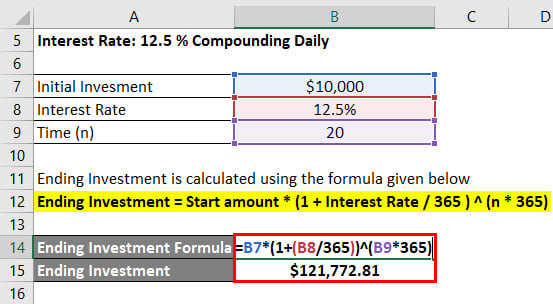

Interest Rate: 12.5% Compounding Daily

To calculate the ending investment, you can use the following formula:

Ending Investment = Start Amount * (1 + Interest Rate / 365 ) ^ (n * 365)

- Ending Investment = $10,000 * (1 + (12.5% / 365)) ^ (20 * 365)

- Ending Investment = $121,772.81

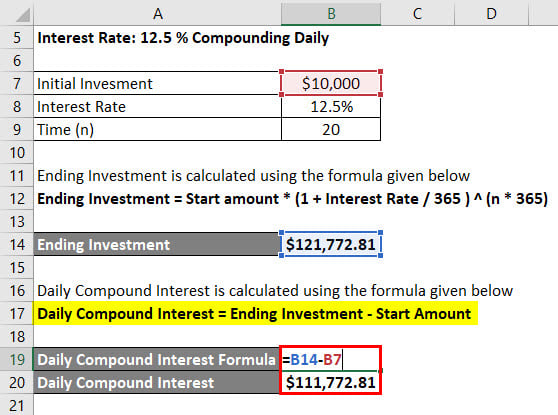

To calculate daily compound interest, you can use the following formula:

Daily Compound Interest = Ending Investment – Start Amount

- Daily Compound Interest = $121,772.81 – $10,000

- Daily Compound Interest = $111,772.81

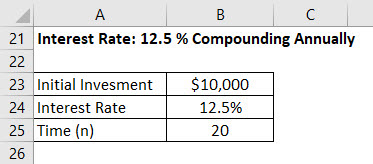

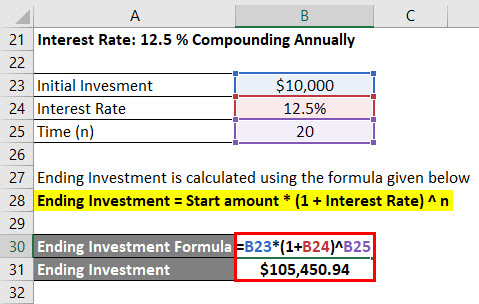

Interest Rate: 12.5 % compounding Annually

The formula for calculating the ending investment is as follows:

Ending Investment = Start Amount * (1 + Interest Rate) ^ n

- Ending Investment = $10,000 * (1 + 12.5%) ^ 20

- Ending Investment = $105,450.94

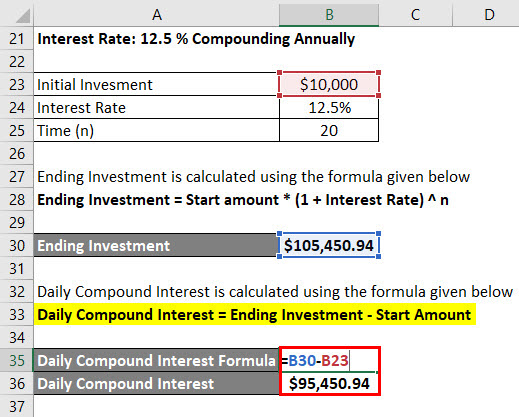

The formula for calculating daily compound interest is as follows:

Daily Compound Interest = Ending Investment – Start Amount

- Daily Compound Interest = $105,450.94 – $10,000

- Daily Compound Interest = $95,450.94

So, if we see effectively, you earn more if you invest in Bank 1 due to daily compounding.

Explanation

Compounding is a very intriguing concept in finance, but some assumptions sometimes do not make much practical sense. Daily compounding assumes that the interest amount will be reinvested at the same rate for the investment period. However, the interest rate never remains the same and varies. Because of this, we might be unable to invest our money at the same rate, and our effective returns might differ. So, in essence, this theoretical representation demonstrates what we could achieve if we reinvested all the money at that rate each day.

Relevance and Uses of Daily Compound Interest Formula

Compounding as a whole help earn interest on interest, which makes logical sense. In simple interest, you earn interest on the same principal for the investment term and lose out on income you can earn on that additional amount. So, for example: if you have $100 and the simple interest rate is 10%, for two years, you will have 10%*2*100 = $20 as interest. But if you invest that only for one year, you will earn $10, and then again if you invest $110 at 10% for a year, you will have $11 interest in the 2nd year.

So in total, you have $21 interest, and you were losing out on $1 interest in the case of simple interest. For daily compounding, we can say that the more, the merrier. As you increase the compounding frequency, you will effectively earn more money since your money will go through more rounds of compounding.

Daily Compound Interest Formula Calculator

You can use the following Daily Compound Interest Calculator.

| Start Amount | |

| Interest Rate | |

| n | |

| Daily Compound Interest | |

| Daily Compound Interest = | [Start Amount * (1 + Interest Rate)n]-Start Amount |

| = | [0 * (1 + 0)0]-0 = 0 |

Recommended Articles

This is a guide to Daily Compound Interest Formula. Here we have discussed how to Calculate Daily Compound, practical examples, and a downloadable Excel template. You may also look at the following articles to learn more –