Data Science in Crypto – Introduction

In recent years, the worlds of data science and cryptocurrency have converged in fascinating ways, giving rise to innovative opportunities for analysis and investment. One such innovation that incorporates data science in crypto is Numeraire.

Numeraire (NMR) is a unique cryptocurrency specifically created for Numerai. Numerai is a hedge fund that combines cryptocurrency and data science.

If you want to make the most of crypto investments, you must first learn about investing! Visit Immediate Vault to connect with top educational firms and start learning.

Table of Contents

Numerai Hedge Fund and Data Science Model

The Numerai hedge fund platform easily integrates data science in crypto by organizing tournaments. On the Numerai hedge fund platform, users, usually data scientists, participate in data science tournaments. In these tournaments, they must analyze financial data, create models, and predict the stock market.

To participate, they use the NMR tokens. If their predictions are accurate, they receive more tokens as rewards. These tournaments occur weekly; the better their predictions, the more tokens they earn.

Apart from being a huge part of the tournaments, NMR tokens also enable users to contribute to Numerai’s governance, i.e., how they run the platform. Additionally, NMR has utility beyond the tournament, being tradable on various cryptocurrency exchanges.

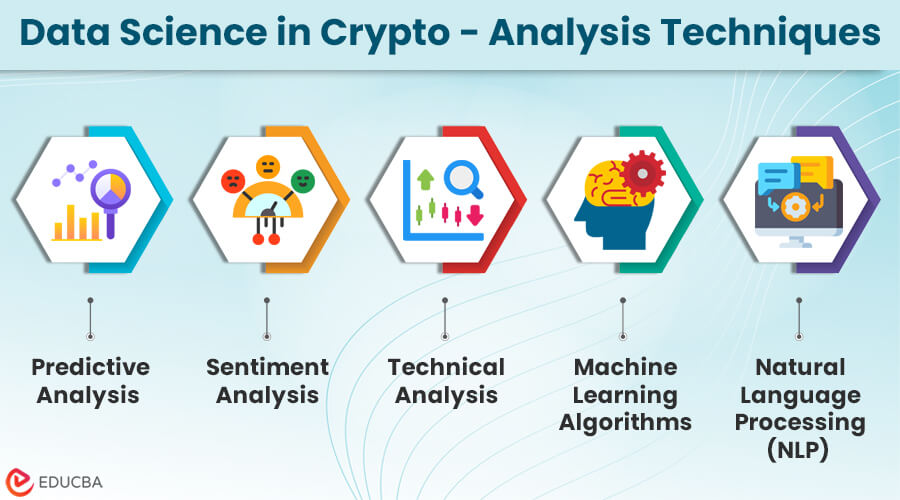

Data Science in Crypto – Analysis Techniques

To employ data science in crypto predictions, data scientists use the following data analysis techniques.

1. Predictive Analysis

Data scientists use market data, including price, volume, and order book data, to perform historical analysis and create predictive models. Using these predictive models, they make predictions about stock market price fluctuations.

2. Sentiment Analysis

While performing sentiment analysis, users assess what the public has to say about a specific security or currency. They can do this by collecting data from social media and news.

3. Technical Analysis

In technical analysis, users analyze chart patterns and indicators and examine underlying factors (e.g., the reason for price fluctuations) to make predictions.

4. Machine Learning Algorithms

Data scientists deploy machine learning algorithms to make predictions about cryptocurrency price movements using historical data and market indicators.

5. Natural Language Processing (NLP)

NLP means using AI to understand human language and expressions. Consider this a subset of sentiment analysis where users decode opinions to predict market prices.

Challenges in Data Science in Crypto

Most of the time, privacy and security concerns in cryptocurrency arise from its inherent anonymity and the risk of security breaches. Data manipulation is also risky, which can lead to unfair advantages and market problems.

So, it’s vital to use data science responsibly in cryptocurrency trading, focusing on transparency and fairness. Balancing innovation with ethical standards is crucial for the industry’s long-term success.

Future of Data Science in Crypto

Emerging trends and technologies in cryptocurrency, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), are opening up exciting avenues for data science in crypto exploration. DeFi platforms are reshaping traditional financial services, offering data scientists opportunities to devise new analytical models and risk assessment tools. Meanwhile, with their unique digital assets and provenance tracking, NFTs provide data scientists with novel challenges and opportunities for studying market dynamics and valuations.

Furthermore, institutional adoption of cryptocurrencies is gaining momentum, bringing vast capital and liquidity into the market. Simultaneously, regulatory changes are gradually establishing a more structured and secure environment. In this context, data scientists are pivotal in shaping the crypto landscape, leveraging their analytical skills to navigate complexities, assess risks, and drive innovation.

Final Thoughts

Digital assets like Numeraire provide unique insights into the potential and challenges of the data science field. As data science techniques evolve, how we analyze and understand cryptocurrencies will also evolve. Data science in crypto offers exciting opportunities for investors and researchers alike. Data scientists will remain at the forefront of the cryptocurrency revolution, optimizing trading strategies, ensuring data integrity, and contributing to the ongoing evolution of digital assets.

Recommended Articles

We hope you found this EDUCBA article on data science in crypto fascinating. For similar articles, refer to the following: