Overview of Day Trading

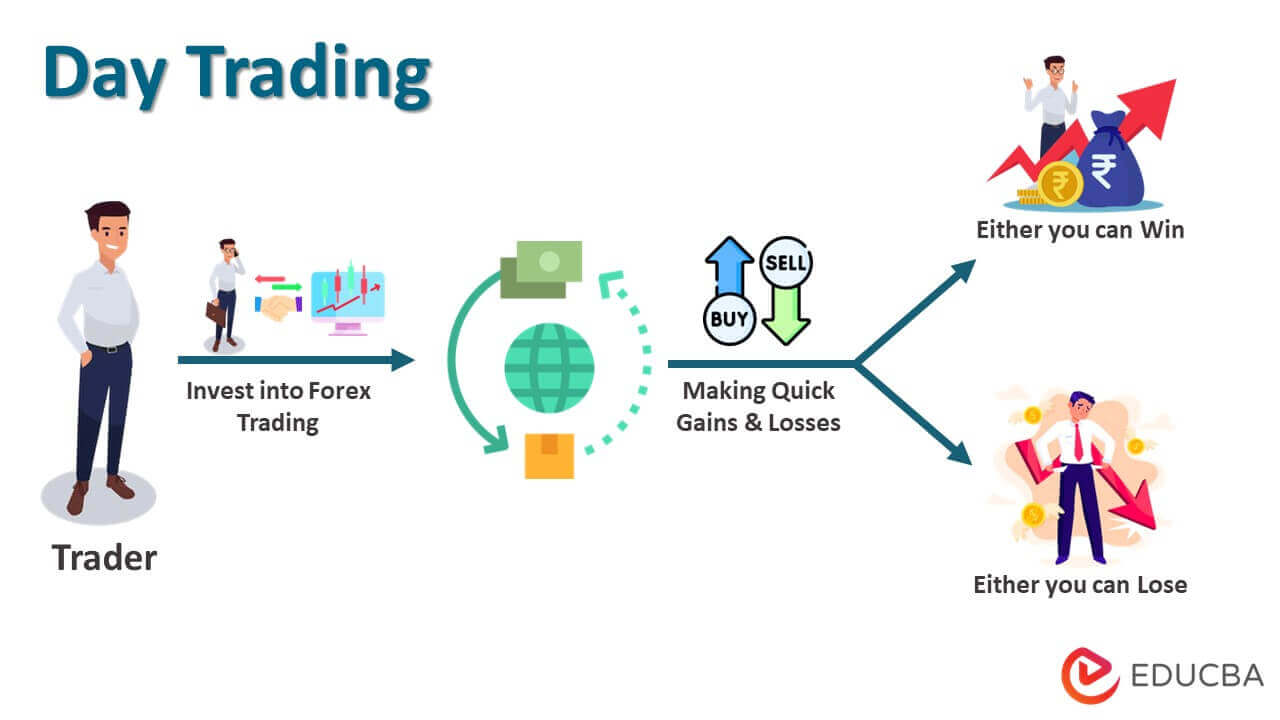

The high-leverage game of retail forex trading just got more exciting. With day trading sessions on, traders are making quick gains (and losses) quickly.

A little knowledge is a dangerous thing. With adequate know-how, discipline, and an approach that relies on alternatives, you, too, can win the prize (and score the goal) in the markets.

Mistakes of Day Trading

Below are 24 mistakes to avoid while day trading:

1. Averaging Down: The Flip-Side

Averaging down is not an excellent way to move up in day trading sessions. While most traders try to avoid this from happening, it inevitably does. There are many problems with averaging down.

The first is that a losing position is held, which proves costly in terms of time, effort, and money. A better place is a step up the money ladder, and the day trading concept is about anticipating the wins (and the losses) before they happen. For every dollar or rupee lost, more significant returns are required on capital to bring back losses.

For instance, for a 50% loss sustained, a 100% gain has to be made to even things out. Averaging down in such a situation can lead to massive losses or margin calls. This is because trends can stay put even when traders are liquid- more so if capital is added as the position moves out of winning gains.

Day traders are also sensitive to issues, and the short time frame for trades translates into opportunities that can be enchased as they occur. It’s essential to exit bad trades as quickly as possible to enter good trades. Day traders should be alert to how news events are moving the market and the direction of the trend.

Taking a position before a news announcement can harm a trader’s chance of success. There is no easy money… it’s all about working hard and thinking smart.

2. Don’t Trade Right After the News

A news headline may hit the markets, which start rushing. This does not necessarily mean you will earn money. Trading is like gambling if you do not have a solid training plan. News announcements lead to panic reactions and emotional responses, which harms day trading.

3. Wait for Volatility to Lessen

Day traders should ensure that volatility subsides and there is a distinct trend for developing after news announcements have been made. With fewer liquidity concerns, more effective management of resources is possible. A stable price direction is, therefore, likely.

4. Don’t Risk More Than You Can Afford to Lose

Excessive risk does not hold any returns, and the risk-reward ratio has to be comfortable; otherwise, traders will lose in the long run, something not usually associated with day trading. Regardless of the period, traders should risk no more than 1% of capital within a single trade. Professional traders also risk less than 1% of the capital. Day trading also means extra attention to a daily risk maximum that needs to be implemented.

The daily risk maximum can be around 1 percent or less of the capital, equivalent to the average daily profit over one month. By using the maximum risk, traders ensure they do not risk more than they can afford to lose. Forex leverage can quickly become a double-edged sword, and unrealistic expectations come from varied sources.

5. Accept that the Market Can Be Illogical

Trading expectations are often imposed on the market. We think about what we desire rather than the correct trading direction. The market is not interested in what a person needs. In short, long, and medium-term cycles, calls can fluctuate or trend depending on trading conditions.

To adjust for changes in the market, you need to formulate a trading plan and find out if it yields steady results. Accept what the market behaves like. Remember that increasing position size can accompany capital growth over time to yield higher dollar returns. New strategies can be implemented with a minimum capital to begin with. New strategies can then yield positive results. As time expands and day trading progresses, you may need to modify your strategy.

6. Entering Day Trading Without a Plan Can be Disastrous

A common mistake traders make is entering the trade without an effective plan. Trading without a plan leads to mistakes, especially if you don’t know what you are getting into. Protection against losses means adjusting entry-exit and, most importantly, escaping price or stopping loss.

7. Don’t Leave Out the Margins

Day trading can be made or broken depending on the margin. When you borrow from a broker to purchase securities, the margin is that valuable trade segment that can increase profits. Margin can be a valuable ally for day traders if used effectively. Trade with money you have, not cash you borrowed.

8. Don’t Try Chasing Trades

A standard error during day trading is to chase trades. Rather than concentrating on steady and stable returns, day traders may be tempted to chase after fast-moving stocks. Borrowing more from the brokerage than they can afford will wipe out the day trader’s account and give day trading a bad reputation. Chasing trades when day trading stocks shoot up can lead to plummeting fortunes. If you miss out on a stock, don’t chase after it, hoping you can catch up.

9. Not Understanding Markets or Limiting Orders can Have Consequences

There is always a toss-up between market and limit order. While a market order is to purchase or sell the stock at current market rates, a limit order permits establishing a maximum or minimum price for trading security. Market orders can be filled fast, but the market should not control the order. Similarly, limit orders can permit the parameters to be controlled. Whether limit orders or market orders make sense to you, you must be clear that you cannot miss a fast-moving stock to save a few rupees. High-quality liquid stocks permit the use of either market or limit orders.

10. Adhere to Tips, Pay the Price

In what might seem counterintuitive, it is crucial day trading tips to remember that those who want to help you need not be your best friends. Market informants often have agendas, and nothing comes close to fair trading. Successful day traders think about what they want to infer and judge accordingly. They do not get swayed by what others think.

11. Refusing to Cut Losses Can Be Expensive

Human nature is inherently hopeful. This means day traders could be hoping for a turnaround. This can be a lethal mistake. Refusal to cut losses can harm your account. If your stock is headed south, continuing a journey to nowhere is unnecessary. Prevent small losses from turning into larger ones.

12. Timing is Everything in Day Trading

Trading too early or late, too little or too much, can be disastrous. Remember that the first few minutes of trading are always confusing, and the competition towards the opening or closing bell is always between institutional investors and high-frequency trading experts- in other words, the big fish in the sea. So, if you wade in too deep, don’t expect to stay afloat because day trading is about making profits and avoiding losses. When indicators become choppy, make sure your drawback.

13. Discipline is Everything

In the markets, discipline is what it takes to be a better day trader. Develop strict rules and do not rely on emotions. Day traders can also use technical analysis. For example, stochastics can chart if a stock is over or under-traded.

14. Rookie Traders Look for Magic, Experts Know Better

Don’t look for a magic bullet or a miracle cure in day trading because there is none. Listening to the charts is as important as listening to the news; there is no easy way to play markets. Strategy and discipline are needed to make sure you gain profits.

15. Uninformed Day Traders Lack Knowledge

A day trader should not think anyone can make money in the markets. To be successful, you need training. A consistently winning trader starts with paper trading and studies hard enough to discover how the market works. Training for day trading can be as intensive and comprehensive as a doctoral degree course!

16. Day Trading is All About Taming the Lion

Making money off minor variations in stock price requires skill and in-depth understanding. High-speed internet connections and plenty of nerve can ensure day trading becomes easy. But having a solid and confident approach is also essential. Much like an animal can sense fear, so can a market. It would help if you were like a lion tamer…confident and bold.

17. Come Up With a Business Plan

Day trading strategies are a business proposition like income production. Business plans should include a list of equipment needed to be successful, a set of day trading training courses, and a projection of minimal profitability over the short and long term. Keeping track of the budget would not be a bad idea either. This includes a record of expenses linked with day trading.

18. Have a Solid Trading Philosophy

You must identify performance metrics and discover which strategies work best during day trading. This includes defining what gives you an edge over others, identifying the trade of trade you are looking to initiate, and defining the exit strategy. It is also essential to assess when you should close your position.

19. Make Allowances for Losses

It is impossible to have a perfect batting average in a one-day match. Similarly, day trading involves accepting losses and appreciating wins. Practicing trading is essential; it is also easy, thanks to modern technologies and day trading methods. Markets involve a think-or-swim approach because sinking is more accessible than surviving, especially for first-time traders.

20. Follow a Trading Strategy

It is easy to bite the bullet and get caught up in emotions. This can lead to dangerous day trading activities like impulse selling or buying. It would help to craft a trading strategy that promises success, not failure. Most importantly, it would help if you kept your emotions out of the equation.

21. Don’t Change Your Strategy Too Often

Day traders often try to change a strategy because it does not work. They do not consider external factors such as market dynamics or volatility. This is their stumbling block.

22. Use the News

Check financial news reports to determine daily trading in the markets. Analyze each trade in the news you get and choose successful and profitable businesses.

23. Maintain a Trading Diary

A trading journal can help you to monitor losses and gains in an organized manner. You can even keep an electronic journal if you find it more easily.

24. Always Do Post Trade Analysis

You need to adapt to the changing markets, and this is only possible if you modify your strategies depending on this. The market’s changing dynamics and inherent volatility must be understood, not feared. If wishes were horses, day traders would ride! Unfortunately, the very opposite is true. So, use a stop loss with every order to avoid a bad trade. Use limit orders well and don’t chase the trend; look for stable returns instead.

Day Trading Conclusion

Not knowing what to capitalize on in the markets is perhaps the biggest problem in day trading. Using principles of psychology or behavioral finance is essential. You need to know what works and (more importantly) what does not. The difference between self-belief and prophecies marks the variance between day trading and gambling!

Recommended Articles

This has been a guide to Day Trading. Here, we discuss the Top 24 mistakes to avoid while day trading. You may also look at some articles to help you get more details about the trading, so go through the link.