Debit Meaning

To record a transaction, companies make journal entries. These journal entries record the amount and accounts involved in the transaction. It also shows which account is debited and which is credited. They record it in the left column and the credit in the right column in the general ledger. Each transaction has both debit and credit entries to ensure everything is balanced.

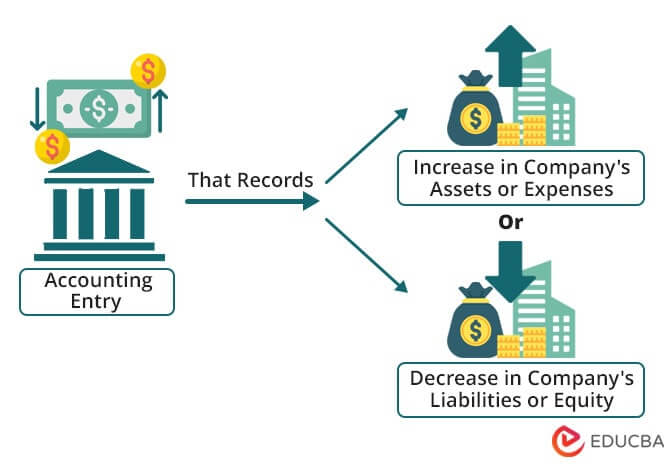

Debit is an entry that companies record to show an increase in the business’s assets/expenses or a decrease in its liabilities or equity.

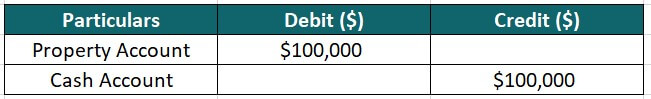

For example, suppose a business buys property such as land or building for $100,000. In that case, they will record it as a debit entry because it reduces the company’s cash balance and increases the property asset account.

The entry will be as follows:

Debit in Accounting

When a company spends money on something that helps their business, they write down a note to show that they spent money. This note is called a “debit”.

Similarly, when the company pays off debt or has less ownership in the business, they write down a “debit” to show that they have fewer liabilities or equity (ownership in the business).

Based on the type of transaction, the company debits the relevant account and records the transaction accordingly.

The various types of transactions are:

1. Sales Transactions

It is when a business sells a product or service in exchange for money. This transaction occurs between a company and its customers. The money the business receives from the customer for the sale is its revenue.

Example: Recording sales revenue or sales returns or discounts in the general ledger.

2. Asset Transactions

This transaction involves the business either purchasing a new asset or disposing of an old asset.

Example: Recording purchases of property, plant, and equipment or disposal of assets or impairment losses.

3. Purchases Transactions

It is when a business or individual purchases goods or services in exchange for money. The money they pay is an expense. Additionally, they can consider the goods they receive as assets.

Example: Recording purchases of goods or services or returns or allowances on purchases.

4. Expense Transactions

These are transactions that companies make to run their day-to-day business operations smoothly. These are a company’s monthly expenses like rent, salary, insurance, advertising, etc.

Example: Recording employee salaries, rent, and utilities, as well as taxes, depreciation, and amortization expenses.

How Does it Work?

Here is a step-step explanation of how it works:

Step 1: Identify the Account

The first step is to find out which account to debit. For example, if you receive a payment in cash, you can debit the cash account.

Step 2: Determine the Amount

After deciding on the account, you must find out the amount you must debit. If you receive $40,000 in cash, you will debit $40,000 in a cash account. However, if you receive $20,000 in cash and $20,000 in the bank, you should debit $20,000 in cash and bank account individually (total of $40,000).

Step 3: Record the Transaction in Appropriate Journal

There are several journals in accounting, such as Purchase, cash, sales, etc. Thus, selecting the appropriate journal as necessary is crucial. For instance, if you want to record a sales entry, you can record it in the sales journal.

Step 4: Post the Entry in General Ledger

Post the entry to the corresponding account in the general ledger. For example, if you record the journal entry in the cash account, then you must post the same entry to the cash account in the general ledger.

Step 5: Balance the Entries

After posting the transaction in the general ledger, we must verify if the debits equal the total credits. In double-entry accounting, every transaction affects at least two accounts, so total debits must always equal the total credits. If they are not equal, it indicates an error in the accounting records that you must correct before preparing financial statements.

Examples

Here is an Excel template that you can download and use to create custom journal entries.

#1 Purchasing Assets

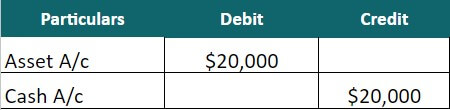

Market Experts Pvt Ltd purchased machinery worth $20,000. After determining what accounts to debit, let us record the transactions in the accounting books.

Solution:

In this scenario, there is an increase in the assets, i.e., machinery. Therefore the entry will debit the assets account. At the same time, there is a decrease in the cash balance. So we will credit the cash account.

The journal entry will be as follows:

#2 Selling Goods

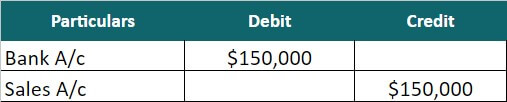

An electronic store sells 150 laptops for $150,000. Let us record this sales transaction in the store’s accounting books.

Solution:

Here, as the store receives $150,000 in its bank account, it will debit the bank account. On the other hand, it will credit the amount to the sales account.

The journal entry will be as follows:

#3 Paying Wages

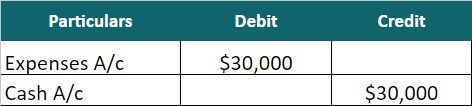

A bakery pays $30,000 to its employees in wages for a month. Record this expense transaction in the accounting books.

Solution:

The bakery will debit the amount in the expense account as salaries paid are expenses. Moreover, as the amount goes in cash form, there will be a credit to the cash account.

The journal entry will be as follows:

Rules of Debit & Credit

The main rules are:

1. Debit what comes in, credit what goes out:

This rule applies to real accounts that don’t close at the end of an accounting period. Accounts like assets, liabilities, and equity carry their balances to the next accounting period.

Here, you should debit the account that receives value and credit the account that loses value. For example, when a company purchases new machinery, it should debit the assets account and credit the cash account.

2. Debit expenses & losses, credit income & gains:

This rule applies to nominal accounts that close at the end of each accounting period. The rule states that you should debit accounts that represent expenses or losses and credit accounts that represent income or gains. For example, when a company pays rent, it should debit the rent expense account and credit the cash account.

3. Debit assets, credit liabilities & equity:

It means that you should debit accounts that represent assets and credit accounts that represent liabilities or equity. For example, when a company purchases equipment with a loan, it should debit the equipment account and credit the loan payable account.

4. A Debit decreases, the credit increases:

It means that you should debit accounts that decrease in value and credit accounts that increase in value. For example, when a company pays off a loan, it should debit the loan payable account and credit the cash account.

5. Debit the receiver, credit the giver:

This rule is applicable to personal accounts. It means that you should debit the account that receives value and credit the account that gives value. For example, when a company receives a payment from a customer, it should debit the cash account and credit the accounts receivable account.

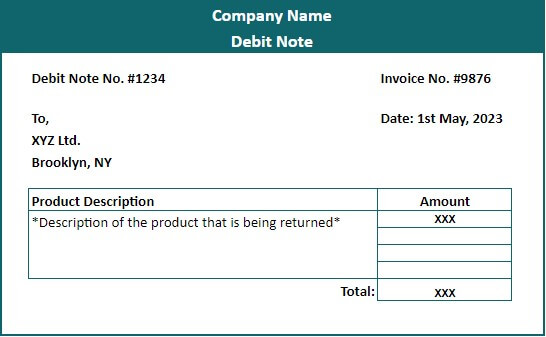

Debit Note

A debit note is very similar to an invoice. The main difference is that an invoice shows a sale, while this note shows returns or adjustments on already made transactions.

It is a document that buyers use to request a refund for a defective product. It includes information such as the reason for the request, the product details, and the amount. The seller can review the request and decide whether to accept or reject it. These notes are common in business-to-business transactions to keep track of financial transactions and resolve discrepancies.

Format:

It includes the company’s name, the note number, the invoice number, the date, and the recipient’s address at the top. Then there is a description of the items to return along with their amounts.

Example:

Margin Debit

Investors can borrow money from brokers when they lack funds to purchase shares, stocks, or securities. The money the investors owe the broker is known as margin debt.

In margin trading, investors can make investments using borrowed funds. However, it also increases the risk of losses, as the investor may have to repay the loan even if the value of the securities declines. Thus, investors must understand the risks and costs of margin trading before engaging in these activities.

Frequently Asked Questions (FAQs)

Q1. Differentiate between Debit vs. Credit.

Answer: A debit is an accounting entry that represents a rise in the asset or expense account of a business or a reduction in the liabilities or equity account. In comparison, credit is the accounting entry that represents the opposite; a reduction in asset or expense account and an increase in liabilities or equity.

Q2. What is a Debit in Bank?

Answer. Debit in a bank means that there has been a withdrawal of money from your bank account. It is the act of money leaving a bank account whenever one makes a payment using a card.

Recommended Articles

The above article is a summary of Debit. Here we discuss its meaning, transactions, how it works, examples with downloadable templates, rules, and more. To learn more, please read the recommended articles,