Updated July 24, 2023

Difference Between Debit Note vs Credit Note

A debit note and credit note are issued when a customer returns the goods to the supplier or seller of those goods. A debit note is issued to the supplier or the seller of the goods, while a credit note is issued to the customer or buyer. When the supplier or the seller receives a return of the goods, he or she receives a debit note stressing that his or her account is debited with a respective amount. In contrast, when the customer or the buyer returns goods, he or she receives a credit note that stresses that his or her account is credited with an amount mentioned in the note.

A debit note reflects a positive amount, whereas a credit note reflects a negative amount. A debit note lowers account receivables, whereas a credit note lowers account payables. A debit note is exchanged for a credit note, whereas a credit note is exchanged for a debit note. When a customer is overcharged for goods, he or she issues a debit note to the supplier, whereas when a customer overcharges a supplier or the seller, the former issues a credit note to the latter.

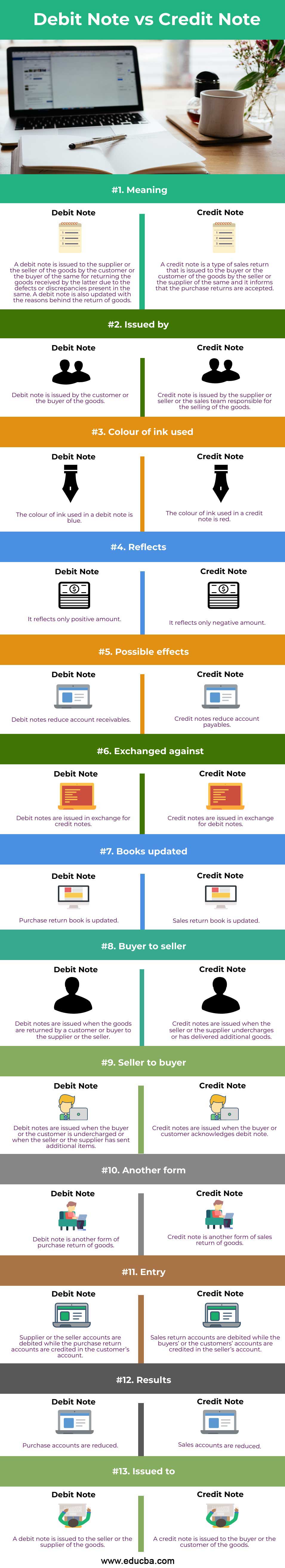

Head To Head Comparison Between Debit Note vs Credit Note (Infographics)

Below are the top 13 differences between Debit Note vs Credit Note

Key Differences Between Debit Note vs Credit Note

Let us discuss some of the major key differences between Debit Note vs Credit Note

- The journal entries passed in the case of a debit note are-

Sales Return Account – Dr.

To Debtors’ Account – Cr.

- On the other hand, the journal entries passed in the case of a credit note are-

Creditors’ Account – Dr.

To Goods Returned Account – Cr.

- The debit note reflects a positive amount, whereas the credit note reflects a negative amount.

- The buyer or customer issues debit notes when returning the products to the supplier or seller. The supplier or seller of the goods issues a credit note when receiving the returned products from the customer or buyer.

- Debit notes are issued in the exchange of credit notes. On the other hand, credit notes are issued in exchange for debit notes.

- The debit note can lower the account receivables, whereas the credit note can lower the account payables.

- In the case of a debit note, the issuer updates the purchase return books, while in the case of a credit note, the issuer updates the sales return books.

- The customer or buyer of the goods issues a debit note to the supplier or seller, while the supplier or seller issues a credit note to the customer or buyer.

- A debit note is another form of purchase return of products, whereas a credit note is another form of sales return of products.

- In the event of credit purchases, the issuer can only issue a debit note, while in credit sales, the issuer can only issue a credit note.

Debit Note vs Credit Note Comparison Table

Let’s discuss the top comparison between Debit Note vs Credit Note:

| Basis of Comparison | Debit Note | Credit Note |

| Meaning | A debit note is issued to the supplier or the seller of the goods by the customer or the buyer for returning the goods received by the latter due to the defects or discrepancies present in the same. A debit note is also updated with the reasons behind the return of goods. | A credit note is a type of sales return issued to the buyer or the customer of the goods by the seller or the supplier, and it informs that the purchase returns are accepted. |

| Issued by | The customer or buyer of the goods issues a debit note | A credit note is issued by the supplier, seller, or sales team responsible for selling the goods. |

| Colour of ink Used | The color of ink used in a debit note is blue. | The color of ink used in a credit note is red. |

| Reflects | It reflects only a positive amount. | It reflects only a negative amount. |

| Possible Effects | Debit notes reduce account receivables. | Credit notes reduce account payables. |

| Exchanged Against | Debit notes are issued in exchange for credit notes. | Credit notes are issued in exchange for debit notes. |

| Books Updated | The purchase return book is updated. | The sales return book is updated. |

| Buyer to Seller | Debit notes are issued when a customer or buyer returns the goods to the supplier or the seller. | Credit notes are issued when the seller or the supplier undercharges or has delivered additional goods. |

| Seller to Buyer | Debit notes are issued when the buyer or the customer is undercharged or when the seller or the supplier has sent additional items. | Credit notes are issued when the buyer or customer acknowledges the debit note. |

| Another Form | A debit note is another form of purchase return of goods. | A credit note is another form of sales return of goods. |

| Entry | Supplier or seller accounts are debited, while the purchase return accounts are credited to the customer’s account. | Sales return accounts are debited while the buyers’ or the customers’ accounts are credited to the seller’s account. |

| Results | Purchase accounts are reduced. | Sales accounts are reduced. |

| Issued to | A debit note is issued to the seller or the supplier of the goods. | A credit note is issued to the buyer or the customer of the goods. |

Conclusion

In purchase returns (return outward), the issuer generally issues a debit note; in the event of sales returns (return inward), the issuer issues a credit note. When the goods return to the supplier, then the customer issues a debit note, and the former shall issue the latter a credit note. The issuer makes a debit note using blue ink, while a credit note uses red ink. A debit note reflects a positive amount, whereas a credit note always reflects a negative amount. A debit note impacts account receivables and causes the same to lower down, whereas a credit note impacts account payables and causes the same to lower.

Recommended Articles

This is a guide to the top difference between Debit Note vs Credit Note. Here we also discuss the Debit Note vs Credit Note key differences with infographics and a comparison table. You may also have a look at the following articles to learn more-