Updated July 21, 2023

Definition of Debt Ratio

Debt Ratio is the proportion of debt to the total assets available and it is an indication of the level of the financial health of the company whereby it gives an overview of whether or not the assets are sufficient to pay off the debt if such a situation arises and the level of risk investment in the company entails.

Formula to Calculate Debt Ratio

The formulae for calculating the Debt Ratio are as follows:

Or

Explanation

The total assets include fixed assets and current assets and any other assets such as goodwill also. However, at times the debt includes only the long-term assets, while at times the debt includes the entire set of liabilities including short-term debt and other liabilities. Such variations in calculations are quite common and the inclusions are mentioned in the fine print or the notes of the financial statements so that the stakeholders are aware of the calculation methodology.

Among many other measures collectively known as the Gearing ratios, the Debt ratio is another measure to understand what a company can do better to achieve its desired capital structure and investors to analyze the investment suitability.

Example of Debt Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

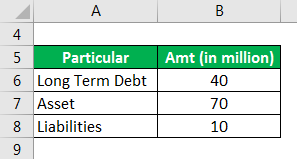

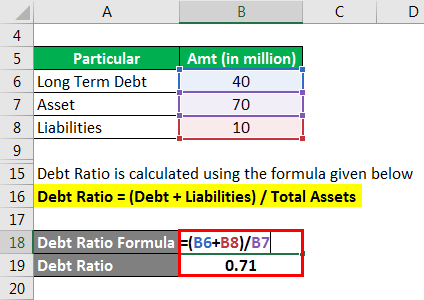

A company has a long term debt of $40 million, liabilities other than the debt of $10million, Assets of $70 million. Then calculate the debt ratio, some analysts may only use the amount of long term debt that is, the $40 million, while some might also include the liabilities other than debt and therefore use $50 million as debt.

Solution:

Debt Ratio is calculated using the formula given below

Debt Ratio = Total Debt / Total Assets

- Debt Ratio = 40 / 70

- Debt Ratio = 0.57

Or

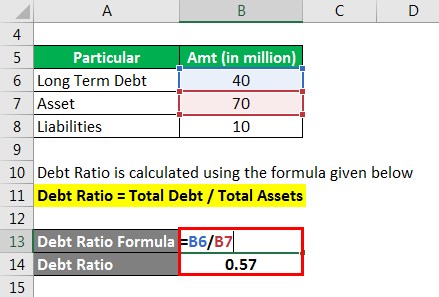

Debt Ratio is calculated using the formula given below

Debt Ratio = (Debt + Liabilities) / Total Assets

- Debt Ratio = 50 /70

- Debt Ratio = 0.71

So we can see that the debt is greater than 50% in either calculation method, therefore, the assets that are financed by equity are lower than those financed by debt and this is not a good sign for the investors if they are more risk-averse.

A ratio of lower than 50% implies greater equity contribution, which is less risky for risk-averse investors as there are lower liabilities that need to be paid even when the company is incurring losses.

What Does Debt Ratio Indicate?

- Financial Position: The ratio implies how much of the assets are financed by debt or liabilities and therefore we can derive how much of the assets are financed by equity. A ratio of less than 0.5 would mean that the company has a greater proportion of owned capital in comparison to borrowed one and the opposite is true when it comes to a ratio greater than 0.5

- Capital Structure Measure: Companies have a desired capital structure work towards achieving the same, therefore periodic monitoring of this ratio is a common practice and it also helps in determining how much more debt is acceptable without going over the board and disturbing the capital structure

- Riskiness of the Company: When there is already too much debt, any prospective debt holder would not want to take on a subordinate debt or would require a greater return on the same because this ratio conveys how risky the investment is and higher the amount of existing debt, riskier is the investment.

Advantages and Disadvantages

Below are the points to explain the advantages and disadvantages of the same:

Advantages

- The determinant of Estimated Available Profit for Equity Holders: Analysts can look at the prior years’ profits and make an estimate of the current year’s profit but deducting the interest expense from the same. Interest expense is fixed and can be calculated from the debt ratio and balance sheet information on the percentage of interest. This expectation can lead to analysts planning their investment into the company

- Keeps a Check on Debt Levels: Once the companies have this number in front of them and the targeted capital structure, they can restrict taking on unwarranted levels of debt because they would be aware that the assets of the company are not sufficient to pay off additional debt. If that is the case then the ratio helps in keeping a check on debt levels of the company.

- Can Indicate when a Company Should Borrow More: Companies with a very low debt ratio could mean that the company is missing out on the available growth opportunities. There it acts as a reminder for the companies to increase debt and benefit from quicker growth and tax savings as the interest on the debt is tax-deductible

Disadvantages

- Calculation Methodology: The ratio can be calculated in different manners and as explained earlier and therefore, before drawing any comparisons between two companies, adjustment is required to be made to the ratios for bringing them to a comparative level. Finding the inclusions and the method of calculation makes such comparison cumbersome

- Varies from One Industry to Another: The ratio varies from one industry to another as various industries have different needs for capital. Those Industries which require a huge investment in fixed assets, generally have a higher ratio because initially the amount of capital required might be too huge for a company to raise a through equity. Therefore the ratio doesn’t facilitate inter-industry comparison

Conclusion

Therefore, we are now aware that the Debt ratio is a type of leverage ratio and is one of the constituents of the category called the Gearing ratio. It facilitates a comparison between companies and therefore helps the prospective investors in determining the investment suitability. The ratio acts as a barometer of the risk of the company and thereby enables it to address the risk levels if the ratio is very high to keep attracting a larger pool of investors.

There are several calculation techniques of the ratio which makes it necessary for the investor to carefully go through the same in the process of drawing a comparison and also a prerequisite of such a comparison is that the companies should be in the same industry and have similar stature, that is ensuring an apple to apple comparison so that the outcome of such a comparison is meaningful.

Recommended Articles

This is a guide to the Debt Ratio. Here we discuss how to calculate along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –