Updated July 21, 2023

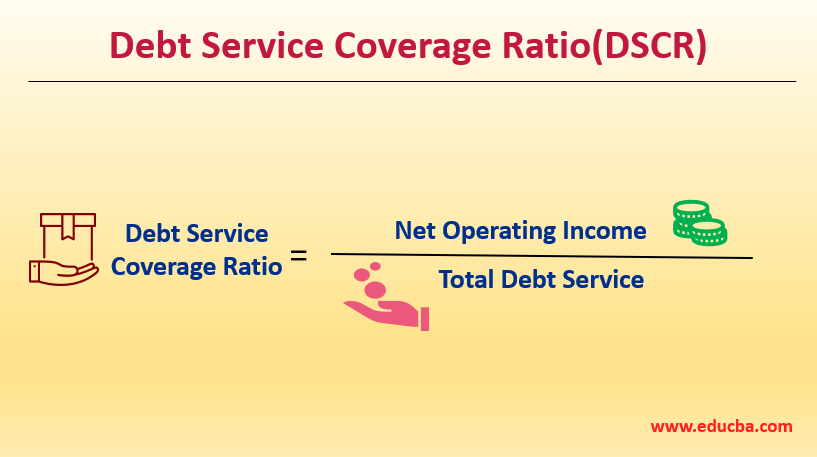

Definition of Debt Service Coverage Ratio

The term “debt service coverage ratio” or simply “DSCR” refers to the financial metric that measures the ability of a company to cover its scheduled debt repayment obligations (sum of interest and principal payment).

In other words, DSCR assesses whether the cash flow available is adequate to pay off the debt repayment obligations of the company.

Formula

The formula for DSCR can be expressed as net operating income (EBITDA) divided by the total debt service. Mathematically, it is represented as,

Examples of Debt Service Coverage Ratio (With Excel Template)

Let’s take an example to understand the calculation of the Debt Service Coverage Ratio in a better manner.

Example #1

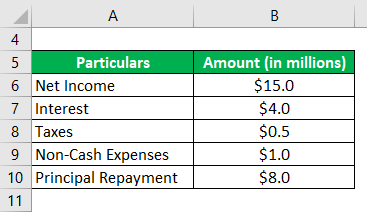

Let us take the example of a company to illustrate the concept of DSCR. During 2019, the company booked net income of $15.0 million, while it incurred interest expense of $4.0 million and paid taxes of $0.5 million. The depreciation & amortization expense for the period was $1.0 million. Calculate the DSCR of the company if its principal repayment for the period was $8.0 million.

Solution:

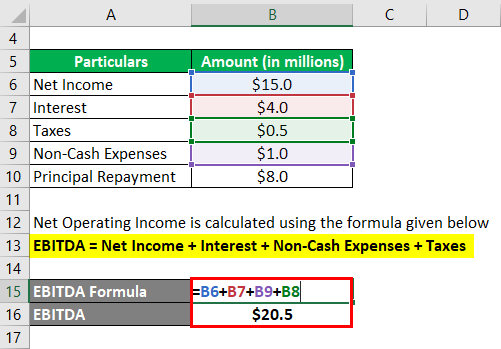

Net Operating Income is calculated using the formula given below

EBITDA = Net Income + Interest + Non-Cash Expenses + Taxes

- EBITDA = $15.0 million + $4.0 million + $1.0 million + $0.5 million

- EBITDA = $20.5 million

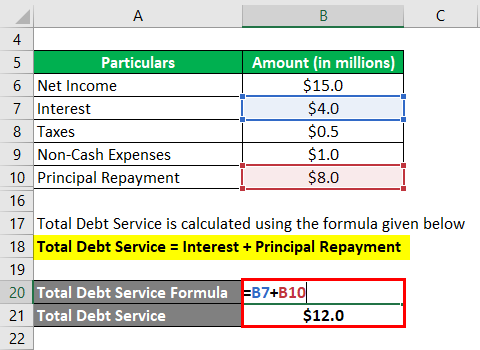

Total Debt Service is calculated using the formula given below

Total Debt Service = Interest + Principal Repayment

- Total Debt Service = $4.0 million + $8.0 million

- Total Debt Service = $12.0 million

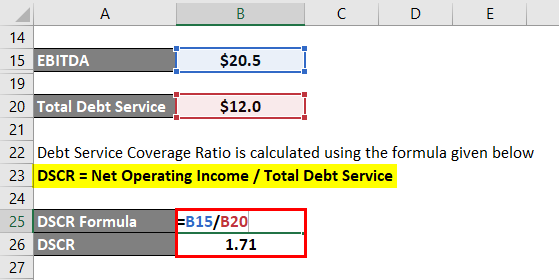

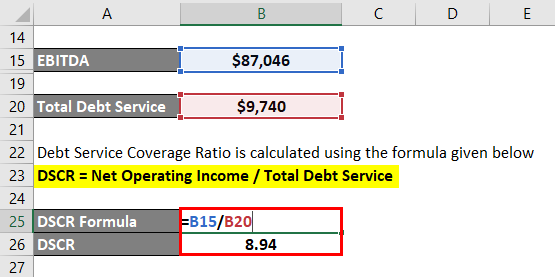

Debt Service Coverage Ratio is calculated using the formula given below

DSCR = Net Operating Income / Total Debt Service

- DSCR = $20.5 million / $12.0 million

- DSCR = 1.71x

Therefore, the company’s DSCR for the year 2019 was 1.71x.

Example #2

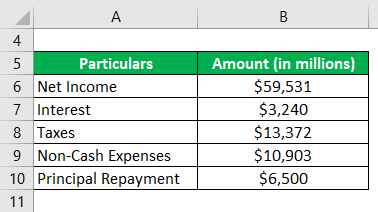

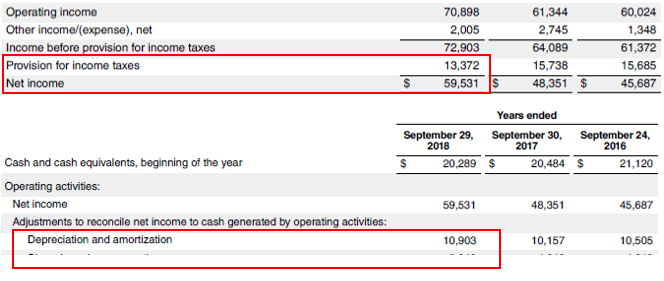

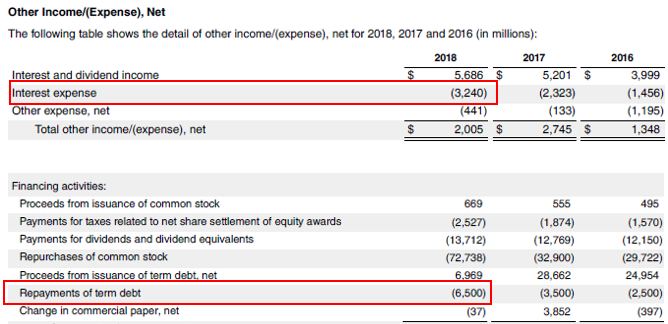

Let us now illustrate the computation of DSCR using the example of Apple Inc. During 2018, the company booked a net income of $59,531 million, while it incurred interest expense of $3,240 million, depreciation & amortization of $10,903 million and paid taxes of $13,372 million. Compute Apple Inc.’s DSCR for the year 2018 if the principal repayment for the period was $6,500 million.

Solution:

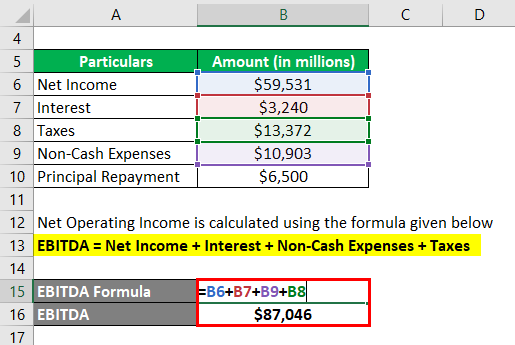

Net Operating Income is calculated using the formula given below

EBITDA = Net Income + Interest + Non-Cash Expenses + Taxes

- EBITDA = $59,531 million + $3,240 million + $10,903 million + $13,372 million

- EBITDA = $87,046 million

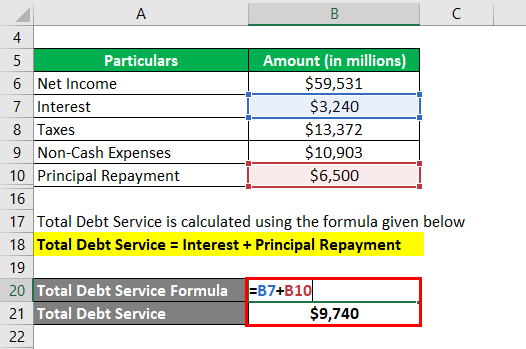

Total Debt Service is calculated using the formula given below

Total Debt Service = Interest + Principal Repayment

- Total Debt Service = $3,240 million + $6,500 million

- Total Debt Service = $9,740 million

Debt Service Coverage Ratio is calculated using the formula given below

DSCR = Net Operating Income / Total Debt Service

- DSCR = $87,046 million / $9,740 million

- DSCR = 8.94x

Therefore, Apple Inc.’s DSCR for the year 2018 was 8.94x.

Screenshot of income statement used for calculation

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for DSCR can be derived by using the following steps:

Step 1: Firstly, compute the cash flow available for debt service or net operating income of the company, which is the summation of net income, interest expense, non-cash expenses (such as depreciation and amortization) and taxes paid. Net operating income is also known as EBITDA.

Net Operating Income (EBITDA) = Net Income + Interest + Non-Cash Expenses + Taxes

Step 2: Next, compute the value of total debt service during a given period, which is the aggregate of interest expense incurred and principal repayment.

Total Debt Service = Interest + Principal Repayment

Step 3: Finally, the formula for DSCR can be derived by dividing the net operating income (step 1) by the total debt service (step 2) as shown below.

DSCR = Net Operating Income / Total Debt Service

Difference Between DSCR and FCCR

Both DSCR and fixed charge coverage ratio (FCCR) are considered to be key indicators of a company’s gearing level and liquidity position. However, since these two metrics convey somewhat similar meanings, it is very easy to confuse one with the other. So, it is important that as an analyst you understand the fundamental difference between the two. The key differences between DSCR and FCCR are:

- DSCR assesses the cash flow available for servicing only the debt obligations, while FCCR measures the company’s ability to pay off the outstanding fixed charges. The fixed charges can include anything costs such as lease payments, preferred dividend payments, and insurance payments.

- DSCR is computed by using net operating income (EBITDA), while FCCR computation uses operating income (EBIT).

DSCR = EBITDA / (Interest + Principal Repayment)

FCCR = (EBIT + Fixed Charges) / (Interest + Fixed Charges)

Advantages and Disadvantages of Debt Service Coverage Ratio

Below are the advantages and disadvantages:

Advantages

Some of the major advantages of DSCR are:

- It is a good indicator of a company’s historical liquidity position and reflects if there has been any instance of potential debt repayment default.

- Lenders usually use this metric for project-based companies where they check whether the expected cash inflow will be adequate to cover the scheduled debt repayment.

- It helps banks to make decisions on loan proposals. If the DSCR of a company is less than 1.0x then it indicates that there is a high probability that the company won’t be able to meet the debt obligation. In such a case, a lender may either decline the loan proposal or increase the collateral requirement.

Disadvantages

Some of the major disadvantages of DSCR are:

- There is no benchmark as to what can be considered to be a comfortable level of DSCR and as such, it is exposed to a greater degree of subjectivity.

- The ratio fails to incorporate other sources of funding that can be used to repay the debt obligation. It purely focuses on operational cash flow for debt serviceability. Companies in their initial stage often resort to promoter funding rather than operational cash flow.

Conclusion

So, it can be concluded that DSCR is one of the most important liquidity ratios for banks and other financial institutions as it gives an idea about the ability of a company to cover its debt obligations.

Recommended Articles

This is a guide to Debt Service Coverage Ratio. Here we discuss how to calculate DSCR along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –