Updated July 27, 2023

Debt to Equity Ratio Formula (Table of Contents)

Debt to Equity Ratio Formula

The term “debt to equity ratio” refers to the financial ratio that compares the capital contributed by the creditors and the capital contributed by the shareholder.

In other words, the ratio captures the relationship between the fraction of the total assets that have been funded by the creditors and the fraction of the total assets that have been funded by the shareholders. The formula for debt to equity ratio can be derived by dividing the total liabilities by the total equity of the company. Mathematically, it is represented as,

Examples of Debt to Equity Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Debt to Equity Ratio in a better manner.

Debt to Equity Ratio Formula – Example #1

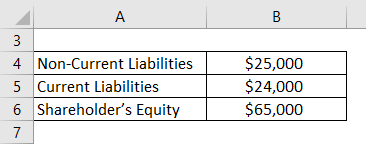

Let us take a simple example of a company with a balance sheet. Calculate the debt-to-equity ratio of the company based on the given information.

Solution:

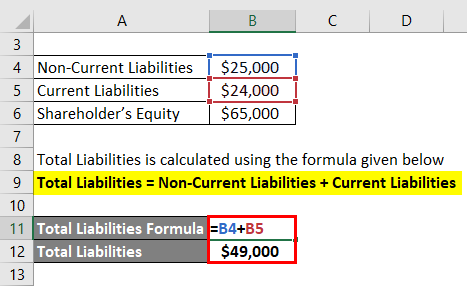

Total Liabilities is calculated using the formula given below

Total Liabilities = Non-Current Liabilities + Current Liabilities

- Total Liabilities = $25,000 + $24,000

- Total Liabilities = $49,000

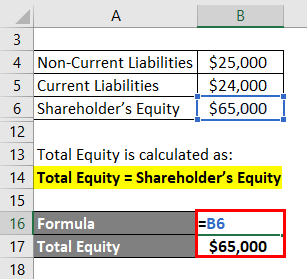

Total Equity is calculated as:

Total Equity = Shareholder’s Equity

- Total Equity = $65,000

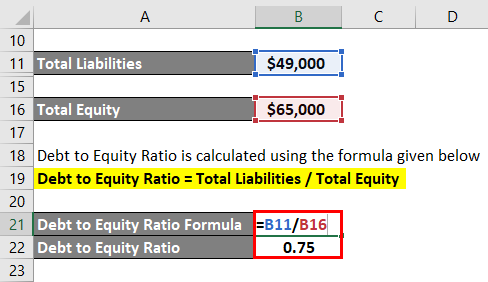

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Liabilities / Total Equity

- Debt to Equity Ratio = $49,000 / $65,000

- Debt to Equity Ratio = 0.75

Therefore, the debt-to-equity ratio of the company is 0.75.

Debt to Equity Ratio Formula – Example #2

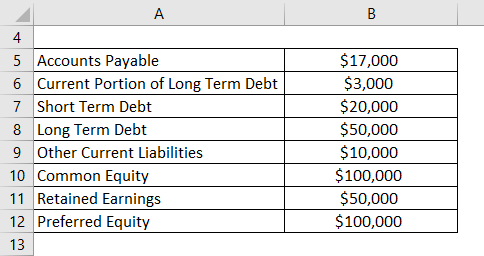

Let us take the example of XYZ Ltd which has published its annual report recently. As per the balance sheet as on December 31, 2018, information is available. Calculate the debt-to-equity ratio of XYZ Ltd based on the given information.

Solution:

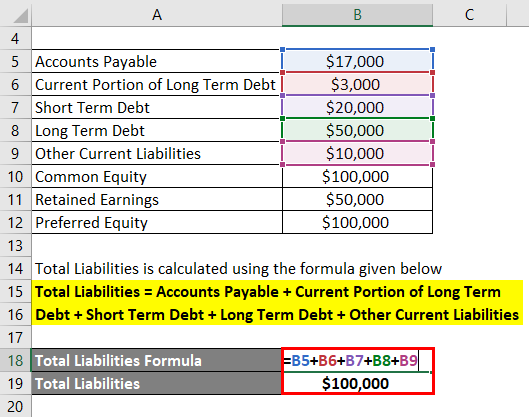

Total Liabilities is calculated using the formula given below

Total Liabilities = Accounts Payable + Current Portion of Long Term Debt + Short Term Debt + Long Term Debt + Other Current Liabilities

- Total Liabilities = $17,000 + $3,000 + $20,000 + $50,000 + $10,000

- Total Liabilities = $100,000

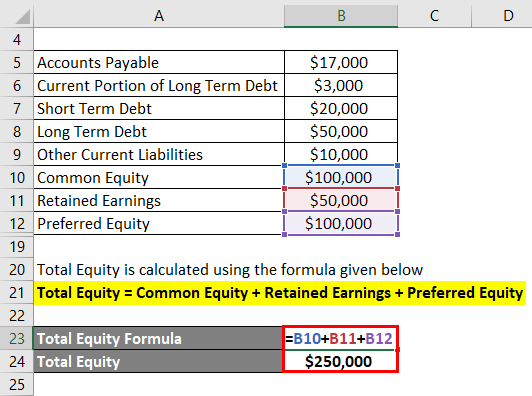

Total Equity is calculated using the formula given below

Total Equity = Common Equity + Retained Earnings + Preferred Equity

- Total Equity = $100,000 + $50,000 + $100,000

- Total Equity = $250,000

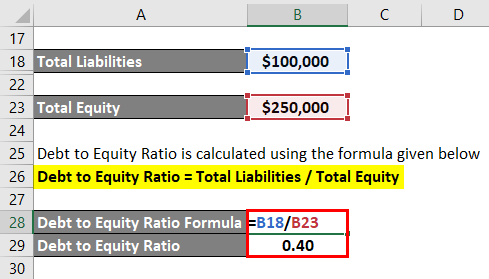

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Liabilities / Total Equity

- Debt to Equity Ratio = $100,000 / $250,000

- Debt to Equity Ratio = 0.40

Therefore, the debt-to-equity ratio of XYZ Ltd stood at 0.40 as on December 31, 2018.

Debt to Equity Ratio Formula – Example #3

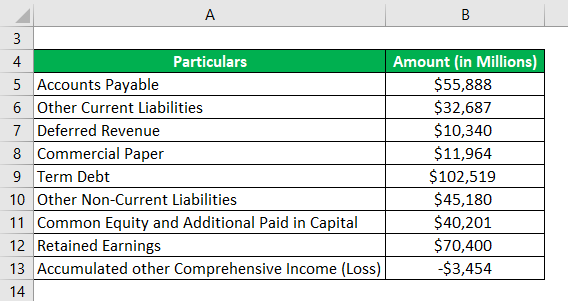

Let us take the example of Apple Inc. to calculate the debt to equity ratio as per its balance sheet dated September 29, 2018. The following financial information (all amounts in millions) is available:

Solution:

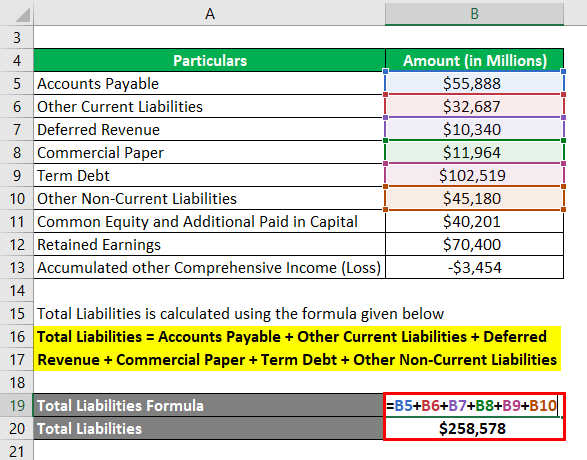

Total Liabilities is calculated using the formula given below

Total Liabilities = Accounts Payable + Other Current Liabilities + Deferred Revenue + Commercial Paper + Term Debt + Other Non-Current Liabilities

- Total Liabilities = $55,888 + $32,687 + $10,340 + $11,964 + $102,519 + $45,180

- Total Liabilities = $258,578

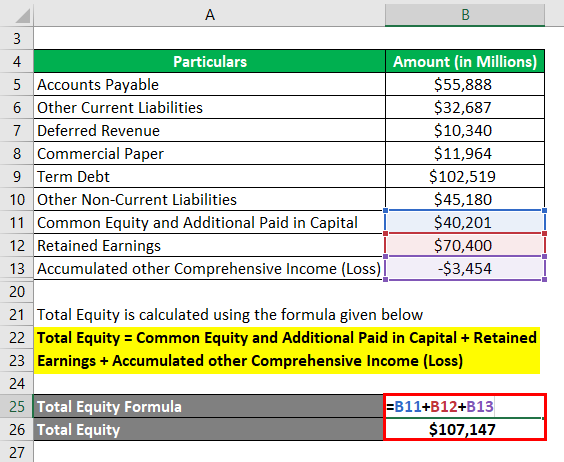

Total Equity is calculated using the formula given below

Total Equity = Common Equity and Additional Paid Capital + Retained Earnings + Accumulated Other Comprehensive Income (Loss)

- Total Equity = $40,201 + $70,400 – $3,454

- Total Equity = $107,147

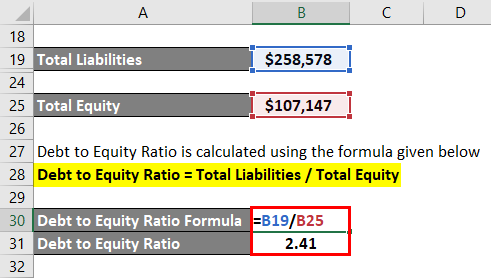

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Liabilities / Total Equity

- Debt to Equity Ratio = $258,678 million / $107,147 million

- Debt to Equity Ratio = 2.41

Therefore, the debt-to-equity ratio of Apple Inc. stood at 2.41 as on September 29, 2018.

Explanation

The formula for debt to equity ratio can be derived by using the following steps:

Step 1: Firstly, calculate the total liabilities of the company by summing up all the liabilities which is available in the balance sheet. Examples of liabilities include accounts payable, long-term debt, short-term debt, capital lease obligation, other current liabilities, etc.

Step 2: Next, calculate the total equity of the company by adding up all that is available under shareholder’s equity and some examples of equity include common equity, preferred equity, retained earnings, additional paid-in capital, etc.

Step 3: Finally, the formula for debt to equity ratio can be derived by dividing the total liabilities (step 1) by the total equity (step 2) of the company as shown below.

Debt to Equity = Total Liabilities / Total Equity

Relevance and Uses of Debt to Equity Ratio Formula

From the perspective of lenders and credit analysts, it is important to understand the concept of debt-to-equity ratio because it is used to assess the degree to which an entity is leveraged. Typically, a relatively high debt-to-equity ratio signifies that the company is unable to make adequate cash vis-à-vis the debt obligations. On the other hand, a low value of debt to equity ratio can be indicative of the fact that the company is not taking advantage of financial leverage. Inherently, debt-to-equity ratios are higher for capital-intensive as compared to low-capital industries because the capital-intensive companies are required to incur regular capital expenditure in the form of new plants and equipment to operate efficiently. As such, it is always advisable to compare the debt-to-equity ratios of companies in the same industry.

Debt to Equity Ratio Formula Calculator

You can use the following Debt to Equity Ratio Calculator

| Total Liabilities | |

| Total Equity | |

| Debt to Equity Ratio | |

| Debt to Equity Ratio | = |

|

|

Recommended Articles

This has been a guide to the Debt to Equity Ratio Formula. Here we discuss How to Calculate Debt to Equity Ratio along with practical examples. We also provide a Debt to Equity Ratio Calculator with a downloadable excel template. You may also look at the following articles to learn more –