Updated November 1, 2023

Difference Between Debt and Equity Financing

Debt vs Equity Financing are two ways businesses use to raise money. In debt financing, a company borrows money from banks or financial institutions and pays it back with interest. Whereas in equity financing, businesses sell a part of their ownership in the company to raise funds.

Debt will attract interest expenses that need to be paid by the company, and with equity, the cost will be claimed on earnings to the extent of shareholders’ ownership. Some companies choose debt financing per their business activities, requirements, and industry type, and some choose equity financing.

What is Debt Financing?

In simple words, debt financing means when a borrower borrows money from a lender. In return, lenders charge Interest on the debt, where an entity issues a debt instrument to the financer to raise money. (For example, Company ABC Ltd needs $200,000 of financing to extend the business; hence they issue bonds to take out a $200,000 bank loan at 10.75% per annum). There are various advantages of debt financing. The lender won’t interfere in the business activity, and Interest expenses will be charged under the income statement as it is tax-deductible. With any advantages, it also has some disadvantages, as your business does not perform well and fails in its ideas. Still, debt is a liability, and the company is bound to pay debt and interest charges in any situation.

What is Equity Financing?

Equity financing is a convenient source of financing where the company raises capital by issuing equity shares to investors. The main benefit of equity financing is there is no such obligation to repay the amount to an investor or any scheduled payments like Interest in case of debt. When the company earns good profits, it grows, increasing the price of shares. This benefits the equity shareholders; they also sell the share to other parties and can convert it into cash. Any family, friends, or venture capitalist can invest in your business idea. Equity shareholders enjoy voting rights, which is very important to participate in business activity; voting power will be to the extent of shares held by the shareholders.

Equity financing is important in specific industries and businesses like tech startups. (For example, Company ABC Ltd needs $200,000 of financing to extend the business; hence they issue 20000 equity shares of $10 each to raise $200,000 for an investor, Mr. Y, who wants to invest in the industry.)

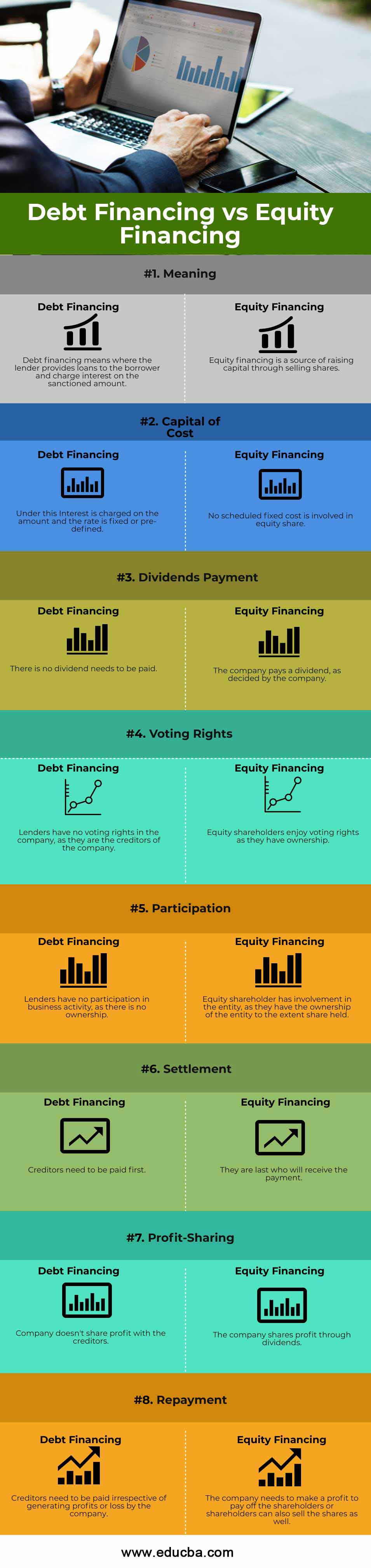

Debt Financing vs Equity Financing Infographics

Below are the top 8 differences between Debt and Equity financing:

Key Differences

Let us discuss some of the primary key differences between Debt and Equity financing:

- Debt means raising capital from the lender by issuing some debt instruments at a fixed interest rate. In contrast, equity financing is a source where the company presents the money by selling equity shares to investors.

- Debt is a cheap source of financing as compared to equity financing. Debt expenses are charged as expenses; hence, it helps in tax savings. At the same time, there is no such case in equity financing as it is a convenient source of financing.

- In case of the dissolution of the company, creditors will get their amount first, and equity shareholders will be the last to get the amount.

- Equity shareholders have ownership of the company to the extent of shares held. Creditors don’t have any ownership of the entity.

- Creditors get interest expenses, which are fixed or pre-defined, whereas in the case of equity financing company pays a dividend to the investors when declared by the company.

- Equity shareholders have voting rights; hence, they can cast their votes for business activity done by the company. In the case of debt, voting rights are not available.

- In the case of debt, the company must pay the interest expenses irrespective of profits or losses generated by the company. In the case of equity financing, shareholders receive the dividend (declared by the company).

Comparative Table

| Basis of Comparison | Debt Financing | Equity Financing |

| Meaning | Debt financing means when the lender provides loans to the borrower and charges interest on the sanctioned amount. | Equity financing is a source of raising capital through selling shares. |

| Capital of Cost | Under this, Interest is charged on the amount, and the rate is fixed or pre-defined. | No scheduled fixed cost is involved in equity share. |

| Dividends Payment | No dividend needs to be paid. | The company pays a dividend, as decided by the company. |

| Voting Rights | Lenders have no voting rights in the company, as they are the company’s creditors. | Equity shareholders enjoy voting rights as they have ownership. |

| Participation | Lenders have no participation in business activity, as there is no ownership. | Equity shareholders are involved in the entity, as they have ownership of the entity to the extent of the share held. |

| Settlement | Creditors need to be paid first. | They are the last who will receive the payment. |

| Profit-Sharing | The company doesn’t share profit with the creditors. | The company shares profit through dividends. |

| Repayment | Creditors need to be paid irrespective of generating profits or losses by the company. | The company needs to make a profit to pay off the shareholders, or shareholders can also sell the shares. |

Conclusion

As we have gone through both the types of financing and the significant differences between them, the entity can choose whichever source of funding they want as per their need; both financing have their merits and demerits. If they don’t want the obligation to pay regular interest expenses, they can pitch to investors to get invested in your idea. It also depends on the industry. But every company should ensure that to take the benefits of leverage. It does not pay the high cost of capital. Every business can strategize how much capital they want to raise by issuing equity shares (Equity Financing) and how much capital from secured or unsecured loans (Debt Financing).

Recommended Articles

This is a guide to Debt vs Equity Financing. Here, we discuss the Debt and Equity Financing differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –