What Is Deferred Compensation?

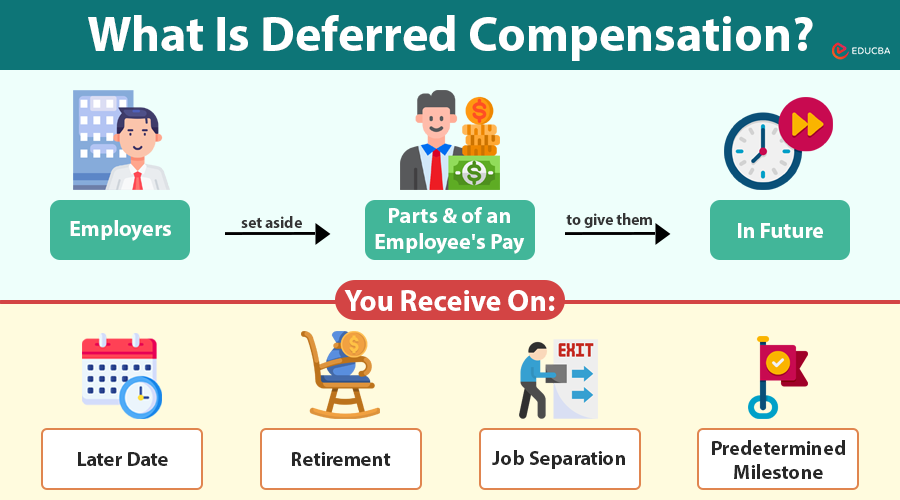

Employers save a portion of an employee’s earnings to pay later as deferred compensation. Instead of receiving the full salary upfront, employees agree to receive part of it in the future, typically after retirement or when they leave the company.

The concept of deferred compensation is straightforward; instead of receiving your full paycheck today, you agree to postpone part of your earnings until a later date, often retirement, job separation, or a predetermined milestone.

For example, Raj, a senior software engineer, earns $150,000 a year. He agrees to defer $30,000 into a deferred compensation plan to manage his taxable income. This means he will receive $120,000 this year and the remaining $30,000—possibly with investment gains—when he retires. He pays tax on the $120,000 now and delays tax on the rest.

Why Is Deferred Compensation Useful?

Deferred compensation serves multiple financial planning and business goals. It offers employees a way to build wealth, defer taxes, and prepare for retirement. It gives employers a powerful tool to retain top talent, especially in competitive industries.

Key Advantages:

- Lower tax burden now: Employees can avoid higher tax brackets by reducing their current taxable income.

- Long-term planning: Deferred amounts grow over time and offer a predictable income stream post-retirement.

- Employer loyalty: These plans often come with vesting schedules, incentivizing employees to stay with the company.

Types of Deferred Compensation

Deferred compensation comes in two primary forms:

1. Qualified Deferred Compensation

These plans comply with ERISA regulations and IRS guidelines. They are offered to all eligible employees and typically include protections like guaranteed vesting and bankruptcy security.

Common Types:

- 401(k) plans: Employees contribute pre-tax income; employers may match.

- 403(b) plans: Similar to 401(k)s but for public education and nonprofit employees.

- Traditional pensions: Employers promise a specific payout upon retirement.

Pros:

- Contributions grow tax-deferred

- Funds are protected in a trust

- Regulated and transparent.

Cons:

- Contribution limits (e.g., $23,000 for 401(k) in 2025)

- Less flexibility in structuring payouts.

2. Non-Qualified Deferred Compensation (NQDC)

Companies typically offer non-qualified deferred compensation (NQDC) plans to executives, partners, and key employees. These plans are not subject to ERISA’s strict rules, allowing for high customization.

Common Types:

- Top Hat Plans

- Supplemental Executive Retirement Plans (SERPs).

Pros:

- No contribution limits

- Flexible payout and vesting structures

- Useful for high-income earners who have maxed out qualified plans.

Cons:

- Not protected if the company declares bankruptcy

- Requires trust in the employer’s financial health.

How Does Deferred Compensation Work?

A deferred compensation plan follows a simple but structured process:

- Plan agreement: The employer and employee sign a contract outlining the deferred amount, schedule, investment options, and distribution triggers.

- Deferral phase: The agreed amount is withheld from the employee’s paycheck and invested in a designated account.

- Growth period: The funds may earn interest or returns based on the investment choices, similar to a retirement account.

- Distribution phase: Employers pay out the funds when specific events occur, such as retirement, resignation, or reaching a specified age, as outlined in the plan’s terms.

Some plans allow lump sum payouts, while others spread it across several years to manage the tax impact.

Tax Implications of Deferred Compensation

Tax treatment is one of the main reasons employees opt for deferred compensation.

For Employees:

- No tax on deferred income until it is received.

- Investment gains are also tax-deferred.

- If retirement income is lower, you may be in a lower tax bracket and save money.

For Employers:

- Employer does not take a deduction until the employee receives the compensation.

- Helps manage immediate payroll expenses.

- Can be structured to encourage long-term employment.

Benefits of Deferred Compensation

Deferred compensation provides financial, strategic, and psychological benefits that extend beyond traditional salary structures.

For Employees:

- Tax efficiency: Save more for the future while reducing current tax bills.

- Retirement planning: Complements 401(k), IRA, and other plans.

- Income smoothing: Spread post-retirement income over the years.

- Investment growth: Funds grow tax-deferred, leading to compounding benefits.

For Employers:

- Retention tool: Encourages long-term commitment.

- Succession planning: Useful in grooming future leaders with vested interests.

- Payroll flexibility: Helps manage current payroll load without reducing total compensation.

Risks and Drawbacks

Despite the benefits, it has potential downsides you should be aware of:

- Employer solvency risk: In NQDC plans, you could lose the funds if your employer fails.

- Delayed gratification: You will not have access to the funds during emergencies.

- Investment risks: Returns are not guaranteed unless the plan offers fixed options.

- Tax timing risk: If payouts happen during high-income years, your tax liability could increase.

Who Should Consider Deferred Compensation?

Not all employees are eligible or suited for these plans. However, if the following applies to you, it might be worth considering:

- Earning over $150,000 annually

- Already maxing out 401(k) or IRA contributions

- Have long-term employment plans with your current employer

- Comfortable with locking funds for future use

- Need an additional layer of retirement savings.

How is Deferred Compensation Different from a 401(k)?

| Feature | Deferred Compensation | 401(k) Plan |

| Contribution Limits | Flexible in NQDC | Capped annually |

| Access to Funds | Restricted, delayed | Loans/early withdrawals allowed (penalties apply) |

| Risk | Higher (NQDC tied to employer) | Lower (assets held in trust) |

| Tax Treatment | Deferred until payout | Deferred on contributions and earnings |

| Customization | Highly flexible | Standardized options |

Customization Options in Deferred Compensation

This is where deferred compensation shines, especially in NQDC plans. They can be tailored to fit individual financial goals.

Common Customization Features:

- Vesting schedules: Encourage retention (e.g., 5-year cliff vesting).

- Distribution triggers: Retirement, disability, death, specific dates.

- Payout format: Lump sum vs. annual installments (tax smoothing).

- Investment options: Stocks, mutual funds, fixed-income instruments.

This level of control is rare in traditional retirement vehicles.

How to Set Up a Deferred Compensation Plan?

For Employers:

- Partner with a benefits consultant or financial advisor.

- Decide eligibility criteria and types of plans (qualified or non-qualified).

- Set up legal documentation that is compliant with IRS and ERISA (if applicable).

- Clearly communicate the plan to employees.

For Employees:

- Thoroughly review the contract and understand the payout schedule.

- Clarify vesting terms and distribution triggers.

- Seek tax advice to ensure alignment with your overall financial goals.

- Monitor investment performance and employer health.

Pro Tips to Maximize Your Deferred Compensation Plan

- Diversify your retirement strategy: Combine with 401(k), IRAs, and taxable investments.

- Time your payouts: Structure distributions to avoid overlapping with high-income years.

- Revisit your plan annually: Adjust accordingly as your life stage or income changes.

- Consider spousal planning: If married, coordinate with your partner’s income to optimize tax efficiency.

New Trends

Modern companies are now integrating deferred compensation into broader employee financial wellness ecosystems. These include:

- Mobile apps with real-time investment tracking

- AI-driven tax optimization tools

- Personalized dashboards for future income projections

- Education modules for financial literacy.

This helps employees make smarter decisions and increases plan engagement and retention.

Final Thoughts

Deferred compensation is more than just a financial tool—it is a strategic career and retirement planning decision. If you are a high-income professional or executive with long-term plans at your current company, it offers immense potential for tax savings and future income security.

However, before committing, always weigh the risks, employer stability, and liquidity needs.

Frequently Asked Questions (FAQs)

Q1. Is deferred compensation guaranteed?

Answer: Not always. Qualified plans are protected, but non-qualified plans are subject to the employer’s financial health.

Q2. Can I change my deferral election later?

Answer: Changes are tightly regulated under IRS rules and often require significant lead time.

Q3. What happens if I die before receiving the deferred compensation?

Answer: Most plans allow beneficiaries to receive the payout based on the plan agreement.

Q4. Can self-employed individuals use deferred compensation?

Answer: They can create similar structures via defined benefit plans or solo 401(k)s, but not in the traditional employer-sponsored NQDC sense.

Recommended Articles

We hope this article helped you understand the meaning, types, and benefits of deferred compensation. Explore these recommended articles to learn more about retirement planning, tax strategies, and executive compensation trends.