Difference Between Deficit vs Debt

Generally, a country’s revenue is not always enough to run the whole country itself. Most of the time, a country’s expenses for its development are not fully possible only with its revenue. It always takes the help of other countries or financial institutions. Therefore, the effectiveness of a country’s government & development is mainly assessed with the help of deficit vs debt. Both Deficit and Debt may sound the same. But both are different terminologies.

What is a Deficit?

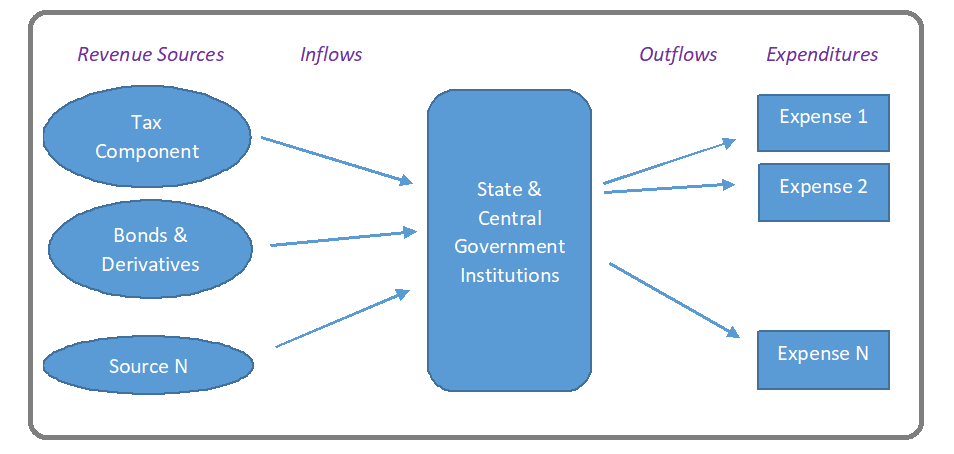

A deficit is a common word in the Income and Expenditure accounts. The word Deficit is defined as excess expenses spent over the revenues at a particular period of time. It denotes the quantum of the amount. It is used while preparing Budget Proposals by the state and Central governments. Generally, Deficit is a term used in Non – Profitable organizations. This Deficit is money that sits on the Balance sheet while preparing the yearly assessments. The time period differs for each Government organization based on the year period. It can be a calendar year, Academic year, Final year, or Assessment year. The deficit is a running statement for a particular period.

In this example, If Inflow < Outflow, it is Deficit. IF Inflow>Outflow, the surplus is an excess of production or more than what is needed or used left over after meeting the requirements. During the Budget proposals, certain plans implements to reduce the Deficit in the coming year, such as Increased Interest rates, Increased Tax %, etc. However, when a deviation in the estimated budget happens, it always results in a Deficit.

What is Debt?

Debt means the Sum of money borrowed by the Central government from other countries’ Financial Institutions or banks to fulfill the Deficit. Simply put, it’s a loan amount owed from others with obligations to repay later regularly. Debt is not a limited term for only Government bodies. It generally occurs at the level of Personal Banking itself. In addition to money, Personal Debt can also be any item or service. Debt describes as the sum of the Deficit amount that happened in previous years. In accountancy, Debt occurs in the Profit and Loss Account and Balance sheet while preparing the Trial Balance for a particular period of time for a particular person or a company or state /central government department.

Based on the Lenders, it is of two types:

- Internal Debt: If the loan amount is taken within the same country.

- External Debt: Financial help is outside the country, such as International Financial Institutions, World Bank, etc.

There is a common aspect of Debt in society. Debt always means Negative. “It’s not like that”. Based on its effect, it is of 2 types.

- Good Debt: Here, the loan amount is used as an investment that will grow in value and produce income for a longer period. We can take Housing Loans, Educational Loans, etc., as an example.

- Bad Debt: Here, the Owed amount does not generate any longer period income or grow in value. The best example is a Credit card.

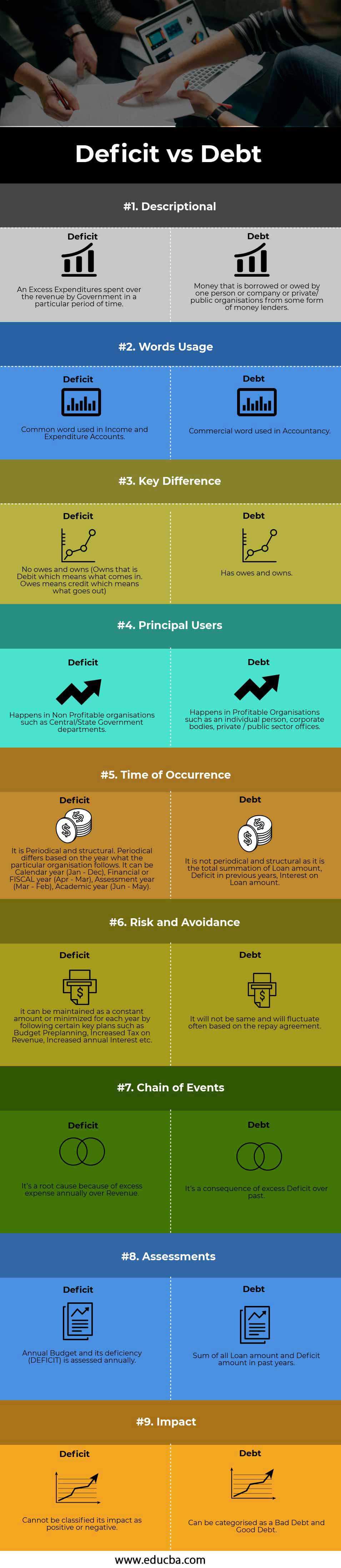

Head To Head Comparison Between Deficit vs Debt (Infographics)

Below is the top 9 difference between Deficit vs Debt:

Key Differences Between Deficit vs Debt

Both Deficits vs Debt are popular choices in the market:

- The Deficit defines as a deviation of a country’s income and its expenses. At the same time, Debt is the sum of all Loan amounts owed by one person or company or private/ public organizations from some form of the moneylender.

- The deficit is an annual excess expenditure amount spent over its revenue. The Debt represents the total outstanding due amount that occurred as a deficit over past years and the present year’s new loan amount.

- If the money is spent pre-planned, at least the Budget Deficit can remain the same as periodical and structural. But Debt cannot be the same as it is not cyclical.

- The deficit is for a single year, but Debt is not for a single year; it’s the accumulation of past and present Loan amounts.

Deficit vs Debt Comparison Table

Below are the 9 topmost comparisons between Deficit vs Debt

| Basis of Comparison |

Deficit |

Debt |

| Descriptional | Excess Expenditures spent over the revenue by the Government in a particular period of time. | Money borrowed or owned by one person or company or private/ public organizations from some form of money lender. |

| Words Usage | A common word used in Income and Expenditure Accounts. | A commercial word used in Accountancy. |

| Key Difference | No owes and owns (Owns that is Debit which means what comes in. Owes means credit which means what goes out). | Has owes and owns. |

| Principal Users | Happens in Non Profitable organizations such as Central/State Government departments. | Happens in Profitable Organisations such as a person, corporate bodies, and private/public sector offices. |

| Time of Occurrence | It is Periodical and structural. Periodical differs based on the year that the particular organization follows. It can be a Calendar year (Jan – Dec), Financial or FISCAL year (Apr-Mar), Assessment year (Mar – Feb), or Academic year (Jun-May). | It is not periodical and structural as it is the total summation of a Loan amount, Deficit in previous years, and Interest on a Loan amount. |

| Risk and Avoidance | It maintains as a constant amount or minimizes yearly by following key plans such as Budget pre-planning, Increased Tax on Revenue, and Increased annual Interest. | It will not be the same and will fluctuate often based on the repayment agreement. |

| Chain of Events | It’s a root cause because of excess expense annually over Revenue. | It’s a consequence of excess Deficit over the past. |

| Assessments | The annual Budget and its deficiency (DEFICIT) assess annually. | The sum of all Loan amounts and Deficit amounts in past years. |

| Impact | It cannot be classified impact as positive or negative | It categorizes as a Bad Debt and Good Debt. |

Conclusion

It is always good to have less Deficit vs Debt for the Good economy of a Country. Having zero Deficit in the balance sheet and Debt in the country shows excellent Development of an economy around all countries. It fully develops but is not practical in real scenarios.

Recommended Articles

This has been a guide to the top differences between Deficit vs Debt. Here we also discuss the Deficit vs Debt key differences with infographics and comparison table. You may also have a look at the following articles to learn more –