Updated June 8, 2023

Definition of Defined Benefit Plan (US Pension)

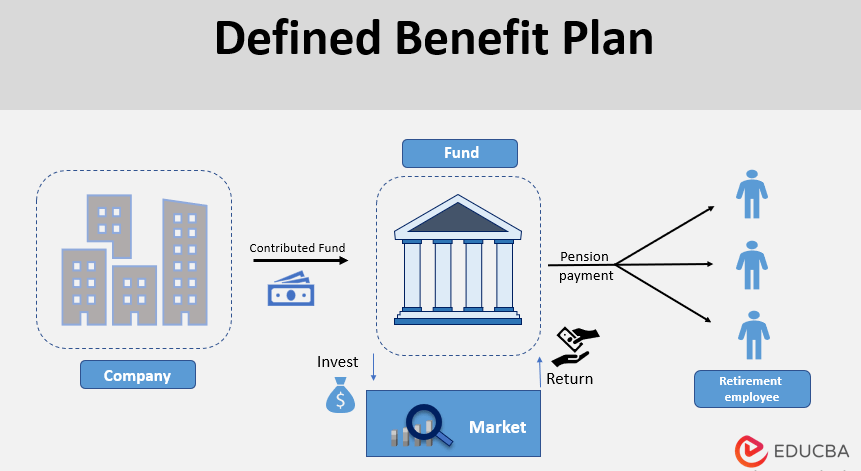

A defined Benefit Plan is an Employer-sponsored retirement plan where employee benefits are computed using a formula. The formula may differ from company to company. However, generally, it includes employment tenure and salary. The critical part in defining the benefit plan is you would know what amount of funds would be deducted toward the pension reserve and how many pensions per month you would get on retirement.

Suppose you are 25 years of age, freshly graduated, with an annual salary of $ 60,000. Your employer supports the Defined Benefit plan, and you are informed that $500 will be deducted monthly from your salary multiplied by years in service. Assuming you would retire on turning 60. Hence this leads to a working tenue for 35 years. Therefore, you would get a monthly pension of $ 17,500 (35*500) until your death when you retire.

It is also essential to understand that you would save $ 6,000 for 35 years in your pension account every year, which adds to a corpus of $ 210,000. You would surely earn interest in your savings. These savings, i.e., Pension funds, are managed by professionals and highly regulated. Hence this gives you a surety that your pension income is guaranteed.

Upon retiring, you have two options to select from:

- To opt for monthly income till you die, called annuity payments.

- Getting the investment amount on a lump-sum basis would lead you to manage your funds till you retire.

Defined Contribution Plan

A defined Contribution Plan is a plan in which an employee and employer contribute funds or a percentage of income equally.

Let’s understand the topic by knowing the human life cycle.

The picture symbolizes 5 phases, from Baby to Teen to Old age. We aim to earn money and live a happy life fulfilling our goals. Most US citizens start working on attaining Teenage. After a university degree, an average American starts with full-time employment with an average salary of $ 56,000 Per year. As of April 2019, the US employed 129.21 Million1 people. You would wonder why I am explaining this because our working ability decreases as age increases. Leading to income reductions with only an increase in expenses.

There will be a time when we will be replaced by someone else, and that age is retirement. The retirement phase is mostly when we are financially dependent on our family, children, or government. Hence, to avoid such dependency, we have a concept of saving called a Pension. When you receive your social security number and take up employment, some of your income will be deducted and deposited with a pension house/pension fund company.

You would get savings (Pension) under two scenarios:

- On reaching your retirement age – Generally, the retirement age in the US is 60.

- Death or permanent disability to work

Points to Remember – Defined benefit plans (DBP) are better and mostly preferred for workers and employers because the program is considered more secure than the Define contribution plan (DCP) as its pensions can be easily predicted to cost employers less than what DCP costs.

Advantages of Defined Benefit Plans

Let’s look at how much an employee and employers would benefit because everyone has one ultimate goal: to reduce costs and maximize returns. Therefore, employees aim for maximum returns, while employers strive for minimum costs.

Advantages for Employees:

- The employee would know their retirement amount in advance (from the day it signs the DBP contract).

- Benefits are indifferent to stock market risk/fluctuations or increase/decrease in bond yield.

- Compared with DCP, the Defined Benefit Plan generates a higher return on investments, including premature/ accidental death benefits to family members.

- The stable and risk-free nature of The Defined Benefit Plan leads to a higher workforce in the organization. This promotes loyalty and helps to retain valued staff.

- As these funds are a collective investment and professionally managed, the savings generate higher returns with relatively less expense (cost of hiring a portfolio manager, administration charges, etc.).

Disadvantages of Defined Benefit Plans

Given below are the disadvantages mentioned:

- Employees don’t control the funds, meaning they don’t know where their funds are invested. Investment experts handle these decisions.

- Employees know how much they will get on retirement; they do not have the option to increase their retirement benefits.

Conclusion

As soon as you get your social security number and take up employment, start contributing towards your Pension, i.e., retirement planning. The Employee Retirement Income Security Act (ERISA), enacted in 1974, ensures that a government agency named the Pension Benefit Guaranty Corporation (PBGC) provides insurance guarantees for defined benefits plans. Our research shows that Defined Benefit Plans are more cost-effective for all stakeholders, i.e., government and taxpayers, and have a proven record in meeting the employees’ retirement needs.

The plan is cost-effective because it averages risk over many participants instead of reducing it by higher contribution as necessary in DCP. Historically, the Defined Benefit Plan has generated higher returns on its investment with lower fund management fees. In simple terms, of 1 dollar paid in Pension to the pensioner, about 65 to 80% comes from its investment returns and not the principal he invested during his earning age. I.e., of $ 17,500 received on turning 60, he would have contributed just $ 3500 rest is his interest accumulation over 35 years of tenure. Due to this, young workers opt to define Benefits plans and prefer to invest in public pension funds instead of privately managed ones.

Key Note:

According to a survey conducted in 2008 in West Virginia, which included 79% of teachers who voted to switch from DCP to DBP, 70% of the voters in this survey were under 40.

Recommended Articles

This has been a guide to What is a Defined Benefit Plan and its Definition. Here we discuss the Defined Contribution Plan with its Advantages and Disadvantages. You can also go through our other suggested articles to learn more –