Updated July 17, 2023

Definition of Defined Contribution Plan

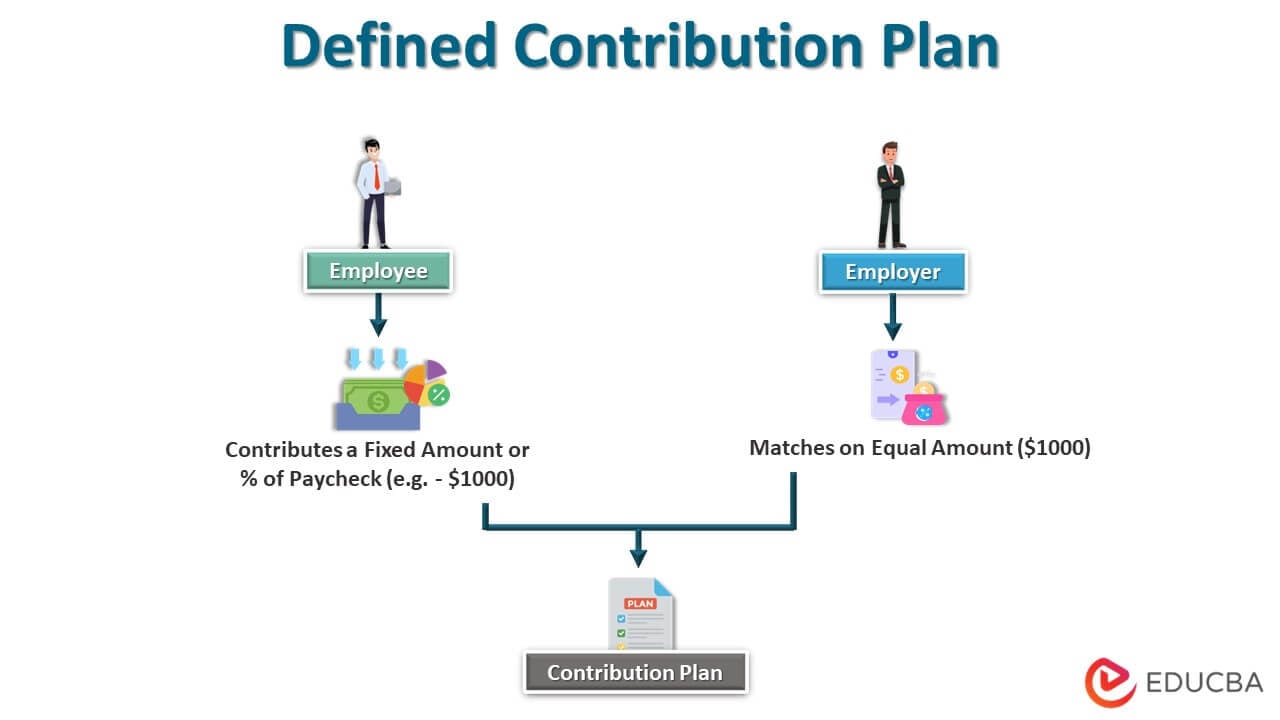

A defined Contribution Plan is one of the most common and popular methods of pension arrangement between Employer and employee. It is a type of retirement plan under which the Employer contributes a fixed amount of sum of money which is based on certain factors related to the employee compensation, years in service, and so on, and an equal amount is contributed by the employee as well in the employee retirement account which is usually managed by an Independent entity.

Any fluctuation in gains or losses arising out of Investment in such an account is the employee’s sole responsibility, and employees take the entire investment risk.

Explanation

Under a Defined Contribution Plan, the Employer and employee contribute an equal specified amount, usually a certain percentage of the employee’s Base Salary, to an Independent Retirement Fund Account every month. Fund managers make investment decisions related to such funds as per the choice undertaken by employees. Regardless of the returns generated by such Funds, the Employer doesn’t have to make good any loss suffered by an employee on account of such Investment returns.

How Does It Work?

Under a typically defined contribution plan, the final returns are uncertain and depend upon the contribution and asset returns which fluctuate based on market performance.

Let’s understand this with a simple example where an employee is contributing a fixed sum of $1000 per year, and an equal amount of $1000 is also contributed by the Employer. This amount will get invested every year in a retirement fund, and actual returns will depend upon the asset class in which these funds are invested year on year.

Thus defined contribution plan works based on the contribution and return on assets in which funds are invested.

Examples of Defined Contribution Plan

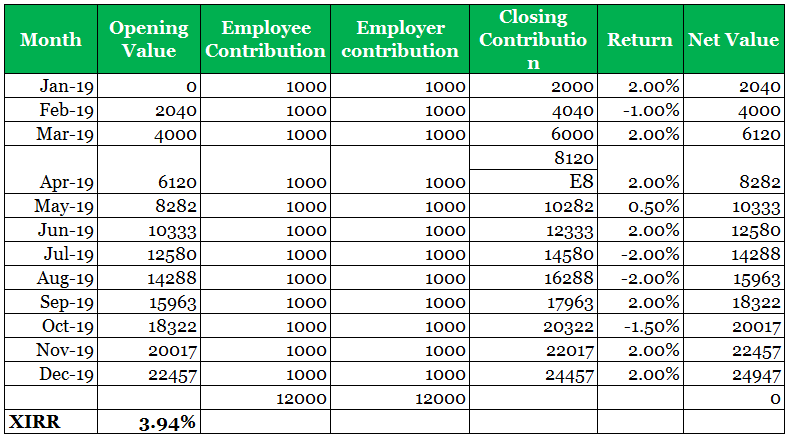

Mr. A was employed by ABC international from 1st Jan 2019 with a fixed emolument of $10000 monthly. The fixed contribution made by employees every month as part of the defined contribution plan is 10%, i.e., $1000, which is contributed equally by the Employer.

The contribution is invested in the s&p 500 fund by the retirement fund, which generates a xirr of 3.94% for the year 2019-20

Detailed contributions and monthly returns are shown below:

Thus it can be observed that defined contribution plan returns are dependent on assistance and return on assets.

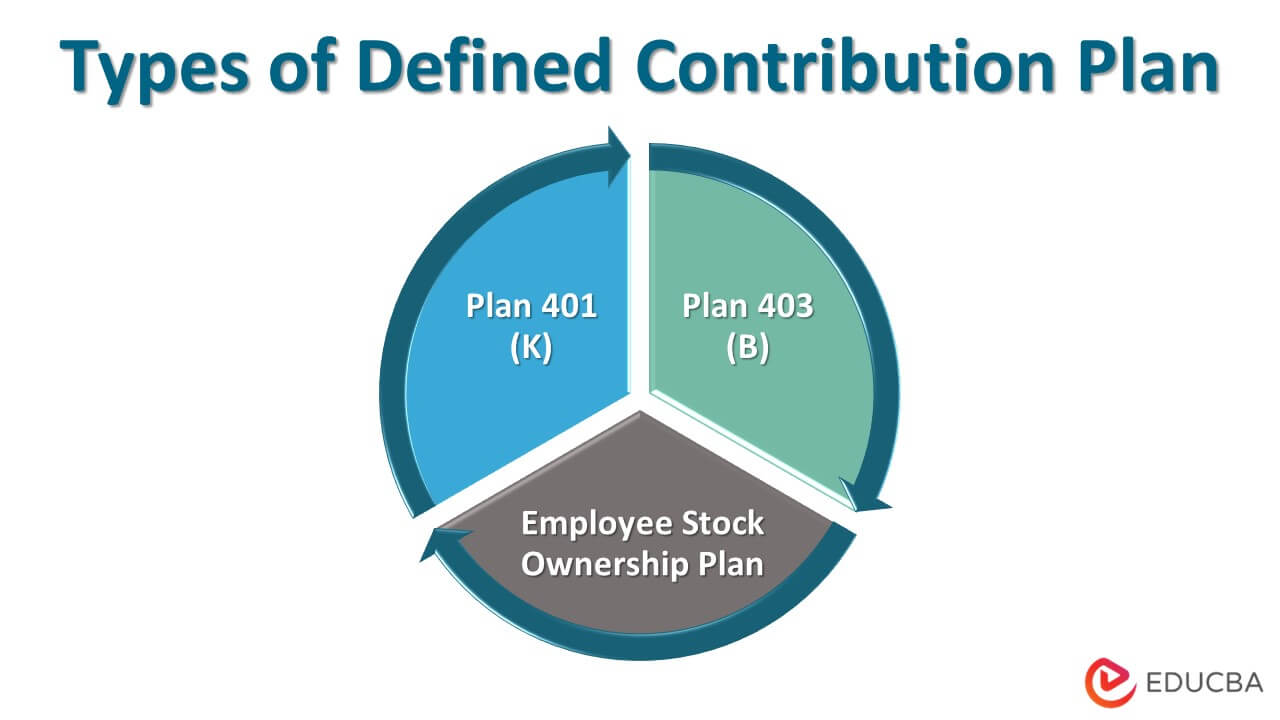

Types of Defined Contribution Plan

Popular types of defined contribution plans are as follows:

- Plan 401 (K): This is a popular defined contribution plan which involves deferring a part of the salary of the employee who contributed to this plan. Under this arrangement, the employee must make their investment allocation decision independently. It is provided to an employee who is employed under companies and businesses which are public.

- Plan 403 (B): Another type of plan similar to plan 401 (k), which also provides tax advantage benefits to the investor. It is offered to employees who are employed under a non-profit organization.

- Employee Stock Ownership Plan: As the name suggests, employees are provided with stock options based on specific criteria. This is usually common for start-up firms and IT companies.

Besides these plans, specific country-specific defined contribution plans cater to the same purpose. For instance, in India, the national pension scheme (nps) is a defined contribution scheme that is tax-efficient and open for enrollment for private and public sector employees, including self-employed people.

How to Invest in a Defined Contribution Plan?

An employee can contribute to a defined contribution plan in two ways, namely:

- As part of the employer-sponsored plan, employees and employers will contribute an equal amount every month.

- Voluntarily, the employee can contribute to avail income tax benefits which vary from jurisdiction to jurisdiction. For instance, in India, an employee can voluntarily contribute an amount equal to rs 50000 and avail of income tax benefit under the relevant section of 80ccd of the income tax act over and above the standard tax exemption limit of rs 150000 available under section 80c of the income tax act.

Advantages

It offers multiple advantages. A few noteworthy are enumerated below:

- It limits the retirement liability of employers towards employees.

- It reduced the administrative cost for the Employer as financial reporting requirements are significantly less in the case of a defined contribution plan and involve a straightforward entry into income statements like pension expenses.

- It benefits the employee as they can decide the Investment per their risk appetite and choice of the asset class.

- Unlike the defined benefit plan, a defined contribution doesn’t result in an uncertain liability for the business as it doesn’t form part of the balance sheet.

- It can be withdrawn up to a subject limit on certain occasions, such as marriage, house purchase, etc., during the employee’s lifetime.

Disadvantages

Despite certain advantages, it has certain disadvantages, as enumerated below:

- It requires the employee to make investment decisions that may not be possible for all employees and may lead to a wrong investment decision.

- Unlike a defined benefit plan, it doesn’t guarantee a fixed pension amount and leads to more insecurity for retirement planning.

- It is entirely market-driven, which makes it prone to market risk.

Conclusion

A defined contribution plan is a straightforward pension plan under which the Employer contributes a fixed sum based on certain factors such as compensation and years of service into a third-party managed independent retirement fund account on behalf of the employee. Such funds are managed on behalf of employees and regulated by law. For the Employer, this pension plan provides ease of accounting and certainty regarding pension liability, unlike defined benefit plans where determining liability is uncertain. For the employee, it gives the freedom to choose as per their investment style and asset allocation preference.

Recommended Articles

This is a guide to the Defined Contribution Plan. Here we also discuss the definition and how does defined contribution plan work, along with its advantages and disadvantages. You may also have a look at the following articles to learn more –