What is Deflation?

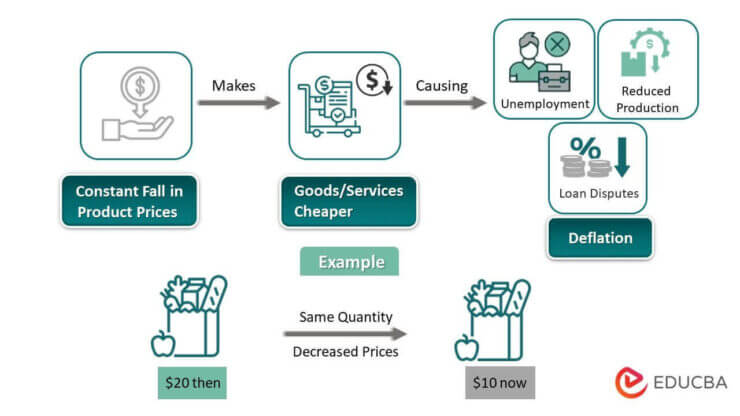

Deflation is when the prices of goods and services go down over time instead of going up. This means that people can buy more things with the same amount of money. Therefore, people may hold off on buying things because they expect prices to go down further, which leads to less demand and less production.

This can cause businesses to lay off workers, which further decreases demand and creates a cycle of economic decline.

Key Highlights

- Deflation happens due to an imbalance in the economy on the demand or supply side that brings a decline in the price of goods and services.

- It typically happens when supply exceeds demand in the market, forcing producers to reduce prices to meet the new demand.

- The International Monetary Fund (IMF) officially acknowledges the state of deflation if it prevails for over two semesters.

- The advantage is that goods become more affordable as the price of the goods and services declines.

How Does Deflation Work?

Step #1 Oversupply

There is an increase in the supply of goods and services in an economy.

Step #2 Fall in price

The supply of goods and services outweighs their demand, making many goods and services available to the general public at a lower price than before.

Step #3 Lower money supply and fewer profits

The overall money supply in the economy decreases, and companies decide to lower their prices to remain competitive in the market. Trade falls, and the money supply decreases.

Step #4 Layoffs & Unemployment

Companies start to lay off employees, causing unemployment in the economy.

Step #5 Decreased spending

With most individuals losing their jobs, households lose their income and thus decrease their normal spending levels.

Step #6 Falling demand

With decreased spending, an economy’s demand for goods and services falls further.

How is Deflation Measured?

There are a couple of ways to measure deflation, which are:

Consumer Price Index (CPI)

- It checks the shifts in prices of various goods and services that residents frequently buy, including apparel shopping, traveling expenses, healthcare, food, and shelter.

- Government agencies publish CPI regularly and use it to frame taxation, benefits, and remuneration.

Wholesale Price Index (WPI)

- It is the difference between retail and wholesale prices and tracks the overall rate of change in the cost of manufacturing goods and services.

- Economists set the base price for calculating WPI at 100. They use this base price to measure subsequent increase or fall in wholesale prices.

Real-World Examples

#1 China

A global crisis impacted the US and UK, and as a result, banks began to close down. Consequently, the situation compelled the countries to cut down on consumption, as they struggled to cope with the economic turmoil As a result, declining demand for Chinese goods in the US and UK further led to the closures of factories and unemployment in China. In 2008, the price of food products dropped by 14%, and the cost of consumer goods decreased by 10%. To top that, the price of industrial products fell by 11%, which established a state of deflation in the economy.

#2 Ireland

Beginning in January 2008, the cost of living began to fall by 6.6% every month for a year, which ultimately led to deflation in the Irish economy in 2009. There was an overall fall of 1.7% in consumer prices. The Irish economy experienced such an economic downfall for the first time since 1960. As per the Irish finance minister, there was no notable cause of deflation.

Causes of Deflation

Reduction in Business Revenues

As businesses generate lesser and lesser revenues, there is a fall in trade in an economy. Consequently, weak trade emerges as one of the major causes of economic decline.

Decrease in the Money Supply

When a market runs short of money supply, it becomes inactive and sluggish. Money supply fuels trade and growth. Without it, an economy faces deflationary periods.

Fewer Demands for Goods

One of the most common reasons is the lesser demand for goods and services. People in an economy who find goods undesirable and not worth their money often decrease their spending substantially.

Increase in the Demand for Money

As the demand for a specific currency increases, its prices also increase. When a currency rises in value, the goods and services it can buy become comparatively cheaper, thus inviting deflation.

Variations in Consumer Spending

When customers diversify their spending, it becomes harder for sellers to project the demand for a particular product, often creating an oversupply situation. Over-supply of goods makes them cheaper and gives rise to deflation.

Reduced Stake in Investments

When the general public refuses to invest their hard-earned money in different avenues, their stake in investments reduces. An economy with a weak investment scenario often gives room for deflation.

Wage Cutbacks and Downsizing

When companies cut down wages and lay off employees to cut manufacturing costs and increase profits, they create a situation of unemployment. Unemployed individuals with no disposable income often cut down on their expenses. It leads to a lesser money supply in the market, further leading to deflation.

Effects of Deflation

Wage Reduction and Unemployment

- Falling prices compel businesses to cut costs and adapt to the market’s new quantity demands.

- It leads to an increase in the unemployment rate and wage reductions.

Customer Changes

- Although the price reduction is beneficial at first, in the future, it also impacts consumers as they start to cut down on their expenses.

- It further leads them to stop purchasing goods and services.

Economic Recession

- A recession happens in the affected economy due to the imbalance in the market.

- It happens due to the requirement to reduce expenses to adjust to the new level of sales and prices.

Bankruptcies

- When a large chunk of the population declares bankruptcy, citizens can easily see the loopholes in the system.

- It leads to widespread distrust among the citizens and further damages the economy.

Stagnation

- When an economy suffers deflation, it becomes stagnant and weak.

- The economy shows no signs of growth or improvement.

Excess Supply

- Consumers cut down on spending and don’t buy the products an economy has to offer.

- It leads to an excess supply of such products in the market.

Declining Business Profits

- When goods become undesirable to the public, companies must reduce prices to keep up with the competition.

- It leads to a fall in profit margins and a further fall in business profits.

Rise in Debts

- The economy witnesses a rise in debts as people are unemployed and need money to sustain themselves.

- Individuals turn to debt, hoping they will soon get jobs and pay back their debts.

Price Competitiveness

- With goods deemed undesirable by the public, companies get into cut-throat competition with their rivals regarding price.

- Price becomes the primary determinant of which company survives this deflationary period.

Declining Business Profits

- When goods become undesirable to the public, companies must reduce prices to keep up with the competition.

- It leads to a fall in profit margins and a further fall in business profits.

Rise in Debts

- The economy witnesses a rise in debts as people are unemployed and need money to sustain themselves.

- Individuals turn to debt, hoping they will soon get jobs and pay back their debts.

Price Competitiveness

- With goods deemed undesirable by the public, companies get into cut-throat competition with their rivals regarding price.

- Price becomes the major determinant of which company survives this deflationary period.

How to Tackle Deflation?

Governments use these strategies to avoid or tackle deflation:

Monetary policies

It involves the central bank increasing the money supply to increase aggregate demand. They also lower interest rates to stimulate the economy.

Fiscal policies

To stimulate demand for goods and services, the government increases its spending or decreases the taxes it charges to the people. However, this may lead to inflation, which is a potential consequence of such measures.

Quantitative Easing (QE)

The central bank issues fresh money through an electronic medium to purchase bonds and securities from the opening markets, thus boosting economic business.

Structural Reform

Government can introduce other supply-oriented reforms like easing restrictions related to the supply chain. It would improve the efficiency of an economy and help raise prices.

Deflation vs. Inflation vs. Disinflation

| Particulars | Deflation | Inflation | Disinflation |

| Meaning | Deflation is a decrease in the general price level of goods and services. | Inflation is the increase in the general price level of goods and services. | Disinflation is a decrease in the rate of inflation or, equivalently, an increase in deflation. |

| Causes | It may occur due to a decrease in aggregate demand or an increase in aggregate supply. | Inflation occurs when aggregate demand remains constant, but the supply decreases. | Disinflation occurs due to adverse supply shocks, like a sudden price rise. |

| Effects | Increases the ability of the general public to purchase and invest more money. | Decreases the ability of the general public to purchase and invest money. | Decreases the purchasing power of individuals but less than what happens in inflation. |

| Remedies | Governments employ monetary policies to increase the money supply and lower the interest rates in an economy. | Governments use monetary policies to decrease the money supply and increase an economy’s interest rates. | Implementing a mixture of policies stabilizes the economy. |

| Merits | Prices fall, making it cheaper for people to buy goods and services. | Slight inflation of up to 2% is ideal for business and economic growth. | It ensures stability in an economy with adequate supply and demand. |

Frequently Asked Questions (FAQs)

Q1. What are the types of deflation?

Answer: Deflation is of only two types: strategic and circulation. Strategic condition is due to the implementation of specific monetary policy by the government to slow down consumption in public. The Circulation type occurs naturally, without any government interference, due to unstable economic conditions in a country.

Q2. Who benefits from Deflation?

Answer: The consumers benefit the most from deflation. It increases their purchasing and investing powers. Since the prices of assets decrease, consumers can afford to make more significant purchases. They can also invest their surplus savings in various avenues.

Q3. Does Deflation hurt the rich?

Answer: Yes, it does hurt the rich citizens as their assets decline in value. In contrast, people with low investments and hard cash benefit more as they don’t own high-value assets.

Q4. Is deflation bad or inflation?

Answer: Deflation is worse than inflation because consumers expect prices to go even lower and wait to make significant purchases. As a result, demand falls, damaging the economy’s trade.

Recommended Articles

This is an EDUCBA guide to Deflation. To learn more, please refer to the recommended articles,