Updated July 21, 2023

Introduction to Delaware Corporation

Delaware Corporation can be defined as those companies with legal registration of conducting business in the state of Delaware in the US and may also conduct business in any state.

This law was adopted in the late 19th century when Delaware was in the phase of changing the rules to attract business from outside states too especially giving competition to New York, where significant businesses were conducted.

Delaware corporations are very famous in the US because of the business-friendly laws to which they are subjected, and almost half of the Standard & Poor’s 500 rated are present in Delaware. Finance companies, to be specific, are very popular here because of the higher charge of interest on loans that they charge from their customers, and Delaware corporations are allowed to do so. Delaware corporation rules give lenders greater freedom to charge higher interest on loans.

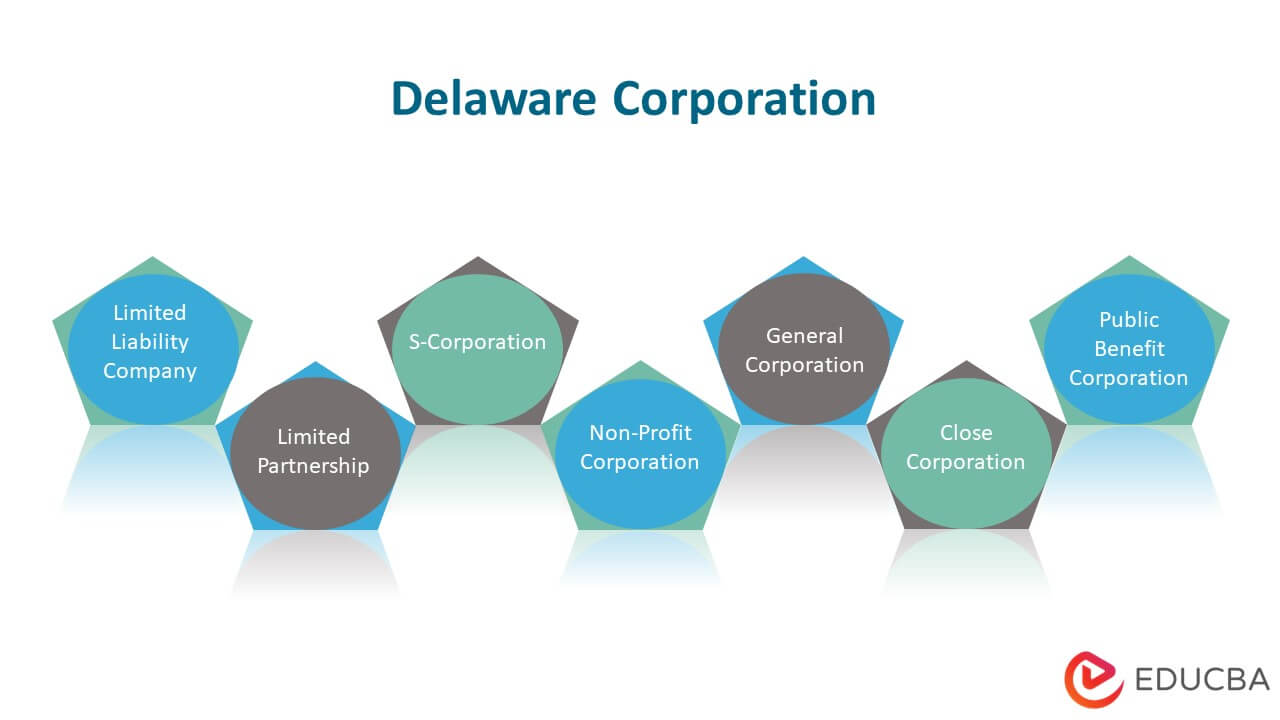

Types of Delaware Corporation

The different types of Delaware corporations are as follows:

1. Limited Liability Company

A Delaware LLC is registered with the specific Certificate of Formation with the Delaware Secretary of State. These corporations have meager start-up fees and a friendly tax rate. This setup offers the owners or members protection of their assets against liability or creditors, which means members are not responsible for liability more than the initial investment one has put into the LLC.

2. Limited Partnership

A Delaware Limited partnership firm includes more than one member or partner. General partners’ duties include general management function, and one or more members should be the ones who will not participate in the management function and are termed, limited partners. To conduct business, one has to obtain a Certificate of limited partnership from the Delaware Division of Corporations. General partners are responsible or liable for any financial obligations of the firm, whereas limited partners have no liability towards the firm’s debt or obligations.

3. S-Corporation

Delaware S-corporation is an entity that doesn’t pay federal taxes. An S-Corp needs to firm form a Delaware general or close corporation and then file for Form 2553 with the IRS. The IRS, upon approval, won’t tax such a corporation, but the tax liability will be passed to each shareholder by their proportionate ownership of the company.

4. Non-Profit Corporation

The firm needs to form first a Delaware nonstock business firm. These businesses have no shareholders, are owned by a limited set of members, and are non-profit firms. Members may have both voting and non-voting rights. Members can join by paying annual fees, or some firms may have strict rules and criteria for joining such firms. The non-stock firm, after this, has to file with IRS to gain a non-profit status by furnishing form 1023.

5. General Corporation

This is called C-Corp and is generally formed when the company plans to go public or IPO. This corporation is formed to lure in venture capital investments. The shareholders are the company owners but don’t contribute to managing the company.

6. Close Corporation

A Delaware close corporation is where shareholders, management, directors, and officers are the same people and are organized into a small, closed group. A closed corporation cannot have more than 30 shareholders. The closed corporation operates with all legal protection that a corporation enjoys.

7. Public Benefit Corporation

The public benefit company makes it mandatory to act ethically regarding society and the environment. The company is formed the same way a Delaware corporation is formed to ensure it works for the common public benefit.

Structure of Delaware Corporation

The Delaware Corporation primarily has three levels or tiers:

- Shareholders: They are generally considered to be the firm’s owners and are responsible for all significant decisions. They are the ones who own the shares of the corporation. These shareholders have power over the company’s common stock and voting rights to elect the board of directors.

- Directors: Directors are elected by owners or shareholders of the firm and are responsible for making significant decisions. They oversee the company and make critical managerial decisions.

- Officers: Officers are elected by directors and look over the day-to-day management of the corporation. They are generally the “President” of the firm or “Treasurer.”

Difference Between Delaware Corporation vs LLC

The Delaware Corporation or C-Corp requires a board of directors for its management, whereas an LLC doesn’t need it. LLC can be managed even by a single owner and doesn’t follow a hierarchical management structure. The prime difference arises in the governance structure. In the case of C-Corp, the management comprises three levels: shareholders, directors, and officers. In contrast, in the case of an LLC, there is a legal agreement called the operating agreement, which is a contract between all the members of the LLC.

Second is the ground of federal taxation. A Corporation has three choices of taxation, i.e., C-Corp, S-Corp, and Tax-exempt. In contrast, when it comes to LLC, there are only two choices, i.e., IRS considers a single member firm as a disregarded entity and a multi-member firm as a partnership agreement. The last and final grounds of difference can be based on privacy. A corporation requires providing the names and addresses of all directors in its annual statement, whereas an LLC has to provide very minimum information. It doesn’t have to give its members’ names and addresses.

Advantages and Disadvantages

Below are the advantages and disadvantages of Delaware Corporation:

Advantages

- Delaware Court of Chancery has high grounds of respect and is very well established. In any litigation, one gets a very experienced lawyer to resolve the problem.

- The corporation’s structuring can be done quickly because Delaware laws are very business-friendly.

- Delaware involves greater privacy as it doesn’t call upon declaring the names and addresses of directors.

- Investors have the high ground of faith in Delaware Corporations, and thus these corporations are also investor-friendly.

- Delaware has business-friendly taxation policies, which benefit the business operating under its umbrella.

Disadvantages

- One demerit can be if a business is doing business there but not headquartered in Delaware; it has to pay or follow the tax structure of both states of Delaware and the state where it is headquartered.

- One has to bear additional fees to do business in Delaware.

- Delaware Corporation requires additional annual reporting documents in addition to the state where a business may be headquartered.

Conclusion

Delaware Corporation has both benefits and demerits, but on looking closely, the benefits outweigh the demerits. It solely depends on the business firm at what point of the advantage they are looking for. The Delaware Corporation is well guided by the laws of Delaware State and offers a lot of flexibility in doing business.

Recommended Articles

This is a guide to Delaware Corporation. Here we discuss the introduction to Delaware Corporation with its types and structure with advantages and disadvantages. You can also go through our other related articles to learn more –