Updated July 27, 2023

Delta Formula (Table of Contents)

What is Delta Formula?

In the world of options or derivatives, the term “delta” refers to the change in the value of the option owing to the change in the value of its underlying stock.

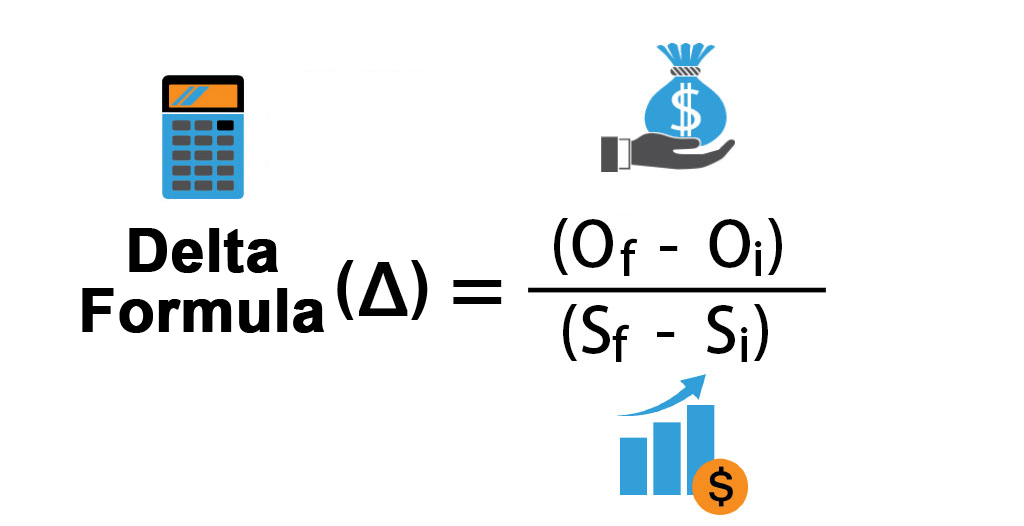

In other words, delta measures the rate of change of option value vis-à-vis the movement in the value of the underlying stock. Since delta is predominantly used for hedging strategies, it is also known as hedging ratio. The formula for delta can be derived by dividing the change in the value of the option by the change in the value of its underlying stock. Mathematically, it is represented as,

where,

- Of = Final value of the option

- Oi = Initial value of the option

- Sf = Final value of the underlying stock

- Si = Initial value of the underlying stock

Examples of Delta Formula (With Excel Template)

Let’s take an example to understand the calculation of Delta in a better manner.

Delta Formula – Example #1

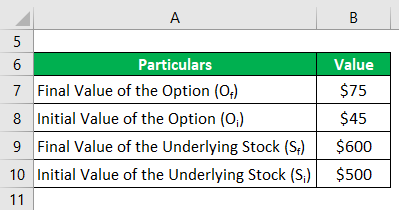

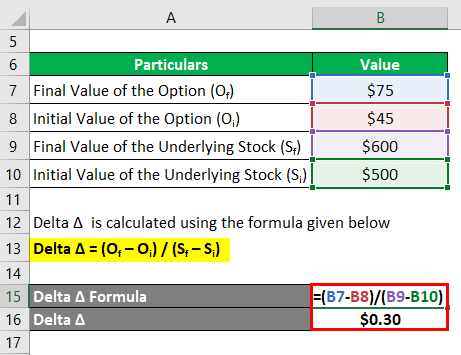

Let us take the example of a commodity X which was trading at $500 in the commodity market one month back and the call option for the commodity was trading at a premium of $45 with a strike price of $480. Now, currently, the commodity is trading at $600 while the value of the option has surged up to $75. Calculate the delta of the call option based on the given information.

Delta Δ is calculated using the formula given below

Delta Δ = (Of – Oi) / (Sf – Si)

- Delta Δ = ($75 – $45) / ($600 – $500)

- Delta Δ = $0.30

Therefore, the delta of the call option is $0.30 where a positive sign indicates an increase in value with the increase in underlying stock price value which is the characteristic of a call option.

Delta Formula – Example #2

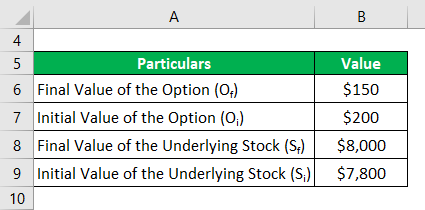

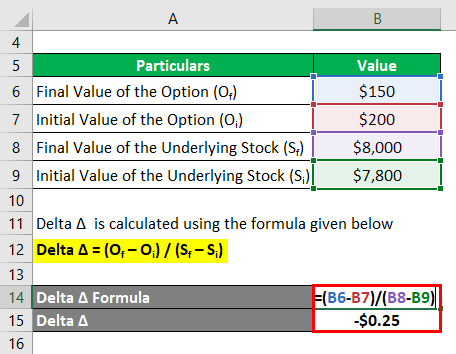

Let us take another example of a benchmark index which currently trading at $8,000 while the put option for the index is trading at $150. If the index was trading at $7,800 a month back while the put option was trading at $200, then calculate the delta of the put option.

Delta Δ is calculated using the formula given below

Delta Δ = (Of – Oi) / (Sf – Si)

- Delta Δ = ($150 – $200) / ($8,000 – $7,800)

- Delta Δ = -$0.25

Therefore, the delta of the put option is -$0.25 where a negative sign indicates a decrease in value with the increase in underlying stock price value which is the characteristic of a put option.

Explanation

The formula for delta can be calculated by using the following steps:

Step 1: Firstly, Calculate the initial value of the option which is the premium charged for the option. It is denoted by Oi.

Step 2: Next, Calculate the final value of the option which is denoted by Of.

Step 3: Next, calculate the change in the value of the option by deducting the initial option value (step 1) from the final option value (step 2).

Change in an Option Value, ΔO = Of – Oi

Step 4: Next, Calculate the initial value of the underlying stock which can be any company stock, commodity index or benchmark index, etc. It is denoted by Si.

Step 5: Next, Calculate the final value of the underlying stock which is denoted by Sf.

Step 6: Next, calculate the change in the value of the underlying stock by deducting its initial value (step 4) from its final value (step 5).

Change in the Value of the Underlying Stock, ΔS = Sf – Si

Step 7: Finally, the formula for delta can be derived by dividing the change in the value of the option (step 3) by the change in the value of its underlying stock (step 6) as shown below.

Δ = ΔO / ΔS

or

Δ = (Of – Oi) / (Sf – Si)

Relevance and Uses of Delta Formula

In the world of options and derivatives, the concept of delta (one of the Greeks) is a very important one because it helps in assessing the option pricing and the direction of the underlying stock. Delta can have either positive or negative values depending on the type of option we are dealing with, i.e. delta can be in the range of 0 to 1 for call options which means the call option value increases with the increase in the underlying, while it can be in the range of -1 to 0 for put options which means exactly opposite to that of call option. Delta is often used as a hedging strategy where the portfolio manager intends to build a delta neutral strategy so that the portfolio has almost zero sensitivity to any movement in the underlying. As such, delta is a good indicator of the investor community.

Delta Formula Calculator

You can use the following Delta Calculator

| Of | |

| Oi | |

| Sf | |

| Si | |

| Delta Δ | |

| Delta Δ = |

|

|

Recommended Articles

This is a guide to Delta Formula. Here we discuss how to calculate Delta along with practical examples. We also provide a Delta calculator with a downloadable excel template. You may also look at the following articles to learn more –