Updated July 12, 2023

What is Depreciation?

The following article provides an outline for depreciation. It is an allocated (allocation is based on the scientific method) fixed charge over the useful life of the tangible assets (i.e., physical assets only) wherein no cashflow is involved in the allocation and which represents the normal wear & tear of the asset due to usage of the tangible asset in the ordinary course of business of the organization.

Explanation

- “Tangible assets experience a reduction in value, which is referred to as depreciation.”

However, for intangible assets, we use the term “amortization.” - It is allocated in the profit & loss account over the asset’s useful life.

- The per annum allocation may or may not be the same, depending upon the method calculation of depreciation.

- The balance sheet presents the asset as “subtracting accumulated depreciation from the gross value.” The written down value (WDV) indicates the net value. The accumulated depreciation in the balance sheet reflects the amount of the asset utilized.

- It is charged since the asset is used annually for revenue generation.

Formula

The formula depends on the method in use. Following are the formulae for different methods.

1. Straight Line Method:

2. Diminishing Balance Method:

3. Double Declining Balance Method:

4. Units of Products Methods:

Example

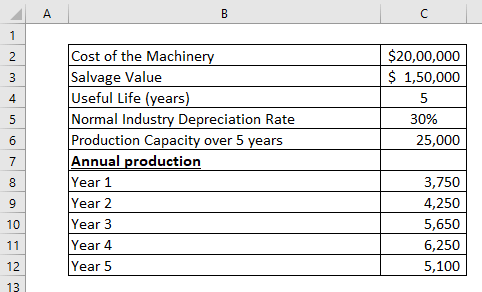

Let us look at the below example with calculations:

The company has the following information:

Solution:

Calculate as per different methods let’s. See the calculation for the first year

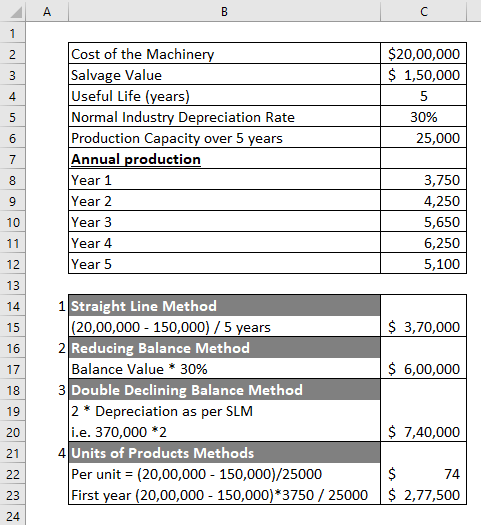

Chart:

The asset’s value at the end of the year is the salvage value for all the methods except the reducing balance method. The reason is that the dep rate (30%) needs to consider the asset’s life and salvage value.

Explanation:

- It is higher at the start of the year in the case of the reducing balance method but lower dep towards the end of the asset’s life. An asset is most efficient in its first year of operation.

- The double-declining method stops at 370,000 in year three, thereby retaining the salvage value within the asset’s block.

Types of Depreciation

Below are the four Types with explanations:

| Types | Explanation |

| Straight-line |

|

| Declining balance method |

|

| Double Declining method |

|

| Unit of products method |

|

Recording of Depreciation

The annual dep records in the books by the following journal entry:

| Depreciation expense (Debit) | XXXX |

| Accumulated Depreciation (Credit) | XXXX |

At the end of the year, the depreciation is transferred to the P&L account as follows:

| Profit & Loss Account (Debit) | XXXX |

| Depreciation expense (Credit) | XXXX |

The balance sheet shows a reduction in the cost of assets in the form of accumulated depreciation.

| Gross block of asset | XXXX |

| Less: Accumulated Depreciation | (XXXX) |

| Written Down Value | XXXX |

Why is Depreciation Used?

- The usual practice is systematically allocating capital expenses over the asset’s life.

- Higher dep expense represents the company’s aggressive accounting wherein the company wants most capital expenses to be wiped out as soon as possible.

- The primary intention behind playing with the depreciation method & figures is the management of tax outflow.

- Further, it can be rationalized with the revenue the company generates over a particular year.

- Lower dep also helps a company identify which assets must be replaced before the end of the year.

Advantages

- Allocation of expenses in the profit & loss account helps the company to analyze the profits of the company.

- The company can consider replacing the asset when the expense has been reduced over the years.

- There is no cash outflow in charging depreciation.

- Its allocation reduces the book profits & increases the cash profits. An increase in cash profits helps the company to accumulate amounts for future assets or business needs.

- No doubt, a reduction in income leads to a reduction in taxes.

- In the balance sheet, the asset is shown at gross value. Accumulated depreciation is shown as a negative value. This shows a better picture of financials.

Disadvantages

- Analysts never focus on depreciation figures. They often use the term” “EBITDA,” i.e., Earnings before interest, depreciation & amortization. Thus, this value has no relevance for analyzing the company value.

- An appropriate depreciation method is essential since it affects the business’s profits. The wrong depreciation method represents inaccurate results till the correction is made.

- It is based on the estimates of the salvage value of the life of an asset. Thus, incorrect estimation leads to inappropriate results in operation.

- The salvage value at the end of life may or may not represent the actual recovery of the asset.

Conclusion

It is a non-cash expenditure of the organization. Thus, many business decision-makers ignore this value due to their non-relevance. Thus, the allocation need not help every analyst. On the other hand, the company cannot expense out all the capital expenses in one year. Recent corporate laws resolve this double-sided issue wherein the companies must expense out the capital expense as soon as possible through a higher depreciation charge. Also, from the tax front, IRS allows only one method of depreciation to calculate taxable income. This is why small taxpayers prefer to use this method of the IRS in charging depreciation in books.

Recommended Articles

This is a depreciation guide. Here we discuss the introduction, types, examples, advantages, and disadvantages, along with a detailed explanation and downloadable Excel template. You can also go through our other suggested articles to learn more –