Updated July 4, 2023

What is Depreciation for Building?

Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear and tear, age, or obsolescence.

Economists use this reduction in value to calculate and record for the purpose of financial accounting. This allows a business or organization to reduce the cost of ownership of a fixed asset, thus reducing the taxes the company will pay on that fixed asset. Accounting for depreciation for buildings greatly impacts the profitability of the business.

For example, a company AXY, after purchasing a building for $1 Million, will deduct some of its prices annually to account for the depreciation. Doing so will help the company save money on income tax, as depreciation is deducted from the final income of the company.

Key Highlights

- Depreciation for buildings refers to a systematic reduction in the value of buildings, which a company does to accurately reflect its value in the financial books.

- Economists calculate depreciation by multiplying the depreciable basis with the rate of depreciation, where the Basis is the difference between the purchase price and salvage value of buildings, and the rate of depreciation is the rate at which a company depreciates its buildings after a certain period of time, usually a year.

- Accountants treat depreciation as an expenditure and deduct it from the final income of the company. This helps a company save money on income tax.

- Correctly accounting for depreciation helps a company to know where they stand financially. Knowing the value of their assets helps them plan their future ventures keeping in mind the efficiency of assets.

How does Depreciation for Building work?

Follow these steps for calculating depreciation:

Step #1: Determine the depreciable basis for buildings

A company must determine the depreciable basis by Subtracting the salvage value, which is the value of buildings at the end of their life, by purchasing the cost of buildings.

Step #2: Determine the rate of depreciation

A company can determine the depreciation rate for buildings by dividing the digit 1 by the expected useful life of buildings.

Step #3:Calculate the depreciation for buildings

A company can determine the depreciation for buildings by multiplying the outcomes of step 1 and step 2, that is, the depreciable basis and rate of depreciation.

It’s important to note that the depreciation for buildings is a complex area of tax law, and it’s advisable to consult with a tax professional to ensure that you are properly calculating and claiming your depreciation expenses.

Depreciation for Building Formula

The formula to calculate the depreciation for buildings is as follows,

Where,

- Depreciable basis is the difference between the purchase price and the salvage value of the building. Here, the purchase price is the cost at which a company bought the building, and the salvage value is the final value of building after deducting all the depreciation.

- The rate of depreciation is the rate at which a building is depreciated after a certain amount of time, usually a year. Economists calculate it by dividing 1 by the useful life of the building.

Depreciation for Building Examples

Example #1

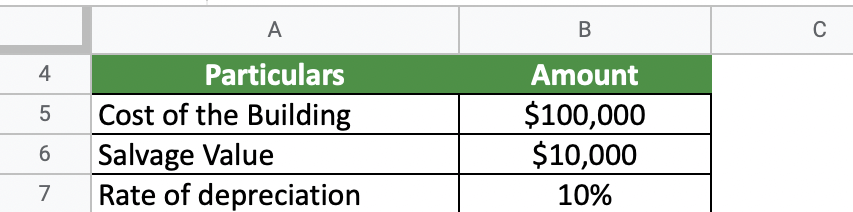

Mr. John purchased a commercial building worth $100000. It has a salvage value of $10,000 at the end of its life. The rate of depreciation is 10%. Calculate depreciation at the end of the building’s life.

Given,

Solution:

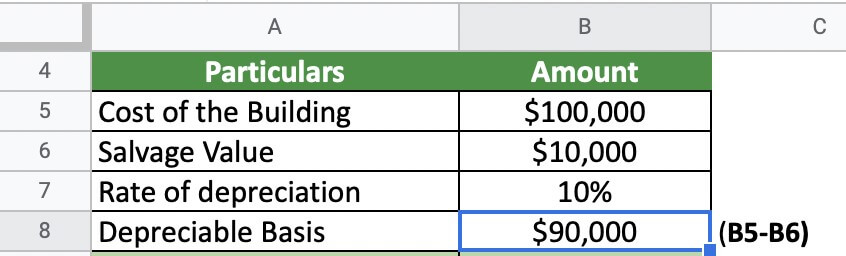

Step #1: To calculate the depreciable basis, we subtract the salvage value ($10,000) from the cost of building ($100,000).

Step #2: To calculate the depreciation, we multiply the depreciable basis ($90,000) by rate of depreciation (10%).

Depreciation for the building is $9000. By accounting for this depreciation, Mr. John can save a lot of tax money.

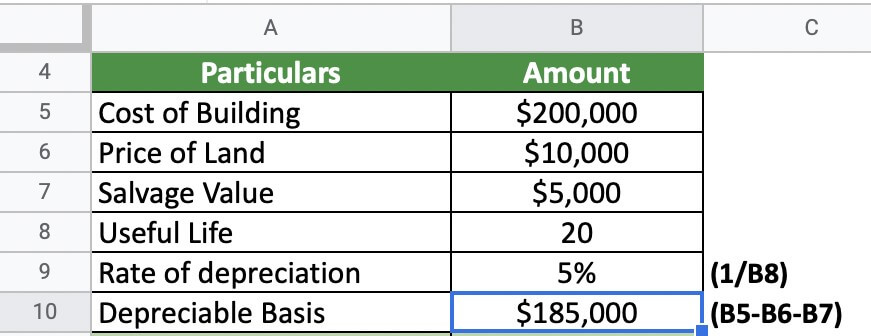

Example #2

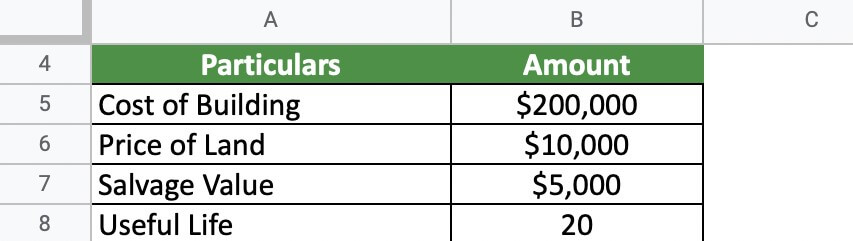

Ms. Susan purchased a building worth $200,000. It included the purchase price of land, which is $10,000. The building has a useful life of 20 years and a salvage value of $10,000. Calculate the depreciation for the building.

Given,

Solution:

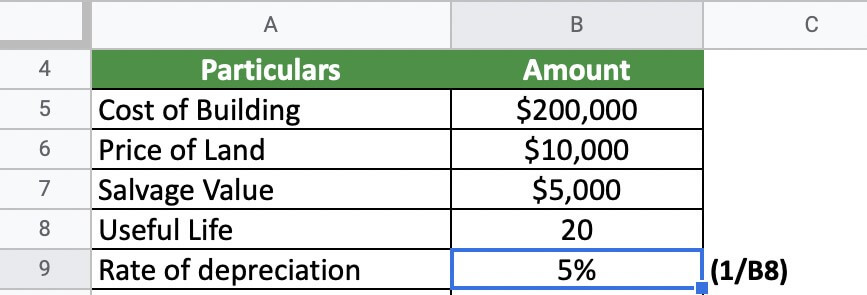

Step #1: To calculate the rate of depreciation, we divide digit 1 by the useful life of the building.

Step #2: To calculate the depreciable basis, we subtract the price of land ($10,000) and salvage value ($5,000) from the cost of building ($200,000).

Step #3: Finally, we calculate the depreciation by multiplying the depreciable basis ($185,000) with the rate of depreciation (5%).

Depreciation for the building is $9,250. Ms. Susan will account for this depreciation to showcase the correct value of her asset after every year in her books.

Depreciation for Building Income Tax Act

- Under the Income Tax Act of India, the Depreciation rate for a building is determined based on the type of the building, whether it is a residential or commercial building, and the year of construction of the building.

- It’s worth noting that these rates may be subject to change, and you should verify the current rates before calculating the depreciation of buildings.

- As per the IRS, building depreciation can be deducted from the taxable income only if it has a determinable useful life, will last more than a year, and is owned by the taxpayer.

- The individual or business cannot claim the tax return for property created or acquired after July 27, 1989.

- In the US, the depreciation rate for buildings is calculated using the formula. Thus, they don’t have any specific rates for depreciation. However, the depreciation rates for buildings as per the Indian income tax act are as follows:

| Buildings Type | Construction Date | Rate of Depreciation per annum |

| Residential Buildings | Regardless of the year of construction | 5% |

| Commercial Buildings | Before 31st March 1981 | 5% |

| Commercial Buildings | After 1st April 1981, but before 1st April 2000 | 4% |

| Commercial Buildings | After 1st April 2000 | 3.5% |

Factors Contributing to Depreciation for Building

- Age: As a building ages, it becomes more prone to wear and tear, which can decrease its value.

- Maintenance: Proper maintenance and repairs can help to extend the life of a building, but if a building is not maintained, it will depreciate more quickly.

- Obsolescence: Buildings that are not updated or modernized may become obsolete and lose value.

- Quality of construction: Buildings constructed with lower-quality materials or poor workmanship will depreciate more quickly.

- Climate and environment: Buildings located in areas with harsh climates or high pollution levels will depreciate more quickly.

- Economic conditions: Economic downturns can cause a decrease in the value of buildings due to a decrease in demand for commercial and residential properties.

- Technological advancements: Building technology keeps advancing. If a building is not updated with the latest technology, it may lose value.

- Government regulations: Changes in building codes, zoning laws, and environmental regulations can affect the value of a building.

Calculator

Use the following calculator for calculations.

| Depreciable Basis | |

| Rate of Depreciation | |

| Depreciation For Building = | |

| Depreciation For Building = | (Depreciable Basis * Rate of Depreciation) |

| = | (0 * 0 ) = 0 |

Final Thoughts

Depreciation for buildings is an important aspect of accounting for any purpose, be it business or personal. Depreciation is recorded as an expense on the income statement, which reduces the organization’s net income, thus saving income tax. Factors such as age, maintenance, obsolescence, quality of construction, climate and environment, economic conditions, technological advancements, and government regulations can all contribute to the depreciation of a building.

Frequently Asked Questions (FAQs)

Q1. How do you calculate the depreciation of a building?

Answer. Economists calculate depreciation by dividing the difference between the cost of buildings and their salvage value by the total useful life of buildings.

Depreciation for building = Cost for building-Salvage Value/Useful Life for building,

Where,

Cost for buildings includes the initial price and improvements made to buildings. Salvage value is the value at the end of the building’s life. The useful life for buildings is the expectancy of life on which the owner can use the building.

Q2. What is the depreciation rate for a house building?

Answer. A house building depreciates at 10% per annum. This small depreciation rate allows owners to save money spent on tax and helps potential buyers deduce the correct value of the building.

Q3. Can a building be fully depreciated?

Answer. There is a possibility that a building can be depreciated fully. If no improvements are made to the building, there will be no depreciation charges after the 30th year since the construction of the building.

Q4. Why are buildings depreciated?

Answer. A business calculates its buildings’ depreciation to showcase its appropriate value in the books every year. They also use depreciation as a tax-saving tool, showing that the value of their fixed assets is less than originally thought.

Recommended Articles

This was an EDUCBA synopsis of Depreciation for the building. You can view EDUCBA’s recommended articles for more information,