What Does Depreciation for Rental Property Mean?

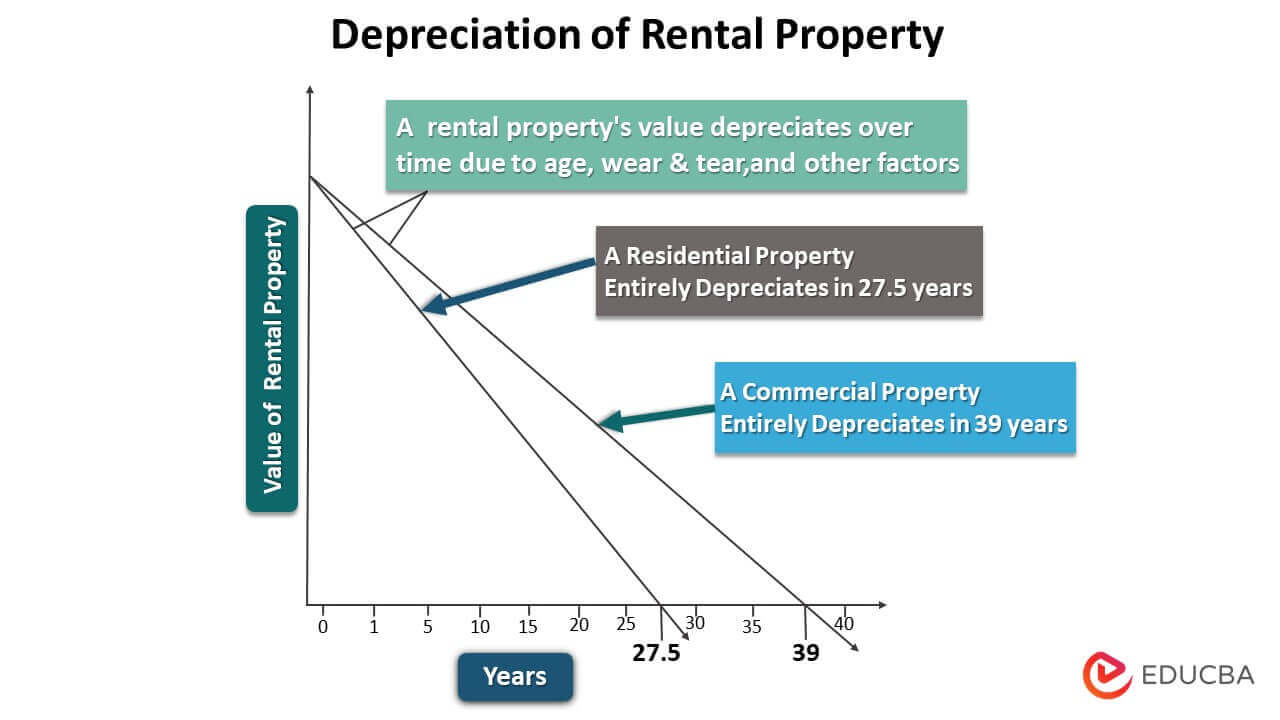

Depreciation for rental property shows how factors, such as wear & tear, age, etc., can lead to a decline in the value of a rental property over time.

It is a significant financial concept for rental property owners as it lets them deduct the property cost from taxes over time. It helps landlords lower their taxable income and gives them a safety net in case they lose money.

For example, Steve buys a rental property for $300,000 with a useful life of 25 years. If he uses the straight-line method [Depreciation for Rental Property= Original Cost ($300,000)/ Useful Life (25 years)], he can claim $12,000 in depreciation for a residential rental property each year. Thus, he can deduct $12,000 from the taxable rental income annually, reducing the tax liability. In this way, depreciation helps people who own rental properties manage their money and pay less in taxes.

Key Highlights

- Rental property depreciation is a metric used to track the cost of a depreciating asset.

- One significant advantage is the tax advantages it provides to property owners, who can claim deductions on their tax returns to reduce their taxable income.

- It allows property owners to recover the cost of their investments over time, making it a helpful tool for financial planning and management.

- The most commonly used method for calculating the depreciation of rental property is the straight-line method, which involves dividing the cost of the property by its useful life to determine the annual depreciation amount.

- Accurate calculations are essential, as they determine the number of depreciation deductions that one can claim on tax returns. Property owners should always consult a tax professional or accountant to ensure that they are making the correct calculations.

How does it Work?

- It is a tax deduction that allows landlords to recover the cost of the property over a set period.

- The Internal Revenue Service (IRS) recognizes rental property as a depreciable asset and allows landlords to claim a portion of the cost each year as a tax deduction.

- The IRS determines the depreciation period for rental property, typically 5 years for residential properties and 39 years for commercial properties.

- The landlord calculates the annual depreciation expense by dividing the cost of the property by the number of years in the depreciation period. This annual expense is then claimed as a tax deduction on the landlord’s tax return each year.

- It’s important to note that depreciation is a non-cash expense, meaning that the landlord does not receive any money from the deduction. However, the deduction reduces the year’s taxable income, lowering the landlord’s tax bill.

- It is a complex area of tax law, and landlords need to seek the advice of a tax expert to guarantee that they are correctly claiming and documenting their depreciation expenses.

How to Calculate Depreciation on a Rental Property?

Step #1: Determine the cost of the property:

This includes the purchase price, renovation or improvement costs, and other costs associated with acquiring the property.

Step #2: Determine the depreciation period:

For residential properties, the depreciation period is typically 27.5 years. For commercial properties, it’s 39 years.

Step #3: Determine the annual depreciation expense:

Divide the cost of the property by the number of years in the depreciation period to determine the annual depreciation expense.

Step #4: Claim the annual depreciation expense on your tax return:

You can claim the yearly depreciation expense as a tax deduction on your tax return each year.

Step #5: Repeat the calculation each year:

The annual depreciation expense remains the same for the duration of the depreciation period, so you will continue to claim the same amount each year.

Step #6:Seek the advice of experts:

It’s important to note that It is a complex area of tax law, and it’s advisable to seek the advice of a tax expert to guarantee that one is appropriately calculating and claiming your depreciation expenses.

Formula to Calculate

To calculate the depreciation, one can use the following formula,

- The original cost is the initial cost at which one purchases the property and determines its initial value.

- Useful life is the product’s rough lifespan in years.

Examples

Example #1

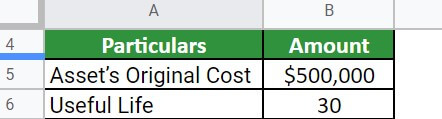

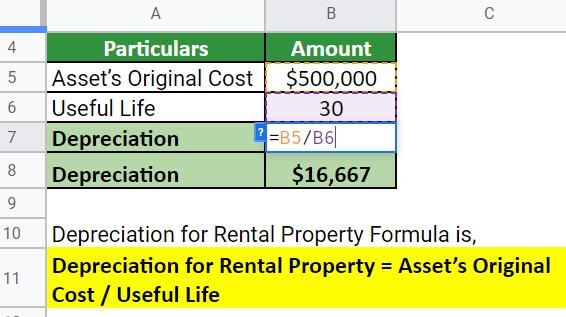

Firm A took a building on rent worth $500,000. As per the company, it has a useful life of 30 years. Calculate the depreciation of the property.

Given,

Solution:

As the original cost is $500,000, which we divide by the useful life, which is 30 years, the depreciation is:

Thus, the asset’s depreciation after every year of usage is $16,667.

Example #2

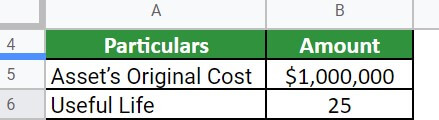

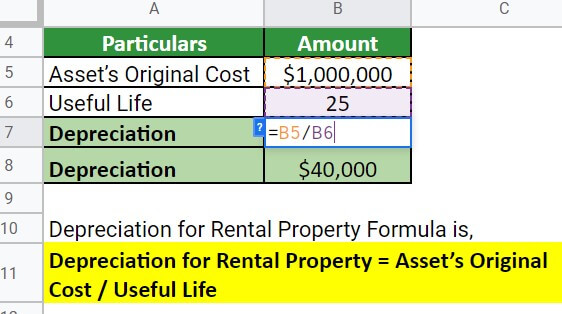

Firm ABZ took a factory on rent worth $1,000,000. As per the company, it has a useful life of 25 years. Calculate the depreciation of the property.

Given,

Solution:

As the original cost is $1,000,000, which we divide by the useful life, which is 25 years, the depreciation is:

Thus, the asset’s depreciation after every year of usage is $40,000.

Bonus Depreciation for Rental Property

- Bonus depreciation is a tax incentive that allows rental property owners to depreciate the cost of their rental property more quickly than they would under standard depreciation rules.

- The government sets the bonus depreciation amount, which changes yearly. Currently, bonus depreciation is at 100% for new and used assets, allowing rental property owners to entirely write off the cost of their property in the first year of ownership.

- It is important to note that bonus depreciation is only available for certain types of property and has certain restrictions, such as a phase-out threshold and limitations on the kind of depreciable property.

Depreciation Rates for Rental Property

The Internal Revenue Service (IRS) determines the depreciation rates for rental property based on the type of property and how long it is expected to last. However, the actual depreciation of the property depends on various factors such as its age, condition, and the frequency and extent of any renovations.

The depreciation rates for rental property for the first year are as follows:

| Month | Depreciation Value |

| January | 3.485% |

| February | 3.182% |

| March | 2.879% |

| April | 2.576% |

| May | 2.273% |

| June | 1.970% |

| July | 1.667% |

| August | 1.364% |

| September | 1.061% |

| October | 0.758% |

| November | 0.455% |

| December | 0.152% |

(Source: IRS)

Who Is Eligible To Claim Rental Property Depreciation?

- The property must be used for income-generating purposes and must have a determinable useful life of more than one year if one wants to claim depreciation.

- Additionally, the property must be expected to last longer than the tax year for which depreciation is claimed.

- Individuals or entities that own a rental property and generate rental income from it are eligible to claim depreciation.

- Moreover, Individuals, Partnerships, Limited Liability Companies (LLCs), and S & C corporations can claim this return.

Rules for Rental Property Depreciation

The Internal Revenue Service (IRS) sets the rules for rental property depreciation. They are designed to allow property owners to write off the cost of their rental property over time.

The following are some of the key rules:

- Eligible Property: Only rental property used for income-producing purposes is eligible for depreciation. Personal property, such as furniture and equipment, may also qualify for depreciation.

- Depreciation Method: The IRS requires the Modified Accelerated Cost Recovery System (MACRS) for calculating depreciation. This method calculates the cost of the property over a set number of years based on the property’s expected useful life.

- Depreciation Period: The depreciation period for rental property is generally 27.5 years for residential property and 39 years for commercial property.

- Basis: The basis for depreciation is the original cost of the property that will depreciate over time.

- Limitations: There are limitations on the amount of depreciation one can claim each year. For example, bonus depreciation is limited to a set amount each year and is phased out over time.

- Documentation: Property owners must maintain adequate records and documentation to support their depreciation calculations. It includes documentation of the property’s purchase price, any improvements or renovations, and any other costs included in the depreciation calculation.

Calculator

Use the following calculator for calculations.

| Asset’s Original Cost | |

| Useful Life | |

| Depreciation for Rental Property = | |

| Depreciation for Rental Property = | (Asset’s Original Cost / Useful Life) |

| = | (0 / 0 ) = 0 |

Frequently Asked Questions(FAQs)

Q1. What is depreciation of rental property?

Answer: The depreciation of rental property happens when the property’s value depreciates over the year. It can occur due to a malfunction, a decline in overall infrastructure, or property rates.

Q2. What do you mean by cost-basis in depreciation for a rental property?

Answer: The cost basis is the total capital expenditure of the property minus the value of the land on which it sits. Only certain items like legal, abstract, or recording fees and any seller debts that a buyer agrees to pay qualify as capital expenses when calculating this sum.

For example, a landlord buys a rental property for $200,000 and spends $20,000 on significant improvements to the property. Thus, the cost basis for the property is $220,000 ($200,000 + $20,000). Over several years, the property loses value, which lowers its taxable value each year. During its sale, the cost basis will help determine if there is a taxable gain or loss. If the property sells for $250,000, the taxable profit will be $30,000 ($250,000 – $220,000). However, if the property sells for $18,000, the taxable loss will be $40,000 ($220,00-$180,000).

Q3. How to calculate depreciation of a rental property?

Answer: To find the depreciation for the rental property, we divide the property’s original value by its estimated useful life. Thus, use the following formula to calculate depreciation:

Depreciation for rental property= Original Value/Useful Life

Q4. Why is IRS Publication useful in calculating depreciation?

Answer: IRS Publication 946 provides guidance and procedures for calculating depreciation on rental property. It includes information on the Modified Accelerated Cost Recovery System (MACRS), the method used to depreciate most property types, and special rules and tables for calculating depreciation. By using IRS Publication 946, rental property owners can ensure they are calculating depreciation correctly and in line with tax laws. This book can assist landlords in obtaining the most tax breaks and paying the least taxes possible.

Recommended Article

We hope that this EDUCBA information on “Depreciation of Rental property” was beneficial to you. For further guidance on depreciation-related topics, EDUCBA recommends these articles: