Updated July 12, 2023

What is the Depreciation Rate?

The depreciation rate refers to the percentage at which assets depreciate over the useful life. It varies across assets and determines the asset’s nature and use. The depreciation rate for a building is less compared to other assets that depreciate fast.

Explanation

Every asset has a useful life. One can’t use an asset forever. So the rate at which the asset becomes obsolete is the depreciation rate. It is booked as an expense and helps reduce the tax liability. There can be discrepancies regarding. The rate companies apply and the tax authority. This discrepancy may lead to a rise in Deferred Tax Assets or Liability.

How to Calculate Depreciation Rate?

Step 1: Need to find the total depreciable value of an asset

Say a machine purchase for $200,000. After completing its useful life, the machine can be sold for $50,000. So the depreciable value is

- Depreciable Value = 200,000 – 50,000

- Depreciable Value = 150,000

Step 2: Estimate the useful life of the machine

Useful life varies as per assets. If the machine can operate efficiently for a long period of time, then its useful life will be high. Let’s consider the useful life of the above-mentioned machine to be 10 years.

Step 3: Calculate the depreciation rate

- D. Rate = (1 / 10) * 100

- D.n Rate = 10 %

So each year, the asset will depreciate by 10%.

Step 4: Calculate the depreciation value per year

- D. Value per Year = 10% * (200,000 – 50,000)

- D. Value per Year = 15,000

Example of Depreciation Rate

Company XYZ is a manufacturing company and wants to purchase 2 machines to increase productivity. Both machines are the latest models that are available on the market. The cost, useful life, and salvage value of the machines are as follows:

Machine 1

- Cost = $100,000

- Salvage Value = 10,000

- Useful Life = 5 Years

Machine 2

- Cost = $500,000

- Salvage Value = $100,000

- Useful Life = 20 Years

Calculate the depreciation rate and per-year depreciation value for both machines.

Solution:

Machine #1

The calculation is as follows:

Depreciation Rate = (1 / Useful life) * 100

- D. Rate = (1 / 5) * 100

- D. Rate = 20%

Depreciable Value per Year calculates as:

Depreciable Value per Year = Depreciation Rate * (Purchase Price of Machine – Salvage Value)

- Depreciable Value per Year = 20% * (100,000 – 10,000)

- Depreciable Value per Year = 18,000

Machine #2

The calculation is as follows:

Depreciation Rate = (1 / Useful life) * 100

- D. Rate = (1 / 20) * 100

- D. Rate = 5%

Depreciable Value per Year calculates as:

Depreciable Value per Year = Depreciation Rate * (purchase Price of Machine – Salvage Value)

- Depreciable Value per Year = 5% * (500,000 – 100,000)

- Depreciable Value per Year = 20,000

For Company XYZ, the total depreciation that will charge each year is:

Total Depreciation = Yearly Depreciation of Machine 1 + Yearly Depreciation of Machine 2

- Total Depreciation = 18,000 + 20,000

- Total Depreciation = 38,000

Company XYZ will not have to pay tax on $38,000 as profit before tax will reduces by $38,000, and tax will be charged on the remaining amount. So It is an expense that reduces the tax liability.

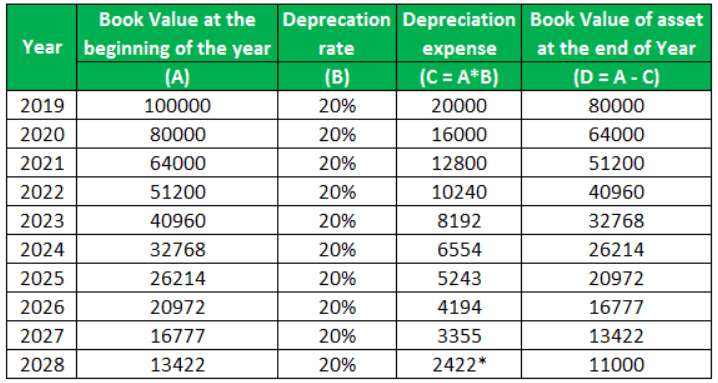

Depreciation Rate Chart

D. rate chart shows the entire breakup of depreciation that will be charged from the asset. Year-wise Book Value of the asset at the beginning, depreciation rate and expense, and Ending book value of the asset are shown in the chart. It is very useful for assessing the productive life of an asset.

Advantages

Some of the advantages are given below:

- This helps to minutely calculate the exact depreciation that will be charged on an asset in a year. The depreciation rate of different assets is different. So, it helps the accounting software calculate the yearly of different assets as different rates are fitted for different assets.

- The tax benefit is received on the depreciation charged. It is treated as an expense and helps minimize the “Profit before Tax”. Higher the d. rate, more benefits regarding tax expense can be drawn.

- This is easily calculated and accepted by tax authorities. Every asset has a different useful life. So tax authorities have assigned different rates to each asset.

Disadvantages

Some of the disadvantages are given below:

- Companies try to charge more depreciation rates to assets to avoid taxes. As it treats as an expense, the greater the expense, the less the taxable amount.

- It is a non-cash expense. The analyst shouldn’t confuse this as a regular cash expense. So depreciation charges reduce Net profit, but it doesn’t reduce the firm’s cash flow.

Conclusion

The depreciation rate is used to calculate the depreciation of individual assets of a firm. The d. rate can stay fixed for an asset’s entire life or vary as per the usage of the asset. Depreciation is a non-cash expense, so the firm’s cash flow is unaffected by the d. rate.

Recommended Articles

This is a guide to the Depreciation Rate. Here we also discuss the definition and how to calculate it. Along with advantages and disadvantages. You may also have a look at the following articles to learn more –